Solana (SOL) Analysis

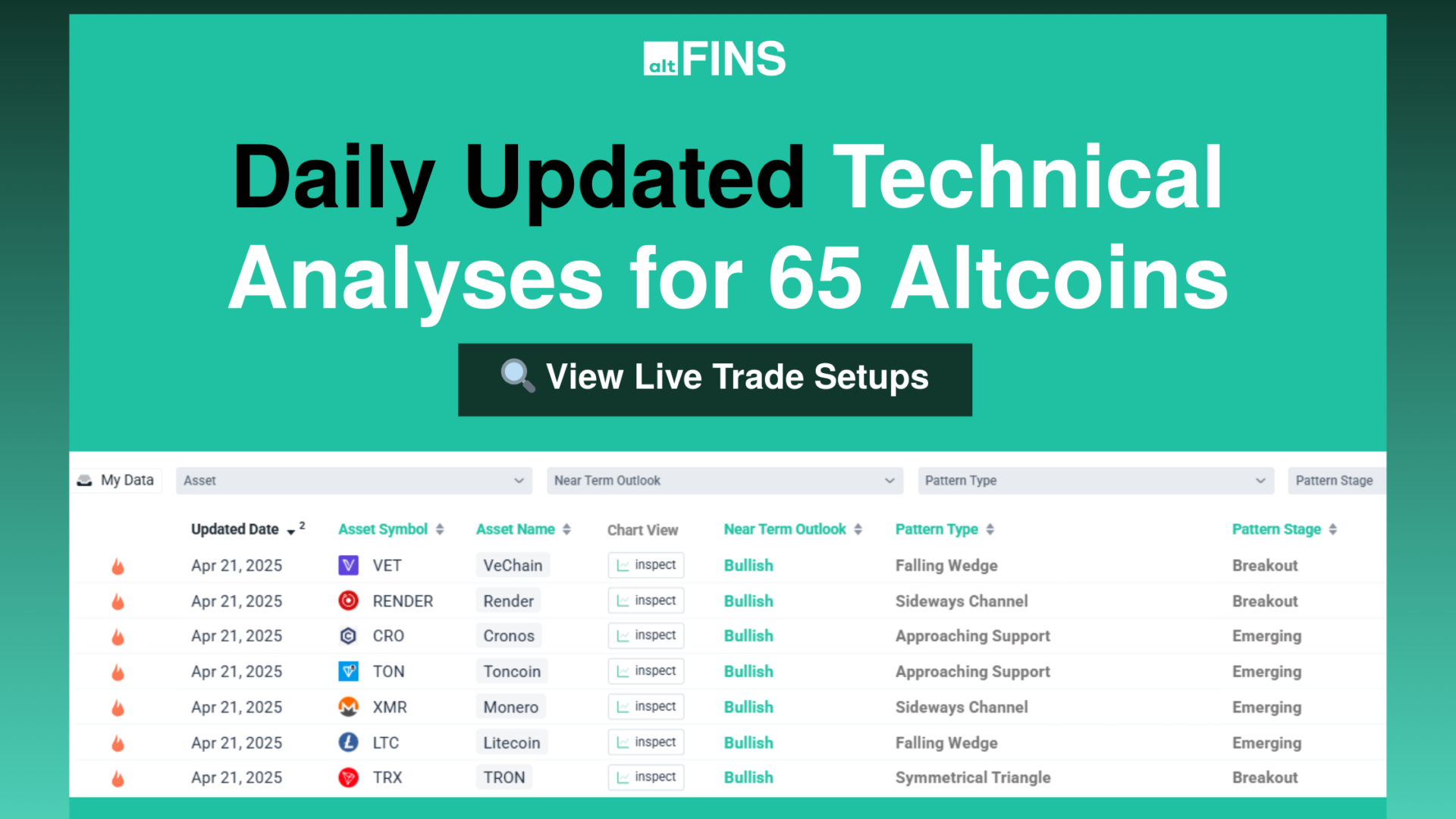

