Cryptocurrency Hot Wallets vs. Cold Wallets: Understanding the Key Differences for Secure Investing

What are Hot Wallets?

Hot wallets are digital wallets that are connected to the internet, providing users with quick and easy access to their cryptocurrency assets. These wallets can be software-based, such as mobile apps, desktop applications, or web-based platforms, and are designed to facilitate fast transactions. By being online, hot wallets allow users to buy, sell, and trade cryptocurrencies with minimal delays, which is particularly beneficial for those who engage in frequent trading or need to move assets swiftly.

There are different types of hot wallets, each with its own set of features and functionalities. Mobile wallets are popular among users who prefer managing their assets on the go, offering convenience and accessibility. Desktop wallets, on the other hand, are installed on a computer and provide a more robust interface for managing larger portfolios. Web wallets are accessible through a browser, making them versatile and easy to use from any internet-connected device.

Despite their convenience, hot wallets come with inherent risks due to their constant online presence. Cybersecurity threats such as hacking, phishing, and malware attacks pose significant dangers to the assets stored in hot wallets. It is crucial for users to implement strong security measures, such as two-factor authentication and regular software updates, to mitigate these risks. Understanding the nature of hot wallets and their vulnerabilities is the first step in making informed decisions about where to store your digital assets.

Advantages of Hot Wallets

One of the primary advantages of hot wallets is their ease of use. The ability to access your funds instantly from any internet-connected device makes hot wallets incredibly convenient for everyday transactions. Whether you're making a purchase, transferring funds to another user, or engaging in trading, hot wallets allow you to perform these actions quickly and efficiently. This immediacy is particularly advantageous in the fast-paced world of cryptocurrency, where market conditions can change rapidly.

Another significant benefit of hot wallets is their integration with various cryptocurrency platforms and services. Many hot wallets are designed to work seamlessly with exchanges, making it simple to buy, sell, and trade digital assets. Some wallets also offer additional features such as portfolio tracking, price alerts, and transaction history, which can be valuable tools for managing your investments. The ability to integrate with decentralized finance (DeFi) applications and other blockchain-based services further enhances the functionality of hot wallets.

Hot wallets also offer a user-friendly experience, often featuring intuitive interfaces that make managing digital assets straightforward, even for those new to cryptocurrency. The ease of setting up a hot wallet, coupled with the ability to access funds quickly, makes them an attractive option for many users. Additionally, hot wallets typically support a wide range of cryptocurrencies, allowing users to store multiple assets in one place. This versatility and accessibility make hot wallets a popular choice for both novice and experienced investors.

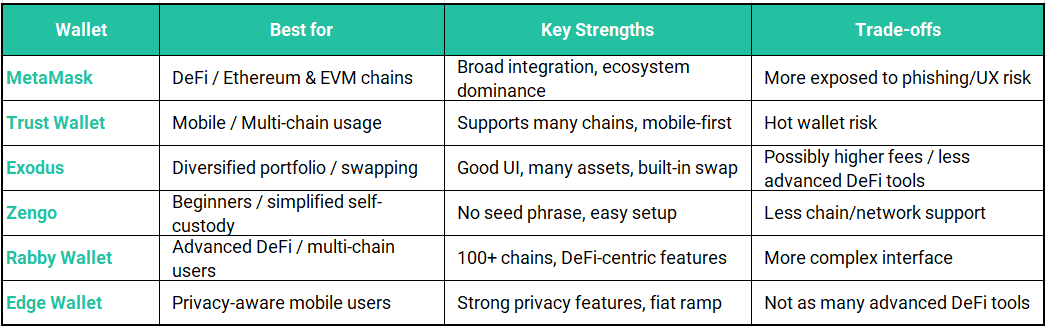

Top Hot Wallets in 2025

What are Cold Wallets?

Cold wallets, in contrast to hot wallets, are digital wallets that are not connected to the internet. This offline status provides a layer of protection against online threats, making cold wallets one of the most secure methods for storing cryptocurrency. Cold wallets can come in various forms, including hardware wallets, paper wallets, and even physical devices like USB drives. The primary characteristic of cold wallets is their ability to keep private keys, which are crucial for accessing and managing cryptocurrency, offline and away from potential hackers.

