You do not need to constantly check dozens of websites to trade well. You just need the right ones. Below is a practical mix of charting, data, education, and community sites that — used together — cover your daily workflow from idea to execution. We’ll explain what each site does best, how to use it, and where it fits in your stack.

This list focuses on tools you can use every week, regardless of your market or style. It also weaves in solid trading education, so you keep sharpening your edge while the market shifts.

Quick Overview for Busy Traders

If you only skim one section, make it this one. The full write-ups follow below.

|

Website |

Category |

What to Use It For |

Why It Helps |

|

TradingView |

Charts & screeners |

Multi-asset charting, Pine Script indicators, custom scans, alerts |

Fast layouts and custom logic let you keep one playbook from scan to execution |

|

Investing.com |

Quotes, screeners & calendar |

Charts, technical analysis summary, economic calendar, portfolio tracker |

One hub to check symbols, news, and key events quickly |

|

WR Trading |

Mentorship & tools |

Trading coaching programs, browser simulator, profit/risk calculators |

Practical drills and feedback that shorten trial-and-error and improve planning |

|

BabyPips |

Forex education |

School of Pipsology, quizzes, forum support |

Clear lessons that build a strong base before you add risk |

|

CME Group |

Futures & options education |

Product guides, options courses, trading simulator |

Structured paths for specific markets and strategies you actually trade |

|

altFINS |

Crypto screener and AI signals |

Pre-set and custom scans, AI chart patterns and trade setups |

Quick trade ideas generations, AI features |

|

Finviz |

Stock screener |

Momentum, mean-reversion, and earnings gap scans; heatmaps |

Quick filters and visuals that surface candidates in minutes |

|

Yahoo Finance |

Quotes & portfolios |

Watchlists, news, screeners, earnings dates |

One place to track context when you’re away from your main platform |

|

FRED |

Macro data |

CPI, jobs, yields, credit spreads; custom charts/exports |

Clean, consistent series to anchor your market bias |

|

Trading Economics |

Global calendar & data |

Country calendars, indicators, API access |

Worldwide releases and historicals for cross-asset decisions |

|

Forex Factory |

FX calendar & forum |

High-impact event filters, alerts, sentiment reads |

Simple, fast calendar that keeps you out of trouble around releases |

|

Myfxbook |

Performance analytics |

Verified tracking, symbol/session stats, public systems |

Honest reviews of what’s working, so you cut what doesn’t |

|

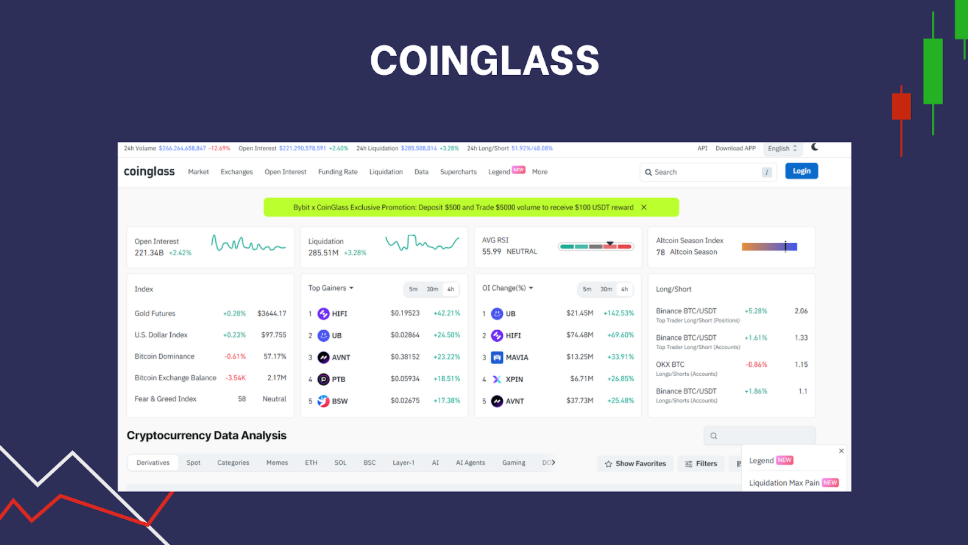

CoinGlass |

Crypto derivatives metrics |

Open interest, funding, liquidation maps across exchanges |

Snapshot of positioning and risk so you size smarter on perps |

TradingView — Charts, Scripts, and Alerts that Scale

TradingView remains the default charting desk for retail and many pros. You get multi-asset charts, robust alerts, and a huge library of community indicators. The newer Pine Screener lets you scan markets with your own Pine Script logic, so the same rules you code into indicators can filter entire watchlists. That keeps your process consistent from scan to trade.