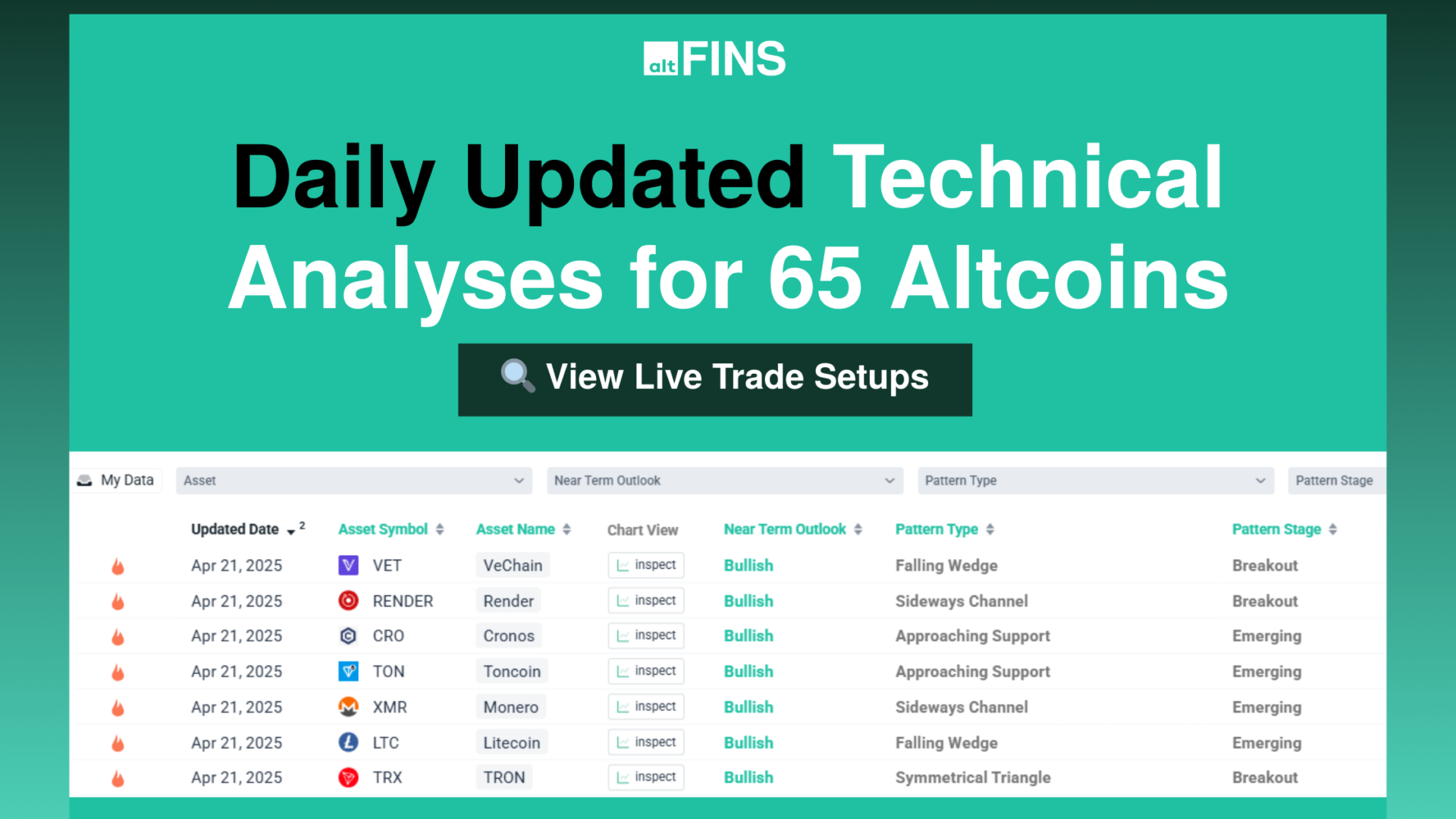

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance.

