Crypto Alert: Bullish Breakout Signals Potential 10% Gain!

Is a crypto trend reversal on the horizon? A recent technical analysis suggests a potential buying opportunity, but with a crucial caveat. Let's dive into the details.

The Setup:

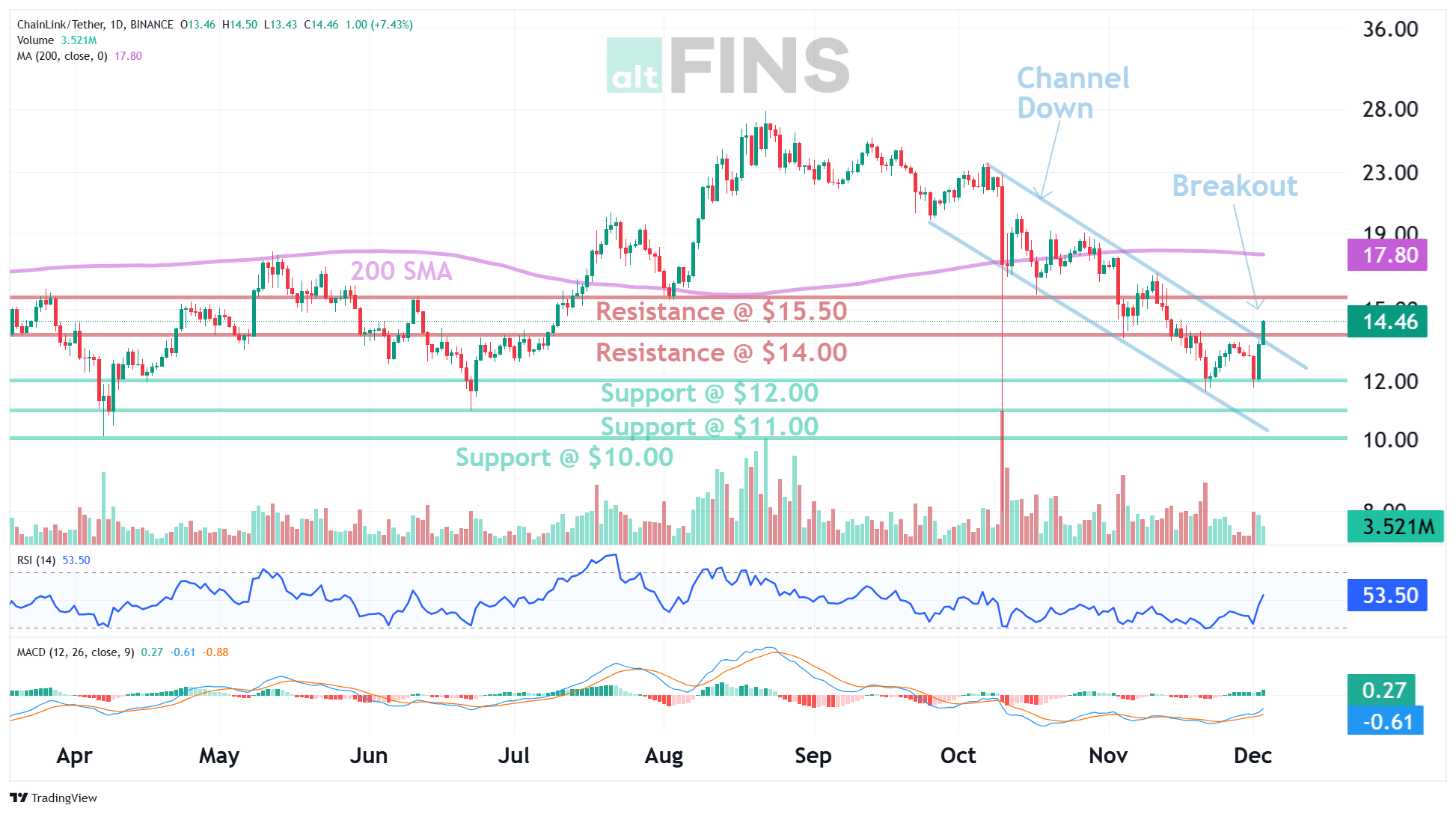

Price has broken out of a Channel Down pattern, smashing through the $14.00 resistance level. This bullish breakout could signal a short-term trend reversal, offering a potential 10% upside to $15.50. Set your Stop Loss at $13.25 to manage risk.

Why This Matters:

- Channel Down Breakout: A Channel Down pattern typically indicates a downtrend. A break above the upper trendline often suggests bullish momentum is building. Learn more about trading Channel Down patterns.

- $14.00 Resistance Breached: Overcoming this resistance level is a significant signal, suggesting buyers are gaining control.

- Potential 10% Gain: The target price (PT) of $15.50 represents a substantial profit opportunity for traders who capitalize on this breakout.

The Catch:

This trade is considered riskier because it's a trend reversal, not a continuation of an existing uptrend. It goes against the overall downtrend, so proceed with caution and proper risk management.

Key Considerations:

- Trend Analysis:

- Short-term: Down

- Medium-term: Strong Down

- Long-term: Strong Down

- Momentum: Currently neutral (RSI between 30 and 70). This means the asset isn't overbought or oversold.

- Support and Resistance:

- Support: $12.00, $11.00

- Resistance: $15.50, $17.50

Whale Activity:

Adding fuel to the fire, recent reports suggest accumulation by large crypto holders ("whales"). This could indicate increased confidence in the asset's future performance. Check out the whale insights report.

Trading Strategies:

Traders looking to capitalize on this breakout should consider the following:

- Entry Point: After a confirmed break above $14.00.

- Profit Target (PT): $15.50

- Stop Loss (SL): $13.25

Important Reminder:

Always remember to manage your risk. Trend reversals can be volatile. Set your Stop Loss and stick to your trading plan. Learn more about risk management.

Disclaimer: This is not financial advice. Trading cryptocurrencies involves significant risk. Always do your own research before making any investment decisions.

Chainlink (LINK): Powering Real-World Data in Smart Contracts

Chainlink is a decentralized oracle network that connects smart contracts with real-world data, events, and off-chain computation. It enables blockchains to securely interact with external APIs, data feeds, payments, and other systems — making smart contracts truly “smart.”

The LINK token is used to pay for oracle services and secure the network through staking and collateral.

What Is Chainlink?

Chainlink is an oracle protocol designed to:

- Feed blockchains with accurate, tamper-proof real-world data (e.g., price feeds, weather, sports scores)

- Enable hybrid smart contracts that combine on-chain logic with off-chain data

- Support cross-chain interoperability and decentralized automation

Launched in 2017, Chainlink has become a critical part of the Web3 infrastructure, used by DeFi platforms like Aave, Synthetix, and Compound.

Key Features of Chainlink

-

Decentralized Oracle Network: Aggregates data from multiple sources and oracles to ensure reliability and security.

-

Secure Data Feeds: Provides real-time price oracles used across DeFi, NFTs, insurance, and more.

-

LINK Token Utility:

- Paid to node operators for delivering data and computation

- Staked to secure services and earn rewards (Chainlink Staking v0.2)

- Used for collateral in reputation-based oracle selection

-

Chainlink Functions & Automation: Supports off-chain computation, Web2 APIs, and decentralized task scheduling (like limit orders or recurring actions).

-

Cross-Chain Interoperability Protocol (CCIP): Aims to be the universal messaging and asset bridge between blockchains.

Chainlink is essential Web3 infrastructure — bridging the gap between blockchains and the real world through secure, decentralized data.

⭐ More about Chainlink’s current market performance, technical trends, fundamentals, and recent developments find on altFINS.