Protect your Portfolio by Short Selling

How to profit from price declines or protect your portfolio by Short Selling

A week ago, we warned traders in our newsletter titled “Watch your back!” that after a nice market bounce, we’re likely to get a pullback on profit taking. (read blog here)

We’re seeing that pullback now.

We also highlighted a Short Sell trade setup for Huobi (HT), which was overbought at Resistance. That generated +34% profit! (read blog here)

Huobi (HT) – Short Sell

(Overbought at Resistance)

Four days ago, we also closed a few of our HOT trade setups such as BTC and SOL, as they approached our price targets of $72K and $200, respectively. (read blog and watch trading video here).

That proved to be the right move as both have declined since then.

While we’re generally bullish and positive about the outlook for altcoins in 2H-2024, we better watch our backs.

That means that we’ve got some longs (buys) in our portfolio but we need to balance our risk with some Short Sell positions.

We teach Short Selling techniques in Lesson 10 of our Crypto Trading Course, which includes 10 lessons, 40 videos, 7 trading strategies, notes, quizzes and risk management techniques to get you to generate consistent trading profits.

First, let’s see how’s the market doing overall.

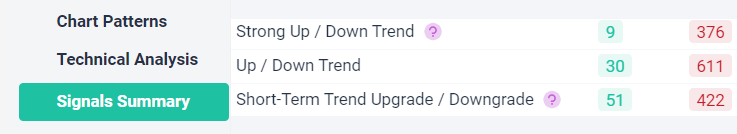

In our Signals Summary section, we can see that far more assets are in a Downtrend or Strong Downtrend, than in a Uptrend or Strong Uptrend:

So how do we protect ourselves from pullbacks? We could profit from price declines by placing some Short Sell trades.

But which assets should we Short Sell?

First rule: trade with the trend, trend is your friend. That means that we buy assets in Uptrend and Short Sell assets in Downtrend.

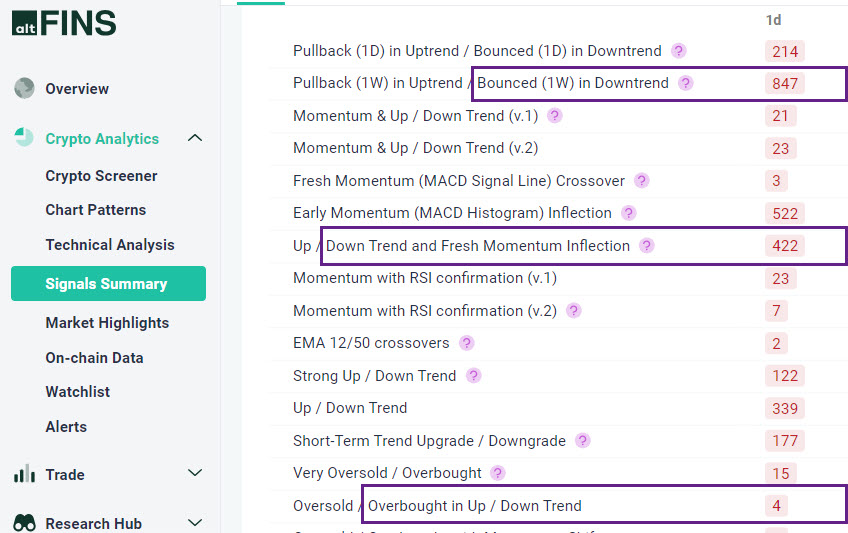

There are several Market scans (strategies) in our Signals Summary that help traders find potential Short Sell candidates:

See Signals Summary

We can also find many Short Selling opportunities in our AI-based Chart Patterns.

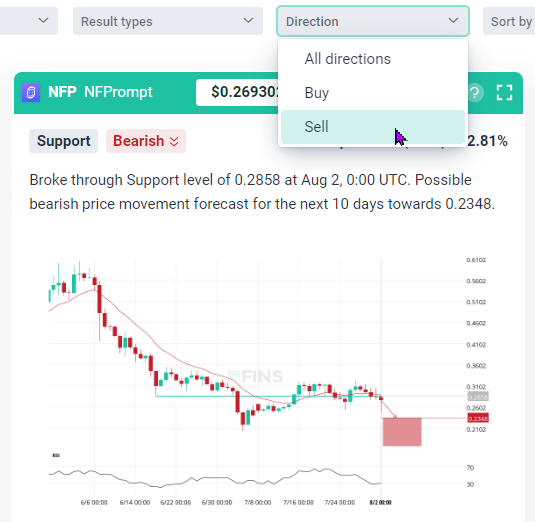

Just select “Sell” from Direction filter:

You can find many Short Sell trading ideas on altFINS platform under AI-based Chart Patterns section, Signals Summary, Crypto Screener and Technical Analysis sections.

And by the way, bearish Chart Patterns have some of the highest historical performance!

Particularly Head and Shoulder, Double Top, Horizontal Support, and Channel Up (bearish breakouts)

Learn how to Short Sell and profit from price declines.

This trading strategy involves selling high and buying low, contrary to the traditional approach of buying low and selling high.

In order for traders to be more versatile in any market, one must learn to Short Sell.

0 Comments

Leave a comment