The Big Merge from ETH to ETH2

![]()

“ETH Merge is like changing engines

to an airplane in mid-air”

*Crypto Twitter

Update, 12,August, 2022:

After delaying many times, the exact launch date of the Merge seems to come around finally.

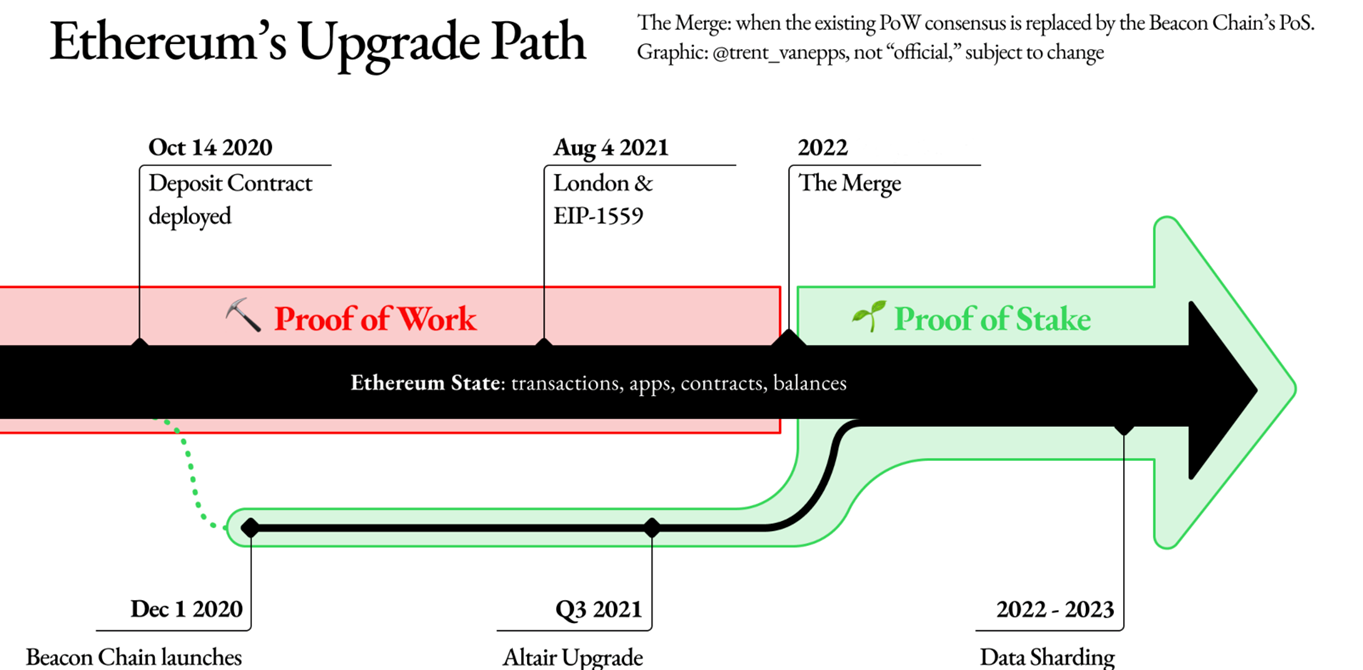

Migration of ETH from Proof-of-Work (Pow) to Proof-of-Stake (PoS), also called “The Merge”, is now scheduled to conclude on September 15th – 16th 2022.

The Merge event will move Ethereum Mainnet activity over to the Beacon Chain. It is not expected that the Merge will reduce Ethereum’s high gas fees, but it will have a significant immediate effect on the network’s energy use.

We believe that “The Merge” could be a significant catalyst for ETH price appreciation and potentially other altcoins in ETH ecosystem.

