altFINS vs TradingView Comparison

Platforms' Overview

altFINS

altFINS is a crypto-first trading and analytics platform designed specifically for altcoin traders. Since its launch in 2020, it has built a loyal user base among technical analysts and swing traders looking for advanced screening, pattern recognition, and portfolio tracking tools tailored for the crypto market. It offers excellent customer support, a highly rated VIP Telegram group with expert commentary, and a vibrant user community focused on results. Visit altFINS.

TradingView

TradingView is the world’s most popular charting platform, covering not just crypto, but stocks, forex, indices, and commodities. Known for its clean design, customizable charts, and social trading features, TradingView is a powerhouse for multi-asset traders and technical analysts alike. Visit TradingView.

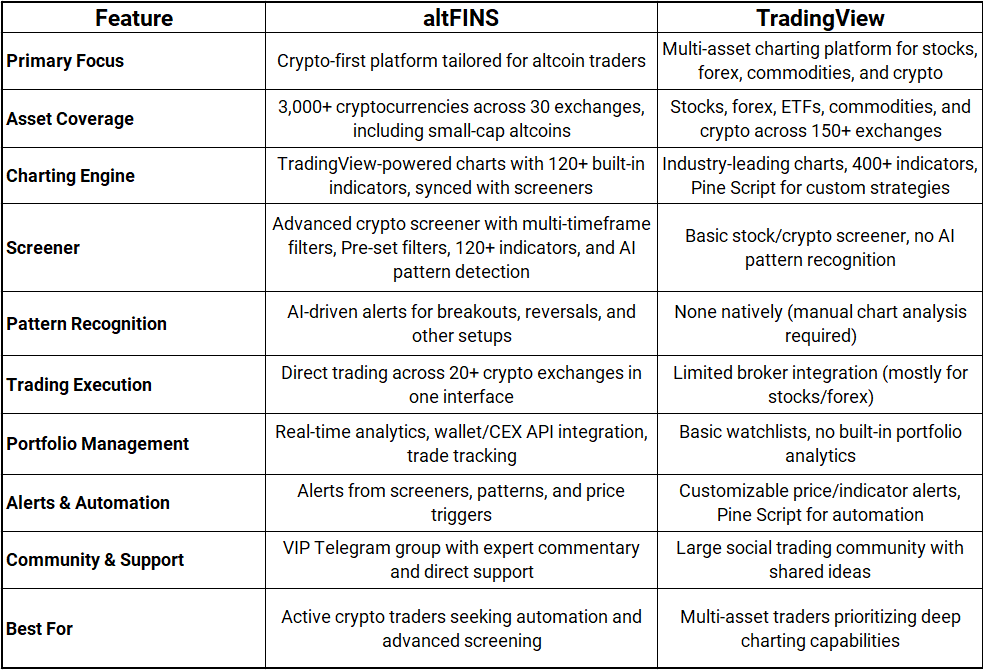

Comparison altFINS vs TradingView

Asset Coverage

- altFINS: 3,000+ cryptocurrencies, across 30 exchanges, including smaller altcoins not typically found on traditional platforms.

-

TradingView: Multi-asset support including stocks, forex, ETFs, commodities, and crypto across 150+ exchanges.

If you're trading altcoins, altFINS has deeper coverage and insights. For broader asset classes, TradingView leads.

