Price of ETH after The Merge

What will happen to ETH price after The Merge?

Recently, traders in our Telegram channel have been asking “What will happen to ETH price after The Merge”.

Will The Merge hype fizzle out after the event? Will it be the typical “buy the rumor, sell the news”?

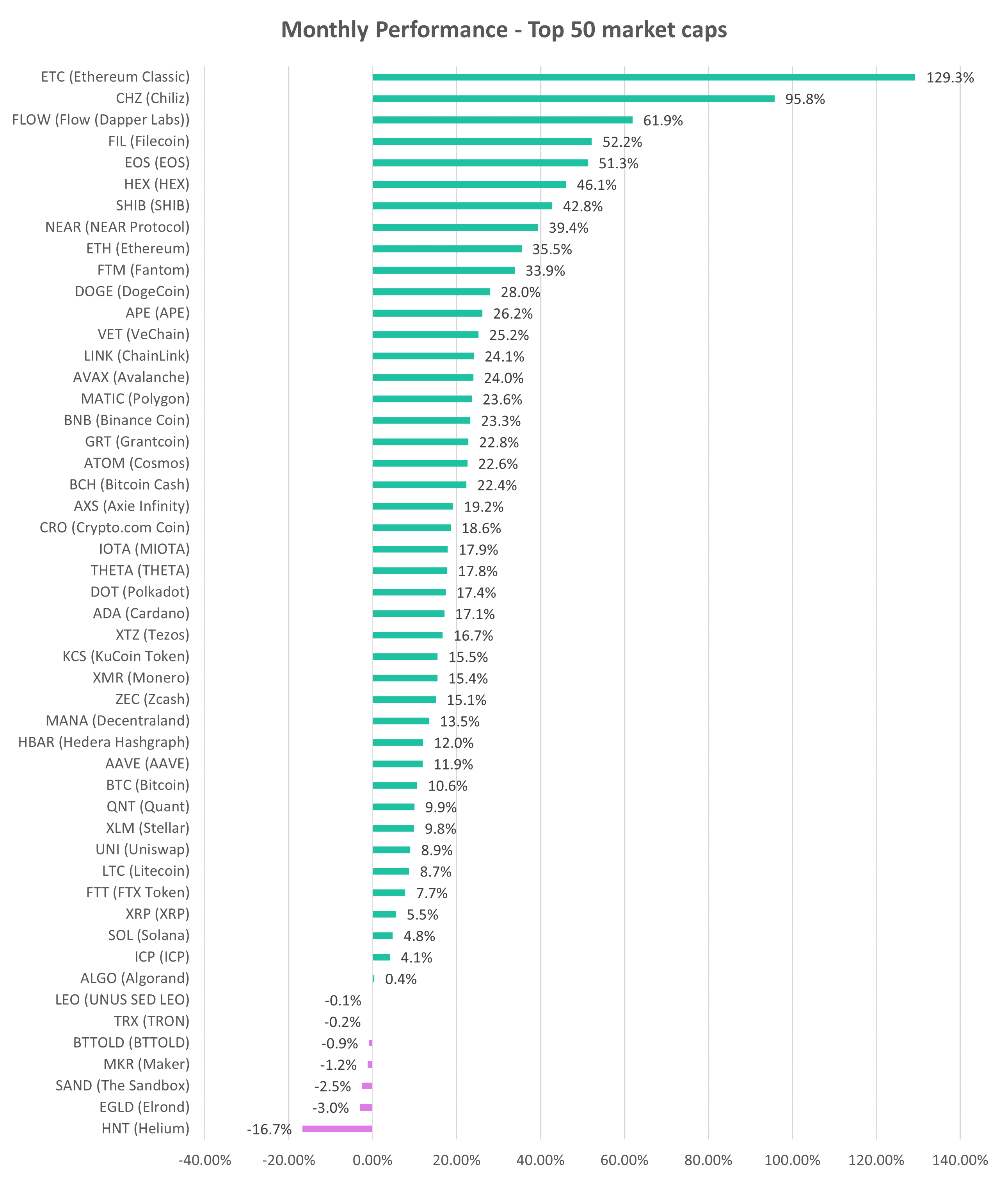

ETH price is up 36% in the last 30 days, and up 114% since it’s lows ($882) in June. It’s one of the best performing altcoins in the top 50.

Some of that is due to general market trend reversal spurred by slowing pace of inflation (see blog) but a great deal of outperformance is related to the upcoming Merge.

For details regarding The Merge, read our comprehensive report here.

In this brief article, I will lay out some arguments why I personally think that ETH will appreciate in price following Merge.

Let me first mention that if you care about deep fundamental research on Coins that could 5–10x, check out altFINS Research Hub where our team posts reports on their favorite Coin Picks. Our recent picks are up 120% (Lido), 57% (ETH), 12% (Uniswap), 11% (StepN) and 3% (Aave) since we released research.

So with ETH, it comes down to this.

On the negative side, following The Merge (migration from proof-of-work to proof-of-stake), about 13.3m ETH staked so far will begin to unlock, giving their owners a chance to sell it. That’s about 11% of total ETH supply that will be unlocked. But the unlocking will be gradual, over the following 12 months. Still, this could create some selling pressure from those who want to take profits or have other pressing reasons to raise capital and sell their ETH holdings.

My opinion, however, is that very few will sell because 1) most invested at much higher ETH price levels, so are under water and would be selling at a loss 2) ETH staking rewards should double to about 8% APY, which is very attractive, 3) big portion of staked ETH is from large validators who are in it for the yield not price gains.

And that brings me to the Positive side of The Merge event :

1) higher staking yield (~8%) should attract new ETH buyers, lots of institutional investors,

2) it will reduce new ETH minting and could in fact become deflationary (reduce supply) due to ETH burn,

3) more “green” aspect could attract some environmentally conscious institutional investors,

4) higher scalability of Ethereum network should stimulate new activity on the ETH protocol (defi, web 3.0, NFT…) which ultimately drives demand for ETH.

In conclusion, price of any asset is driven by supply v. demand. Post The Merge, my opinion is that demand will outweigh temporary increase in supply from sellers. This is likely in the near term (weeks) but even more likely long term (months) after The Merge.

References:

- ETH staking dashboard: https://dune.com/arch1111/eth-staking-dashboard

- The Big Merge from ETH to ETH2: https://altfins.com/the-big-merge-from-eth-to-eth2/

- Crypto Market Update: https://altfins.com/crypto-market-update-2/

Read more info:

- Ethereum’s Merge To Kick Off With Bellatrix Upgrade On Sept. 6