Four Powerful Candle Stick Patterns!

Traders can use altFINS to scan the market for 30 different candlestick patterns. Here are four essential patterns every crypto trader should know about. Be sure to check out the live scan results for each of them.

Candlestick Patterns are visual representations of price movements in the crypto market provide insights into market sentiment, aiding in the identification of trend reversals and continuations.

Watch Tutorial Video

1. Doji

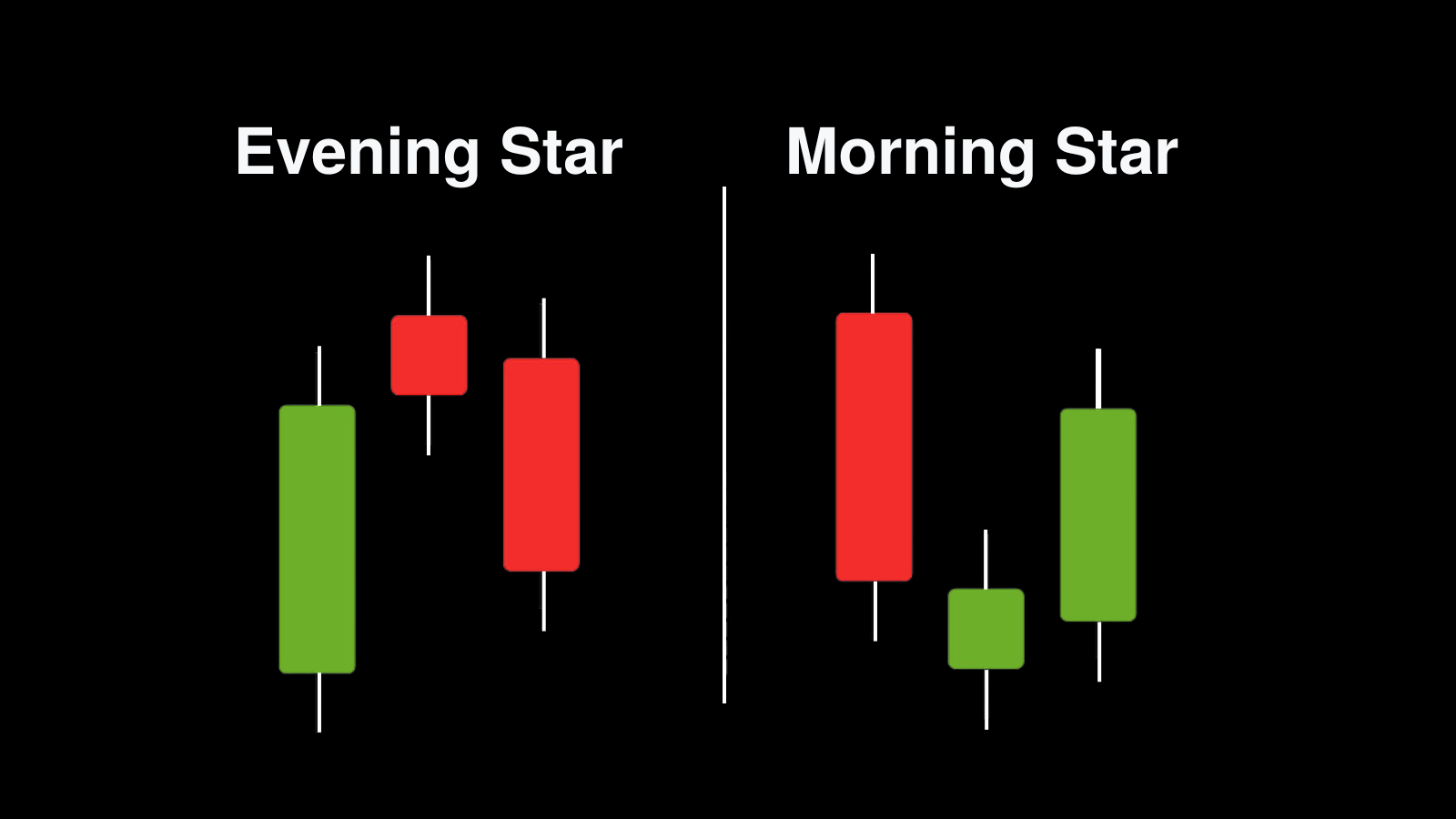

Dojis are single-candle patterns characterized by long shadows on both sides, signaling market indecision. The Morning Star and Evening Star variations of the Doji pattern provide insights into potential trend reversals.

