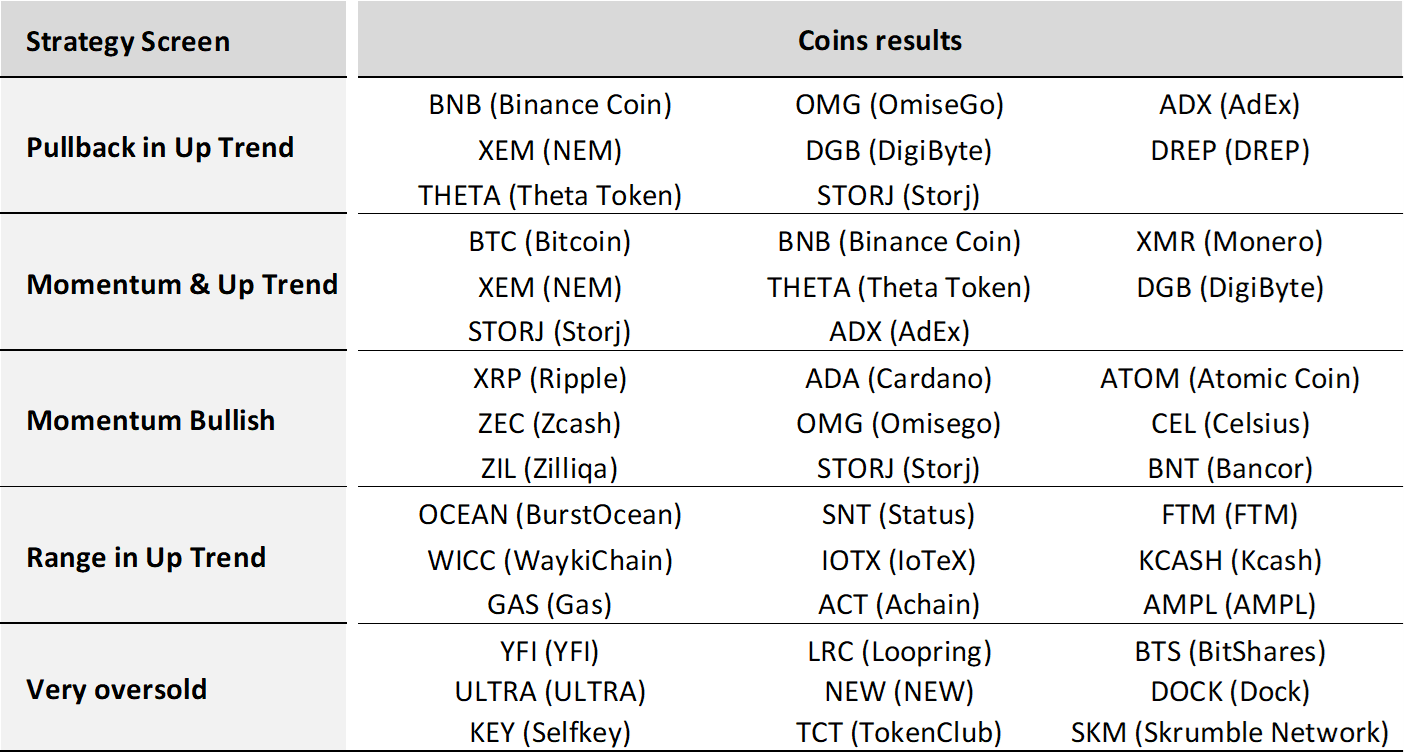

Five trade strategies - highlights (BTC, BNB, STORJ, OMG, OCEAN, KEY)

We’re highlighting results for five popular strategy screens.

These screens are now accessible in our Signals Summary tab to all users.

You can run these screens anytime and create alerts to get notified with coins or pairs that match the screen criteria.

Below we highlight one specific setup for each strategy screen, but let’s start with Bitcoin (BTC), because it sets the tone for the entire market.

