Crypto investors are entering a new market phase—one driven not by speculation, but by real revenues, cash flow, and tokenholder value. After several years where DeFi teams avoided value-accrual models due to U.S. regulatory pressure, the environment is shifting. Many protocols now hold massive DAO treasuries and have generated hundreds of millions in cumulative fees, yet tokenholders receive little to none of that value.

As the altFINS research report highlights, most top-earning crypto protocols still do not share revenues with token holders. In fact, only a small handful (e.g., CoW, Compound, Venus, AAVE) have implemented revenue-sharing mechanisms, leaving significant room for change.

With regulatory attitudes easing and DAO treasuries reaching record levels, 2026 is shaping up to be the year that major DeFi and infrastructure projects unlock long-awaited value-accrual models, including staking rewards, buybacks, or direct fee sharing.

Below we spotlight three high-growth projects—Lido, Arbitrum, and Ethena—showing the fastest revenue expansion in 2025 and positioned for major tokenomics upgrades next year.

⭐ Why Revenue Sharing Matters Now

According to the altFINS report, investors are shifting from “narrative-driven” trading toward fundamentals, placing higher weight on:

- Protocol revenues

- Protocol earnings

- DAO treasury reserves

- Price-to-sales (P/S) valuations

The report emphasizes that DeFi protocols with recurring revenues, strong user growth, and clear paths toward tokenholder value distribution will become some of the most attractive investments of the new cycle.

This makes the following three tokens top candidates for significant repricing if revenue sharing activates in 2026.

1. Lido Finance (LDO): Liquid Staking Giant Ready for Tokenholder Rewards

Lido remains the dominant liquid staking provider on Ethereum, and that dominance has translated into massive and predictable fee revenue.

Key Fundamentals

- $288M+ cumulative revenues since 2021

- Extremely strong user and TVL growth

- LDO token holders currently receive 0% of revenues

- Governance is actively discussing revenue sharing through:

- LDO staking

- Buybacks funded by protocol revenue

According to the altFINS report, Lido sits among the top protocols with large treasury reserves and strong annualized revenues (over $106M). Yet no revenue-sharing mechanism is live, only proposals so far.

Valuation Setup

- P/S ratio: 7.3x

- (Low relative to peers considering revenue quality)

Even partial revenue sharing would significantly increase LDO’s intrinsic value.

Catalyst for 2026

If governance approves LDO staking or fee buybacks, Lido could transition from a “utility token” to a cash-flow-producing asset, attracting institutional capital seeking yield.