Charting & Technical Analysis

-

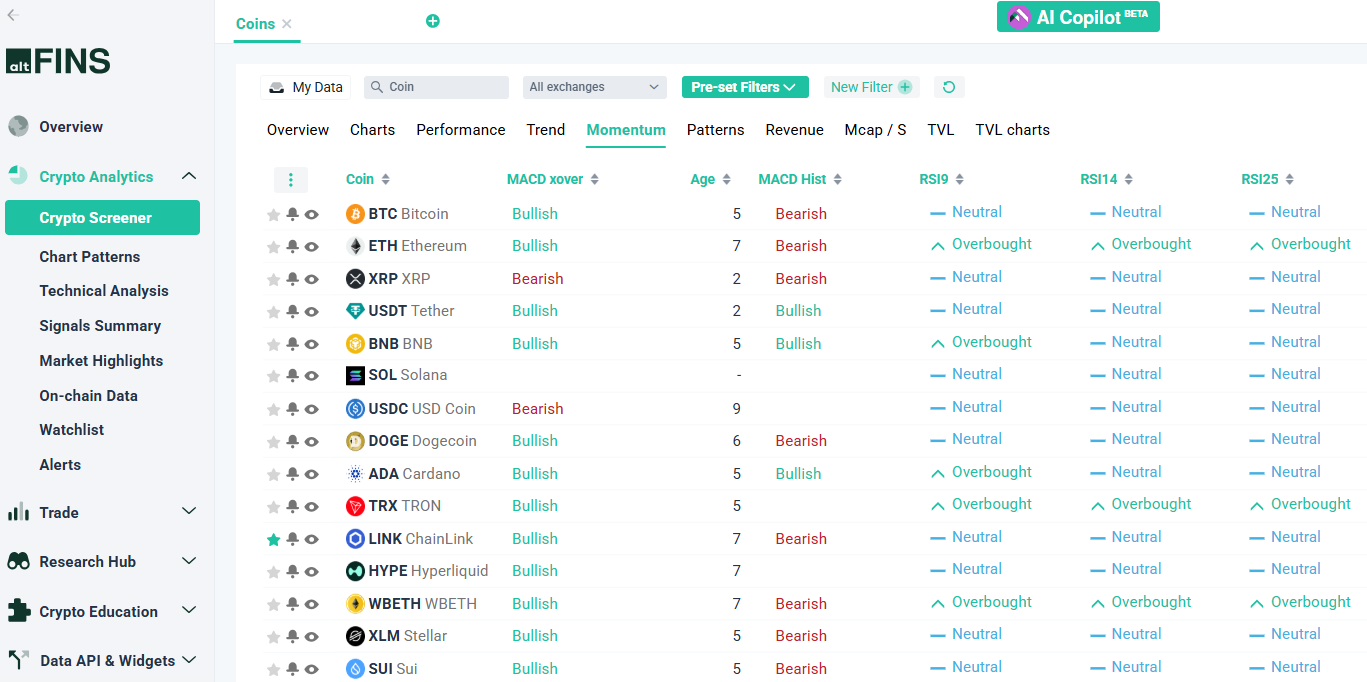

altFINS: AltFINS offers an advanced crypto screener with 120+ technical indicators, 100+ pre-set filters, on-chain data, and AI-detected chart patterns. It features in-house charts as well as integrated TradingView charting. Go to altFINS Crypto Screener and explore all features.

altFINS Crypto Screener

-

TradingView: Industry leader in charting. Over 400 built-in indicators, Pine Script for custom strategies, and multiple chart layout views.

TradingView Screener

While TradingView dominates in raw charting power, altFINS wins in contextual crypto analysis with signals and screeners directly tied to chart data.

