Are MEME Coins Done?

As is the case in every up-cycle in crypto markets, the most speculative assets often rise the most.

MEME coins are purely speculative. No fundamentals. No product, no team, no community, they’re not even pretending to create any utility.

MEMEs are just pure trader psychology, sentiment driven.

MEMEs are perfect for Technical Analysis!

As such, they can actually be perfect for Technical Analysis!! Because TA uses indicators and tools that leverages market psychology, pure price action.

You can find 43 MEME coins on altFINS platform by selecting “MEME” category (see here). These are the more “legit” MEMEs that have been listed on CEX and have decent trading liquidity.

(btw, you can find over 100 asset categories on altFINS including AI, DeFi 2.0, Base Ecosystem, Layer 2, LSD, Restaking)

Some MEMEs have made massive gains and WIF (dogwifhat) is on top of the YTD performance list with 1,600% gain!!

But most MEMEs have pulled back along with the rest of the market, or more so. MEMEs are more volatile than your regular digital asset, both, on the way up and down.

MEMEs Performance

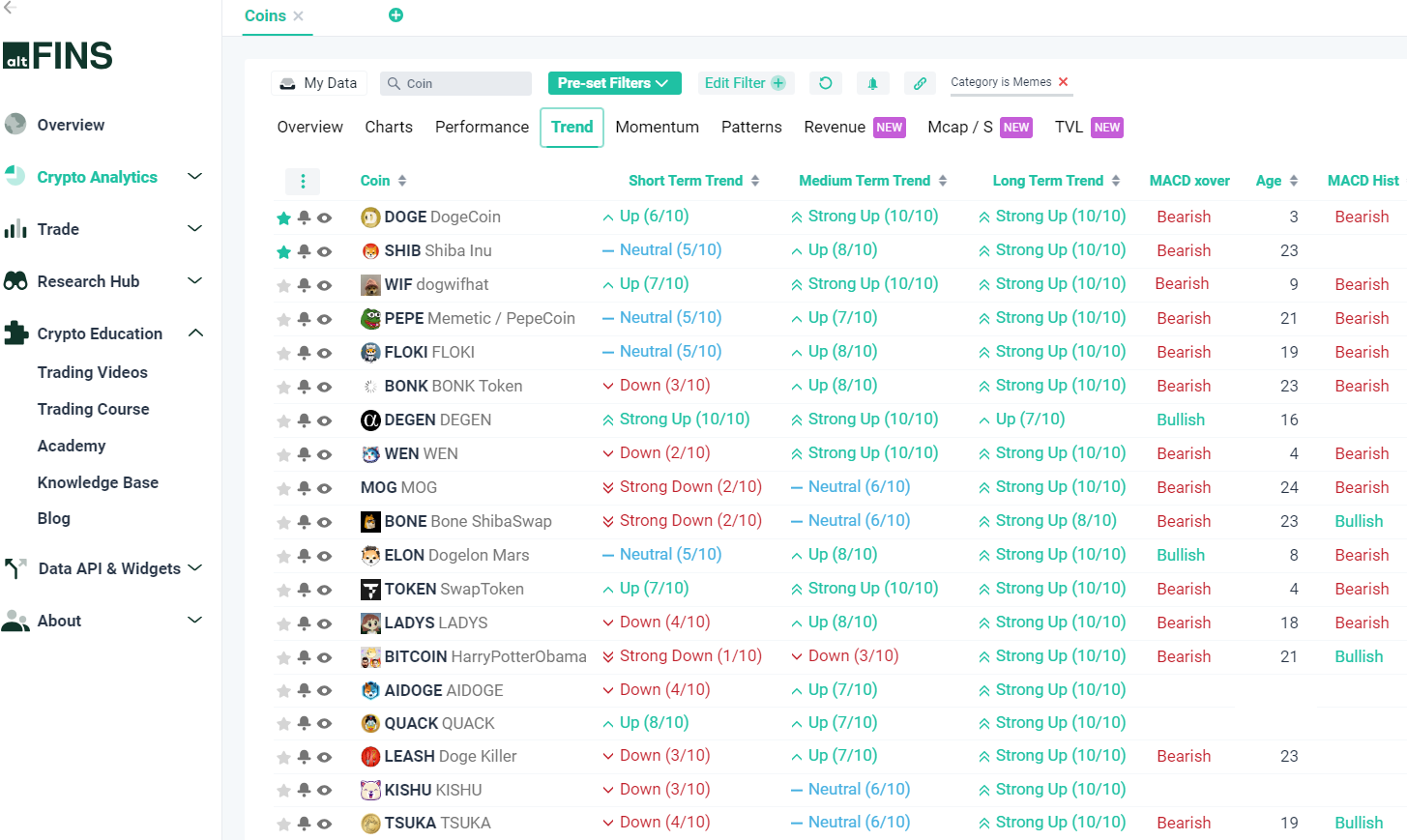

Despite the pullback, most MEMEs are still technically in an Uptrend, at least on a Medium- and Long-Term basis. See table below.

(altFINS platform constantly updates trend ratings for nearly 3,000 assets)

Near-term, their momentum remains Bearish, based on MACD Signal line crossover and MACD Histogram trends. But there are a few exceptions such as BONE, DEGEN and TSUKA.

MEMEs Trend Ratings

MEMEs How to Trade Next?

Traders can use the following market scan to find potential trading opportunities: MEMEs in Uptrend & Momentum upswing (see live results) – assets with prices that are still in an Uptrend and are already bouncing up.

We teach this trading strategy in our new Crypto Trading Course.

WIF – Technical Analysis

WIF topped out at $5.00 resistance where it got rejected and pulled back. Price remains in an uptrend. It’s approaching $3.20 support area, which was previously a resistance (concept known as Polarity – we teach this in our new Crypto Trading Course). It does not appear that price will respect this level and could dip as low as $2.00 support before bouncing up.

Price is not oversold yet (RSI > 30) and momentum is bearish (MACD).

We’d wait for price to find support, ideally around $2.00 level, for a swing trade entry.

0 Comments

Leave a comment