Use it for:

-

Fast multi-timeframe chart work and synchronized layouts

-

Custom indicators and screened ideas with Pine Screener

-

Sharing annotated charts with your team or community.

Pro tip: Build one “core” Pine screener that checks your absolute must-haves (trend, volatility regime, risk filters). Don’t chase 20 versions — maintain one and iterate.

Investing.com — Quotes, Screeners, and a Calendar You’ll Actually Use

If you want one tab for prices, news, and events, Investing.com earns a spot in your daily stack. It covers stocks, ETFs, futures, FX, bonds, and crypto with real-time quotes, clean charts, and a technical summary. You also get robust screeners, an economic calendar with filters, alerting, and a simple portfolio tracker. It’s a fast way to check a symbol, scan for candidates, and confirm what’s on the macro clock, which simplifies your trading experience.

Use it for:

-

Real-time quotes and charts across asset classes

-

Stock/ETF/FX/crypto screeners to surface momentum or value ideas

-

Economic calendar filters and event alerts before high-impact releases

-

A lightweight portfolio/watchlist to track P&L and earnings dates.

Pro tip: Build a “First 5” pre-market routine inside one tab: open your watchlist, run a saved screener, glance at the technical summary on your top symbols, and scan the calendar for red-flag events. You’ll start the session with context, candidates, and timing — no tab maze.

WR Trading — Practical Mentorship, Calculators, and a Free Simulator

Learning should never stop, so add WR Trading, a site that blends trading education and coaching with hands-on tools, to your arsenal. You get a browser-based trading simulator that needs no sign-up, plus profit/risk calculators to tighten planning. The heart of the brand is trading mentorship built around high-risk, high-reward setups, structured routines, and live feedback — useful if you’re comparing trading mentorships.

Use it for:

-

Risk-free practice with a live-market feel on the simulator

-

Calculators for position size, R multiples, and win-rate maths

-

A clear path if you prefer a mentor-led ramp instead of self-study.

Pro tip: Treat the simulator like a gym: short, focused sessions, one playbook setup, and post-session notes. Then consider a structured trading education program if you want critique on entries and management.

BabyPips — The Friendliest Path into Forex

If currencies are on your radar, the School of Pipsology remains the best free start. It’s a complete, step-by-step curriculum with bite-sized lessons and quizzes, plus a community that answers questions fast. It’s perfect if you want to learn trading concepts without getting buried in jargon on day one.

Use it for:

-

A full beginner-to-intermediate forex course

-

Quizzes that lock in price action and risk basics

-

Community support when you get stuck.

Pro tip: Pair a Pipsology unit with 30 minutes of chart replay to link theory to real candles the same day.

CME Group — Futures and Options Done Right

Whether you trade equity index futures, rates, or energy, CME Group’s education hub is a goldmine. You’ll find 60+ free courses, product-specific lessons, and even a trading simulator for practice. For options on futures, there’s a guided curriculum that takes you from basics to strategy in the right order.

Use it for:

-

Product-specific lessons

-

Options on futures strategy primers and examples

-

Simulator sessions to test spreads and hedges.

Pro tip: Keep the CME “Browse All” page bookmarked. When volatility hits a new asset class, you’ll have a fast learning track ready.

.jpg)

altFINS — Crypto Trading, Simplified with AI

Whether you trade Bitcoin breakouts, altcoin trends, or meme coin momentum, altFINS is your all-in-one hub. You’ll find 120+ technical indicators, pre-set and custom screeners, and AI-powered chart pattern detection. For trade execution, automation flows connect signals directly to your exchange.

Use it for:

-

Pre-set scans for momentum, breakouts, and oversold/overbought setups

-

AI chart patterns with trade setups and targets, AI Copilot

-

Coin Picks for long-term investing

Pro tip: Bookmark your custom scan dashboard. When a new market narrative emerges, you’ll instantly see which coins fit your strategy.

Finviz — Fast Stock Screening and Visual Heatmaps

Finviz is the screener you open when you have 10 minutes before the bell. It blends fundamental and technical filters, quick charts, and crisp visuals. The Elite account adds real-time quotes, advanced filters, and exports/API, but the free tier is already useful for daily top-down scans.

