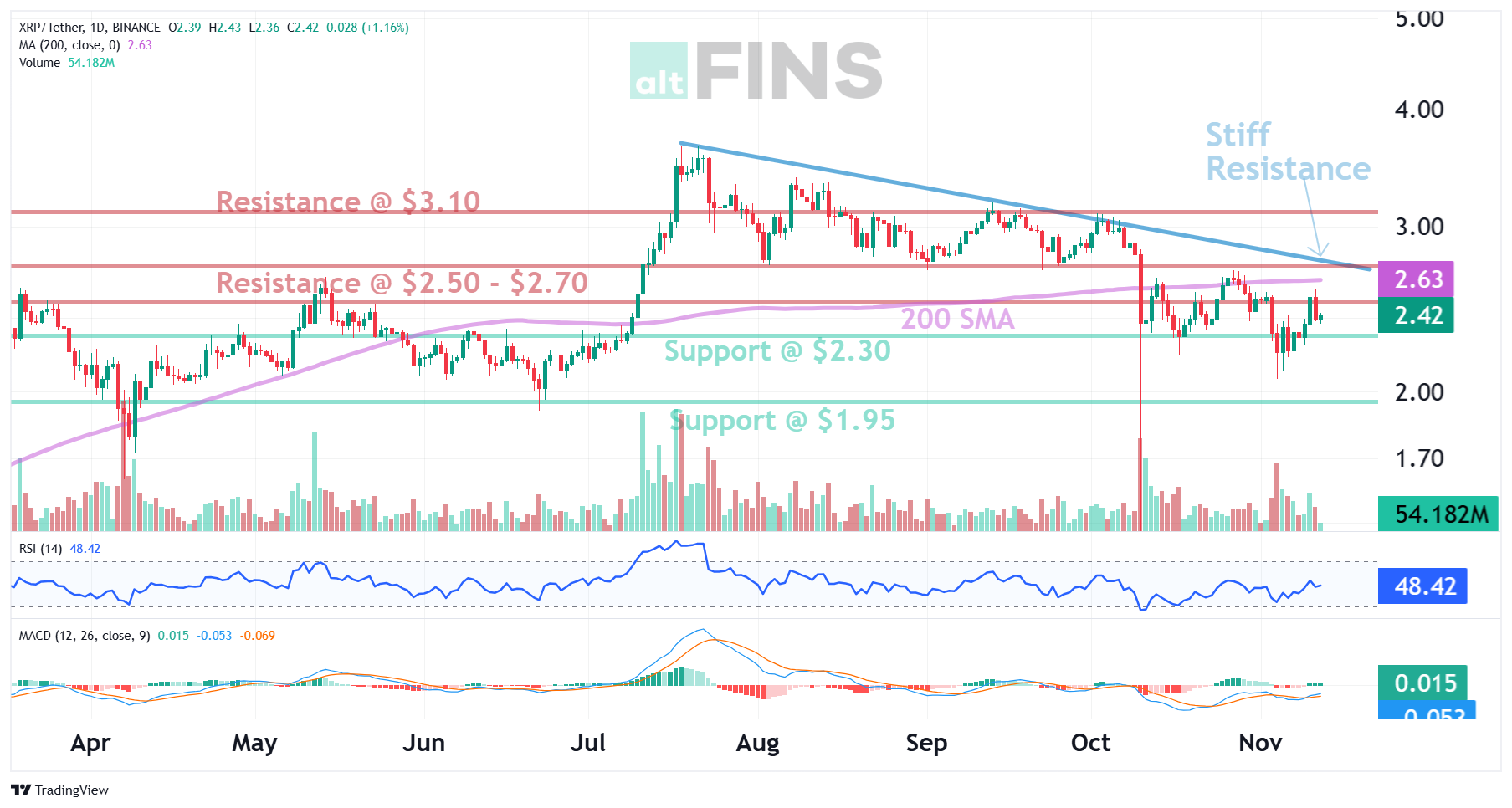

Is a Crypto Breakout Imminent? Watch the $2.50 - $2.70 Zone!