The Merge will result in:

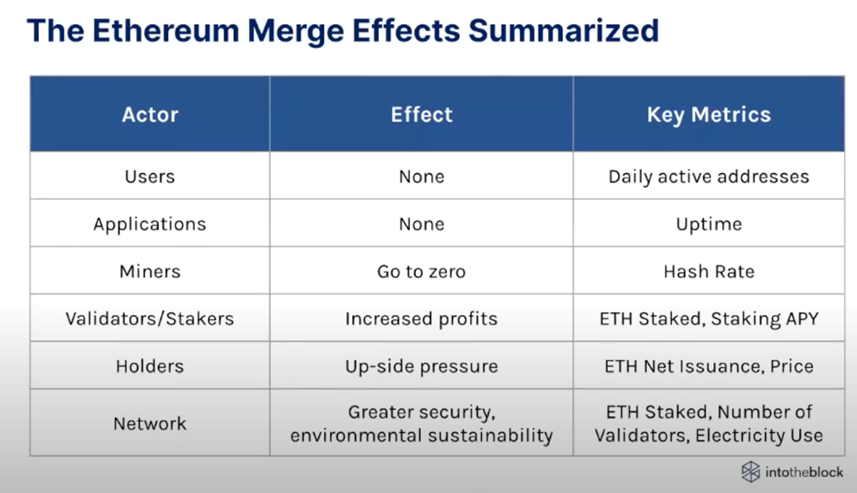

1) An increase in staking yield

2) Increased development activity on Ethereum (Dapps)

3) Lower carbon footprint

4) Reduced ETH supply

Coupled with Layer 2 (L2) solutions, Ethereum gas fees should also substantially decline, and throughput should increase. Consequently, demand for ETH will increase and supply will decrease. Naturally, this dynamic should drive ETH price up. Maybe even substantially (2x or more).

Who will benefit?

- Investors holding ETH

- Higher staking yields will drive revenue growth for staking providers like LIDO, Aave, Curve, etc.

- Stakers and Validators as they will get higher APRs

- Increased usage should benefit L2 providers like Optimism, Arbitrum One, Aztec Network

What is ETHEREUM 2.0?

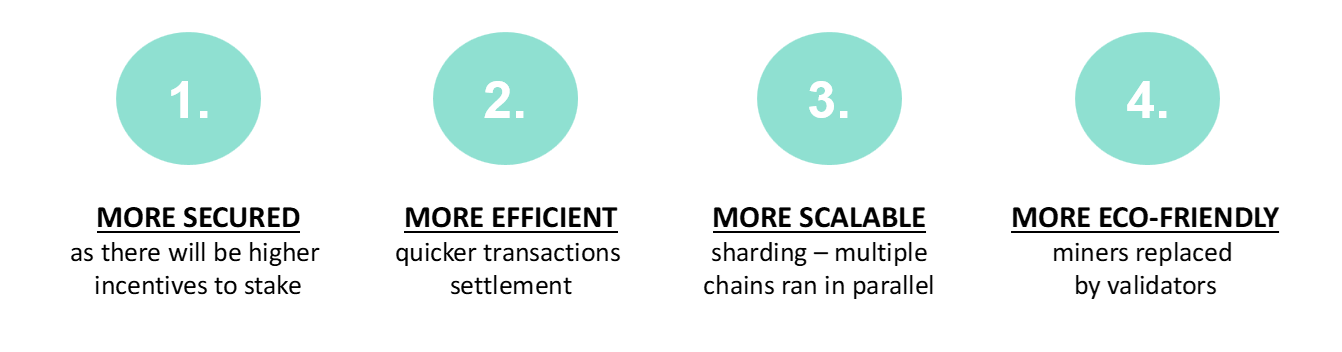

Ethereum’s very first version went live back in 2015. Ethereum 2.0. ETH2 (also known as the Serenity) is an upgraded version of ETH. The principal difference between the two versions is that ETH 2.0 uses different mechanisms, proof-of-stake, sharding and onboard layer 2 solutions. The transition to ETH 2.0 is a very complex technological endeavour that requires time and rigorous testing.