Use it for:

-

Rapid “what’s moving” scans by sector, float, or setup

-

Daily top gainers/losers and unusual volume

-

Visual heatmaps to spot rotation.

Pro tip: Save three screeners: momentum continuation, mean reversion, and earnings gaps. Rotate them based on the market regime.

Yahoo Finance — Quotes, Portfolios, and Broad Market Context

Yahoo Finance remains a solid, free hub for quotes, curated news, and portfolio tracking. Its screeners now offer 100+ filters, so you can build custom stock and ETF scans without paying for pro tools. If you manage multiple watchlists across brokers, the portfolio tracker keeps your P&L and day change in one place.

Use it for:

-

Quick checks on earnings dates, news, and float

-

Lightweight screens across equities and funds

-

Tracking watchlists when you’re away from your main platform.

Pro tip: Create a “macro map” watchlist — major indices, VIX, DXY, 10-year yield, and key commodities — so you always start with context before drilling into setups.

FRED — The Macro Dashboard Traders Trust

The St. Louis Fed’s FRED site aggregates hundreds of thousands of time series from dozens of sources. Think CPI, payrolls, yields, credit spreads, and much more. It’s not about headlines — it’s the clean data behind them, with a release calendar and tools to chart and download series for your models.

Use it for:

-

Tracking macro regimes with consistent series

-

Building quick charts for inflation, jobs, and growth

-

Exporting data for your spreadsheets or notebooks.

Pro tip: Save a “macro four” dashboard: CPI YoY, unemployment rate, 10-year yield, and ISM PMI. Check it weekly to keep your bias honest.

Trading Economics — Global Data and a Serious Calendar

When you trade around events — or trade outside the U.S. — you need a 24/7 economic calendar and easy access to global indicators. Trading Economics offers both, with near real-time updates and an API if you automate screens or alerts. It’s ideal for cross-asset traders who want one source for releases and historicals.

Use it for:

-

Country-by-country calendars and consensus vs. actuals

-

Quick checks on GDP, inflation, PMIs, and rates worldwide

-

API pulls for alerts or strategy inputs.

Pro tip: If you code, the official repositories make it simple to fetch series and calendar events from Python. Keep it lean: pull only the data your setup needs.

Forex Factory — The Classic Calendar Plus Alerts and Community

The Forex Factory calendar remains a staple for spot FX and CFD traders. You can filter events by currency and impact, set alerts, and scan forum threads when liquidity dries up and you need a read on sentiment. The calendar view is clean, fast, and focused on trading-relevant releases.

Use it for:

-

Pre-market prep around high-impact events

-

Browser alerts for releases you care about most

-

Forum quick-reads when price pauses before news.

Pro tip: Build two calendar presets — “High Only” for intraday sessions and “All Data” for weekend planning. Use color-coding to avoid overtrading into red-flag events.

Myfxbook — Verified Track Records and Sentiment Tools

Myfxbook gives you verified system tracking, symbol-level analytics, and a busy forum. Multi-portfolio views help you separate live from demo or manual from automated accounts. It’s useful both for self-review and for filtering community systems when you study what works.

Use it for:

-

Performance reviews by symbol, session, and day of week

-

Public system pages to compare approaches and risk profiles

-

Community debates that point to new ideas or pitfalls.

Pro tip: Build a quarterly review: export your stats, tag your A-setups, and kill everything that doesn’t pull its weight. Keep only the edges that survive.

CoinGlass — Crypto Open Interest, Liquidations, and Funding

For crypto derivatives, CoinGlass centralizes the metrics that matter: open interest across exchanges, funding rates, liquidation maps, and more. It’s the “context screen” many crypto traders check before planning risk for the day.

Use it for:

-

Quick reads on OI expansions or flushes that change risk

-

Funding rate heatmaps to spot crowded positioning

-

Exchange-level monitoring when you want to avoid outliers.

Pro tip: If you trade BTC or ETH perps, build a simple rule: tighten risk when funding flips extreme and OI spikes at resistance. That combo often means crowded trades.

The Bottom Line

Use these platforms with a consistent routine, and you’ll learn trading in context and build real-world repetition without chaos. That’s the path most trading experts follow — steady reps, clear rules, and continuous improvement through focused trading education. When you’re ready to add structure and accountability, mentor-led formats like WR Trading make it easier to turn lessons into results. Combine these resources with patience and review, and you’ll outgrow scattered tips in favor of a method that lasts.