Cryptocurrency Price Analysis - week 30 and YTD (2021)

Cryptocurrency Analysis – week 30 and YTD, 2021

altcoins gain but pullback is likely near-term

Crypto markets have experienced a strong bounce during the last two weeks. We’re seeing some positive signs of trend reversals. Prices are finally making Higher Lows and Higher Highs, and Short-Term trends are inflecting to Neutral or Up again.

While we hope the trend reversal continues during rest of 2021, near term, it appears that traders are starting to cash in on the big gains, taking some profits off the table. We can see that in the fading momentum as MACD Histogram bars are inflecting from rising to declining.

So we’d expect a brief period of profits digestion, which could create some buying opportunities again at lower levels.

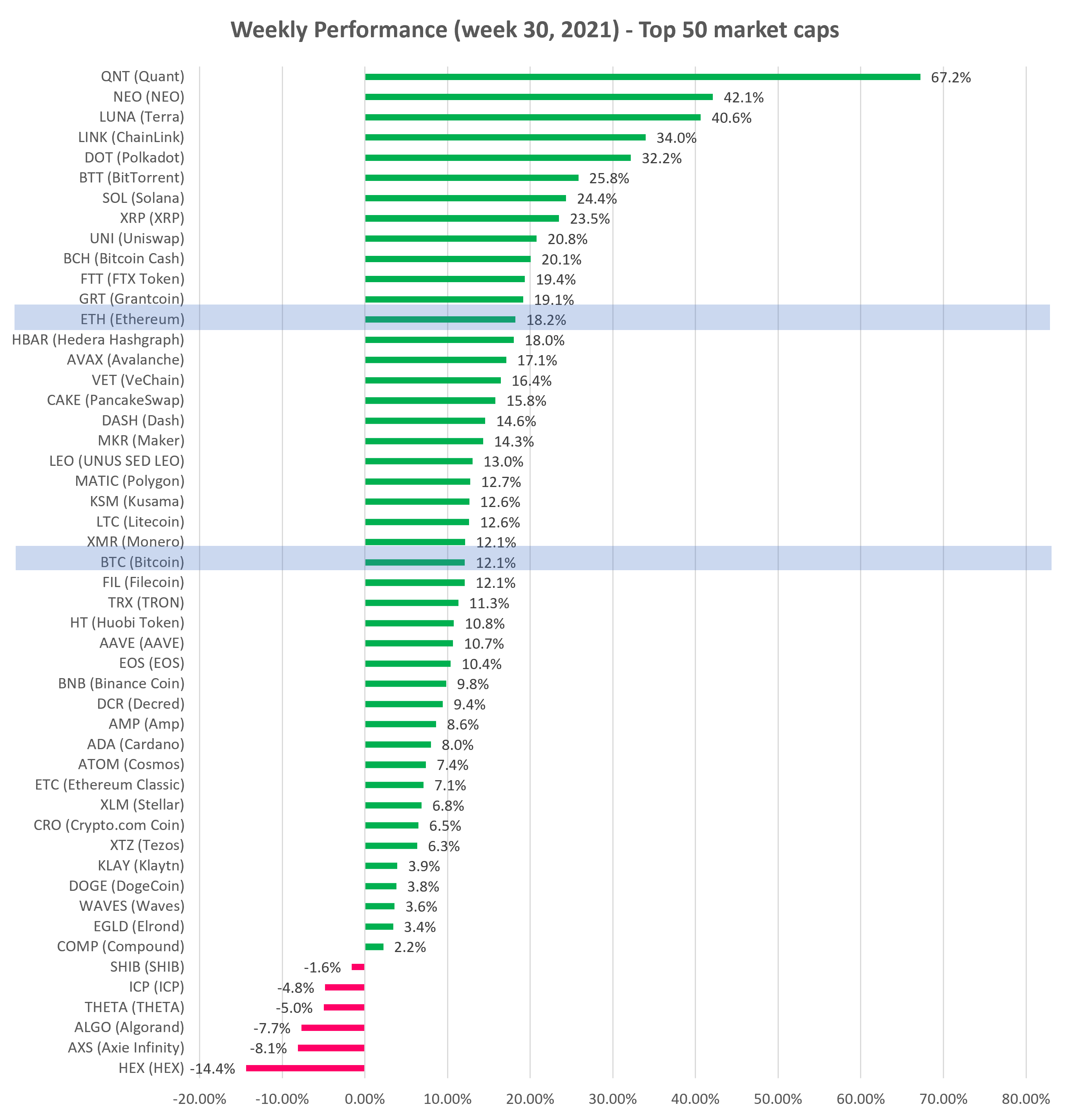

Bitcoin (BTC) ended the week up +12.1% and Ethereum (ETH) was up +18.2%, versus last week’s gains of +20.3% and +23.3%, respectively.

