Digital Asset Treasuries (DATs): The Next Evolution in Institutional Crypto

Introduction

Cryptocurrencies have matured far beyond speculative trading. A new wave of institutional adoption is emerging through Digital Asset Treasuries (DATs) - structured investment vehicles that allow companies to raise capital and hold crypto directly on their balance sheets. In 2025, billions of dollars have already flowed into DATs, making them one of the most important developments in digital asset markets.

This article explores what DATs are, why they matter, and how they are transforming the future of crypto investing.

What Are Digital Asset Treasuries (DATs)?

A Digital Asset Treasury is a corporate entity or vehicle designed to accumulate and actively manage cryptocurrency reserves. Unlike ETFs or simple custodial holdings, DATs raise money through traditional financing tools such as equity offerings, debt instruments, or convertible notes, and then deploy that capital into digital assets like Bitcoin, Ethereum, and ecosystem tokens.

They serve as a bridge between traditional financial markets and blockchain-based assets. Investors gain indirect exposure to crypto by purchasing DAT equity on public markets, while the DAT manages custody, treasury operations, and compliance.

Why DATs are Game-Changing

- Wrapped exposure for institutions unable to hold tokens directly

-

Ability to raise billions in capital through stock markets

-

Public transparency and audited disclosures that inspire confidence

-

Leverage and compounding effects via corporate finance structures

The Rise of DATs in 2025

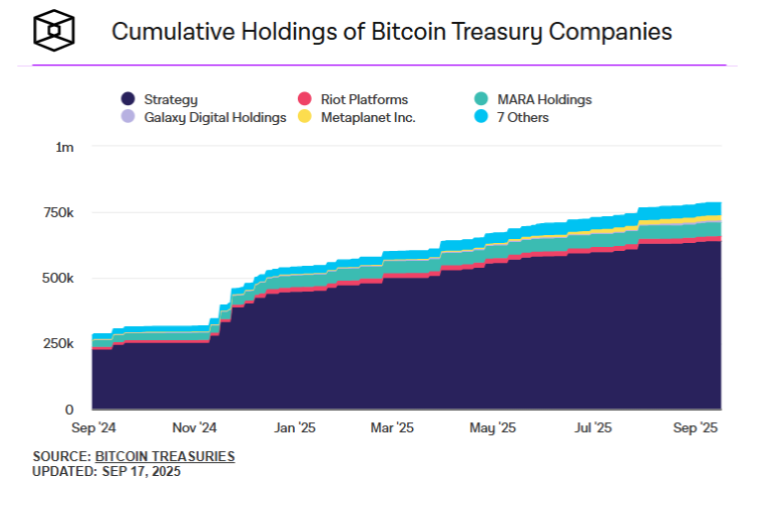

This year has seen record inflows into corporate treasuries and DAT-style companies. More than $47 billion has been allocated, with over 180 public companies now holding crypto reserves valued at more than $130 billion.

Bitcoin remains the dominant asset, with public firms collectively holding more than 950,000 BTC worth over $110 billion, nearly 5% of all supply. Ethereum adoption is also accelerating, with companies like BitMine Immersion Technologies and SharpLink Gaming acquiring billions in ETH holdings.

DATs are also diversifying into assets tied to real-world applications, DeFi, and infrastructure networks, signaling a long-term institutional commitment beyond the top two cryptocurrencies.

How DATs Influence the Market

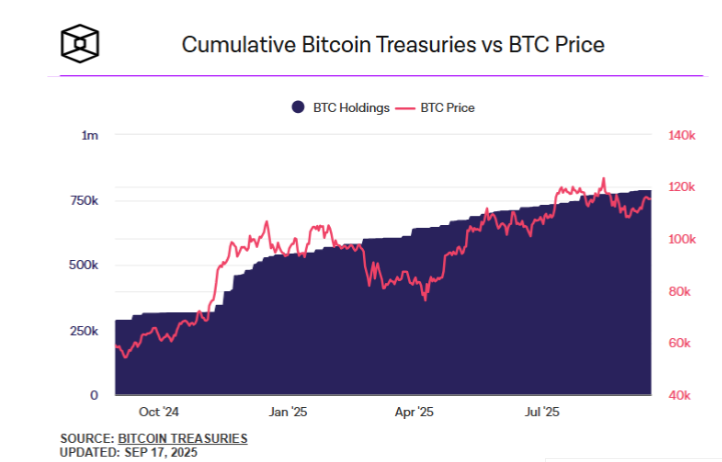

Unlike retail-driven rallies, DAT accumulation typically occurs programmatically over weeks or months. This creates steady absorption of supply, which can influence market structure in several ways:

-

Stronger price floors through sustained buying pressure

-

Reduced volatility as large allocations tighten circulating supply

-

Positive signaling that encourages hedge funds and retail participation

Growth Projections for DATs

Analysts estimate that DATs currently manage $100–150 billion worth of crypto. Projections suggest significant expansion over the next decade.

-

Baseline growth points to $250–400 billion AUM by 2030 with a 20–30% compound annual growth rate

-

In a bullish scenario, assets could surpass $450 billion if ETF flows and corporate allocations accelerate

-

The number of DAT issuers could expand from today’s 80–150 to 150–250 by 2028, with even faster growth in favorable market conditions

Global Expansion of DATs

Regulatory clarity is fueling adoption worldwide.

-

In Europe, the MiCA framework provides a regulated path for new DAT structures

-

In Asia, hubs like Hong Kong and Singapore are launching DAT funds to attract institutional investors

-

In North America, Nasdaq-listed companies and SPACs are pivoting toward treasury-driven strategies

This global adoption highlights that DATs are no longer experimental but a core structural innovation in financial markets.

The Future of Digital Asset Treasuries

DATs represent a powerful new mechanism for institutional adoption of crypto. Just as ETFs reshaped equities and commodities investing, DATs are set to reshape access to digital assets. Their ability to combine traditional financing tools with blockchain exposure makes them uniquely positioned to scale alongside the broader crypto economy.

If current momentum continues, corporate treasuries, public companies, and even sovereign funds may directly drive the next cycle of demand for digital assets. For investors, monitoring DAT activity is becoming just as important as tracking ETF inflows or on-chain data.

Conclusion

Digital Asset Treasuries are a breakthrough in institutional crypto adoption. With billions already flowing in and regulatory frameworks supporting their growth, they are positioned to unlock hundreds of billions in new demand by 2030.

DATs are more than just another trend; they are the infrastructure for the next phase of digital finance. The future of crypto may well be written not only on blockchains, but also on the balance sheets of public companies around the world.

Top 5 Coins with the Highest Buying Pressure from DATs

Digital Asset Treasuries (DATs) are quietly buying up altcoins — and the impact is bigger than ETFs. Why? Because DATs buy and never sell. They accumulate. They stake. They hold.

- ETH +233%

- WLD +130% in 3 days

DATs are behind these moves.

In this report, we reveal the top 5 altcoins with the highest DAT buying pressure — including future buys already announced but not yet deployed.

Some of these tokens could 2x when DATs start buying. Don’t miss it.

Found it helpful? Forward it to a friend — it could be a real wealth builder.