Ethereum (ETH) Analysis

In addition to automated chart patterns, altFINS’ analysts conduct technical chart analyses of top 30 cryptocurrencies. We call these Curated Charts and they evaluate 5 core principals of technical analysis: Trend, Momentum, Patterns, Volume, Support and Resistance.

Ethereum (ETH) technical analysis:

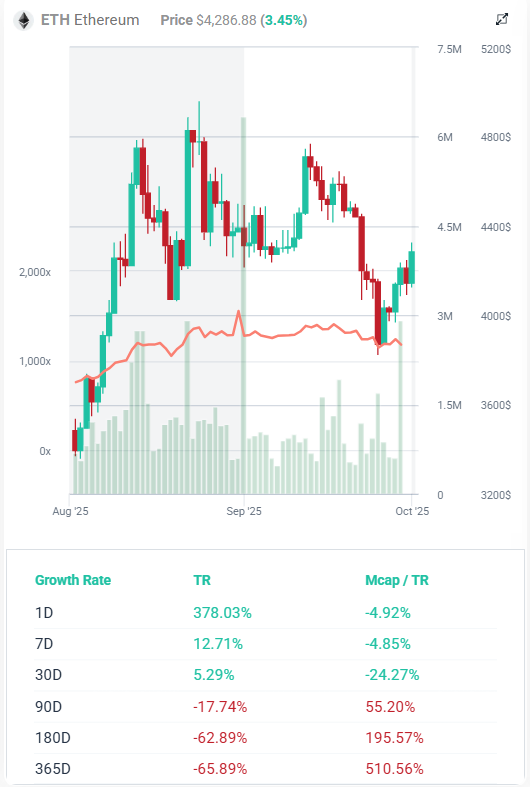

Trade setup: Price made a new ATH of $4,956, above prior ATH from Nov 2021. Pullback near $4K support level could be a swing trade entry in Uptrend with +20% potential upside back to $4.9K. Data from the Ethereum Validators Queue shows that the ETH unstaking backlog now spans 43 days, with over 2.48 million ETH, valued at approximately $11.3 billion, awaiting withdrawal. This selling pressure may keep a lid of ETH price for weeks ahead. (Set a price alert). Learn to trade breakouts in Lesson 7 and Risk Management in Lesson 9.

Pattern: Pullback in Uptrend. Price remains in an Uptrend but has pulled back, which could present a ‘buying dip’ opportunity. Traders should look for the nearest support level where price could stabilize and resume its Uptrend. This support level could be a level where price bounced off of in the past, or a level that was previously resistance. (concept known as polarity).Learn to trade key levels in Lesson 3.

Trend: Short-term trend is Neutral, Medium-term trend is Neutral, Long-term trend is Strong Up.

Momentum is Bearish but inflecting. MACD Line is still below MACD Signal Line but momentum may have bottomed since MACD Histogram bars are rising, which suggests that momentum could be nearing an upswing. Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance: Nearest Support Zone is $4,000.00, then $3,450.00. Nearest Resistance Zone is $5,000.00, then $5,500.00.

See live Ethereum (ETH) chart here

See more curated charts of coins with technical analyses.

Visit altFINS.

What is Technical analysis?

Technical analysis is a method used in financial markets, including cryptocurrencies like Ethereum, to forecast future price movements based on historical price patterns, trading volume, and other market data. It revolves around the belief that market trends and patterns repeat themselves, allowing traders to make informed decisions.

At its core, technical analysis assumes that all relevant information about an asset is already reflected in its price and volume. By analyzing charts and applying various indicators and tools, traders aim to identify patterns, trends, support and resistance levels, and other signals that can help predict future price movements.

Technical analysis utilizes a wide range of tools and techniques. Some common ones include trend lines, moving averages, oscillators, and chart patterns like triangles, double tops, and head and shoulders. These tools help traders identify potential entry and exit points for trades, determine levels of buying or selling pressure, and gauge market sentiment.