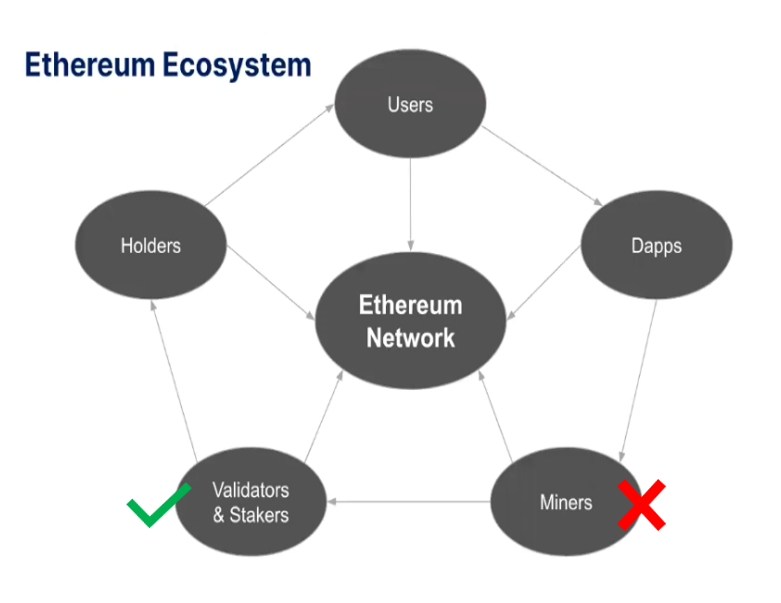

ETH 2.0 is a multi-stage shift of the Ethereum network from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. Just like the way PoW blockchains rely on miners to validate transactions, the PoS consensus mechanism relies on “stakers” to validate transactions by running nodes.

The Ethereum Ecosystem consists of Holders, Users, Dapps and Miners who will be soon replaced by Validators & Stakers.

Ethereum ecosystem developers initially introduced Beacon Chain, a coordination mechanism responsible for creating new blocks in a chain, ensuring their validity, and rewarding validators for keeping the network secure until the Merge is fully implemented.

The network load will be distributed among 64 separate shards that will process information simultaneously, making the overall transaction times faster and more efficient.

All-in-all, the ETH 2.0 will be:

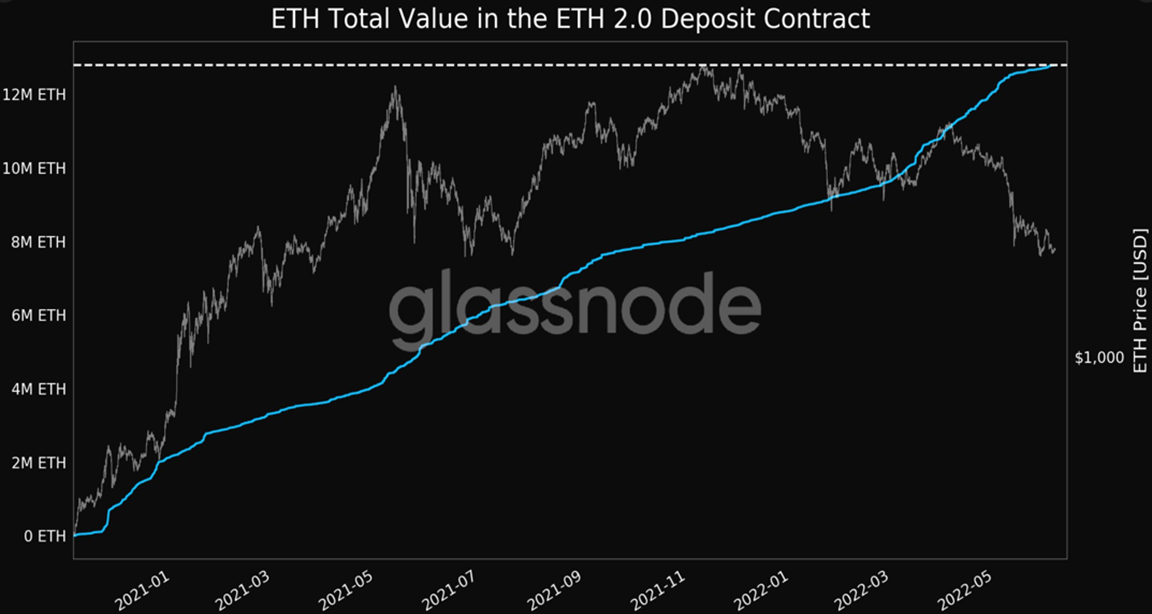

According to Glassnode, the total number of Ether (ETH) staked in Ethereum’s ETH 2.0 hit an all-time high of 12,789,829 ETH. That equates to more than 10.73% of the circulating supply and is worth roughly $23,2 billion at today’s prices. That is a big advantage Ethereum possess over its competitors: a big user base attracts more DeFi developers, creating a strong flywheel effect.