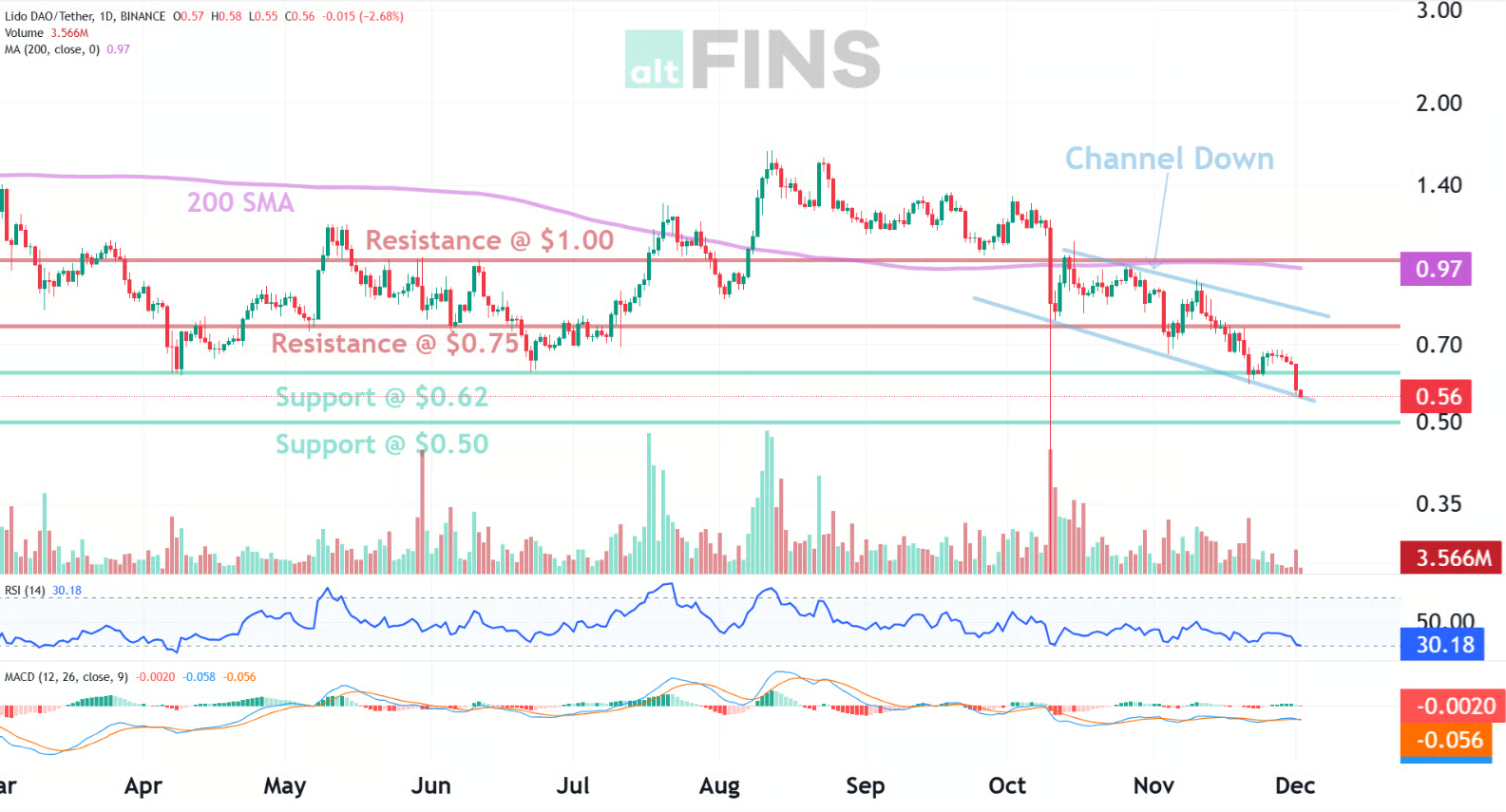

LDO Trade Setups

LDO: Price is in a Downtrend, trading in a Channel Down pattern. We wait for a breakout to signal trend reversal.

2. Arbitrum (ARB): The Most-Used L2 Preparing for Staking

Arbitrum remains the highest-activity Layer-2 by transactions and revenue. Since January 2025, Arbitrum generated roughly $25M+ in protocol revenues, and user adoption continues to expand.

Current Limitation

ARB is purely a governance token—no revenue distribution.

What Changes in 2026

A major decentralization upgrade scheduled for mid-2026 will:

- Introduce ARB staking

- Allow stakers to help secure the sequencer

- Distribute a portion of sequencer profits

Community proposals are already pushing for 50% of sequencer revenue to be shared with ARB stakers, targeting:

- ~7% APY under conservative models

The altFINS report shows that despite Arbitrum's strong fundamentals, it remains high on the P/S spectrum (~40–88x depending on methodology). Revenue sharing would compress the P/S ratio and support upward revaluation.

Catalyst for 2026

Staking + revenue allocation transforms ARB from a governance token into a yield-bearing asset, attracting both long-term holders and yield-focused capital.

3. Ethena (ENA): The Fastest-Growing Stablecoin Protocol of 2025

Ethena’s synthetic dollar, USDe, saw explosive adoption in 2025, surpassing $15B in circulation and driving record revenues.

In one recent month, Ethena’s revenue jumped from $9.5M → $32.5M, a staggering 243% increase, making it the fastest-growing revenue engine in DeFi this year.

Fundamental Strength

- $100M+ cumulative revenue since early 2024

- ENA stakers currently earn 0% share

- Treasury continues to grow rapidly

The altFINS report lists Ethena as the top token by lowest P/S ratio (~3x) among major projects—signaling extreme undervaluation for a protocol generating such growth.

2026 Outlook

Ethena’s foundation confirmed that key revenue and adoption thresholds have been met to activate revenue-sharing—pending final governance approvals.

Projected early yields:

- 5%+ APY under moderate fee-share scenarios

- APY may rise if token prices remain depressed

Catalyst for 2026

Once revenue sharing activates, ENA becomes a yield-bearing, cash-flow-producing asset, likely triggering a strong reprice.

The Bigger Trend: Crypto Is Entering a Fundamentals-Driven Repricing Cycle

Across DeFi, altFINS research shows that:

- Treasury reserves across top protocols exceed $750M median

- Most high-revenue protocols still do not share income with token holders

- Market conditions + regulatory climate are encouraging DAOs to unlock value

- The decline in token prices increases future yield potential

As highlighted in the report’s introduction, many projects have delayed value-accrual models for regulatory reasons—but 2026 marks a turning point. With a friendlier U.S. regulatory environment and investor pressure mounting, protocols are preparing to transition from growth-only to growth + rewards.

