I'll start with conclusion:

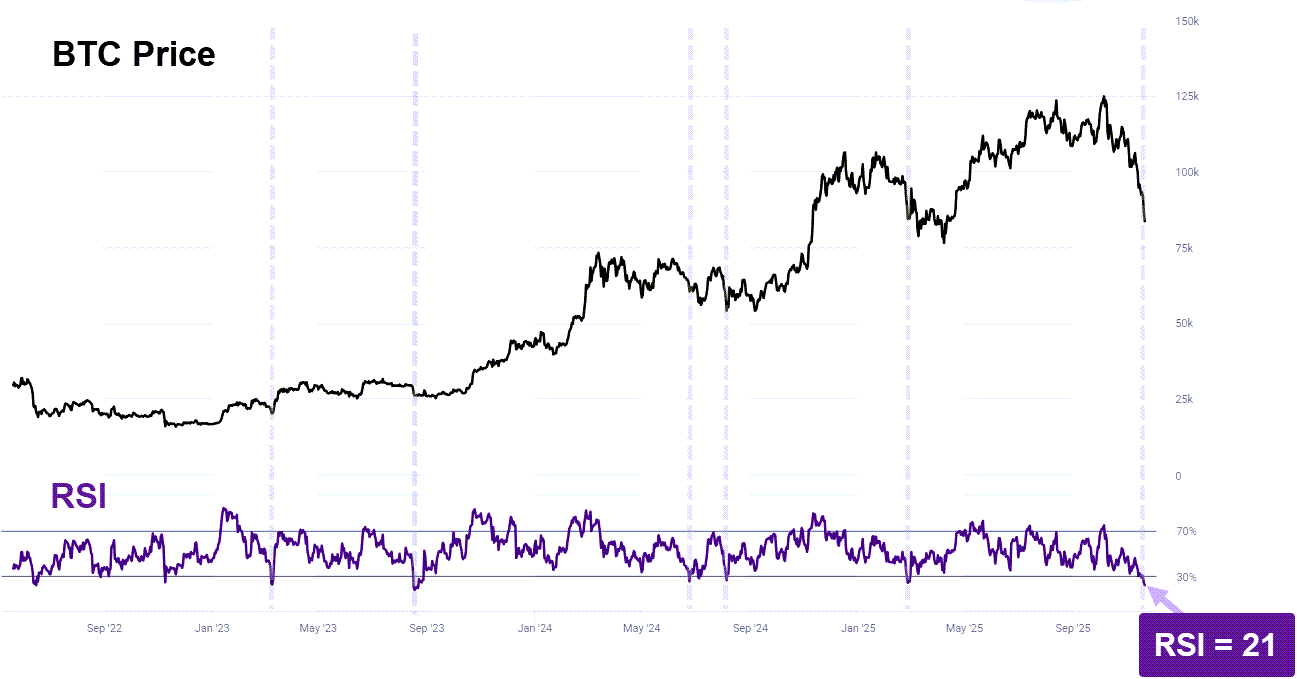

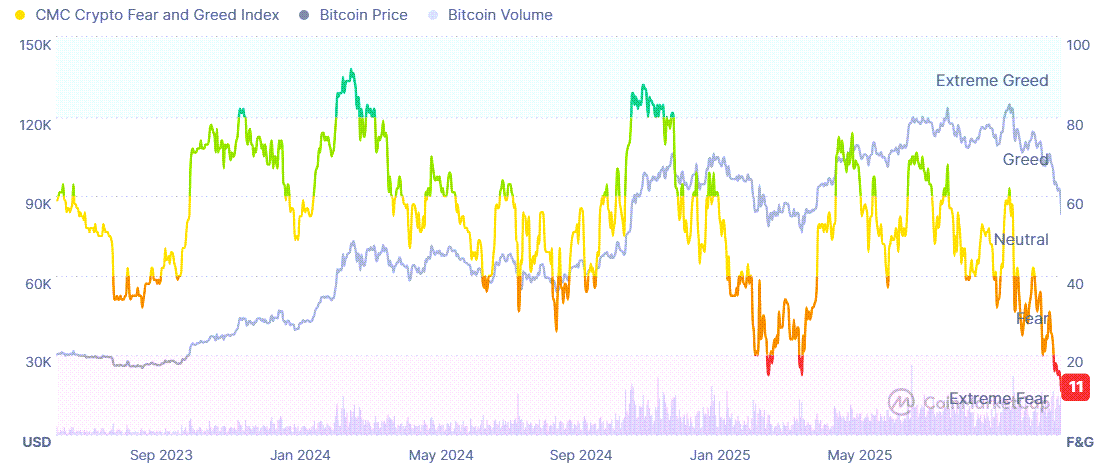

Crypto traders and investors, especially retail, have capitulated. Bitcoin (BTC) is extremely oversold as RSI dips to 21!!, level not seen since Aug 2023. Crypto sentiment index also hits a 3 year low. Meanwhile, whales are buying again and crypto adoption by TradFi is growing.

When there's blood in the water, sharks smell opportunity.

Are you a shark?

