If this market feels exhausting, you’re not imagining it.

Over the last three months, most altcoins are down 30–50%, with many extending losses well beyond that over a six-month horizon. These are not trivial drawdowns. They test conviction, discipline, and most importantly, expectations.

This cycle feels brutal.

So did the last one.

When Markets Feel Broken, They’re Usually Close to Turning

.png)

In 2022, crypto didn’t simply correct, it capitulated.

The Terra/LUNA collapse, rapid Federal Reserve tightening, and the FTX bankruptcy created a cascading failure across liquidity, trust, and sentiment. At the lows, the total crypto market cap excluding Bitcoin and stablecoins had declined by roughly 80%. Many fundamentally sound projects were written off entirely.

It genuinely felt like the experiment had failed.

And yet, that moment marked the bottom.

Over the following two years, that same segment of the market rallied approximately 400%. The lesson is uncomfortable, but consistent: markets tend to feel the worst just before conditions begin to improve.

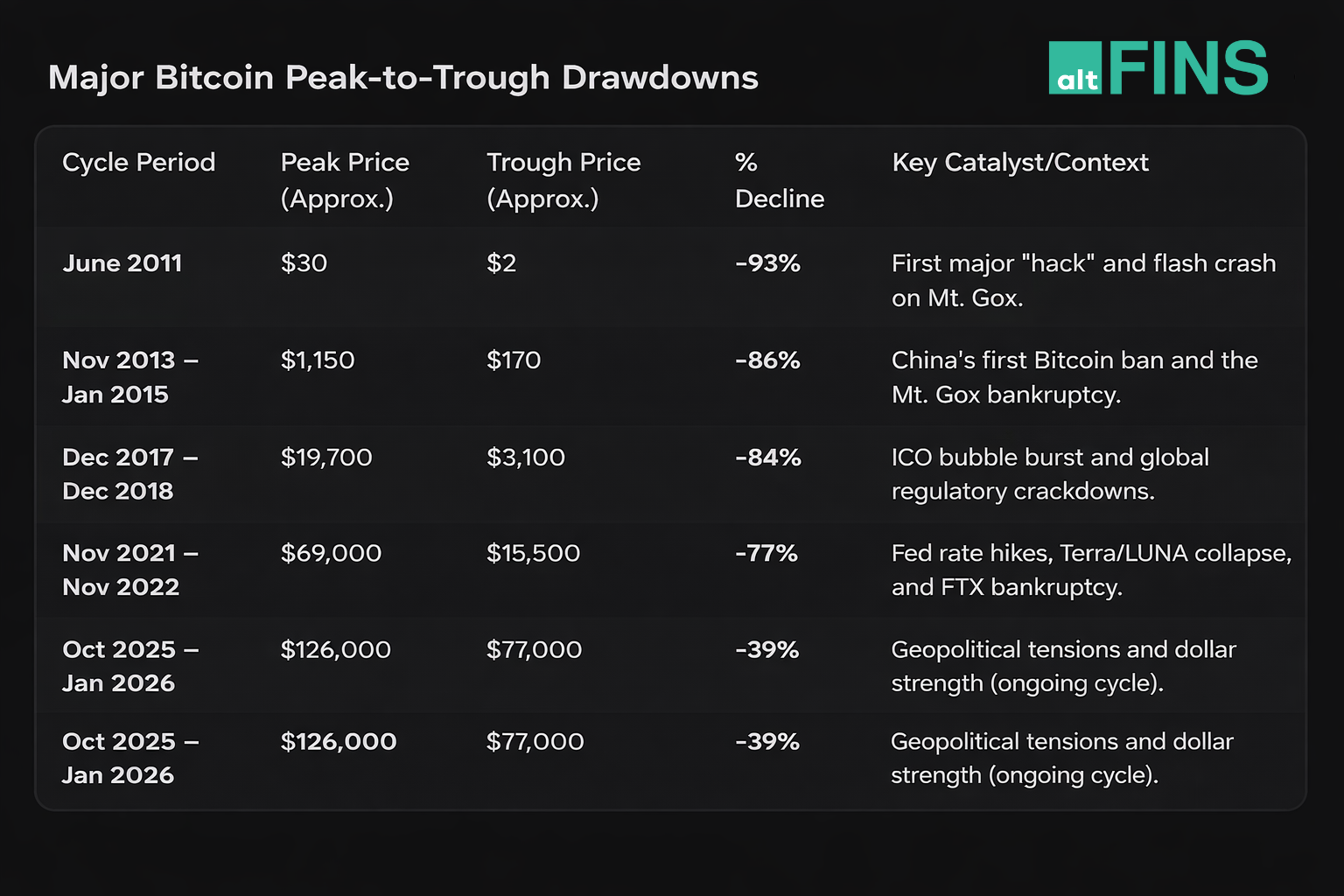

Drawdowns Evolve as Markets Mature

One important difference across cycles is magnitude.

Historical data suggests that each successive bear market has produced slightly shallower peak-to-trough drawdowns. As crypto matures, several structural forces are quietly reshaping the landscape:

-

Deeper and more resilient liquidity pools

-

More sophisticated participants

-

Increased institutional involvement

-

Improved infrastructure and risk management

None of this eliminates volatility, but it does tend to compress extremes over time.

This is why direct comparisons to early-cycle crypto (2011–2014) are often misleading. The asset class remains volatile, but it is no longer fragile in the same way.

Volatility Is Not the Same as a Broken Cycle

One of the most common analytical mistakes is equating volatility with failure.

Even during strong bull markets, Bitcoin routinely experiences 20–40% drawdowns. In 2017, Bitcoin rallied to nearly $20,000 while suffering nine separate corrections exceeding 30%. None of those moves ended the cycle.

Volatility is not a signal that the market is broken.

It is the cost of participation in a reflexive, liquidity-driven asset class.

If History Rhymes, What Comes Next?

If this cycle follows historical patterns, it would not be unusual to see:

-

Several more months of consolidation

-

Choppy, directionless price action

-

Continued pressure on speculative assets

That outcome would not invalidate the broader cycle.

And if the drawdown ultimately proves shallower than previous ones, it would further support the thesis that crypto volatility is compressing as the market matures.

Either way, survivability depends less on prediction and more on preparation.

What Actually Ends Cycles

Historically, cycles do not end because of corrections.

They end when three things fail simultaneously:

-

Liquidity

-

Confidence

-

Narrative

As long as those pillars remain intact, even under stress, volatility alone is not enough to end a cycle.

Final Thought

Every cycle feels obvious in hindsight.

None of them feel obvious while you’re living through them.

Pain tends to cluster near inflection points.

Patience remains one of the most underpriced edges in this market.