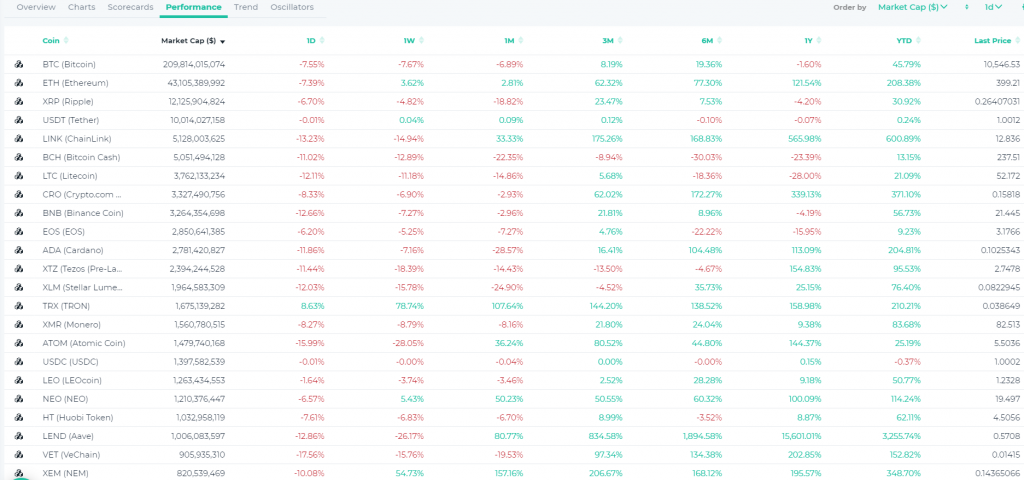

Canary in a coal mine: using MACD as a Sell signal

The last few days were rough for crypto markets.

We’ve had significant corrections from BTC through most of altcoins. We gave up a lot of the recent gains. The larger caps are down 10-20% and the smaller caps even more. Interesting to note that even “traditional” markets are seeing risk-off sentiment as NASDAQ closed down 5% yesterday.

Today we’re seeing a modest bounce, but still, lot of trendlines and support lines were blown out.

Longer term trends remain bullish but shorter term indicators have turned bearish. If you’re a long term investor, maybe a HODLER, you can ride it out, but for trend and swing traders, it’s decision time.

What can we learn from this correction?

- Volatility can spike quickly. Markets had been trending up since the last big drawdown in March and this can make us complacent, ignoring red flags.

- One needs to have a clear strategy for when to exit trades, just as much as for entry.

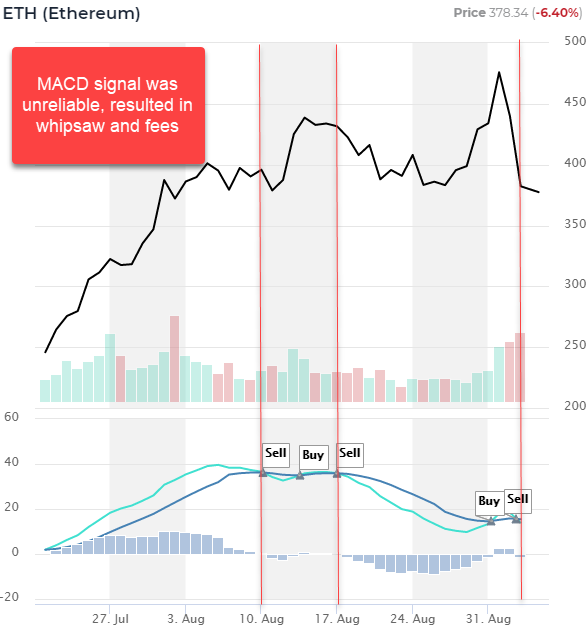

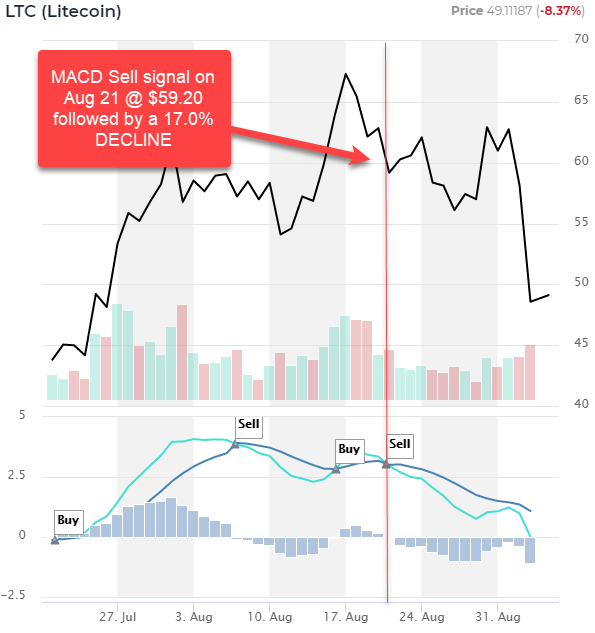

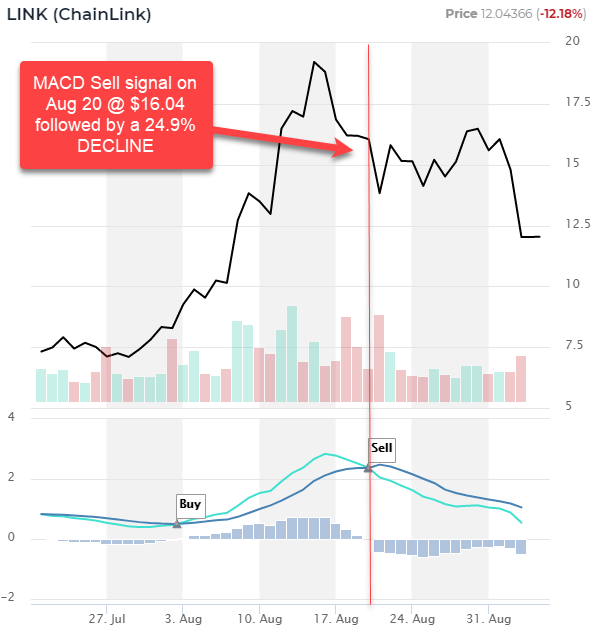

- Use MACD as a warning sign. MACD is great at catching early changes in momentum, up or down.

- Create alerts to get notified of red flags like MACD turning bearish.

Below are examples of MACD giving an early warning. Keep in mind that in some cases even MACD lags, especially when there’s a rapid decline, a big gap down. Also, MACD alone may not be a sufficient Sell signal as it can lead to a whipsaw (see ETH example below). But most of the time, it is a great warning that momentum is changing.

Traders can set an Alert using altFINS platform that will send an email notification when MACD changes to Sell. See video below.

Risk management – Stop Loss and trade size. In all of these setups, traders should use Stop Loss orders to manage their downside risk, in case the trade goes against us, as it often will. is about probabilities and even though these setups have a high win rate, one must be prepared to minimize losses on the trades that go bust. If Stop Loss order types are not supported by they exchange, at least set up a price alert (see video). Also, trade size should be such that you never risk losing more than 2% of your total equity. Keeping the trade size small allows the trader to setup a wider Stop Loss, which gives the trade more room and time to complete with success. Setting Stop Loss levels too tight can often result in getting knocked out of a trade prematurely.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.