Solana (SOL) Trends

Solana (SOL) Performance

Solana (SOL) RSI & MACD

Solana (SOL) technical analysis:

Trade setup: Price is in a downtrend, however, it’s trading in a Channel Down pattern, which typically resolves in a bullish breakout and a trend reversal. We wait for such a breakout, ideally above $175 – $180 resistance (and 200 SMA), with +10%-20% potential upside to $200 – $225 (PT) thereafter. This is a riskier trade setup because it’s a trend reversal not a trend continuation setup. It’s against the overall downtrend. On the positive note, Solana Spot ETFs have launched with decent inflows ($200M in first week) and there have been several Solana-focused Treasury companies buying SOL. Most recently, Forward Industries seeks to raise additional $4B for its Solana-Focused Treasury. That’s on top of the $1.6B they’ve spent to acquire 6.8M SOL. Currently, 15.8M SOL tokens have been acquired by SOL-focused Treasury companies. That’s 3% of supply. Set a price alert. Learn how to trade breakouts in our Trading Course.

Pattern: Price is trading in a Channel Down pattern. With emerging patterns, traders who believe the price is likely to remain within its channel can initiate trades when the price fluctuates within its channel trendlines. With complete patterns (i.e. a breakout) – initiate a trade when the price breaks through the channel’s trendlines, either on the upper or lower side. When this happens, the price can move rapidly in the direction of that breakout. Learn to trade chart patterns in Lesson 8.

Trend: Short-term trend is Strong Down, Medium-term trend is Strong Down, Long-term trend is Neutral.

Momentum is Bearish but inflecting. MACD Line is still below MACD Signal Line but momentum may have bottomed since MACD Histogram bars are rising, which suggests that momentum could be nearing an upswing. Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance: Nearest Support Zone is $160.00, then $140.00. Nearest Resistance Zone is $175.00, then $200.00.

See live Solana (SOL) chart here

See more curated charts of coins with technical analyses.

Recent news and research:

Solana’s $2.85B revenue fuels its next ‘growth phase’ – Here’s how!

After Damning Solana Price Predictions Top SOL Holders Are Jumping Ship To This Emerging Rival

Top Solana and Shiba Inu Holders Are Racing To Remittix After Early Holders See Over 230% Gains

Binance Labs Invests in Solana’s Stablecoin Infrastructure

Surge in Solana Meme Coins Attracts Market Attention

Solana Could Get Enforceable NFT Royalties Via New Metaplex Standard

Jump Crypto To Overhaul Solana

Solana’s developers unveil web3-focused mobile phone

Solana Ventures announces new $150 million fund for blockchain gaming

Solana and Tron See Large Weekly Institutional Inflows

Solana Slows to a Crawl (Again)

Analyst: Reason behind Solana’s network slowdown isn’t a DDoS attack, but…

Solana co-founder believes NFTs will eradicate ‘external poison marketplaces’

DeFi on Ethereum, Solana, Terra, and others hits $250 billion in TVL

Why some strategists say Solana could reach $5,000 in 2030

Solana transactions stop as mainnet experiences intermittent instability

Solana Mainnet Back Online After Day in the Dark

Hoskinson: These are the circumstances in which Cardano (ADA) and Solana (SOL) will collaborate

SOL burn? Solana price hits $100 for the first time after mysterious ‘Ignition’ event revealed

Solana’s Mango Markets DEX Raises $70M in MNGO Token Sale

Neon Labs is deploying the Ethereum Virtual Machine (EVM) on Solana

Should traders buy trending altcoins CAKE, WAVES, MANA, SOL

Solana (SOL) hits new highs as DApps, DeFi and stablecoins join the network

Top Analyst Bullish on Two Crypto Newcomers, Says He’s Reducing Exposure to SushiSwap

Find more real-time news here.

What is Solana (SOL)?

Find full description and news on altFINS platform.

Overview

Solana is a high-performance blockchain platform designed to enable fast, secure, and low-cost transactions. It was launched in March 2020 and is built to support decentralized applications (dApps) and projects that require high throughput, scalability, and low fees.

Solana’s unique architecture is based on a proof-of-history (PoH) consensus algorithm that enables fast transaction processing and confirmation times. Unlike other blockchains that use proof-of-work (PoW) or proof-of-stake (PoS) algorithms, Solana’s PoH is designed to minimize network latency and increase scalability by creating a verifiable time source that enables nodes to process transactions in parallel.

