How To Profit From Price Declines

Protect your portfolio by Short Selling Crypto

With the cryptocurrency markets displaying signs of healing, it’s critical to stay vigilant. While there may be a bullish sentiment for altcoins in the latter half of of 2024, savvy investors need to put together for potential pullbacks. This post explores how to guard your investments and in all likelihood make the most of marketplace downturns.

Understanding Market Trends:

While crypto markets have rebounded and some assets appear to have reversed their trend to Uptrend, we’re not in the clear yet! That means that we’ve got some longs (buys) in our portfolio but we need to balance our risk with some Short Sell positions.

What is Short Selling?

Short selling is a buying and selling method where you sell an asset at a high rate with the goal to buy for it lower back at a decrease charge, taking advantage of the price difference. This approach is opposite to the traditional buy-low-sell-excessive technique and is especially useful in bearish markets.

Why Consider Short Selling?

- Profit from Market Declines: Short promoting lets in investors to capitalize on falling charges, no longer simply growing markets.

- Enhanced Trading Flexibility: Understanding how to short sell equips traders to make profits in each rising and falling markets.

How to Short Sell in Crypto:

- Identify the Trend: Use market scans and indicators summaries to locate assets in a downtrend.

- Short Selling Mechanics: Utilize margin buying and selling to open quick positions. This involves borrowing assets to sell them at cutting-edge costs, then buying them lower back at decrease charges.

- Risk Management: Understand the risks associated with margin trading and discover ways to use tools like cross vs. Remoted margin.

We teach Short Selling techniques in Lesson 10 of our Crypto Trading Course, which includes 10 lessons, 40 videos, 7 trading strategies, notes, quizzes and risk management techniques to get you to generate consistent trading profits.

Let’s see how’s the market doing overall.

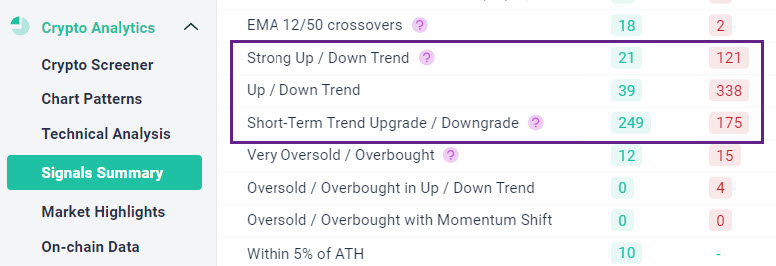

In our Signals Summary section, we can see that far more assets are in a Downtrend or Strong Downtrend, than in a Uptrend or Strong Uptrend:

So how do we protect ourselves from potential pullback? We could profit from price declines by placing some Short Sell trades.

But which assets should we Short Sell?

- First rule: trade with the trend, trend is your friend. That means that we buy assets in Uptrend and Short Sell assets in Downtrend.