Hardware wallets are among the most popular types of cold wallets, known for their robust security features. These devices are designed to securely store private keys in a hardware device that can be connected to a computer or mobile device when needed. Paper wallets, on the other hand, involve printing out the private key and public address on a physical piece of paper, which can then be stored in a safe place. While less convenient for frequent transactions, paper wallets offer a high level of security for long-term storage.

The main advantage of cold wallets is their resistance to online attacks. By keeping private keys offline, cold wallets effectively eliminate the risk of hacking, phishing, and malware attacks. This makes them an ideal choice for long-term storage of large amounts of cryptocurrency. However, the added security comes with a trade-off in terms of convenience, as accessing and using funds stored in a cold wallet typically requires additional steps compared to hot wallets.

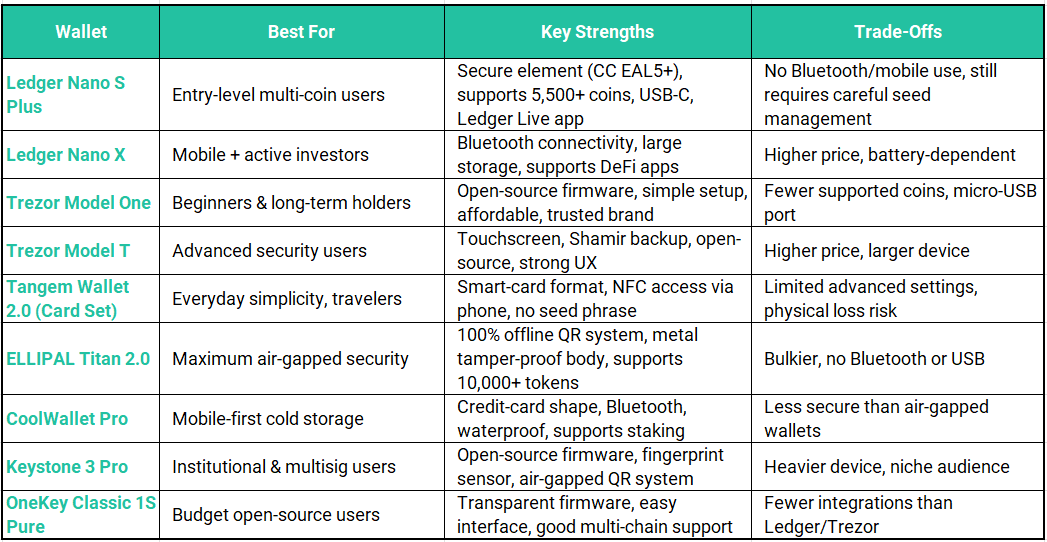

Top Cold Wallets in 2025

Advantages of Cold Wallets

The foremost advantage of cold wallets is their unparalleled security. Since cold wallets are not connected to the internet, they are immune to online threats such as hacking, phishing, and malware attacks. This makes cold wallets an excellent choice for storing large amounts of cryptocurrency or for long-term investment holdings. By keeping private keys offline, cold wallets provide a secure environment for your digital assets, significantly reducing the risk of theft.

Another benefit of cold wallets is their durability and reliability. Hardware wallets, for example, are designed to be resistant to physical damage, making them a robust option for storing cryptocurrency. These devices often include features such as PIN protection and recovery seed phrases, which provide additional layers of security. In the event that the hardware wallet is lost or damaged, the recovery seed phrase can be used to restore access to the funds. This redundancy ensures that your assets remain secure even in unforeseen circumstances.

Cold wallets also offer a degree of privacy and anonymity that is not always possible with hot wallets. Since transactions can be signed offline, cold wallets allow users to maintain a higher level of confidentiality. This can be particularly important for individuals who value privacy and wish to keep their financial activities discreet. Additionally, the absence of an internet connection means that cold wallets are less susceptible to tracking and monitoring, further enhancing their appeal for security-conscious investors.

Key Differences Between Hot and Cold Wallets

When comparing hot wallets and cold wallets, the most significant difference lies in their connection to the internet. Hot wallets are always online, providing instant access to cryptocurrency assets, while cold wallets remain offline, offering enhanced security. This fundamental distinction impacts various aspects of their functionality, including convenience, security, and suitability for different types of users. Understanding these differences is crucial for selecting the right wallet for your investment needs.