Solana is also designed to support smart contracts and decentralized finance (DeFi) applications. Its ecosystem includes a range of DeFi protocols, dApps, and projects, such as Serum, Mango Markets, and Raydium, among others. Solana’s native token is SOL, which is used to pay for transaction fees and incentivize network participants.

Overall, Solana aims to provide a high-performance, secure, and cost-effective blockchain platform for developers and users to build and use decentralized applications.

History

In late 2017, Solana‘s creator Anatoly Yakovenko published a draft whitepaper describing a novel distributed systems timekeeping method dubbed Proof of History (PoH). The amount of time needed to agree on the transaction order in blockchains like Bitcoin and Ethereum is one of the scalability constraints. The goal, according to Anatoly, was to automate the blockchains’ transaction sorting process. This would be a crucial component in allowing crypto networks to expand far more than they could at the time. Later, Anatoly collaborated with his old coworker from Qualcomm Greg Fitzgerald to create a single blockchain network in Rust that utilized PoH as its “internal clock.” In February 2018, the two published the project’s first internal testnet (with demo) and official whitepaper. Stephen Akridge, a different ex-QUALCOMM employee, proposed that shifting signature verification to graphics processors might significantly boost transaction performance (i.e., scalability). To start the business that would become Solana Labs, Anatoly enlisted the help of Greg, Stephen, and three other people.

Along with the Qualcomm veterans, former Apple engineers were also members of the founding team. To prevent confusion with the Loom Network, an Ethereum Layer-2 scaling solution, they changed the project’s original name, Loom, to Solana. In Q2 2018, Solana Labs started gathering money to create its own cryptocurrency network.

The team raised somewhat more than $20 million between April 2018 and July 2019 through a number of private token offerings. By the end of July 2019, they announced the sales as a single Series A. The fundraising endeavor was carried out in tandem with Solana’s work on the protocol, which through a number of permissioned testnet iterations until the company unveiled their public incentive testnet, known as Tour de SOL, in Q3 2020. Tour de SOL’s initial phase went online in February 2020, and it is still active today with Solana’s Mainnet Beta version.

Soon after receiving $1.76 million in a public token auction held on CoinList, Solana became live on the Mainnet Beta in March 2020. The beta network for the project supported smart contracts and provided simple transaction capabilities. But no staking incentives were included since Solana was still figuring out the timing of its ongoing issue. As of now, the goal is to transition from the beta stage to a more production-ready version in either late 2020 or early 2021. Currently, Solana Labs continues to make significant contributions to the Solana network, and the Solana Foundation assists in funding continuing development and community-building initiatives

Technology

The eight ideas used in Solana‘s very effective blockchain are as follows: Proof of History (PoH): A timer before consensus Tower BFT: A PBFT Turbine variant that is PoH-optimized: Block propagation protocol Gulfstream: Mempool-less transaction forwarding protocol Sealevel: First parallel smart contract run-time ever Pipelining: Transaction processing unit for validation Cloudbreak: Horizontally scaled accounts database Archivers: Distributed ledger storage PoH: A timer before consensus As nodes inside the network cannot trust the timestamp on messages received from other nodes, determining the time and order in which events happened is the largest issue in dispersed networks. By establishing a network-wide source of time that is cryptographically safe, Solana makes an attempt to resolve this problem using Proof of History (PoH). A high-frequency Verifiable Delay Function (VDF) called Proof of History needs a certain amount of consecutive steps to assess yet yields a singular result that can be openly confirmed. Because they can trust the date and message-ordering they’ve received, nodes can build the next block without first coordinating with the whole network. As a result, consensus overhead is decreased.

Tower BFT: A PBFT variant that is PoH-optimized. To reach consensus on network transactions, Solana uses its own consensus algorithm dubbed Tower BFT, which is a PBFT-like algorithm, to operate on top of Proof of History. A node on the network commits to a period of time when they are barred from voting on an opposing fork each time they vote on a certain fork. As they continue to vote on the same fork, this time during which they are locked out lengthens exponentially until they reach a maximum lockout of 32 votes for the same fork. Nodes in the network should continue voting on the fork they believe the supermajority of the network is supporting because they won’t start receiving inflation rewards until they hit this maximum vote lockout.