Several recent negative news events have subsided (carbon footprint from BTC mining, China crackdown on miners, Grayscale share unlock) and were countered by positive news like rumors of Amazon looking to accept BTC for payments and upbeat commentary from Elon Musk at a Bitcoin conference (The B Word).

Bitcoin (BTC) technical analysis (see more): BTC broke out of a sideways channel ($30K-$40K) and Short-Term trend has inflected upwards.

However, momentum (MACD) appears exhausted near term as some traders take profits around this critical level after solid 30%+ gains in two weeks.

Following some digestion of profits, price could reach the 200-day MA (~ $45) resistance next. It’s faced stiff resistance at $40K in the past two months, so a break above it is an important step in reversing the downtrend.

Check our curated charts for more technical analyses of top 30 altcoins.

Check our curated charts for more technical analyses of top 30 altcoins.

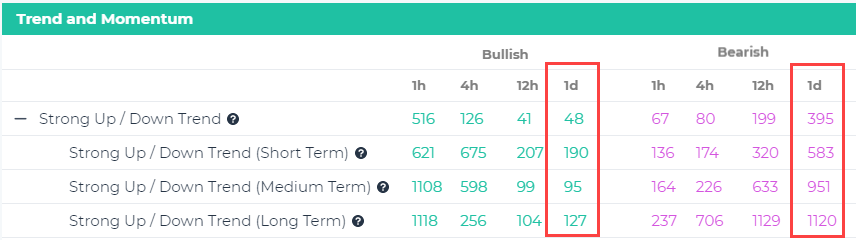

Trends among altcoins improved. We’re seeing good signs of potential trend reversal forming. Some altcoins have posted Higher Lows and are making Higher Highs now. Also, Short-Term trends have neutralized (from Downtrend) and in some cases even turned upwards.

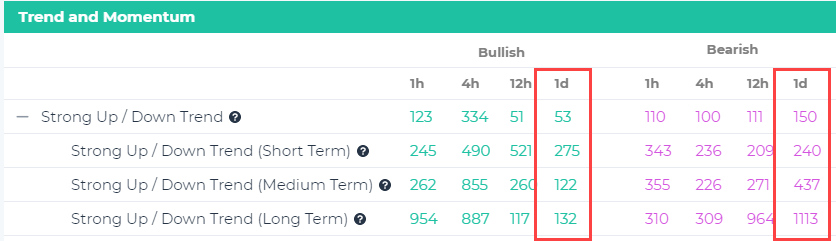

Our Signals Summary page indicates that the number of coins in a Strong Uptrend has increased from prior week:

Versus prior week:

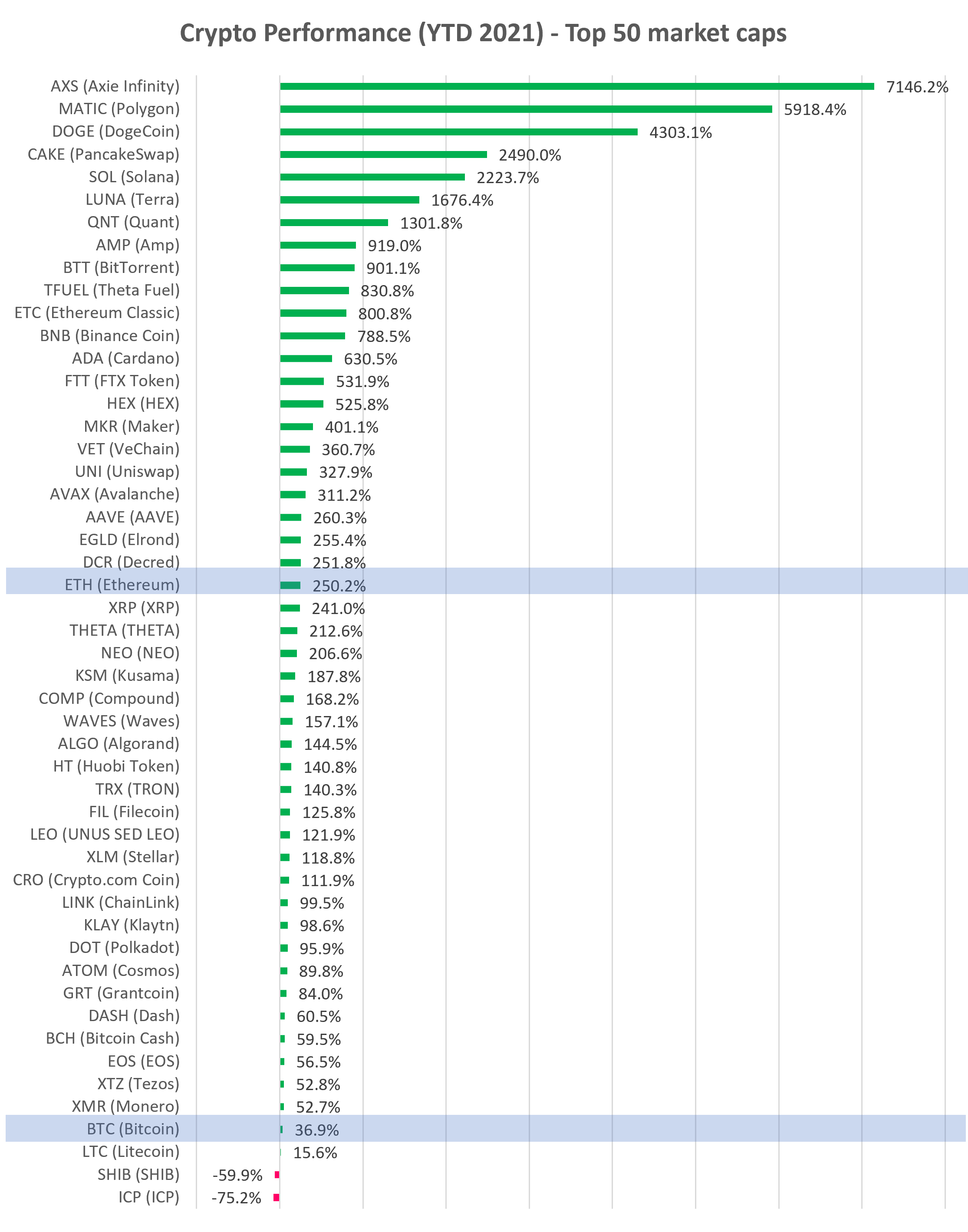

See top 50 coins by market cap “Performance” tab on our platform (see charts below). Check our curated charts for technical analysis of top 30 altcoins.

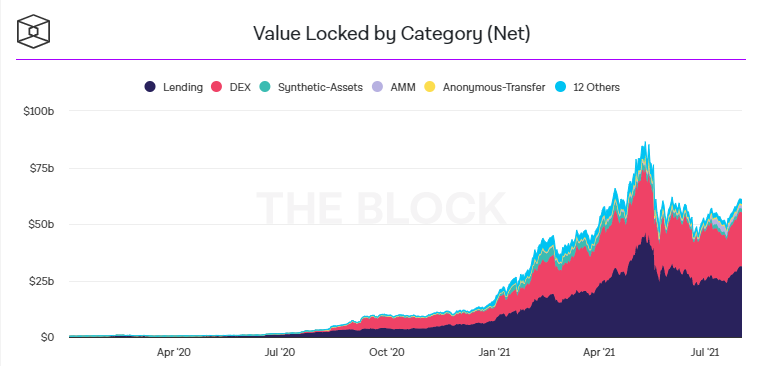

Decentralized Finance (DeFi) – Total Value Locked (TVL) increased last week to $61B, +4% w/w (vs. +22% prior week), and is up +268% YTD.

Decentralized Finance (DeFi) – Total Value Locked (TVL) increased last week to $61B, +4% w/w (vs. +22% prior week), and is up +268% YTD.