One of the main differences is the level of security each type of wallet offers. Hot wallets, being connected to the internet, are more vulnerable to cyberattacks, including hacking, phishing, and malware. Despite the implementation of security measures such as encryption and two-factor authentication, the online nature of hot wallets inherently exposes them to risks. In contrast, cold wallets are not susceptible to these online threats, as they keep private keys offline and away from potential hackers. This makes cold wallets a safer option for long-term storage and large amounts of cryptocurrency.

Another key difference is the ease of access and use. Hot wallets provide immediate access to funds, making them ideal for users who need to perform quick transactions or engage in frequent trading. The convenience of hot wallets is unmatched, allowing users to manage their assets with just a few clicks. Cold wallets, on the other hand, require additional steps to access and use funds. This can involve connecting a hardware device to a computer or retrieving a paper wallet from a secure location. While these steps enhance security, they can also be cumbersome for users who need to access their assets regularly.

Security Considerations for Each Wallet Type

When it comes to security, both hot wallets and cold wallets have their own set of considerations. For hot wallets, the primary concern is their vulnerability to online threats. To mitigate these risks, users should implement robust security measures such as strong passwords, two-factor authentication, and regular software updates. Additionally, it is advisable to use reputable wallet providers and avoid sharing sensitive information. Despite these precautions, the inherent risks associated with hot wallets mean that users should be cautious about storing large amounts of cryptocurrency in them.

Cold wallets, while significantly more secure against online threats, also come with their own set of security considerations. The primary concern with cold wallets is the risk of physical loss or damage. For example, a hardware wallet could be lost, stolen, or damaged, potentially resulting in the loss of access to the stored cryptocurrency. To address this, users should ensure that their hardware wallets are stored in secure locations and that recovery seed phrases are backed up and kept safe. Paper wallets, while immune to online attacks, can also be damaged or lost, so it's essential to store them in a secure and durable manner.

Another important aspect of security for both types of wallets is the management of private keys. Private keys are crucial for accessing and managing cryptocurrency assets, so protecting them is of utmost importance. For hot wallets, this means ensuring that private keys are encrypted and stored securely. For cold wallets, it involves keeping private keys offline and in a secure location. In both cases, users should be vigilant about avoiding phishing scams and other attempts to steal private keys. By understanding the security considerations for each type of wallet, users can make informed decisions about how to protect their digital assets.

When to Use Hot Wallets vs. Cold Wallets

Choosing between hot wallets and cold wallets depends largely on your investment strategy, risk tolerance, and the frequency with which you need to access your cryptocurrency. Hot wallets are ideal for users who need quick and convenient access to their funds. This includes frequent traders who need to capitalize on market opportunities swiftly or individuals who use cryptocurrency for everyday transactions. The ease of use and instant access provided by hot wallets make them well-suited for these purposes, despite the increased security risks.

Cold wallets, on the other hand, are best suited for long-term storage and holding large amounts of cryptocurrency. If you are an investor who plans to hold your assets for an extended period and does not need to access them regularly, a cold wallet is the safest option. The offline nature of cold wallets provides robust protection against hacking and other online threats, ensuring that your investments remain secure. Cold wallets are also a good choice for storing the majority of your cryptocurrency while keeping a smaller amount in a hot wallet for daily use.

Ultimately, many users find that a combination of both hot and cold wallets offers the best of both worlds. By using a hot wallet for frequent transactions and a cold wallet for long-term storage, you can balance convenience and security. This hybrid approach allows you to manage your digital assets effectively while minimizing risks. When deciding which type of wallet to use, consider your specific needs, the amount of cryptocurrency you are storing, and your overall investment strategy. This will help you make an informed decision that aligns with your goals and risk tolerance.

Best Practices for Securing Your Cryptocurrency

Securing your cryptocurrency involves more than just choosing the right type of wallet. Whether you opt for a hot wallet, a cold wallet, or a combination of both, there are several best practices you should follow to ensure the safety of your digital assets. One of the most important practices is to use strong, unique passwords for your wallets and any related accounts. Avoid using easily guessable passwords and consider using a password manager to generate and store complex passwords securely.