Go to live results

Source: altFINS

2. Engulfing Patterns

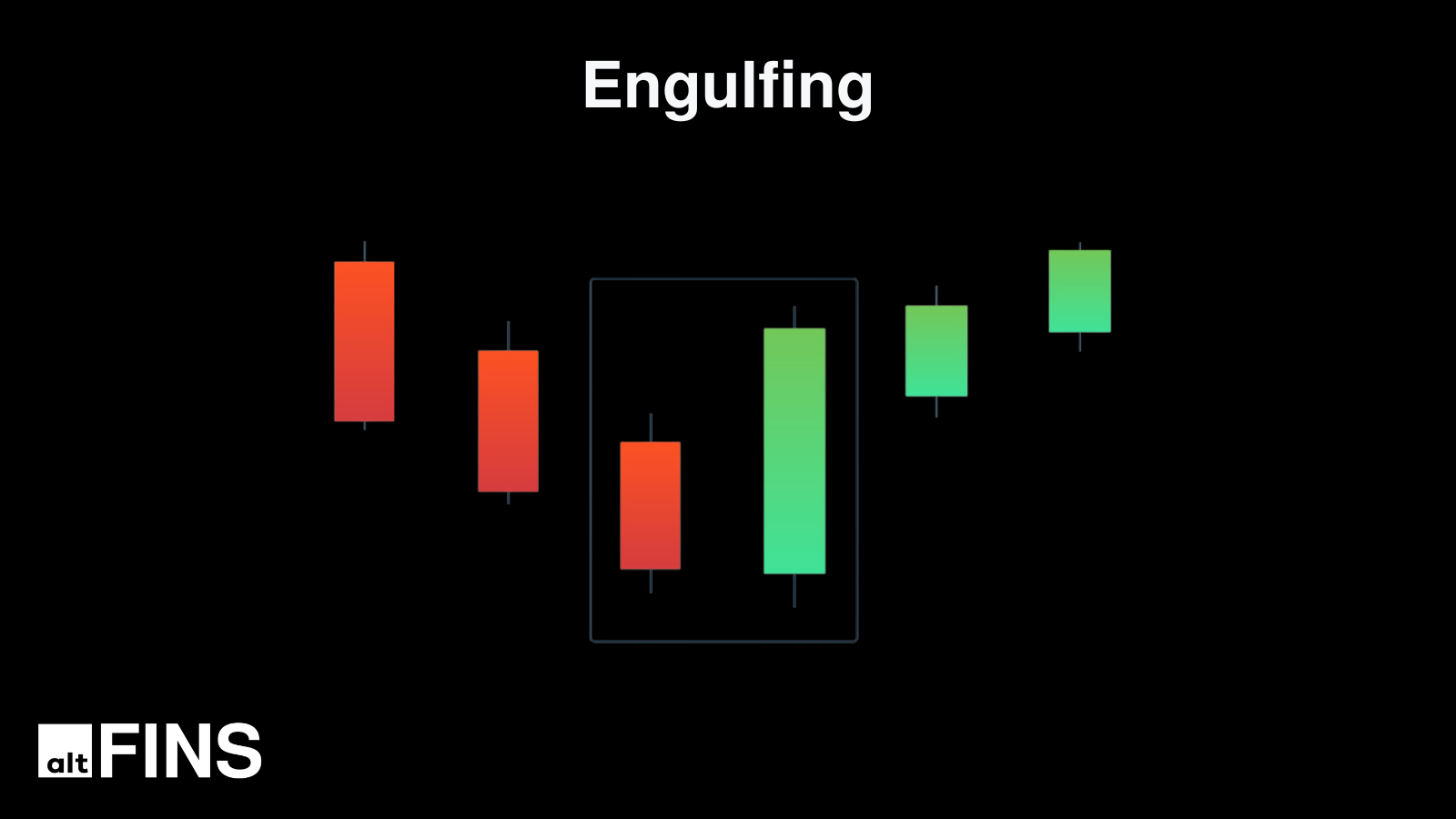

Engulfing patterns, comprising bullish and bearish variations, signal potential trend reversals. A bullish engulfing pattern occurs when a larger bullish candle fully engulfs the preceding smaller bearish candle, suggesting a shift from bearish to bullish sentiment.

