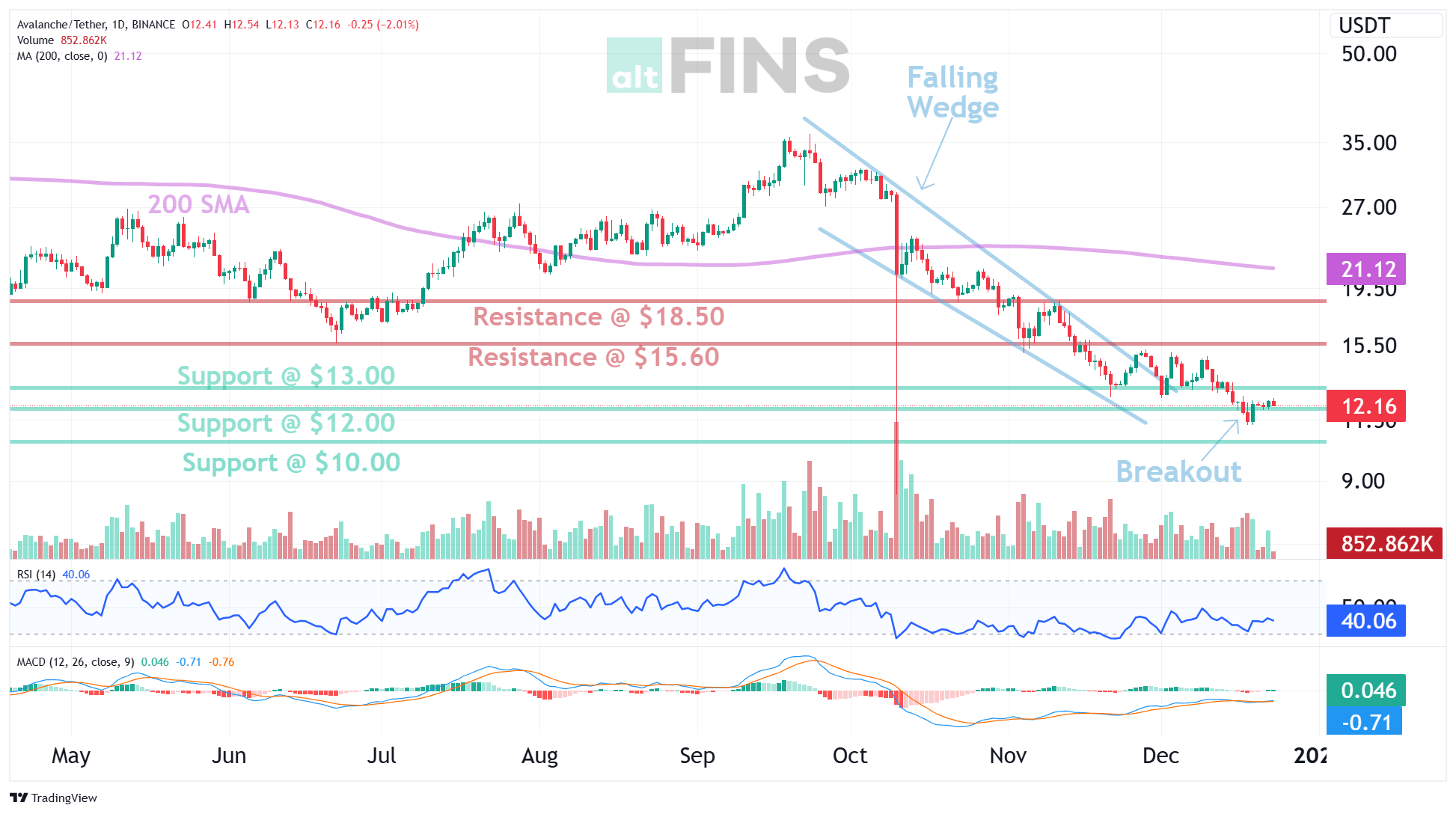

Crypto Alert: Downtrend Resumes - Brace for a Potential Drop to $10!

Is your crypto portfolio feeling the pressure? Recent technical analysis indicates a potential further drop for a specific cryptocurrency (we're keeping it generic for broad applicability). Here's what you need to know:

The Setup: Broken Support and a Resumed Downtrend

Remember that hopeful breakout from the Falling Wedge pattern? It fizzled. The price couldn't conquer the $15.60 resistance and has since retreated, breaking below the crucial $12.00 support level. This Lower Low signals a resumption of the downtrend.

[Optional: Insert Image of a downward trending chart, highlighting the break below support]

Why This Matters: Support Breakout Explained

A support breakout is a bearish signal. It shows that sellers are dominating buyers at the support level, paving the way for further price declines. Think of it like a dam breaking – once the water (price) breaches the barrier (support), it rushes downwards.

The Target: $10 on the Horizon?

The immediate downside target is the next support zone around $10.00. Keep a close watch on price action as it approaches this level.

Trend Check:

- Short-Term: Down

- Medium-Term: Strong Down

- Long-Term: Strong Down

The trend paints a clear picture: the bears are in control across all timeframes.

Momentum Check:

Currently, the Relative Strength Index (RSI-14) suggests that the price is neither overbought nor oversold. This means there's room for the downtrend to continue.

Key Levels to Watch:

- Support: $12.00 (broken), $10.00 (next target)

- Resistance: $15.60, $18.50

What Should You Do?

-

Set a Price Alert: Don't get caught off guard! Set a price alert near the $10.00 level to stay informed of potential further declines.

-

Review Your Risk Management: Are your stop-loss orders in place? Now's the time to revisit your risk management strategy to protect your capital.

-

Hone Your Trading Skills: Understanding breakout strategies and risk management is crucial in volatile markets.

Disclaimer: This is not financial advice. Trading cryptocurrencies involves significant risk. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

About Avalanche (AVAX): Blazing-Fast Smart Contracts and Custom Blockchains

Avalanche is a high-performance Layer 1 blockchain designed for speed, scalability, and flexibility. It supports smart contracts, DeFi, NFTs, and even lets developers launch their own tailor-made blockchains — all while maintaining low fees and fast finality.

The AVAX token powers the Avalanche ecosystem, used for transaction fees, staking, and securing the network.

What Is Avalanche?

Avalanche is a Layer 1 platform that enables:

- Ultra-fast and low-cost smart contract execution

- Launching custom blockchains (subnets) for specific use cases

- Interoperability with Ethereum via the C-Chain

Launched in 2020 by Ava Labs, Avalanche uses a unique consensus mechanism that allows near-instant finality and high throughput without compromising decentralization.

Key Features of Avalanche

-

Three-Chain Architecture:

- X-Chain: Asset creation and transfers

- C-Chain: EVM-compatible smart contracts

- P-Chain: Staking, validation, and subnet creation

-

Subnets: Developers can launch their own blockchains with custom rules, validators, and tokens.

-

High Throughput: Capable of processing thousands of transactions per second with finality in under 2 seconds.

-

AVAX Token Utility:

- Used to pay transaction and deployment fees

- Staked to secure the network and earn rewards

- Required for launching and joining subnets

-

Ethereum Compatibility: Supports Solidity and Ethereum tooling on the C-Chain, making migration seamless for developers.

⭐ More about Avalanche’s current market performance, technical trends, fundamentals, and recent developments find on altFINS.