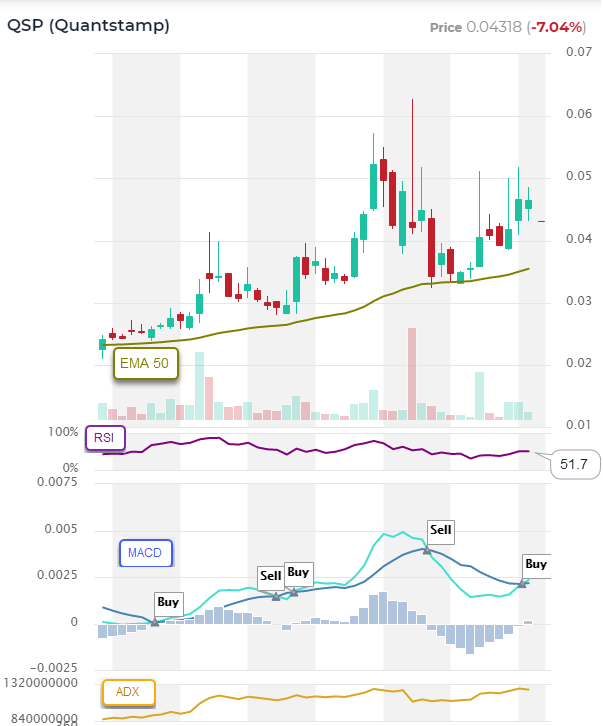

QSP momentum breakout!

Our Crypto Screener has just alerted us of a new Buy opportunity: QSP.

QSP just experienced a bullish MACD crossover (above the MACD signal line) along with a bullish RSI crossover (above the centerline of 50), and a bullish uptrend in OBV. These are overlayed with an Uptrend indicator (upward sloping SMAs and EMAs).

In layman’s terms, this Screen looks for coins in a long-term uptrend and a recent momentum upswing.

Get alerts on such opportunities even sooner by creating your own Crypto Screener and set-up an alert for it. Timing is critical. Follow the 3 min video below.

How to setup your own Uptrend with Momentum screener:

Also, buyers beware – you must monitor your own positions because these signals (MACD, RSI, etc.) can change quickly. You can set up alerts to notify you when your coins receive a Sell signal (MACD or RSI turns bearish). Don’t rely on our newsletter for all crypto signals, use the platform to become a proficient trader!

Risk management – Stop Loss and trade size. In all of these setups, traders should use Stop Loss orders to manage their downside risk, in case the trade goes against us, as it often will. Trading is about probabilities and even though these setups have a high win rate, one must be prepared to minimize losses on the trades that go bust. If Stop Loss order types are not supported by they exchange, at least set up a price alert (see video). Also, trade size should be such that you never risk losing more than 2% of your total equity. Keeping the trade size small allows the trader to setup a wider Stop Loss, which gives the trade more room and time to complete with success. Setting Stop Loss levels too tight can often result in getting knocked out of a trade prematurely.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.