Turbine: A block propagation technique is called Turbine. Using a distinct but linked protocol named Turbine, Solana transfers blocks (communicates blocks amongst validators) independent of consensus. Turbine is designed for streaming and makes extensive use of BitTorrent. A block is split up into several random peers as it is transmitted, accompanied with tiny packets containing erasure codes.

Gulf Stream: A transaction forwarding mechanism without a mempool Mempool management creates a new set of issues in high-performance networks because to the increasing expense of filtering and retaining unconfirmed transactions. Gulf Stream works by moving transaction forwarding and caching to the network’s edge. In the Solana design, clients and validators pass transactions to the anticipated leader in advance since each validator is aware of the order of incoming leaders (block producers). As a result, the unconfirmed transaction pool puts less strain on validators’ memory by enabling them to process transactions in advance, speed up leader switching, and minimize confirmation times. The network gives validators more time to coordinate, which increases the danger of collusion as a result of knowing leaders in advance. Solana’s fast lock time can reduce the possibility of collusion by limiting the time available to plan an attack.

Sealevel: Solana created Sealevel, a highly parallelized transaction processing engine that scales horizontally over GPUs and SSDs. It is a run-time for parallel smart contracts. Single-threaded processors are the norm for other blockchains. In contrast, Solana can enable the processing of simultaneous transactions (along with the verification of signatures) within a single shard. This problem’s solution makes extensive use of the scatter-gather operating system driver approach. The state that transactions will read and write while executing is specified in advance. When reading from and writing to an array of RAID 0 SSDs, Sealevel may identify the non-overlapping transactions occuring in a block and execute them concurrently (referred to as parallel execution). A virtual machine (VM) called Sealevel is used to plan transactions but not carry them out. Instead, utilizing a bytecode known as the Berkeley Packet Filter, Sealevel sends transactions to be processed directly on hardware (BPF).

Pipeline: A TPU for validation and optimization The Solana network’s transaction validation procedure takes considerable use of pipelining, a CPU design improvement. When a stream of input data needs to be processed by a series of stages and separate hardware is in charge of each step, pipeline processing is the best option. The Transaction Processing Unit (TPU), a pipeline mechanism on the Solana network, moves from Data Fetching at the kernel level to Signature Verification at the GPU level, Banking at the CPU level, and Writing at the kernel space level. Before the TPU begins sending blocks to the validators, it has already fetched the following series of packets, checked their signatures, and started crediting tokens. This four-stage pipeline’s GPU parallelization enables the Solana TPU to function at a high performance.

Cloudbreak: Horizontally scaled accounts database, cloudbreak These additional technologies’ methods for scaling computing could lead to memory problems. Because of its small size and slow access rates, memory—which is required to keep track of accounts—can struggle to sustain performance. Cloudbreak was created to be optimized for simultaneous reads and writes distributed across a RAID 0 array of SSDs. Each extra disk increases the amount of storage that on-chain applications have access to, as well as the number of reads and writes that may be executed simultaneously by programs. This complements Solana’s transaction architecture, which permits pre-fetching accounts from disk and setting up the runtime for execution. It also permits nodes on the network to start processing transactions before they are encoded into a block. Everything here strives to decrease network block delays and confirmation latency.

Archivers: Distributed ledger storage for archiving One of the key vectors of centralization is anticipated to be the storing and preserving of data on a high-performance network. Only well-funded businesses will be able to serve as validators and take part in consensus if storage costs are very high. Data storage on Solana is transferred from validators to an archiver network of nodes. Consensus is not engaged by archivists. The state’s history is fragmented into many periods and erasure codes. Small pieces of the state are kept by archivers. The network may occasionally require the Archivers to provide documentation demonstrating that they are properly storing the data. Proofs of Replication (PoRep), which are primarily based on Filecoin, are used by Solana. Archivers are not in use right now but are planned for the future. They will be implemented in response to network data requirements.