Go to live results

Source: altFINS

3. Hammer

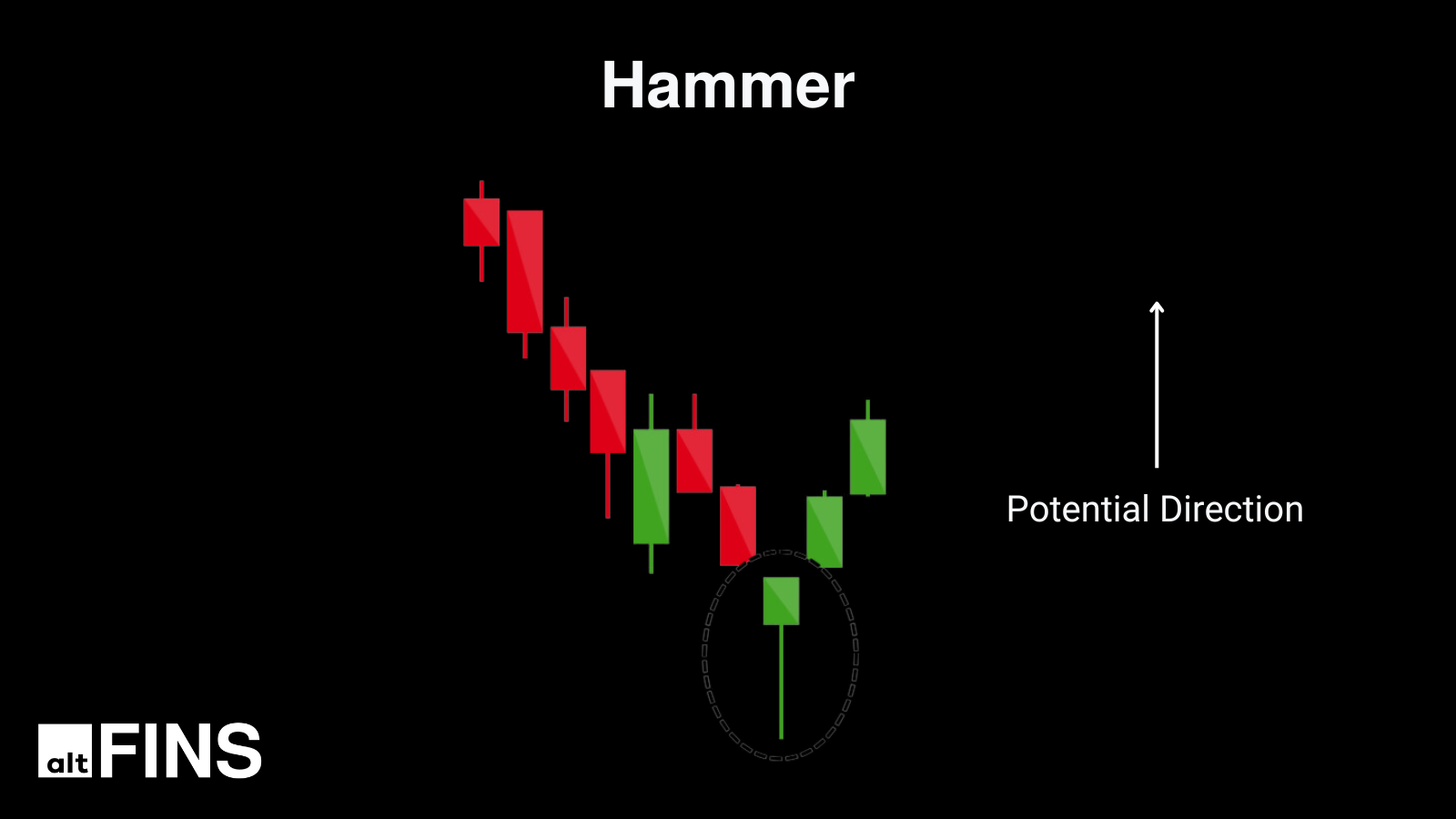

The Hammer pattern, a single-candlestick formation, acts as a strong indicator for a potential shift towards bullish reversal. It is identified by a lengthy lower shadow and a closing price that exceeds the opening price. To confirm the importance of a Hammer pattern, traders can analyze subsequent candlesticks closing higher than the Hammer pattern.

