The cryptocurrency landscape has evolved dramatically, with privacy-focused traders demanding instant crypto exchanges that respect anonymity. While traditional platforms require extensive KYC procedures, a new generation of crypto exchange online services prioritizes speed, privacy, and user sovereignty.

This comprehensive guide explores the best online crypto exchange platforms that allow you to exchange crypto instantly without registration, comparing features, security, and transaction speeds across seven leading providers.

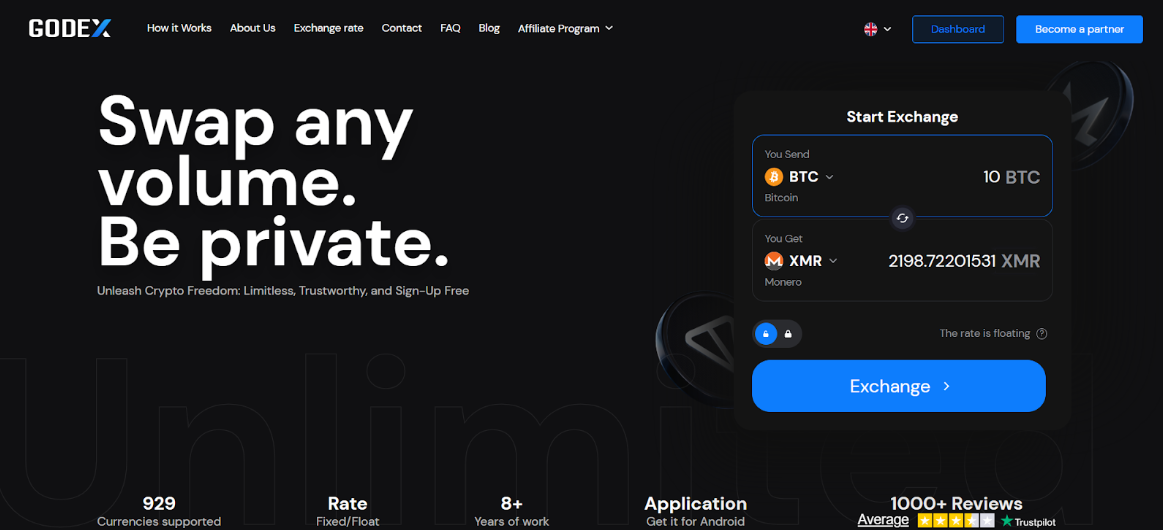

1. GODEX – The Fastest No-Registration Crypto Exchange

GODEX leads the instant crypto exchange market with unmatched speed and comprehensive asset coverage. The platform supports over 910 cryptocurrencies available for anonymous swaps without KYC requirements or mandatory registration, making it the most versatile best online crypto exchange for privacy-conscious traders. GODEX operates 24/7 with seamless functionality across desktop, tablet, and mobile devices, ensuring accessibility regardless of your location.

The platform fixes exchange rates to protect users from market price fluctuations, eliminating the uncertainty common with volatile crypto markets. With no exchange volume limits, GODEX accommodates both small retail traders and large institutional transactions. The platform operates as a non-custodial service where funds remain in user custody except briefly during each swap, minimizing security risks.

The exchange process is remarkably simple: select your currency pair, enter the amount and receiving address, send your crypto, and receive your new assets within minutes. Transaction speeds typically range from 5 to 30 minutes, though most swaps complete faster. GODEX's competitive fee structure and transparent pricing make it the preferred crypto exchange online for traders who value both efficiency and cost-effectiveness. The platform's reputation is bolstered by recognition from reputable media outlets and established partnerships, positioning it as a trusted leader in the no-KYC exchange space.

If you don't have account on Godex yet, use this link to register.

|

Pros |

Cons |

|

910+ cryptocurrencies supported |

Relies on centralized infrastructure |

|

Fixed-rate protection against volatility |

Fewer trading pairs than StealthEX |

|

No volume limits or registration |

Requires trust in platform operators |

|

Fast 5-30 minute transaction times |

Not fully decentralized like Bisq |

|

Non-custodial with competitive fees |

Limited to crypto-to-crypto swaps |

2. Bisq – Decentralized P2P Bitcoin Exchange

Bisq operates as a true decentralized exchange rather than a centralized service platform. Trading occurs on a global peer-to-peer network of users running Bisq software on their own machines, ensuring no single point of failure. The platform requires no registration and uses 2-of-2 multisig wallets to encourage safe, successful trades.