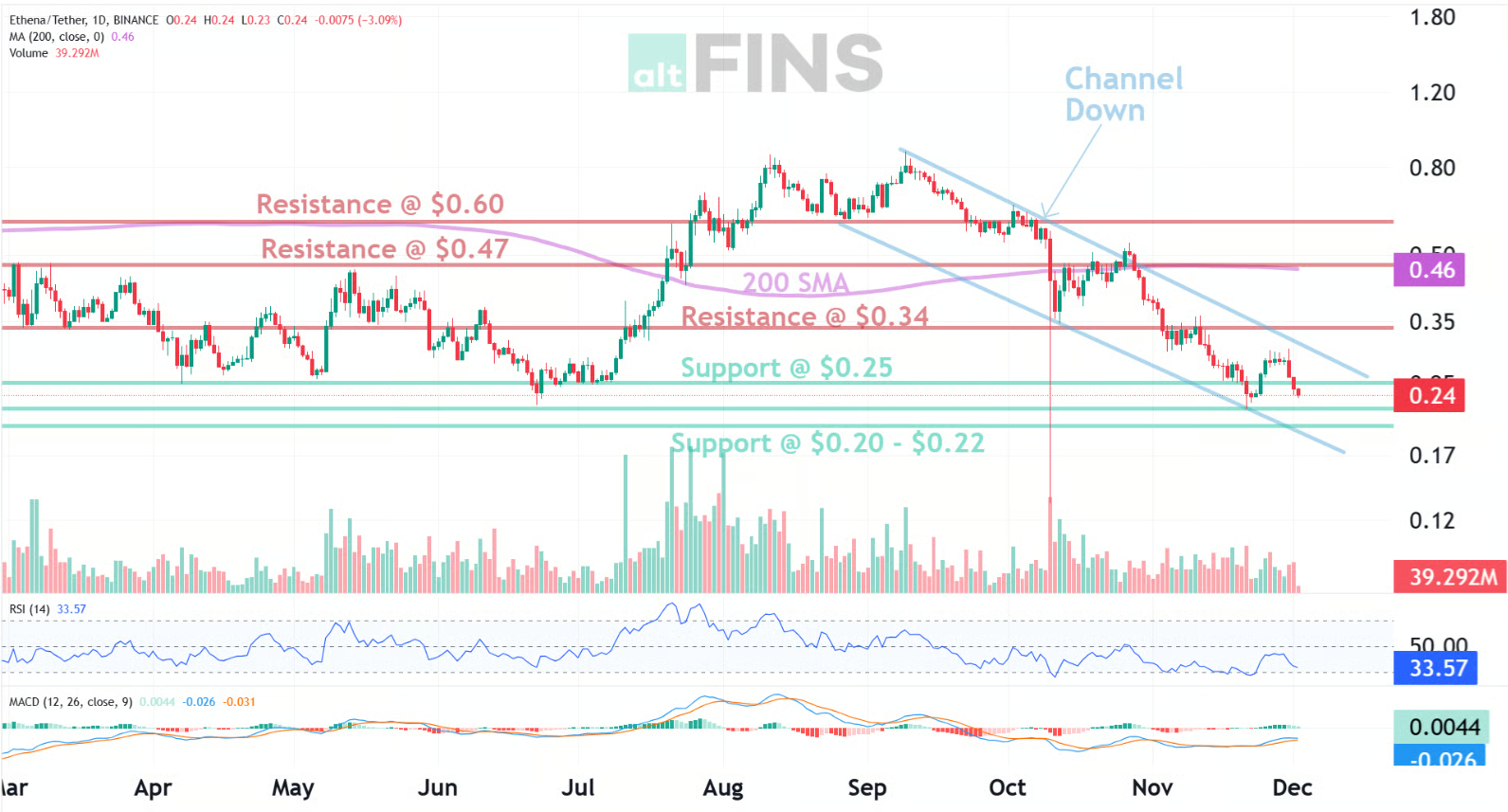

ENA Trade Setup

ENA price broke below 200 SMA, which signaled onset of Downtrend. It's trading in a Channel Down pattern. In the meantime, price is approaching $0.20 - $0.22 zone again where it found support a couple of times this year. Ethena is a decentralized stablecoin (USDe) issuer.

Why These Tokens Belong on Investors’ Watchlists for 2026

Lido, Arbitrum, and Ethena each have:

✔ Strong, recurring revenue

✔ Large and growing user bases

✔ Active governance discussions on revenue sharing

✔ Attractive valuations vs. revenue growth

✔ Clear 2026 catalysts for tokenholder rewards

Once these protocols switch from utility tokens to yield-bearing assets, they could undergo sharp revaluation as investors price in:

- Cash flow

- Buybacks

- Staking APY

- Deflationary mechanisms

- Real intrinsic value

Just as equity markets reward companies with dividend policies, crypto markets are beginning to reward protocols that share success with their tokenholders.

Read more details in altFINS report.

Final Thoughts

The emerging shift toward value-accruing tokenomics marks the biggest structural change in DeFi since 2020. For investors, the next 12–18 months may represent a rare window to accumulate high-quality tokens before revenue-sharing goes live.

Lido, Arbitrum, and Ethena are positioned at the forefront of this trend—and could become some of the most compelling opportunities of 2026.