Are you eyeing a potential crypto comeback? Here's a technical analysis breakdown to help you navigate the market. The price is currently testing a critical resistance zone between $2.50 and $2.70. This zone is not just a random number; it's a confluence of key indicators: the 200 Simple Moving Average (SMA) and a significant downtrend line.

What This Means for Traders:

-

The Challenge: The $2.50 - $2.70 zone represents a major hurdle. It's where selling pressure is likely to be strong. Past price action suggests this level has acted as a ceiling before. This is a classic example of resistance, a concept explained in detail in this trading course lesson (Lesson 7).

-

The Opportunity: If the price can decisively break above this resistance zone, it could signal a resumption of an uptrend. The next target to watch would be the $3.10 resistance level.

-

Think Breakout Trading: This situation is ripe for a breakout trading strategy. Want to learn how to trade breakouts effectively? Check out Lesson 7 of this comprehensive trading course. Don't forget to implement solid risk management strategies (Lesson 9) to protect your capital.

Understanding Key Levels: Support and Resistance

Think of support and resistance levels as the "floors" and "ceilings" of the market. Currently:

- Nearest Support: $2.30, followed by $1.95

- Nearest Resistance: $2.50 - $2.70, followed by $3.10

Remember the concept of polarity (learn more here): A broken resistance can become a support, and vice versa. Understanding these levels is crucial for making informed trading decisions.

Trend and Momentum: A Mixed Bag

- Trend: While the short-term trend is currently down, the medium and long-term trends are strongly down. This means the overall market sentiment is bearish.

- Momentum: The Relative Strength Index (RSI-14) indicates that the price is currently neither overbought nor oversold (RSI between 30 and 70). This means the price has room to move in either direction.

Actionable Steps:

-

Set an Alert: Don't miss the potential breakout! Set a price alert around the $2.50 - $2.70 level.

-

Watch for Confirmation: A break above $2.70 should be confirmed by strong volume and sustained price action above the resistance zone.

-

Manage Your Risk: Always use stop-loss orders to limit your potential losses.

Disclaimer: This is a technical analysis and should not be considered financial advice. Trading cryptocurrencies involves significant risk. Always do your own research before making any investment decisions.

About XRP: Fast, Low-Cost Payments for Global Financial Infrastructure

XRP is the native digital asset of the XRP Ledger (XRPL) — a fast, decentralized Layer 1 blockchain built for efficient cross-border payments. Developed by Ripple Labs in 2012, XRP was designed to move money quickly, affordably, and reliably across borders — making it a favorite among financial institutions.

Unlike many cryptocurrencies, XRP does not use mining or staking, allowing it to achieve high speeds and low fees.

What Is XRP?

XRP is a payment-focused digital currency built to:

- Enable fast, low-cost global money transfers

- Serve as a bridge currency between fiat and crypto

- Support decentralized finance, tokenization, and enterprise-grade settlement

The XRP Ledger can process transactions in 3–5 seconds and is capable of handling 1,500+ TPS at minimal cost.

Key Features of XRP and XRPL

-

High-Speed Transactions: Finality in seconds, with negligible fees (~$0.0002 per tx).

-

No Mining: Consensus is achieved through a unique validator-based model — energy efficient and scalable.

-

XRP Token Utility:

- Used as a bridge currency in international payments

- Required for transaction fees (to prevent spam)

- Powers new XRPL features like NFTs and smart contracts (via Hooks, sidechains)

-

Decentralized & Open-Source: The XRP Ledger is open to developers and community governance — not fully controlled by Ripple.

-

Adoption by Financial Institutions: RippleNet uses XRP for on-demand liquidity (ODL), helping banks and payment providers improve efficiency.

XRP continues to be one of the most battle-tested assets in crypto — built for real-world payments, enterprise use, and evolving DeFi functionality.

⭐ More about Ripple’s current market performance, technical trends, fundamentals, and recent developments find on altFINS.