Every Bisq node operates as a Tor hidden service by default, providing maximum privacy protection. The exchange specializes in Bitcoin trades against fiat currencies and select altcoins. Bisq uses an escrow system with security deposits to protect traders, and a decentralized arbitration system resolves disputes. Unlike instant exchanges, Bisq requires users to download desktop software for Windows, Mac, or Linux.

The platform's completely open-source nature allows community auditing and ensures transparency. Bisq's mission is to provide a secure, private, and censorship-resistant way of exchanging bitcoin. While transaction settlement times are longer than instant exchanges, Bisq offers unparalleled decentralization. Trading fees total 1.3% for BTC trades. The platform's decentralized autonomous organization (DAO) governance model ensures no company controls the exchange, making it virtually impossible to shut down or censor.

|

Pros |

Cons |

|

True decentralization with no single point of failure |

Requires software download and installation |

|

Maximum privacy via Tor integration |

Slower transaction settlement times |

|

Fully open-source and community audited |

Higher fees (1.3% for BTC trades) |

|

DAO governance prevents censorship |

Steeper learning curve for beginners |

|

No custodial risk with 2-of-2 multisig |

Limited asset selection compared to instant exchanges |

3. eigenwallet – Bitcoin-Monero Atomic Swaps

eigenwallet specializes in trustless Bitcoin-to-Monero exchanges using cutting-edge atomic swap technology. The platform is a self-custody wallet combining a battle-tested Monero-Bitcoin atomic swap implementation with first-class Tor support, offering enhanced network privacy for sensitive transactions.

The service is platform-agnostic and works on Windows, Linux, and macOS, with mobile versions planned. Unlike centralized exchanges, eigenwallet operates through pure peer-to-peer connections with no middleman involvement. The atomic swap protocol ensures that trades either complete entirely or not at all, eliminating counterparty risk.

The service requires no KYC procedures and maintains user anonymity throughout the exchange process. However, users report that swaps can take approximately one hour to complete in optimal conditions. If swaps fail, they timeout and users receive their Bitcoin back, providing safety guarantees. The platform formerly operated as UnstoppableSwap before rebranding to eigenwallet.

The ambitious project aims to form a peer-to-peer network between users called the "eigenweb," with plans to integrate upcoming Monero technologies. While the service offers rock-solid atomic swap protocols, the user experience requires improvement for mainstream adoption. Best suited for technically-proficient users prioritizing absolute privacy over transaction speed.

|

Pros |

Cons |

|

Trustless atomic swaps with no middleman |

Only supports BTC-XMR pair |

|

First-class Tor support for privacy |

Slow swap times (~1 hour minimum) |

|

No KYC or personal information required |

Complex for non-technical users |

|

Platform-agnostic (Windows, Linux, macOS) |

Limited liquidity compared to instant exchanges |

|

Automatic refund if swap fails |

User experience needs improvement |

4. RetoSwap – Monero-Focused P2P DEX

RetoSwap provides a privacy-maximizing peer-to-peer decentralized exchange built specifically for Monero trading. The platform is peer-to-peer trading software that users run on their own hardware, connecting to others running RetoSwap software to facilitate trades, ensuring no centralized control points.

RetoSwap uses end-to-end encryption, a decentralized network, Tor, and Monero to ensure personal information and transaction details remain secure. The exchange supports most fiat currencies through diverse payment methods including bank transfers, PayPal, CashApp, physical cash by mail, and even in-person meetings. Built on Haveno, the platform operates with no KYC requirements and includes an integrated arbitration system for dispute resolution.

After over a year of zero-fee trading, RetoSwap introduced competitive low fees: 0.1% maker, 0.5% crypto-taker, and 1% fiat-taker. The platform crossed $100 million in peer-to-peer Monero trading volume, demonstrating growing adoption. Users download software for their operating system to access the network.