One of the key principles of technical analysis is the concept of “support” and “resistance.” Support refers to a price level where buying pressure is expected to be strong enough to prevent further price declines, while resistance refers to a level where selling pressure is expected to be strong enough to prevent further price increases. Identifying these levels can be crucial for traders in setting stop-loss orders and profit targets.

Ethereum On-chain data – Total Revenue

Updated data find here.

Recent Ethereum News and Sentiment

See the current Ethereum news sentiment here.

-

Ethereum is one of the biggest macro trades over the next 10-15 years’ – Tom Lee. Read an article

-

Ethereum Pushes Higher – Will Bulls Overcome Resistance And Extend The Rally? Read an article.

Find more real-time news here.

altFINS Research Report

- Ethereum Shanghai Upgrade Went Live. Read a report.

- Non-custodial Liquid Staking Providers on Ethereum. Read a report.

Read altFINS and 3rd party Research Reports here.

What is Ethereum (ETH)? Read Ethereum Story

Step into the world of Ethereum, a groundbreaking platform that has revolutionized decentralized apps and smart contracts. Created by the visionary Vitalik Buterin in 2013, Ethereum has captured the imaginations of developers and crypto enthusiasts alike.

Buterin’s dissatisfaction with the limitations of the Bitcoin scripting language led him to envision a platform that would go beyond simple transactions. In his seminal Ethereum white paper, he laid out a grand vision for a distributed computing platform that would empower developers to build decentralized applications (dApps) and execute smart contracts.

To turn this vision into reality, Buterin and a team of early contributors established the Ethereum Foundation in 2014. This nonprofit organization became the driving force behind Ethereum’s development, funding research groups, and projects dedicated to expanding the ecosystem.

Ethereum’s journey began with a historic crowdsale in 2014, where supporters flocked to buy ether (ETH), the platform’s native token, in exchange for Bitcoin. The funds raised fueled the initial development of Ethereum and set the stage for its meteoric rise.

Soon after Ethereum’s mainnet went live in 2015, the world witnessed the birth of Initial Coin Offerings (ICOs). Augur, an Ethereum-based project, blazed the trail by launching the first ICO, raising funds by selling its REP tokens. This innovative fundraising method opened the floodgates, as countless projects leveraged Ethereum to create and sell their tokens, raising billions of dollars in the process.

However, Ethereum’s journey hasn’t been without its challenges. In 2016, the infamous hacking of The DAO, a decentralized venture fund, shook the community. Despite a controversial decision to reverse the chain to recover stolen funds, the Ethereum community faced a hard fork, leading to the creation of Ethereum Classic (ETC), a legacy chain that preserved the original transaction history.

One of the main hurdles Ethereum has faced is scalability. During periods of high activity, transaction delays and fees can soar, causing frustration among users. However, Ethereum developers have been diligently working on a solution. Enter Ethereum 2.0, an ambitious upgrade that aims to switch Ethereum’s consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS) and introduce sharding, a scalability technique.

Ethereum 2.0 will transform the Ethereum landscape, bringing increased scalability, security, and efficiency. With multiple phases and years of development ahead, the Ethereum community eagerly awaits the full realization of this groundbreaking upgrade.

At the heart of Ethereum’s technology is the Ethereum Virtual Machine (EVM), a powerful and versatile virtual machine that executes transactions and smart contracts. Powered by the Solidity programming language, the EVM provides developers with the tools to create programmable decentralized applications, ushering in a new era of innovation.

Ethereum’s flexibility is further enhanced by token standards such as ERC-20 and ERC-721. ERC-20 tokens enable the creation of fungible tokens, while ERC-721 tokens, popular in gaming, allow for the creation of unique and non-fungible tokens (NFTs).

As Ethereum continues to evolve, it paves the way for a future where decentralized applications and smart contracts revolutionize industries beyond finance. The upcoming switch to Casper Proof-of-Stake and the emergence of Ethereum 2.0 promise a more sustainable and scalable network, offering exciting possibilities for developers and users alike.

So, step into the world of Ethereum, where innovation knows no bounds and the potential for decentralized applications and smart contracts is limited only by our imagination. Get ready to witness the transformation of the digital landscape as Ethereum leads the charge towards a decentralized future.