In terms of number of stakers, we are seeing more than 70.000 unique depositors and 329.000 validators, which increased remarkably since ETH’s inception.

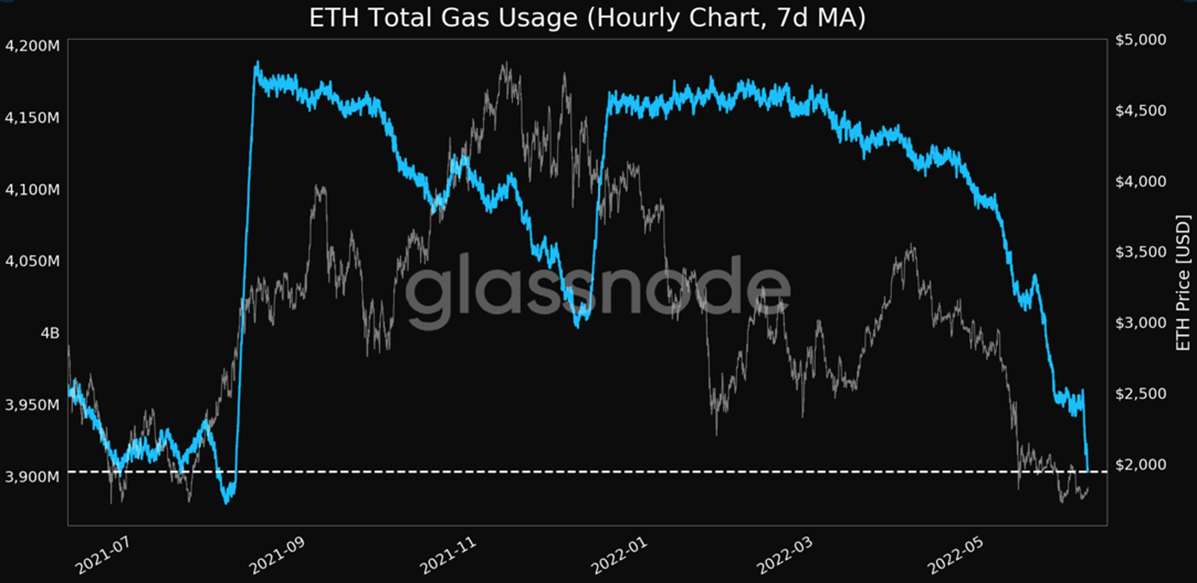

Ethereum’s notoriously high gas fees and transaction speeds have been major pain points for users and developers alike. These were also exploited by competing Layer 1 protocols (Solana, Fantom, NEAR, Cardano, etc.).

ETH 2.0 will alleviate these issues. Although total gas fees on the network recently hit a 10-month low, which is a positive trend, the reason for the decline is related to the current bear market and a drop in TVL to $75B from its all-time high of $181.6B in December 2021. It could also be related to the general decline in NFT sales and adoption of competing PoS blockchains with cheaper fees.

Effects of the merge

“The Merge” refers to a point at which Ethereum will migrate from PoW to PoS consensus mechanism and the Beacon Chain merges with the Proof of Work Chain:

Source: The Ethereum Foundation

From an ETH investor’s perspective, the main takeaway from The Merge is that it will:

- increase demand for ETH due to higher staking yields, and

- reduce (by 90%) issuance of ETH (reduce supply growth).

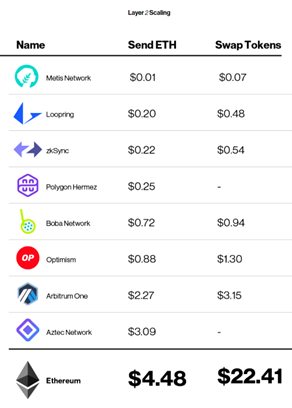

The merge alone will not lower gas fees, but it will help stabilize gas fees regardless of the ETH price. However, Layer-2 scaling solutions like Optimism, Arbitrum One, Aztec Network, Polygon Hermez, zkSync, Loopring, Boba Network or Metis Network rigorously compete to bring ETH transaction fees down on Ethereum and they are expected to lower the gas fees by 5-20x depending on the type of transaction:

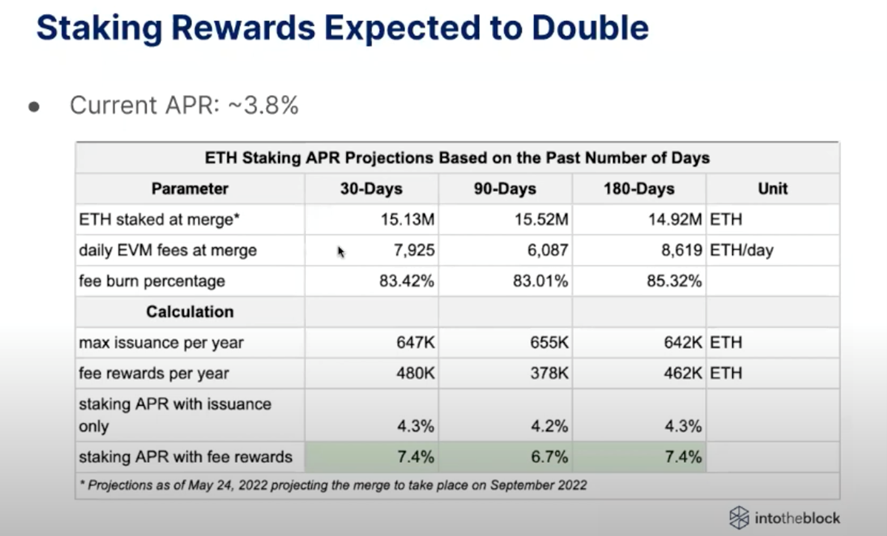

ETH 2.0 will use less electricity and should receive an eco-friendly label. This could attract more institutional investors. In addition, the PoS validator mechanism should in general aid more ETH decentralization. ETH staking demand should grow substantially. ETH Staking Yield (APR) is forecasted to double, which should substantially increase demand for staking and validating.

The main reason for higher staking APRs will be that fees that nowadays go to miners will be shifted to stakers/validators. IntoTheBlock has calculated that the current APR of 3.8% will go up to 7.4% with fee rewards:

Reduced ETH supply, maybe even deflationary

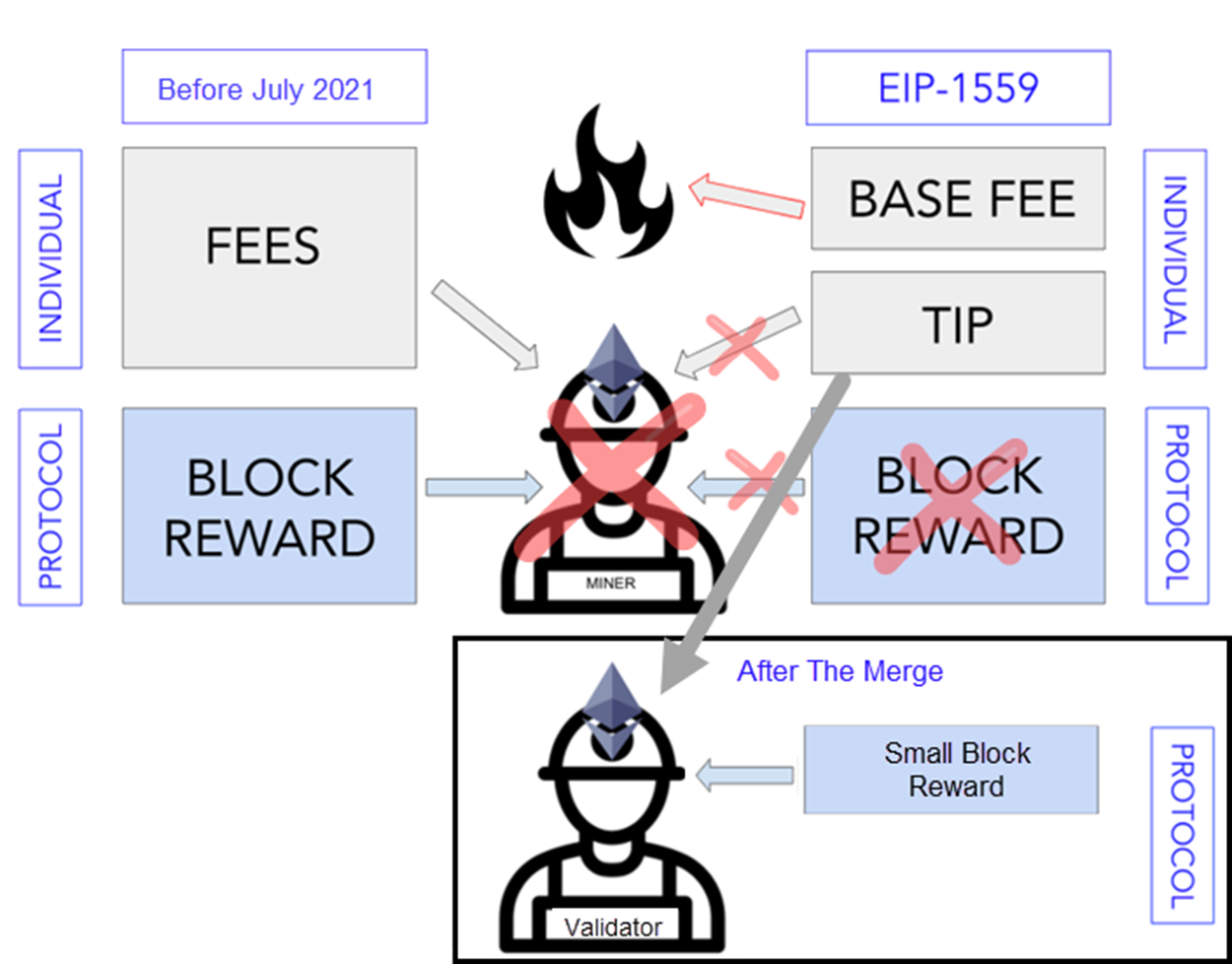

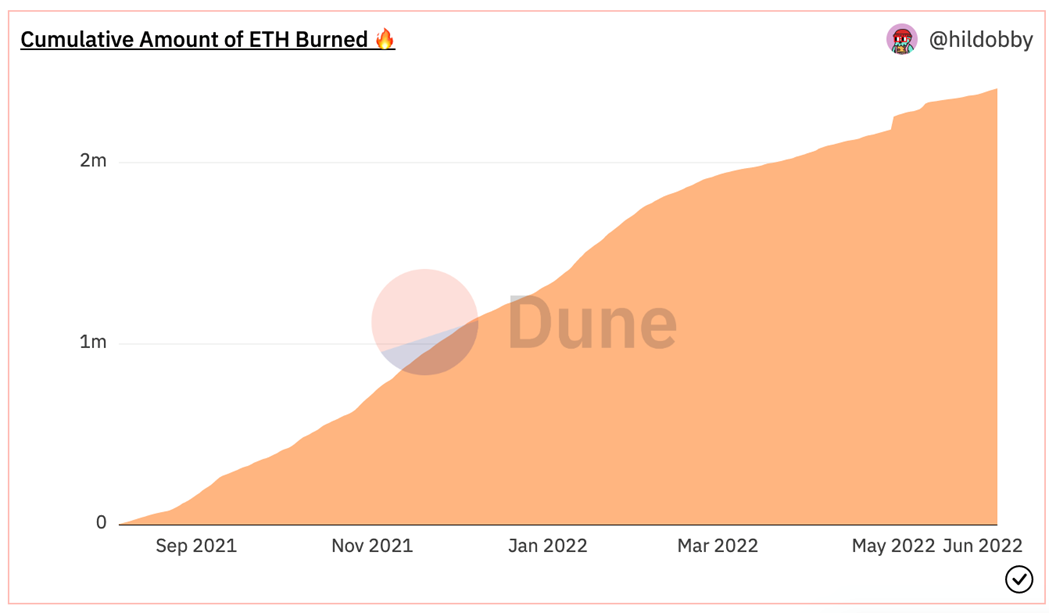

In July of 2021, as part of the London Hard Fork, the Ethereum Improvement Proposal (EIP) 1559 went into effect. It changed the Ethereum’s fee mechanism. Previously, miners were rewarded with a Block Reward and Fees for transaction processing. Now, they still get Block Rewards but the Fees are split into a Base Fee plus Tip. If a user wants to increase the priority of a transaction, he can add a tip. However, the Base Fee (in ETH awards) is burned, reducing ETH supply.