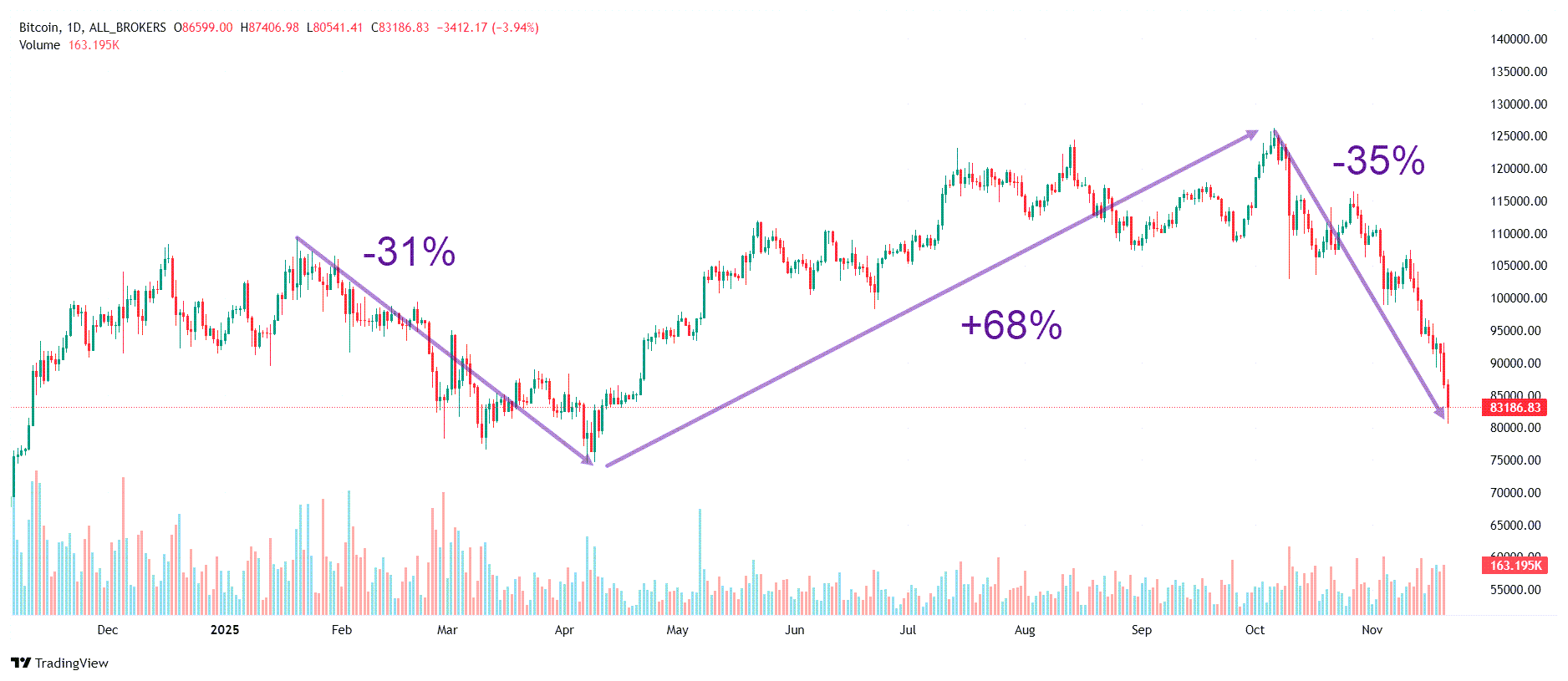

BTC reached ATH of $126K on Oct 6th. Less than two months later, price has corrected by 35%!

That's a similar drop to earlier in 2025 when price made a new ATH of $109K in January and pulled back 31% to $75K in May.

That was followed by a +68% rally to new ATH of $126K.

Let's not forget how quickly sentiment changes, in both directions.

And right now, we're in extreme FUD (Fear Undcertainty Doubt) zone.

Big time. BTC price declines accelerated the last two days and Crypto sentiment index is at the lowest level in over 2 years!

These are signs of trader / investor capitulation. Especially retail traders and retail ETF investors, who are driving the dump in the last few days.

BTC price (daily chart, 1 year)

BTC: RSI dips to multi-year low of 21!

Crypto Sentiment Index at 11 (Extreme Fear)

What drove the decline?

Pundits blame it on million things, liquidity, auto deleveraging, Trump tweets, tariffs, gov shutdown, etc.

But it all boils down to Fed interest rates. After the 25 bps cut in September, markets were expecting another rate cut in December and more in 2026.

Then the outlook gradually changed. Fed Chairman Powell started talking down the need for another rate cut near-term.

On Oct 21, probabilities of another rate cut for December Fed meeting were 98%. A month later, it's at 39%.

What will drive the rebound?

Logically, the opposite of what drove the decline: interest rate outlook. What if unemployment for October and November come in light... or PMI (manufacturing activity) continues to deteriorate.

And as AI increases productivity, lowers costs, creates deflationary pressures and replaces entry-level jobs for recent college graduates. Also, housing in US is weak, which will get reflected in CPI (inflation) data.

Fed will need to cut rates in early 2026.

Simple as that.

Meanwhile, the adoption of crypto by traditional finance and mainstream public (payments, stablecoins, remittance) are growing, infrastructure is being built and integrated deep into the fabric of modern finance.

Have some faith.