Week in review; also some recent winners: TFUEL, CEL, THETA, XEM

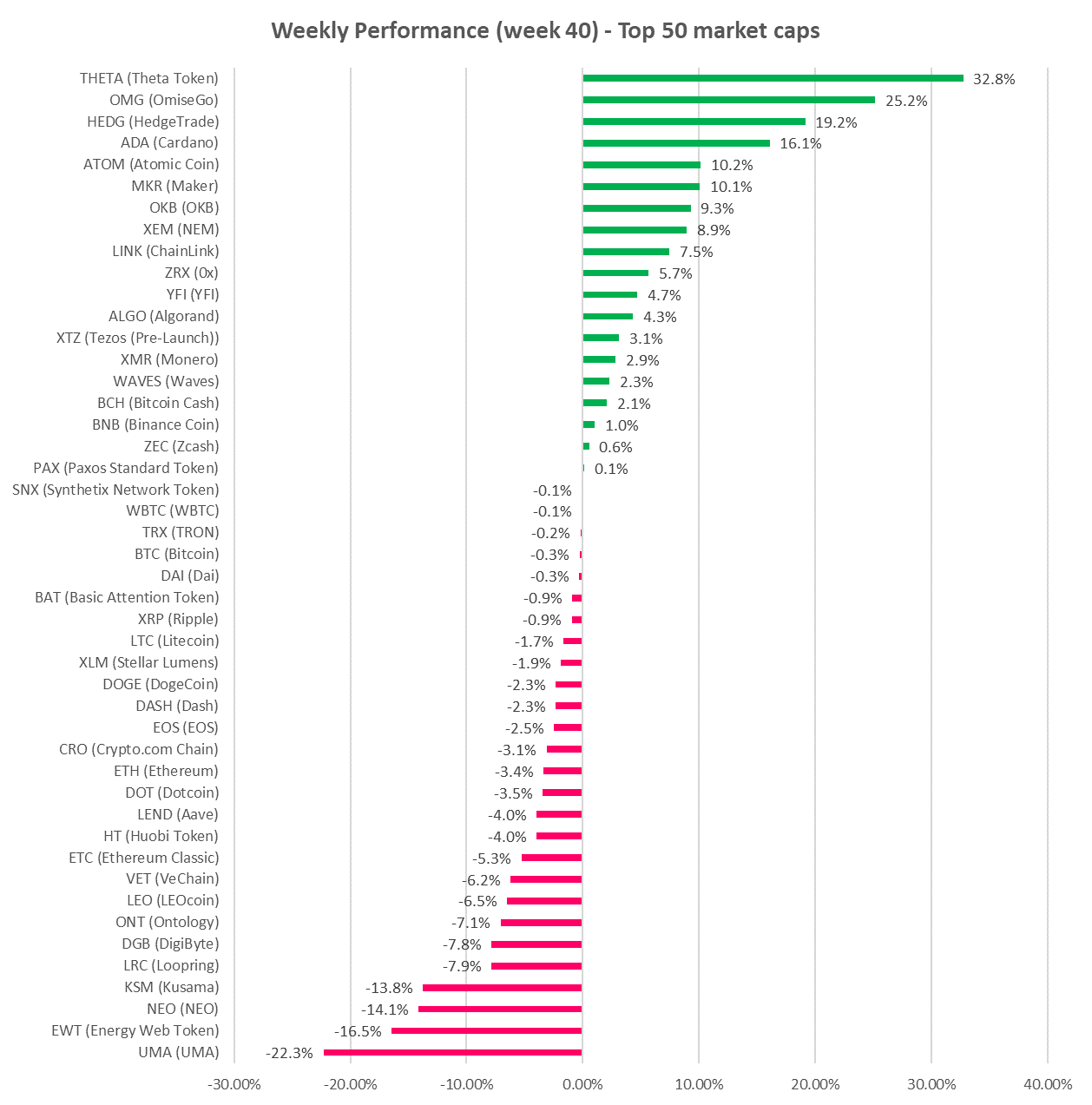

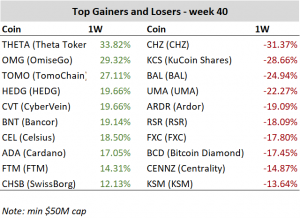

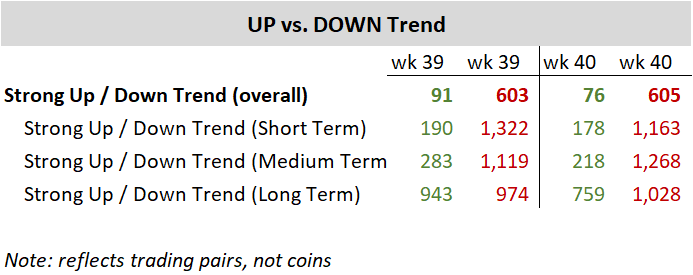

Last week we saw an improvement in market technicals, with balanced gainers and losers. BTC has stabilized in a $10K-$11K range, which helped the altcoins as well. Many altcoins are near their strong support levels too.

Below, for trend following traders, we feature a couple of clear winners, with well established uptrend and sustained momentum: THETA, CEL.

Also, a couple coins with fresh bullish momentum signals that could be in early uptrend stages: TFUEL, XEM.

You can create your own momentum signal filter by following this 3 min video tutorial.

Risk management – Stop Loss and trade size. In all of these setups, traders should use Stop Loss orders to manage their downside risk, in case the trade goes against us, as it often will. Trading is about probabilities and even though these setups have a high win rate, one must be prepared to minimize losses on the trades that go bust. If Stop Loss order types are not supported by they exchange, at least set up a price alert (see video). Also, trade size should be such that you never risk losing more than 2% of your total equity. Keeping the trade size small allows the trader to setup a wider Stop Loss, which gives the trade more room and time to complete with success. Setting Stop Loss levels too tight can often result in getting knocked out of a trade prematurely.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.