Token Buybacks in Crypto: Mechanisms, Risks, and Long-Term Value

What Are Token Buybacks in Crypto?

Token buybacks have become one of the most important innovations in tokenomics. Similar to stock buybacks in traditional finance, they allow blockchain projects to use revenues or treasury reserves to repurchase their own tokens from the market. This reduces circulating supply, creates deflationary pressure, and signals long-term confidence to investors. According to the latest altFINS Exclusive Report on Buyback Tokens (September 2025), this practice has accelerated across DeFi and CeFi, with some protocols spending hundreds of millions of dollars annually on repurchases and burns.

Why Token Buybacks Matter in Web3

Buybacks are not only about short-term price boosts. They serve multiple strategic purposes:

- they increase scarcity by permanently reducing supply

- they provide liquidity support by acting as consistent buyers during volatile markets

- they reinforce trust by tying token value directly to protocol revenues.

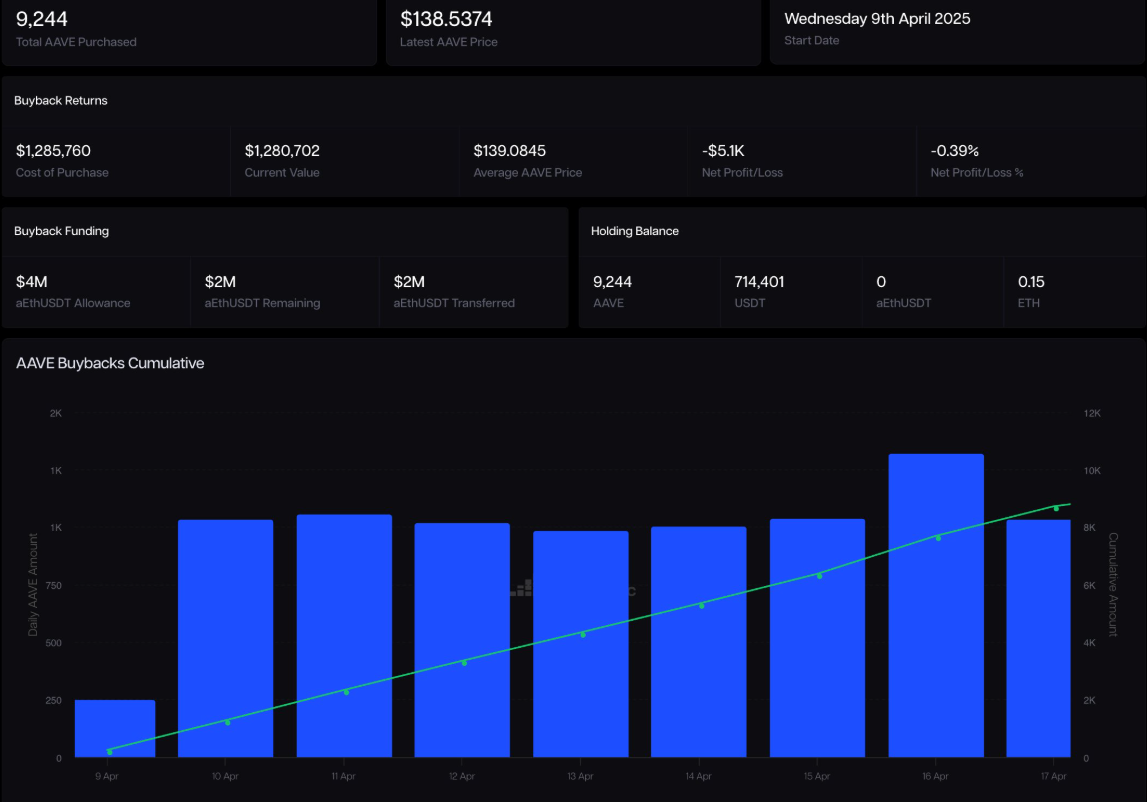

Projects such as Hyperliquid, Raydium, Aave, and Sky illustrate that recurring, revenue-backed buybacks can strengthen both market confidence and long-term fundamentals.

Hyperliquid: Fee-Driven Buybacks

Hyperliquid allocates roughly 97% of its trading fees to continuous token buybacks, generating over $1.2 billion in annualized buy pressure. This aggressive mechanism has significantly tightened liquidity and supported the price of HYPE tokens throughout 2025.

Read more about Hyperliquid in the deep research report.

Raydium: Burn-Based Deflation

Raydium diverts trading fees to automatically buy and burn RAY tokens. In January 2025 alone, it burned $54 million worth of tokens - over 10% of its circulating supply at the time - showing how impactful programmatic burns can be.

Short-Term vs. Long-Term Impact of Buybacks

The altFINS report highlights two critical ratios that investors should track to evaluate buyback strength.

Buybacks vs. Market Cap (MC)

This ratio measures short-term price impact. A high figure means a project is aggressively absorbing liquidity, creating immediate buy pressure. PancakeSwap is the best example, with ~10% of its market cap burned in just 30 days, sparking explosive momentum.

Buybacks vs. Fully Diluted Valuation (FDV)

This ratio measures long-term sustainability. A strong annual buyback-to-FDV ratio shows that repurchases are powerful enough to offset token unlocks and inflation. Sky (ex-MakerDAO) achieved a 5.6% annual buyback-to-FDV ratio, ensuring long-term scarcity and protection against dilution.

Recent Token Buyback Examples

The past year has seen multiple high-profile programs that highlight the diversity of buyback strategies.

WLFI: Governance-Backed Buybacks

World Liberty Financial launched a buyback-and-burn program that received 99.8% approval from tokenholders. The announcement alone caused a 5% price spike within a day, proving how powerful governance and community trust can be in amplifying buyback effects.

Pump.fun: Daily Buybacks from Revenue

Pump.fun directed nearly all platform fees into daily token buybacks, pushing its token to new all-time highs. However, sustainability issues emerged after revenues dropped, underlining the risks of overreliance on buybacks without consistent earnings.

Risks and Limitations of Buybacks

While token buybacks can be powerful, they are not a guaranteed path to long-term success. The altFINS analysis stresses that programs funded by sustainable revenue are more reliable than one-off treasury allocations. Over-reliance on buybacks can create a false sense of security, reduced liquidity from excessive burns may discourage new investors, and weak buybacks relative to FDV can fail to offset dilution from future unlocks.

altFINS: Tracking Buyback Opportunities

For traders and investors, the ability to compare and evaluate buyback programs is critical. altFINS provides detailed analytics, including buyback-to-market cap and buyback-to-FDV ratios, along with rankings of the strongest tokens for both short-term and long-term plays. The September 2025 report identified top five tokens for short-term traders, while another five ranked highest for long-term investors.

Conclusion: Are Token Buybacks Worth It?

Token buybacks are no longer an experimental tool—they are now a central pillar of tokenomics heading into 2026. They can reduce supply, support liquidity, and signal protocol confidence, but their true effectiveness depends on whether they are funded by real, sustainable revenue. For traders, short-term buyback spikes create momentum opportunities, while long-term investors should focus on whether buybacks meaningfully offset dilution. With detailed insights from the altFINS Buyback Tokens Report investors can identify the projects that are not just announcing buybacks but delivering real, measurable value back to tokenholders.