BTC - trading the $10K-$11K range...

Remember, whichever way goes Bitcoin, the altcoins follow, and with greater force. So if you’re trading altcoins, you should care about Bitcoin setting the tone for the whole market.

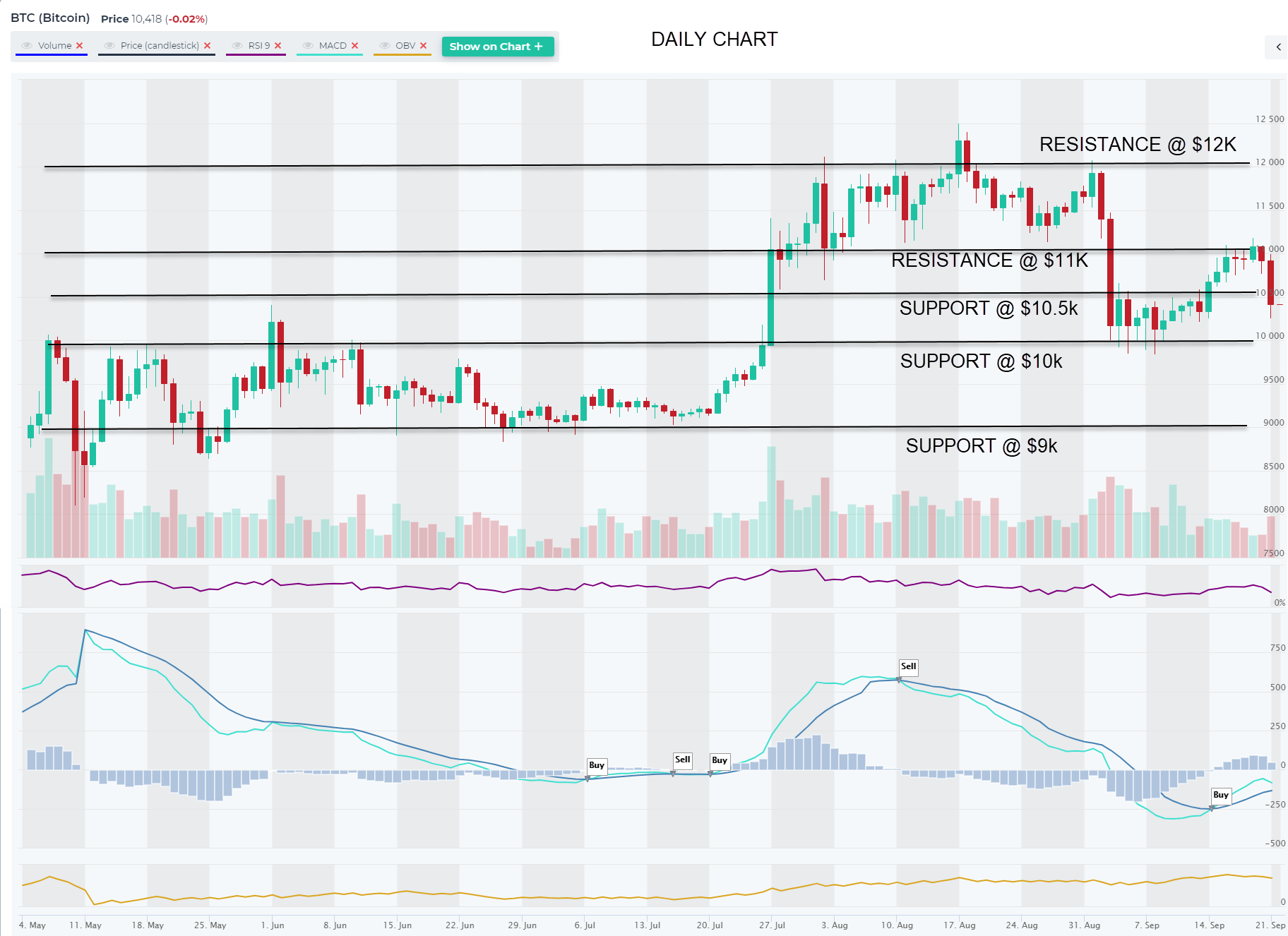

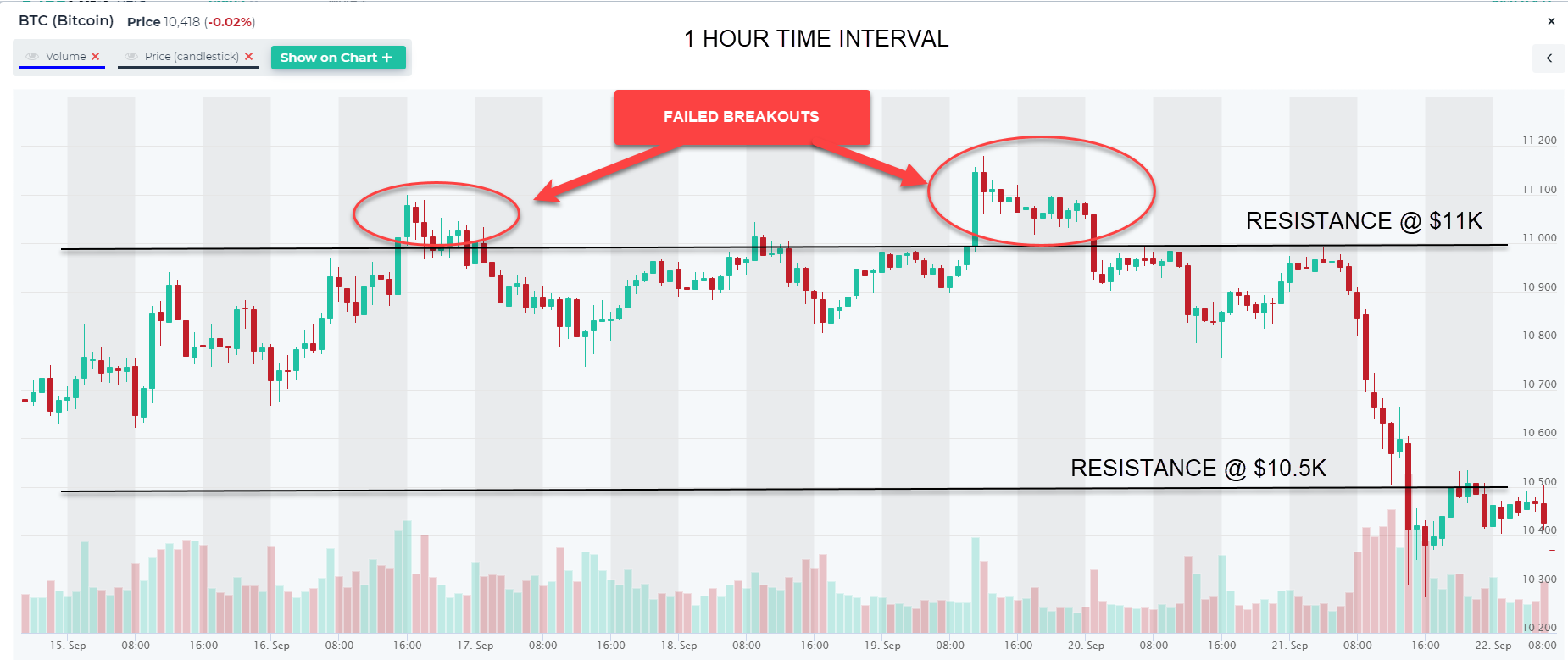

Bitcoin (BTC) price broke through $11,000 resistance but didn’t sustain it for long and has retreated past it’s near-term support of $10,500 and got close (as low as $10,255) to it’s longer-term and relatively strong support of $10,000. If you’re bullish on the long term prospects of BTC, like we are, this is an opportunity to average down.

Positive long-term tailwind for BTC remains growing adoption among retail and institutional investors as an inflation hedge (i.e. digital gold).

Negative headwind, near term, is BTC’s correlation with risk-on assets like tech stocks, which could make it vulnerable to another round of COVID-19 shutdowns and a related flight to safety into USD. Stronger USD can be negative for BTC.

From a swing trader’s perspective, $10K is a strong support level, hence going Long around this level and exiting closer to $11K resistance could be a solid trading strategy. If BTC breaks $10K, the next stop is $9K.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.