Two-factor authentication (2FA) is another critical security measure that can provide an additional layer of protection for your hot wallets. By requiring a second form of verification, such as a code sent to your phone, 2FA makes it much more difficult for unauthorized users to access your wallet. Additionally, keep your wallet software and any related applications up to date. Software updates often include important security patches that protect against newly discovered vulnerabilities.

For cold wallets, ensure that your recovery seed phrases and private keys are backed up and stored in secure locations. Consider using multiple secure locations to avoid a single point of failure. For example, you might store a copy of your recovery phrase in a safe at home and another in a safety deposit box. Additionally, if you are using a hardware wallet, follow the manufacturer's instructions for secure setup and use. By adhering to these best practices, you can significantly reduce the risk of losing your cryptocurrency to theft or other security breaches.

Conclusion: Choosing the Right Wallet for Your Investment Needs

In the dynamic world of cryptocurrency, choosing the right wallet is crucial for securing your digital assets and achieving your investment goals. Both hot wallets and cold wallets offer distinct advantages and come with their own set of risks. Hot wallets provide the convenience of quick access and ease of use, making them ideal for frequent transactions and active trading. However, their constant connection to the internet exposes them to potential online threats, requiring users to implement robust security measures.

Cold wallets, on the other hand, offer unparalleled security by keeping private keys offline and away from hackers. This makes them the best choice for long-term storage and holding large amounts of cryptocurrency. While they may be less convenient for everyday transactions, the added security is well worth the extra steps required to access and use your funds. By understanding the key differences between hot wallets and cold wallets, you can make informed decisions that align with your investment strategy and risk tolerance.

Ultimately, the best approach for many investors may be to use a combination of both wallet types. By leveraging the convenience of hot wallets for daily use and the security of cold wallets for long-term storage, you can effectively manage your cryptocurrency investments while minimizing risks. As you navigate the evolving landscape of digital assets, staying informed about the latest security practices and wallet options will help you protect your investments and achieve peace of mind.

FAQ

1. What is the main difference between hot wallets and cold wallets?

The main difference lies in internet connectivity. Hot wallets are connected to the internet, making them convenient for quick transactions, while cold wallets remain offline, providing enhanced security against hacking and malware.

2. Are hot wallets safe for storing cryptocurrency?

Hot wallets are safe for small or frequently used amounts of cryptocurrency when protected with strong passwords, two-factor authentication, and regular updates. However, they are more vulnerable to cyberattacks than cold wallets, so large holdings should not be stored in hot wallets.

3. What are examples of hot wallets?

Popular hot wallets in 2025 include MetaMask, Trust Wallet, Coinbase Wallet, and Exodus. These wallets are typically mobile or web-based and integrate with exchanges and DeFi platforms for seamless trading.

4. What are examples of cold wallets?

Common cold wallets include Ledger Nano X, Trezor Model T, and Ellipal Titan. These hardware devices store your private keys offline, making them highly secure for long-term cryptocurrency storage.

5. Can I use both hot and cold wallets together?

Yes. Many investors use a hybrid approach—keeping a small amount of crypto in a hot wallet for daily transactions and the majority in a cold wallet for long-term storage. This strategy balances convenience with security.

6. What happens if I lose my cold wallet?

If your cold wallet is lost or damaged, you can recover your funds using your recovery seed phrase—a set of words provided during wallet setup. It’s essential to back up this phrase securely and never share it with anyone.

7. Which type of wallet is better for beginners?

Beginners often start with hot wallets because they’re easier to set up and use for learning and small transactions. As you accumulate more assets, adding a cold wallet is recommended for enhanced security.

8. Are cold wallets completely hack-proof?

While cold wallets are highly secure, they are not completely invincible. Physical theft, improper backup of seed phrases, or connecting the device to compromised computers can still pose risks. Always follow best security practices.

9. How do I secure my hot wallet?

To secure your hot wallet:

-

Use two-factor authentication (2FA)

-

Keep wallet software updated

-

Use strong, unique passwords

-

Avoid public Wi-Fi for transactions

-

Store only small amounts for active use

10. Should I use a hardware wallet for all my crypto?

Hardware wallets are ideal for long-term storage and large investments. However, using them for every small transaction can be inconvenient. A mix of hot and cold wallets offers the best overall security and flexibility.