BTC - almost in sweet spot; THETA trend broken? ULTRA oversold!

BTC touched $10,370 earlier today, completing another round trip in the $10K-$11K trading range that we highlighted on Sept 25 here.

Range-bound trading is a trading strategy that seeks to identify and capitalize on coins trading in price channels. After finding major support and resistance levels and connecting them with horizontal trendlines (zones), traders can buy when the price approaches support and sell when it reaches resistance. Technical indicators, such as the relative strength index (RSI), stochastic oscillator, and the commodity channel index (CCI), can be used to confirm overbought and oversold conditions when price oscillates within a trading range.

In BTC case, the price is approaching the Support Zone, but is not yet oversold based on RSI and STOCK (both not under 30 yet), and CCI (not under -100 yet). Ideal set up is Oversold at Support for Long positions, and Overbought at Resistance for Sell positions. Also, it’s safer to trader in the overall direction, which in BTC case is still Up Trend.

Is THETA’s Up Trend Broken? THETA has been a monster gainer, even during the general crypto and DeFi crash in September. Last few days, the price has pulled back, however. Is the Up Trend broken? or is this just a pullback / consolidation / correction that should be bought?

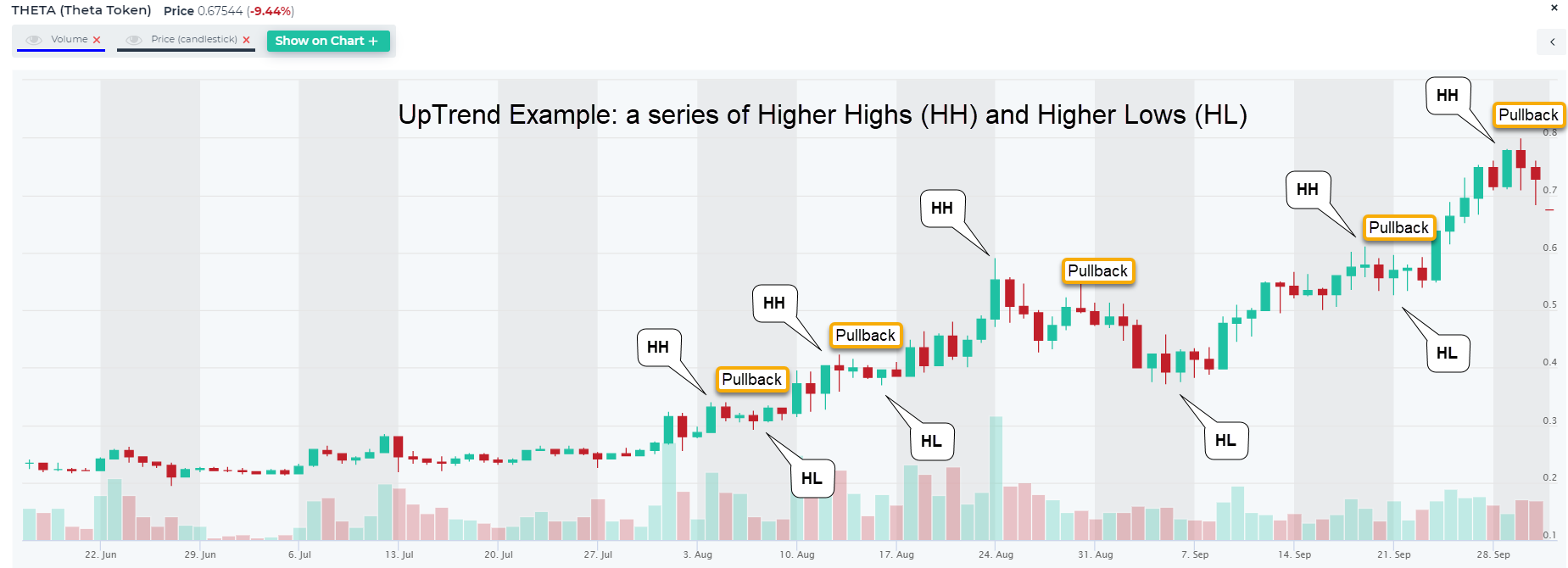

Pullbacks can often provide opportunities to jump on an established trend. It’s difficult to catch a trend in early phases and conservative traders prefer to jump in midstream, once a trend is established. Even in an Up Trend, prices never go straight up, day after day. There are times when price consolidates, pulls back, and then resumes an Up Trend. These corrections are opportunities to join a trend.

An Up Trend’s definition is when the price forms Higher Highs (HH) and Higher Lows (HL). (Down Trend is the opposite – Lower Highs (LH) and Lower Lows (LL)). Traders should visually confirm the HH and HL for an Up Trend, as indicated in the example with THETA.

So far, the current pullback appears to be just that, a pullback. As long as it doesn’t dip bellow the prior Low of $0.52, the Up Trend remains valid. Perhaps that’s where a trend-following trader would place a Stop Loss or an Alert.

With most altcoins still in a short term Down Trend, we took a look at some extremely oversold situations that could be ripe for a bounce. This type of situation ain’t for the faint of heart and is clearly intended for swing traders, not trend followers, because this is clearly in an ugly Down Trend. And trading against the Trend is risky.

We ran the following screen:

- RSI 9 is below 30 (oversold in 0-30 range and overbought in 70-100)

- STOCH is below 20 (oversold in 0-20 range and overbought in 80-100)

- CCI 20 is below -100 (oversold under -100 and overbought over +100)

- Volume ($) is above 200,000 (min liquidity requirement)

The screen gave us only 3 results, so this is a very selective screen. One of them looks very interesting: ULTRA.

ULTRA is very oversold on all three oscillator indicators (RSI = 23.40, STOCH = 13.8, CCI = -188). Also, interestingly, OBV (on-balance-volume) is declining modestly, but not much. That indicates that the volume on down days hasn’t been that strong. After six straight down days of trading, sellers are getting exhausted here. And, lastly, the price is near it’s 100 day SMA, which could act has a support, or at least road bump on the way down.

Risk management – Stop Loss and trade size. In all of these setups, traders should use Stop Loss orders to manage their downside risk, in case the trade goes against us, as it often will. Trading is about probabilities and even though these setups have a high win rate, one must be prepared to minimize losses on the trades that go bust. If Stop Loss order types are not supported by they exchange, at least set up a price alert (see video). Also, trade size should be such that you never risk losing more than 2% of your total equity. Keeping the trade size small allows the trader to setup a wider Stop Loss, which gives the trade more room and time to complete with success. Setting Stop Loss levels too tight can often result in getting knocked out of a trade prematurely.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.