altcoins Riding a Bullish Momentum Swing

altcoins are enjoying a bullish upswing in momentum (MACD), which create attractive swing trade setups between support and resistance zones.

While most coins are still in a downtrend on Short- and Medium-Term basis, many are experiencing and upswing in momentum that could carry them to the next resistance zone.

Swing trade opportunities. While trend traders can continue to screen the market for the few remaining coins in an Uptrend, others can look for momentum swings.

Swing traders are looking to enter on momentum upswing, ideally around key levels (support and resistance) and exit when momentum loses steam. Read more on swing trading here.

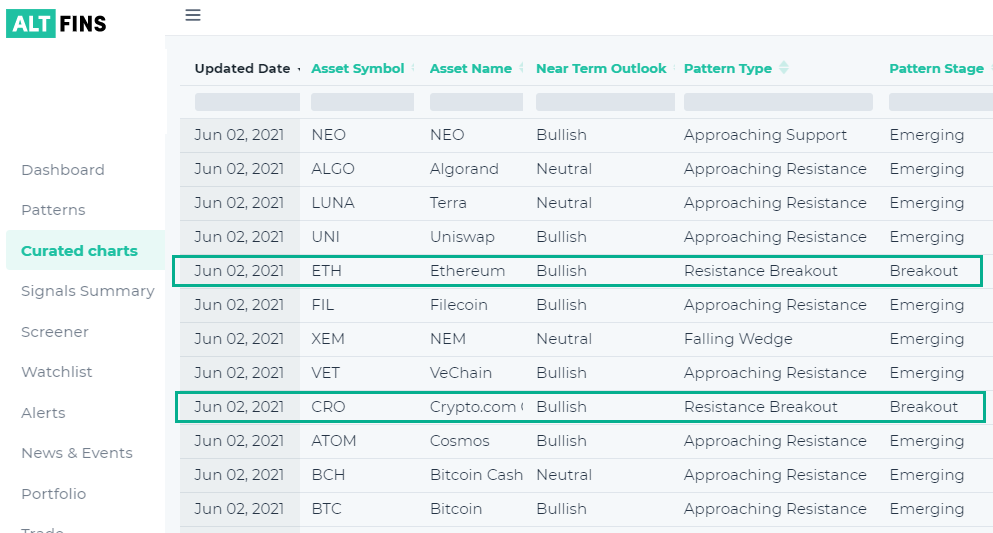

Our Curated Charts highlight several such Swing Trade opportunities today:

Wanna be early? If you wanna catch breakouts early, check our curated charts and create simple price alerts for indicated resistance levels or MACD crossovers.

Typically, resistance breakouts result in further gains to the next resistance zone. Not always, of course, but often enough (~70% of time) to make it one of the most attractive trading strategies.

Ethereum (ETH) is among coins with a pending bullish momentum inflection (MACD) and resistance breakout (above $2,500), which could carry it to $3,000.

Find more trade setups on Curated Charts.

New MACD Buy / Sell signals tutorial video. MACD Buy / Sell crossover signals are a very popular and powerful momentum trading tool. We’ve added a 3 min video to our knowledge base on how to create a MACD Buy / Sell signal and alert for any coin (we used ADA as example). Watch here.