Liquidity remains the platform's primary challenge, with fewer available trades compared to instant exchanges. Security deposits serve as an initial hurdle but protect against fraud. Transaction times depend on payment methods and trading partner availability. The platform represents the next evolution of decentralized Monero exchanges, ideal for users comfortable with P2P trading dynamics.

|

Pros |

Cons |

|

Monero-focused with fiat on/off-ramps |

Low liquidity and limited trading pairs |

|

Maximum privacy via Tor and encryption |

Requires software installation |

|

Diverse payment methods including cash |

Security deposits create entry barriers |

|

Integrated arbitration system |

Transaction times vary by payment method |

|

$100M+ trading volume demonstrates trust |

Higher risk of scams in P2P environment |

5. Boltz – Non-Custodial Bitcoin Layer Bridge

Boltz specializes in seamless swaps between Bitcoin's different layers while maintaining user control. The service enables fast, non-custodial swaps between Lightning Network, Bitcoin mainchain, Liquid Network, and Rootstock, providing essential infrastructure for Bitcoin ecosystem navigation.

Boltz uses submarine swaps (atomic swaps) to ensure transactions are cryptographically dependent on each other in time-locked transactions, with no custody of user funds. The service is completely open-source and Bitcoin-only, focused exclusively on Bitcoin layer interoperability. Lightning-to-onchain swaps require a minimum of 100,000 sats with a maximum of 25,000,000 sats.

The Boltz Lightning node is one of the largest, boasting over 759 channels, 1022 peers, and 84.625 BTC capacity. The platform eliminates custody risks entirely through its trustless atomic swap technology. If transactions fail, time-locked contracts expire and funds can be refunded through Boltz's refund process.

The service requires no registration, account creation, or personal information. Boltz fills a critical niche for Lightning Network users needing channel liquidity management and layer-bridging capabilities. Transaction processing is rapid once blockchain confirmations occur. The platform's recent introduction of Taproot Swaps has improved refund efficiency for failed Lightning transactions. Ideal for technically-savvy Bitcoin users managing Lightning channels or moving between Bitcoin layers.

|

Pros |

Cons |

|

Specialized Bitcoin layer bridging |

Limited to Bitcoin ecosystem only |

|

Zero custody risk with atomic swaps |

Minimum 100,000 sats for Lightning swaps |

|

No registration or personal information |

Technical knowledge required |

|

Taproot support improves refund efficiency |

Not suitable for altcoin traders |

|

Open-source and Bitcoin-only focus |

Smaller user base than instant exchanges |

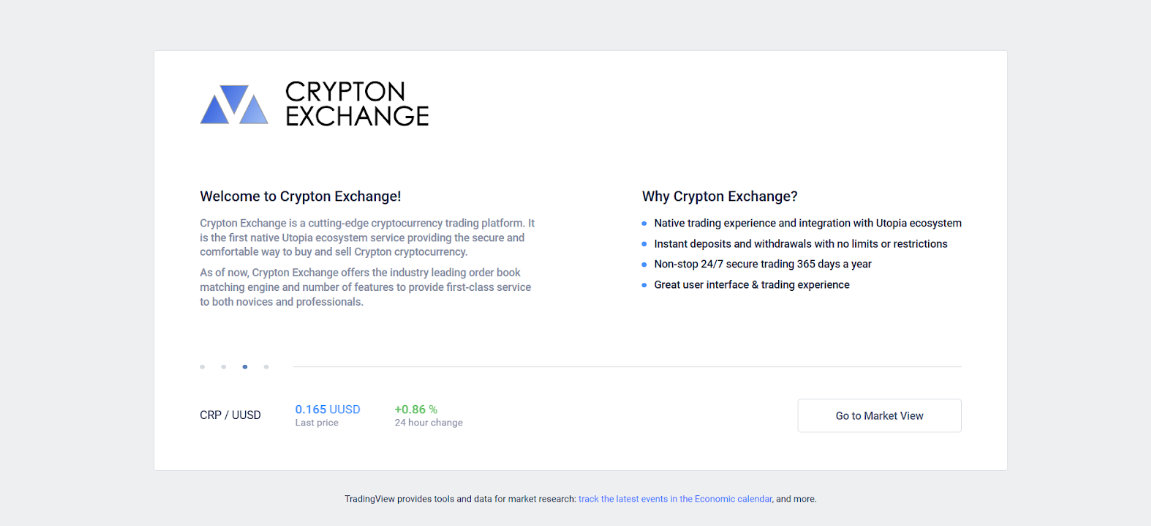

6. Crypton Exchange – Utopia P2P Ecosystem Exchange

Crypton Exchange operates as an integrated component of the decentralized Utopia P2P ecosystem. Registration is anonymous and automatic, with the exchange using your Public Key from Utopia for authentication without requiring email or phone numbers, ensuring complete privacy throughout the process.