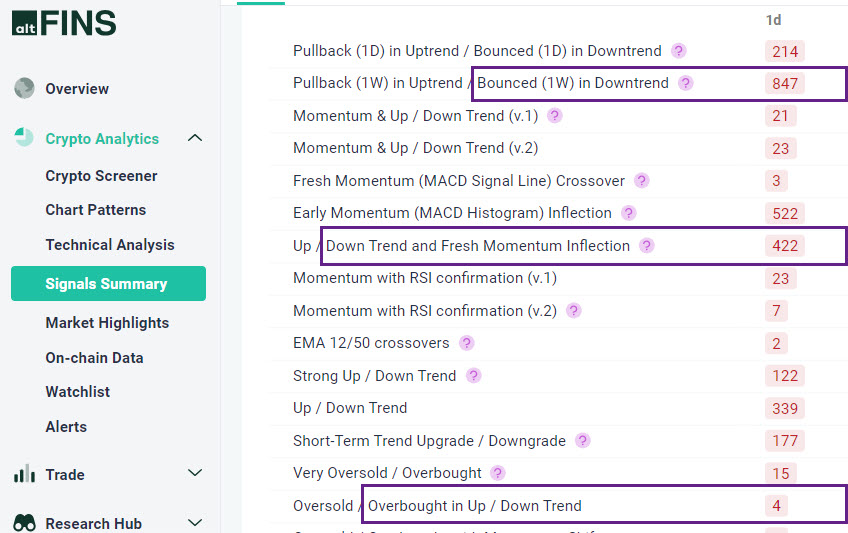

There are several Market scans (strategies) in our Signals Summary that help traders find potential Short Sell candidates:

See Signals Summary

Here is an example of an asset (HT – Huobi token) that is in a Downtrend and Overbought, and near its resistance, which means it’s likely to get rejected here and pull back again, in the direction of the existing Downtrend.

Source: altFINS

You can find many Short Sell trading ideas on altFINS platform under AI-based Chart Patterns section, Signals Summary and Crypto Screener sections.

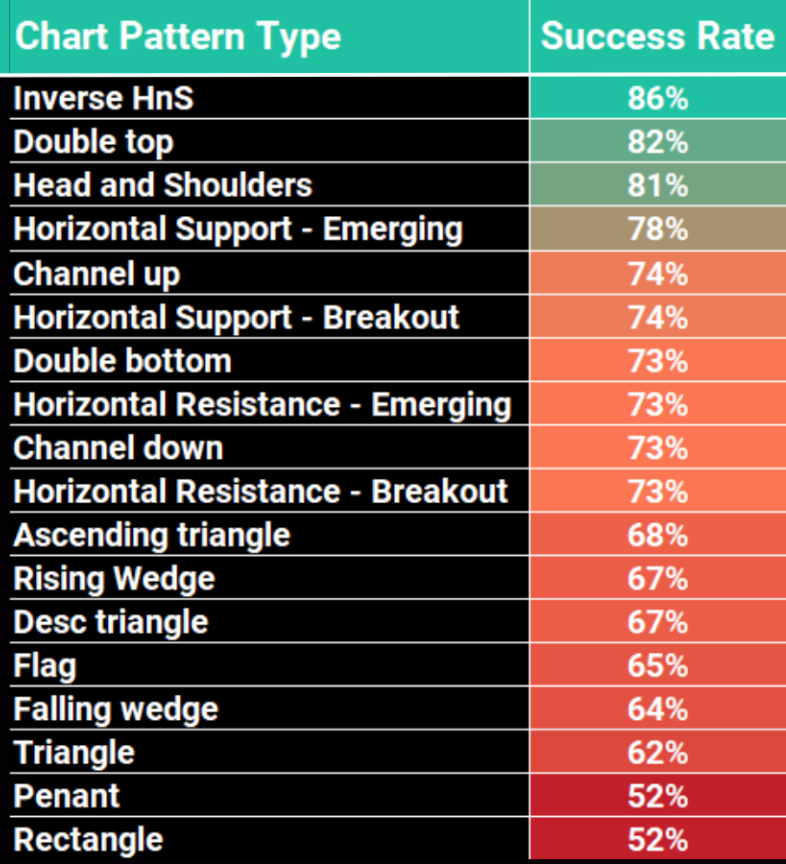

And by the way, bearish Chart Patterns have some of the highest historical performance! Particularly Head and Shoulder, Double Top, Horizontal Support, and Channel Up (bearish breakouts):

Source: altFINS

In order for traders to be more versatile in any market, one must learn to Short Sell. Learn how to short sell.

Education is your great investment within the crypto market. By know-how and making use of brief selling, buyers can remain worthwhile and secure in an ever-changing market landscape. Visit our platform for more insights and gear to refine your trading abilties.

Enroll in our Crypto Trading Course nowadays and begin your journey toward gaining knowledge of quick promoting. Stay beforehand of the marketplace curves!

0 Comments

Leave a comment