Screener & Pattern Detection

-

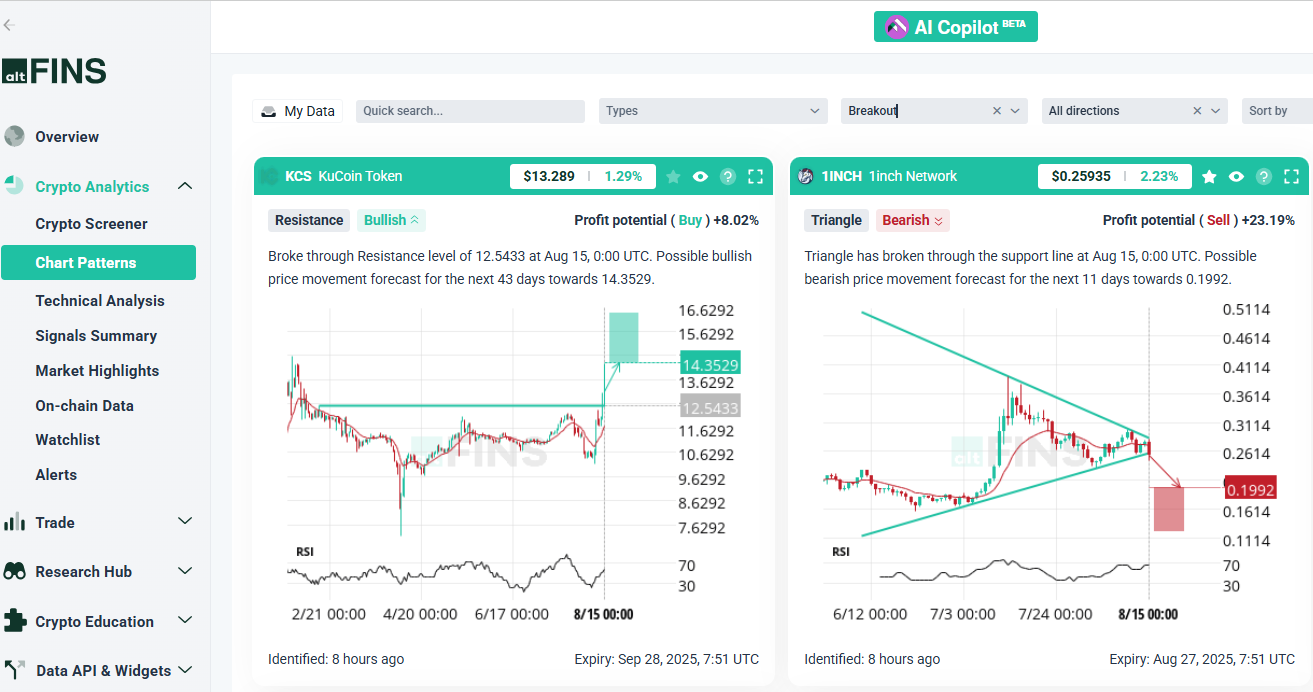

altFINS: Powerful crypto advanced screener with multi-timeframe filters, 120+ indicators, and AI-driven pattern alerts (like breakouts, trend reversals). Traders receive real-time notifications with actionable setups. AltFINS’ AI Chart Patterns automatically scan thousands of crypto assets to identify 27 high-probability chart pattern types, such as breakouts, trend reversals, and continuation patterns. The AI analyzes historical price action to detect patterns with greater accuracy and speed than manual charting. Traders can filter these AI-generated signals to match their strategy and act on opportunities in real time. Go to AI Chart Patterns.

Crypto AI Chart Patterns

-

TradingView: Stock/crypto screener is basic; no AI pattern recognition.

altFINS is built for traders who want to find crypto trade ideas. TradingView requires more manual setup.

Trading Execution

-

altFINS: Lets you trade directly across 10+ crypto exchanges and DEX aggregator from one interface. Save time and avoid jumping between platforms.

-

TradingView: Trade via integrated brokers; limited native execution, mostly for stocks and forex.

If you're trading crypto actively, altFINS offers seamless execution and portfolio syncing.

Portfolio Management & Analytics

-

altFINS: Real-time portfolio analytics, trade tracking, wallets integration and API integration with the main CEXs. Get an end-to-end view of your crypto trading performance.

-

TradingView: Basic watchlists only; lacks built-in portfolio tracking tools.

For long-term crypto portfolio management, altFINS is significantly more advanced.

Alerts & Automation

-

altFINS: Custom alerts based on screeners, patterns, technical analysis, and price triggers. Learn how to set up alerts on altFINS.

-

TradingView: Highly customizable price and indicator alerts. Pine Script allows complex automation. Learn how to set up alerts on TradingView.