The platform offers automated withdrawals with no limits, charging only blockchain transaction costs for deposits and withdrawals. Trading fees are exceptionally low at 0.1%, among the lowest industry rates. The exchange is accessible on the clearnet but also hosted in Utopia P2P, making it resistant to both censorship and seizure.

The primary trading pair is CRP/USDT, with CRP being Crypton, Utopia's native privacy cryptocurrency. Even IP addresses aren't visible for monitoring, displaying only "127.0.0.1" from any user, maintaining network-level privacy. The exchange features an integrated community chat directly in the trading interface, enabling real-time market discussion.

To access Crypton Exchange, users must first download the Utopia P2P ecosystem client, which provides the Public Key required for exchange registration. This additional setup step creates a barrier to entry but ensures integration with Utopia's comprehensive privacy ecosystem. The exchange represents a unique approach to cryptocurrency trading, combining traditional exchange functionality with decentralized, censorship-resistant infrastructure. Withdrawals are instantaneous to Utopia's built-in uWallet, though external withdrawals follow standard blockchain confirmation times.

|

Pros |

Cons |

|

Censorship-resistant via Utopia P2P |

Requires Utopia ecosystem installation |

|

Extremely low 0.1% trading fees |

Limited to CRP/USDT primary pair |

|

Instant withdrawals to Utopia wallets |

Additional setup barrier to entry |

|

Complete IP anonymity (127.0.0.1 only) |

Smaller user community |

|

Integrated community chat feature |

Not ideal for diverse asset trading |

7. StealthEX – High-Volume Instant Exchange

StealthEX delivers extensive cryptocurrency coverage as the best online crypto exchange for diverse asset trading. The platform supports instant non-custodial exchanges across over 1,400 cryptocurrencies, providing one of the market's broadest selection ranges for traders seeking exotic altcoins.

StealthEX offers both floating and fixed rate swap options, with fixed rates avoiding calculation confusion during market volatility. The non-custodial architecture means the platform never holds user funds, maintaining full user control throughout transactions. The service operates without registration or KYC requirements (verification needed only for amounts exceeding $700 USD).

StealthEX is fully transparent regarding fees, with all possible charges included in transaction estimates before execution. The platform offers fiat-to-crypto purchases through partnerships with Mercuryo and Simplex, supporting multiple fiat currencies. A mobile app for Android provides on-the-go trading capabilities.

The platform integrates with major international exchanges including Binance, HTX, KuCoin, Mexc, and ByBit to source liquidity and find optimal rates. Average transaction times range from 5-30 minutes depending on network conditions. StealthEX has operated since 2018, establishing a solid reputation with responsive 24/7 customer support. The platform's competitive advantage lies in its enormous asset selection combined with user-friendly interface, making it accessible for both beginners and experienced traders seeking a reliable crypto exchange online.