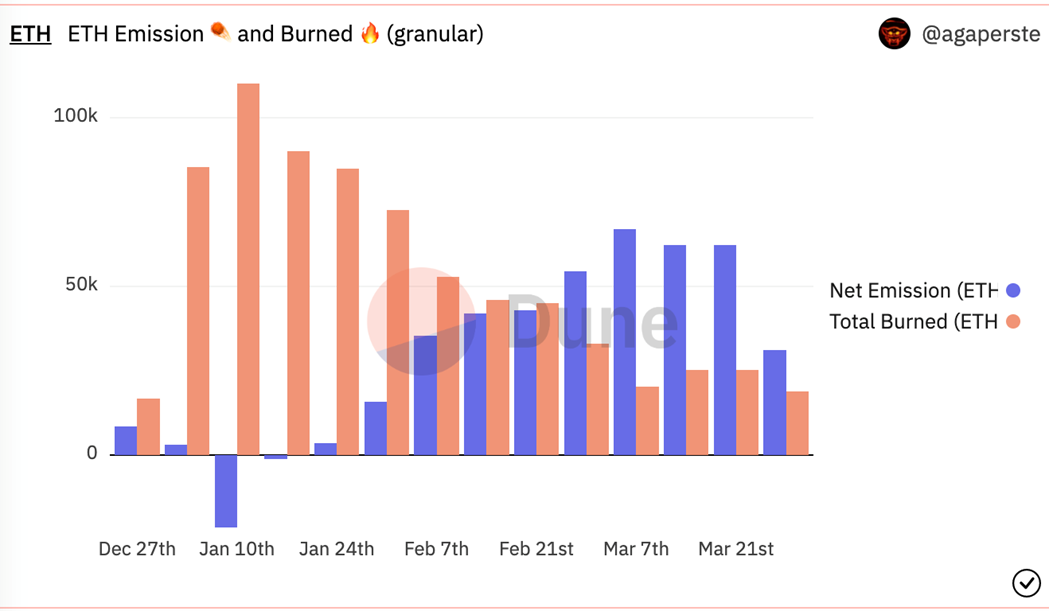

Moreover, after The Merge, when the protocol migrates from PoW to PoS, the miners will cease to function and will be replaced by Validators. Under PoS, Validators will receive much fewer Block Rewards than miners currently receive under PoW. In other words, new ETH issuance will decline. This should also significantly reduce ETH supply growth.

These two effects combined (Base Fee burn and reduction of Block Rewards), could have a deflationary effect on ETH supply: ETH Net Issuance = Issuance – Burn

According to research by crypto service provider LuckyHash, The Merge could result in 1% annual deflation rate: “When the quantity of pledge exceeds 100 million, the annual issuance rate will stabilize at 1.71%, that is, the average daily output is about 5.600. If by then the upgraded Ethereum can maintain the current burn volume, it can achieve 1% deflation every year.”

What should I do with ma ETH holdings during the merge?

You do not have to do anything. Your ETH will be automatically transferred to ETH 2.0.

However, you could stake ETH even ahead of The Merge and earn cca 3.8% APR staking yield.

For that, you can use:

- Staking Platforms such as LIDO, Aave, Curve, Yearn Finance or Benqi.

- Centralized Crypto Exchanges such as Kraken.

- Staking-as-a-Service firms such as Staked.us, Stakefish, Bitcoin Suisse and Figment.

- Self-staking with a minimum of 32 ETH.

Moreover, when staking your ETH via liquid staking providers like LIDO, you will receive stETH, which can be then used on various DeFi platforms even before the ETH Merge event.

Summary

The below table gives a very good summary of the ETH Merge effects. It also provides key metrics to follow depending on who you are in the ETH ecosystem:

altFINS is a leading crypto analytics platform used by tens of thousands of traders and investors to find profitable trading ideas.

Project altFINS began out of frustration with a lack of high-quality tools to find trading ideas, create alerts, execute trading strategies, and monitor portfolio performance across exchanges. Our team decided to fill that void.

We are building a comprehensive and yet intuitive platform that enables coin screening and analysis using traditional technical analysis as well as alternative on-chain data, and trade execution across exchanges. The combination of trade idea discovery and trade execution is truly unique in the crypto trading space.