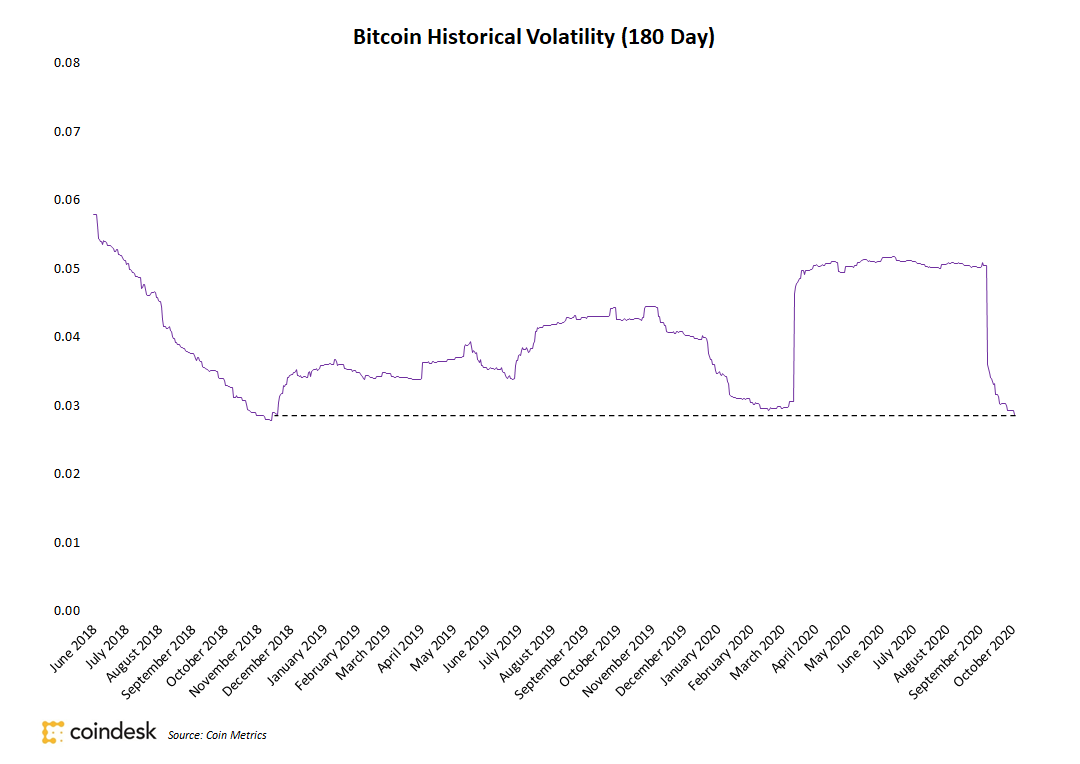

BTC is trading with declining volatility and in a narrowing range. This is very reminiscent of the June and July months. Volatility has dropped 43% in the last 30 days and is reaching a 23-month low. Following such periods of consolidation, an asset tends to make large moves. Perhaps it’ll trade here until the outcome of the U.S. elections that seems to be a driver for the other asset classes currently as well. There remains a strong support – resistance range of $10K-11K.

Many on-chain and off-chain data indicate positive fundamentals for BTC and a growing adoption among institutional and retail investors alike, which bodes well long term.

Now onto the five strategy screens. Here are the highlights:

1. Pullback in Uptrend. This is a trend following strategy. Pullbacks can often provide opportunities to jump on an established trend. Here we chose to highlight BNB (Binance Coin) which is in a solid uptrend but has had a couple of down days that could provide an opportunity.

2. Momentum & Uptrend. This screen looks for coins in a long-term uptrend and a recent bullish momentum upswing.

Storj fits this criteria. It bounced off its 100 day moving average and had bullish momentum signals (RSI and MACD crossovers).

3. Momentum – bullish. This screen looks for coins with bullish momentum, regardless of trend direction.

- Confirmation of a trend. If the momentum signals are bullish and the general uptrend is Up, then this can serve as a confirmation.

- Reversal indication. If the momentum signals are bullish but the general trend has been Down, then this could signal a trend reversal (from Down to Up in this case). Vice versa, if the coin has been in an UpTrend, but momentum signals turn bearish, this could indicate a correction / pullback or a trend reversal.

OMG (Omisego) has received such momentum upswing recently, after bouncing off of its $3.00 support level. It could be a beginning of an uptrend resumption.

4. Range in Uptrend. Range-bound trading is a trading strategy that seeks to identify and capitalize on coins trading in price channels.

After finding major support and resistance levels and connecting them with horizontal trendlines (zones), traders can buy when the price approaches support and sell when it reaches resistance. Technical indicators, such as the relative strength index (RSI), stochastic oscillator, and the commodity channel index (CCI), can be used to confirm overbought and oversold conditions when price oscillates within a trading range.

OCEAN (BurstsOcean) coin fits the bill. It’s sitting on its Support and is oversold (RSI < 30 and CCI < -100).

5. Very Oversold. With most altcoins still in a short term Down Trend, we took a look at some extremely oversold situations that could be ripe for a bounce as sellers get exhausted and value hunters step in. This type of situation ain’t for the faint of heart and is clearly intended for swing traders, not trend followers, because this is clearly in an ugly Down Trend. And trading against the Trend is risky.

One such situation is KEY (Selfkey), which is very oversold on all three oscillator indicators (RSI = 21.86, STOCH = 7.67, CCI = -144). RSI and STOCH readings below 30 are very oversold, and below 20 extremely oversold. Similarly, CCI readings under -100 are very oversold. Plus, the price is at its 200 day moving average and support level of $0.002.

Risk management – Stop Loss and trade size. In all of these setups, traders should use Stop Loss orders to manage their downside risk, in case the trade goes against us, as it often will. Trading is about probabilities and even though these setups have a high win rate, one must be prepared to minimize losses on the trades that go bust. If Stop Loss order types are not supported by they exchange, at least set up a price alert (see video). Also, trade size should be such that you never risk losing more than 2% of your total equity. Keeping the trade size small allows the trader to setup a wider Stop Loss, which gives the trade more room and time to complete with success. Setting Stop Loss levels too tight can often result in getting knocked out of a trade prematurely.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.