Go to live results

Source: altFINS

4. Three White Soldiers

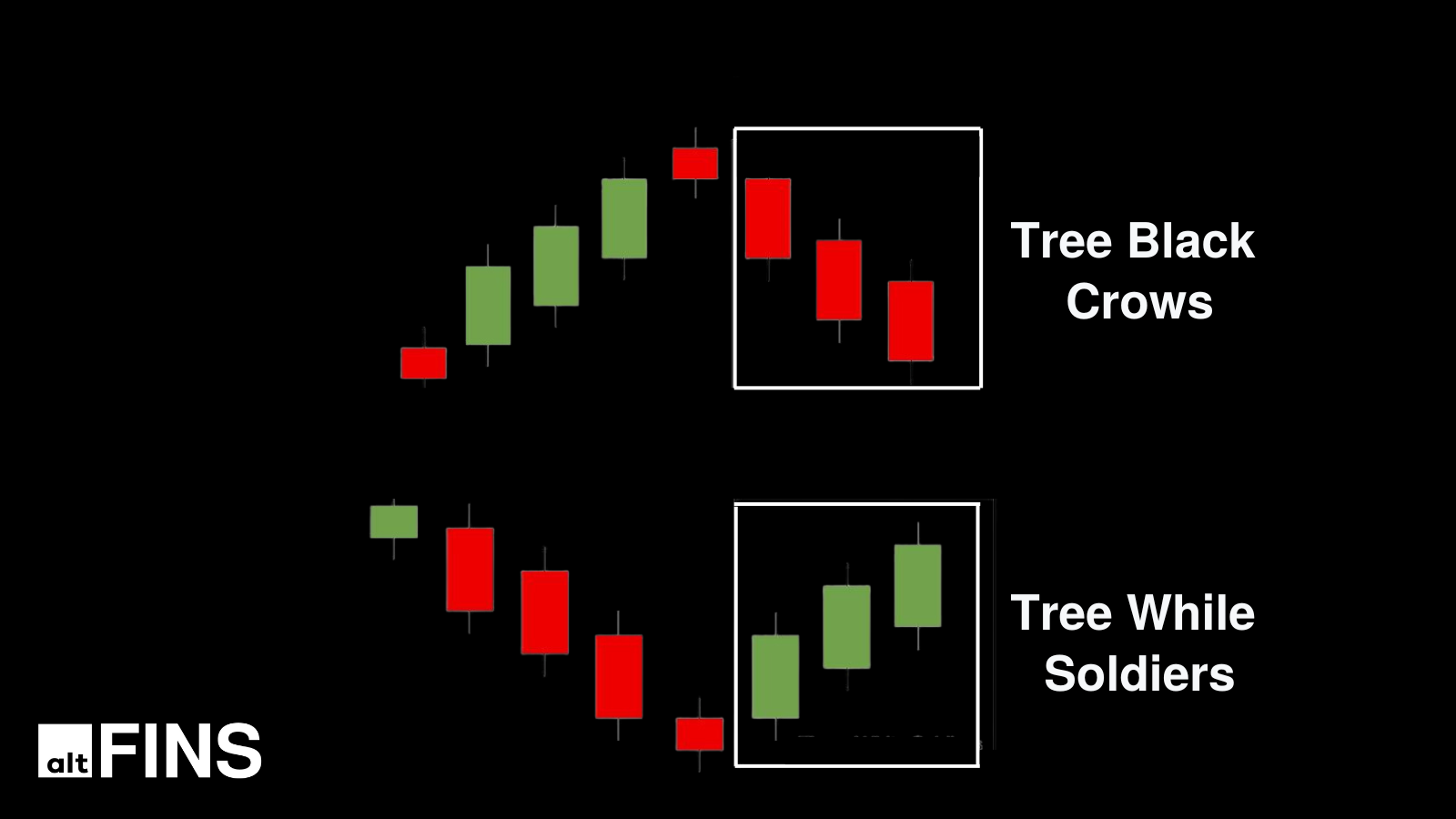

The Three White Soldiers pattern signals a bullish reversal, often observed after a downtrend. This three-candle pattern indicates a shift from bearish to bullish momentum, with each candle boasting higher highs and higher lows. Traders may view this pattern as a signal to enter long positions or anticipate upward price movement.

Conversely, its bearish counterpart is known as the Three Black Crows.

Go to live results

Source: altFINS

0 Comments

Leave a comment