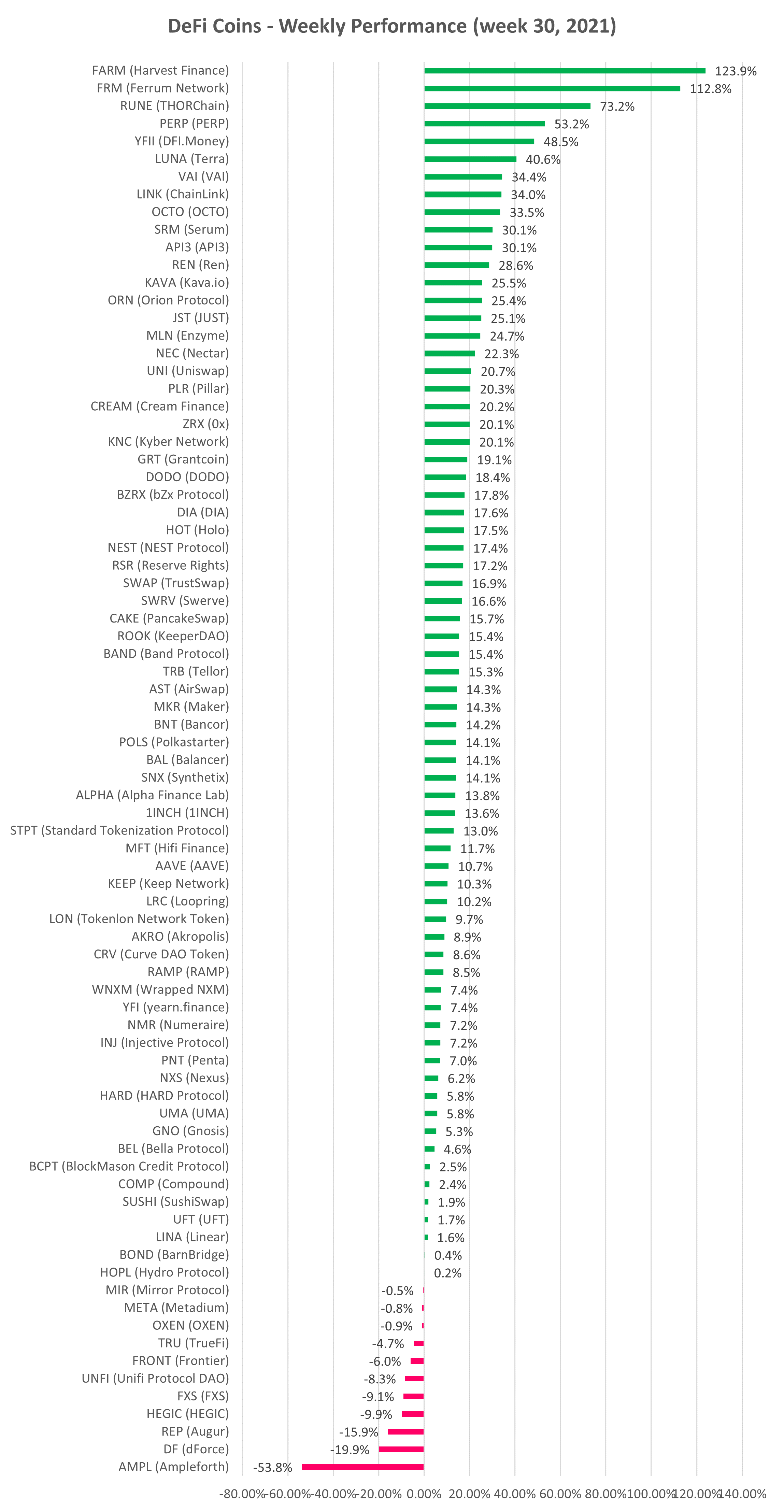

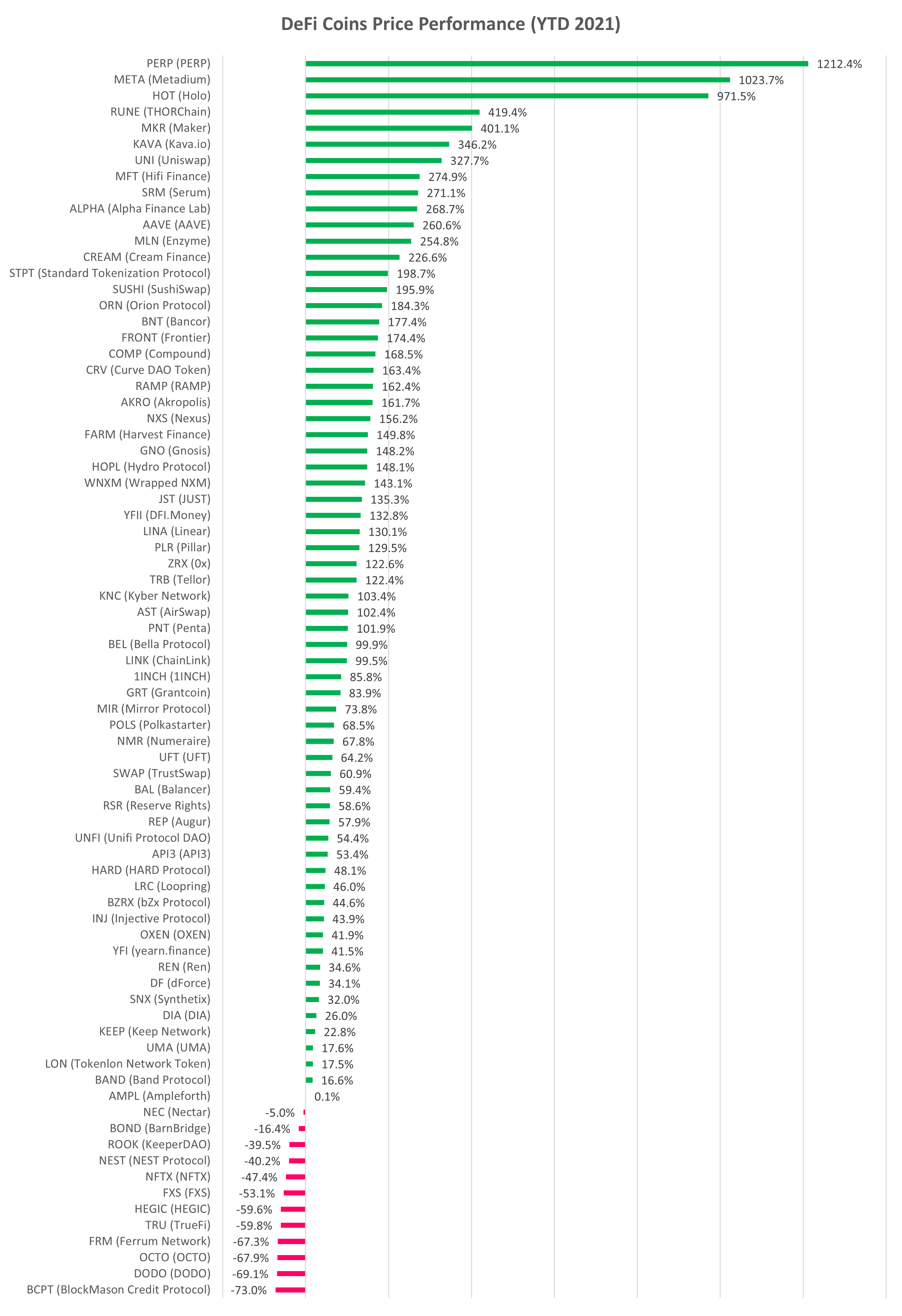

DeFi cryptocurrency prices rebounded along with the rest of the market (see below). Total DeFi category market cap increased last week by 9% (versus +31% prior week), and is up +334% YTD (i.e. ~ 4.3x).

Harvest Finance (FARM) was a standout gainer (+124%) last week after getting listed on Coinbase. To find upcoming exchange listings, search for “Listing” or “Exchange” keywords on our News section. altFINS aggregates Twitter news in real-time for thousands of altcoins.

Source: altFINS.com

Source: altFINS.com

Check our unique automated chart pattern recognition for fresh trading ideas. Also, during market corrections, it’s good to revisit coins in an Uptrend but with a pullback. Our Signals Summary has this and other pre-defined filters ready for action.

Subscribe to our newsletter to receive future blog updates in your inbox and make sure you add altfins.com to your email whitelist.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.