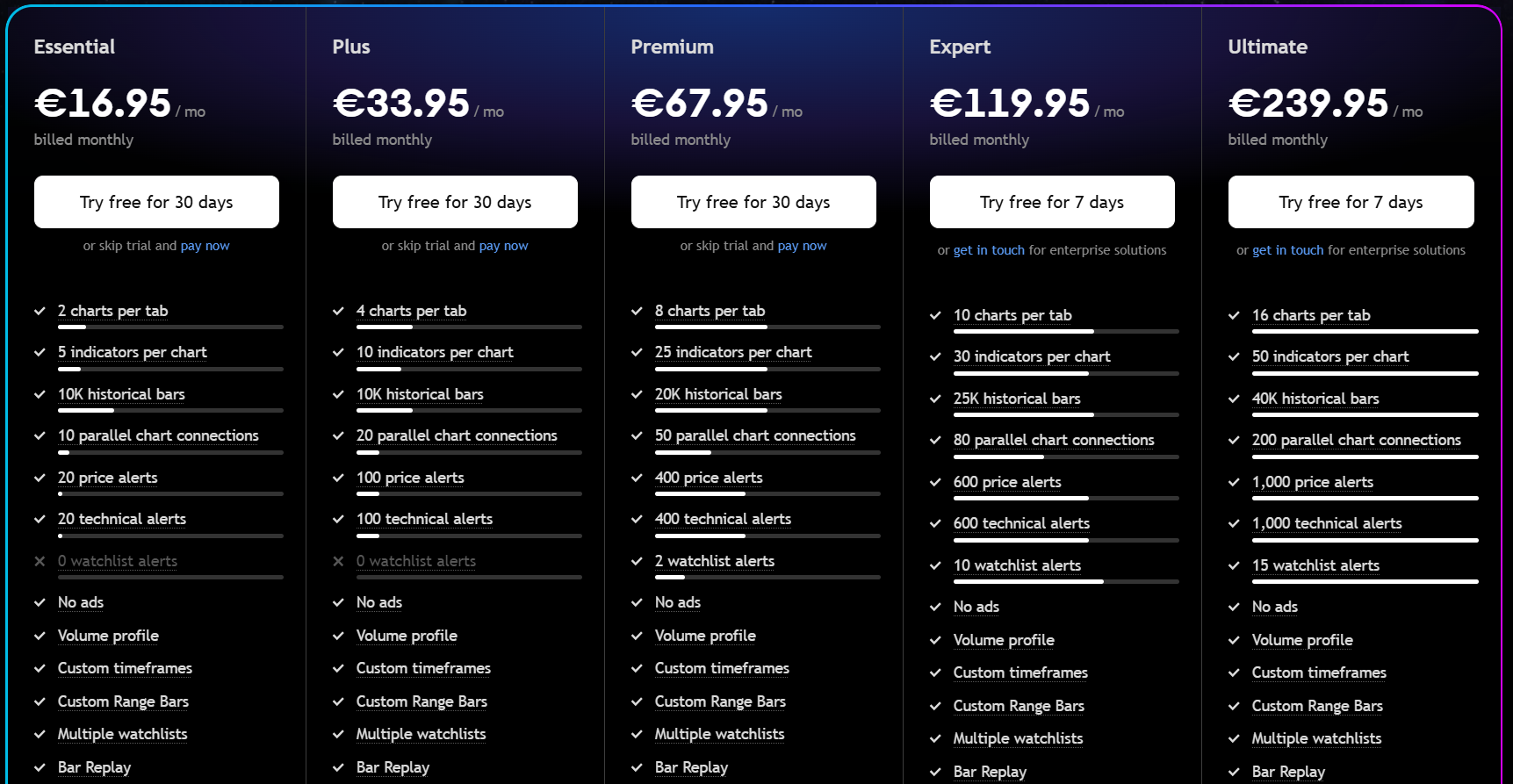

Pricing

-

altFINS: Offers free version with limited features; paid plans start around $20/month for basic plan, $40 for essential plan and $60 for premium plan. VIP group access is included with Annual and Lifetime plans.