Supply Curve Details

Vesting Schedules After the network’s launch, each of Solana’s three pre-launch private transactions came with a nine-month lockup. On January 7, 2021, the first trading day for the tokens created through these operations is anticipated. Once the network went operational, the SOL tokens distributed in the project’s public auction sale, which took place in March 2020 and constituted 1.6% of the initial supply, were fully liquid. There was no lockup timeline provided during the project’s public auction sale. The founder’s allocation (12.5% of the initial supply) will also be locked up for nine months after the network launches. Following the lockup period, these tokens will vest monthly for an additional two years. (expected to fully vest by Jan. 2023). About 38% of the initial SOL supply is held in the Grant Pool and Community Reserve of the Solana Foundation. These allocations have begun to vest in small amounts ever since the launch of Solana’s mainnet. One million Grant Pool tokens vested every three months for the first nine months, and 35 million Community Reserve tokens vested over the following nine months in five million token increments. The entire allocation for these categories will be made accessible in January 2021.

The Solana Foundation’s allotment began vesting in small quantities every month after the network was launched. In addition, the foundation made 11,365,067 SOL accessible at launch for a market maker to borrow for a period of six months. The team informed SOL holders of this information and chose to burn an equal number of tokens from the foundation’s allocation. On December 24, 2020, the continuing emissions Solana validators authorized the “pico-inflation” option. At the moment, 0.1% of SOL coins are minted annually, and they are given among validators and stakers in accordance with the stakes they have made. This relatively low inflation rate is only temporary; it will be replaced with a more significant and long-term inflation notion at some point in 2021. This “final” inflation proposal sets an initial annual inflation rate of 8%. However, this inflation rate will decrease by 15% annually for the “dis-inflation rate.” The network should reach this point in about 10 years, or in 2031, when Solana’s inflation rate will have decreased to 1.5 percent annually. Solana’s long-term inflation rate of 1.5 percent will not change until the network’s top leadership decides to alter it.

Consensus Information

Solana’s Proof of Stake (PoS)-based consensus procedure, referred to as Tower BFT, employs the network’s Proof of History (PoH) technique as a clock before consensus in order to reduce communication costs and latency. A validator may only vote once within a slot, which is a predetermined period of hashes, on each particular fork. In the current network setup, a slot typically lasts 400 milliseconds (ms). Every 400ms, the network has a potential point for rollback, but after that, the network would have to wait twice as long to unroll the vote. To put it another way, secondary votes make it much harder to undo the transactions that were made in a certain slot. A block with a lot of votes has a stronger chance of continuing in the chain forever as a result. For instance, each validator cast 32 votes throughout the course of the last 12 seconds. The vote from 12 seconds ago will be delayed by 232 slots, or roughly 54 years. The network won’t actually ever reverse its choice. The most recent vote had a timeout of two slots, or roughly 800 milliseconds. Every slot that old votes are committed to doubles in size when new blocks are added to the ledger, increasing the likelihood that existing blocks will be confirmed. Tower BTF grants finality once two-thirds of the network validators have selected a specific sequence of actions. Once a transaction has been completed, it cannot be undone.

The Solana mainnet uses the Delegated Proof-of-Stake (dPoS) operating paradigm, which enables token holders to take part in the block creation process and earn rewards by either staking tokens and acting as their own validators or by delegating tokens to validators they trust. Anyone can join the network as a validator to increase the security of the protocol as a whole. There is no minimum staking requirement, even if the leader selection process (which validator gets to propose the next block) is stake-weighted. The network architecture is designed to scale with hardware and bandwidth and employs GPU cores to parallelize execution and reduce verification times. Due to the GPU demand, hardware requirements are a little higher than for some protocols. No more than $5,000 should be spent on an adequate setup.

FAQ

About altFINS

altFINS is the best crypto analytics platform. The platform will help you find the right crypto trading opportunities. You can search for coin in Uptrend, with Momentum or Breakouts. It’s is great for advanced traders but also for beginners to learn basics of technical analysis in Crypto trading Course or in Curated charts or Chart pattern sections. But also more advanced traders can create their own Screens and Alerts of coins with different trading strategies.