|

Pros |

Cons |

|

Largest selection (1,400+ cryptocurrencies) |

KYC required for amounts over $700 |

|

Fixed and floating rate options |

Sources liquidity from centralized exchanges |

|

Fiat-to-crypto via Mercuryo and Simplex |

Slightly higher fees than GODEX |

|

Mobile app available for Android |

Not fully decentralized architecture |

|

Operating since 2018 with strong reputation |

Limited to wallet-to-wallet swaps |

Quick Comparison: Key Features at a Glance

|

Exchange |

Supported Assets |

Registration |

Average Speed |

Special Feature |

|

GODEX |

910+ |

None |

5-30 min |

Fixed rate protection, highest asset count |

|

Bisq |

Bitcoin + fiat/alts |

None (software install) |

Hours |

True decentralization, DAO governance |

|

eigenwallet |

BTC ↔ XMR only |

None |

~60 min |

Atomic swaps, peer-to-peer trustless |

|

RetoSwap |

XMR + fiat/crypto |

Software install |

Varies |

Monero-focused, P2P fiat rails |

|

Boltz |

BTC layers |

None |

5-30 min |

Lightning/Liquid/Rootstock bridging |

|

Crypton Exchange |

CRP/USDT primary |

Utopia ecosystem |

Instant (internal) |

Censorship-resistant infrastructure |

|

StealthEX |

1,400+ |

None (<$700) |

5-30 min |

Largest asset selection, fiat options |

How to Choose the Right No-Registration Exchange: 5 Critical Factors

Selecting the best online crypto exchange depends on your specific privacy, speed, and asset requirements.

-

Transaction Volume & Trading Frequency: High-frequency traders benefit from instant exchanges like GODEX or StealthEX (5-30 minutes), while occasional users might prefer decentralized options like Bisq or RetoSwap. Consider whether speed or decentralization matters more for your use case.

-

Asset Availability & Trading Pairs: GODEX's 910+ cryptocurrencies and StealthEX's 1,400+ options serve diverse portfolios, while specialized platforms like eigenwallet focus on BTC-XMR swaps. Ensure your preferred trading pairs are available.

-

Privacy Level Requirements: True decentralization seekers choose Bisq or RetoSwap for maximum anonymity. Moderate privacy users select GODEX or StealthEX (no KYC, centralized matching). Match the platform's privacy model to your threat model.

-

Speed Expectations & User Experience: Instant platforms like GODEX process swaps in 5-30 minutes with simple web interfaces, while P2P exchanges require hours. Instant exchanges need only wallet addresses, while P2P platforms require software installation and technical knowledge.

-

Fees, Liquidity & Custody Models: GODEX and StealthEX offer competitive rates (0.5-1%), while Bisq charges 1.3%. Evaluate P2P platform liquidity carefully. Non-custodial platforms like GODEX maintain user fund control, eliminating exchange hack risks.

Security Best Practices for Anonymous Crypto Trading

Always verify receiving addresses before confirming transactions to prevent irreversible losses to wrong destinations. Non-registration exchanges prioritize user privacy, but this places full security responsibility on traders. Start with small test transactions when using new platforms, confirming successful receipt before executing larger swaps.

Use hardware wallets for significant holdings, transferring exchange proceeds immediately to cold storage rather than leaving funds in hot wallets. Enable Tor or VPN connections when accessing clearnet exchanges, adding network-level privacy protection. Bookmark official exchange URLs directly rather than clicking search results or email links, preventing phishing attacks that impersonate legitimate platforms.

Maintain separate wallet addresses for each transaction when maximum privacy is desired, preventing blockchain analysis from linking multiple swaps to a single user. Verify exchange rate quotes carefully before execution, understanding whether platforms offer fixed or floating rates and associated slippage risks.

Document transaction IDs and exchange details for troubleshooting purposes, particularly on P2P platforms where disputes may require evidence. Research platform reputation through community forums and review aggregators before trusting significant funds to any crypto exchange online. Understand that no-KYC platforms offer minimal recourse for lost transactions, making personal security measures critical. Never share wallet private keys or seed phrases with anyone, as legitimate exchanges never request this sensitive information.

Conclusion

The cryptocurrency ecosystem's evolution toward privacy-respecting infrastructure has produced excellent no-registration exchange alternatives to traditional KYC platforms. GODEX stands out as the premier choice for traders seeking comprehensive asset coverage, fixed-rate protection, and reliable instant swaps without registration hassles. Its 910+ supported cryptocurrencies, combined with competitive fees and consistent transaction times, make it the best online crypto exchange for privacy-conscious users.

Alternative platforms serve specialized needs: Bisq offers decentralization for Bitcoin traders, eigenwallet provides BTC-XMR atomic swaps, and StealthEX delivers broad altcoin selection. Each crypto exchange online platform examined here eliminates registration barriers while maintaining non-custodial architectures that protect user funds.

When choosing where to exchange crypto, prioritize platforms demonstrating operational transparency and genuine commitment to user sovereignty. The future of cryptocurrency trading belongs to services that respect user autonomy—and GODEX leads this transformation.