-

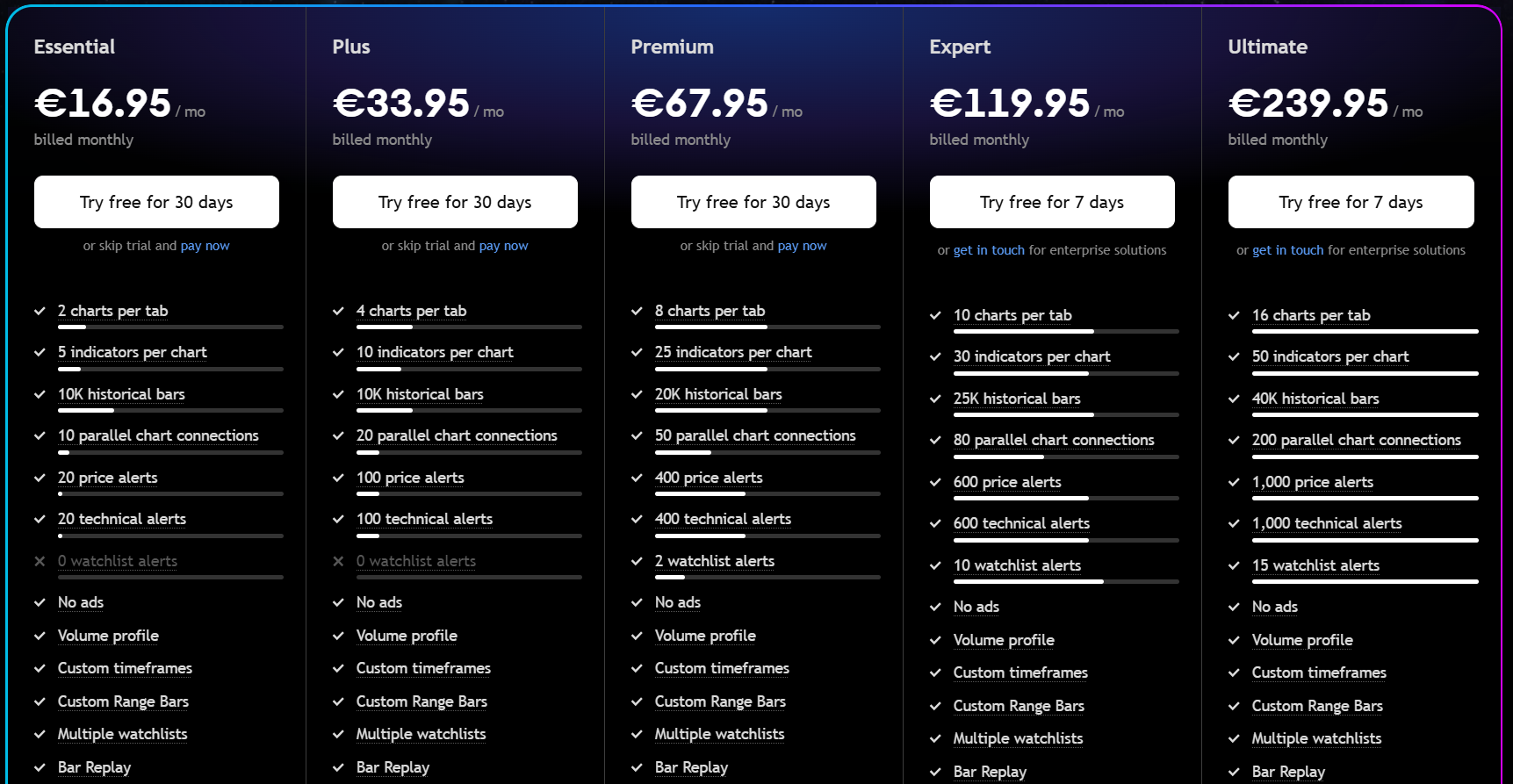

TradingView: Free plan available. Paid tiers range from $16.95/month (Essential) to $239.95/month (Ultimate).

User Reviews

-

altFINS: 4.5/5 stars on Trustpilot. Users consistently praise its accuracy, simplicity, pattern alerts, and friendly customer support. VIP group is often highlighted as a key value driver.

-

TradingView: 1.6/5 stars on Trustpilot. Users love the features but report issues with support and aggressive upselling.

altFINS wins in user satisfaction, especially among crypto traders.

Final Verdict

Choose altFINS if:

-

You trade crypto or altcoins.

-

You want ready-to-use screeners and AI patter.

-

You want an active VIP trading community with expert support.

-

You manage your portfolio across multiple exchanges.

Choose TradingView if:

-

You trade multiple asset classes.

-

You want best-in-class charting and scripting.

-

You value open social communities and shared trading ideas.

In fact, many traders use both: altFINS for trade discovery, alerts, and execution in crypto, and TradingView for multi-asset charting and automation.

Whatever your trading style, the right tool can make a massive difference. Consider your asset focus, experience level, and need for support and signals when making your choice.