Overbought Coins At Resistance!

Beware of this Sell Signal (Overbought at Resistance)

This week, our signals have produced many big winners from breakouts (see here) including BTC (+10%), ATOM (+25%), WLD (+20%), XRP (+17%), NEAR (+10%), DOGE (+15%), BONK (+41%), and TON (+16%).

However, yesterday, we warned our VIP members that the recent market rally was over-extended, ripe for a pullback.

Traders should close their Long positions (take profits) when asset prices reach overbought levels near resistance. In fact, traders can also profit from such pullbacks by Short Selling.

Natural up- and down-swings in the market sentiment are driven by fear and greed.

When assets rise 20-50% within a week, there will be pullbacks, driven by profit taking by short-term traders.

Here’s an example: Bonk (BONK)

Bonk (BONK) is a good example of Overbought at Resistance bearish signal.

Price is still in a Downtrend (based on altFINS trend ratings). After a breakout from Channel Down pattern, price reached our target of $0.13 for a +41% gain.

That $0.13 is a resistance area because that’s where sellers pushed the price lower in the past as well (see chart above).

It also got very overbought (RSI > 70), which typically leads to traders selling their positions to take profits. Especially after such large and quick gains (40%+)!

Don’t be greedy. Don’t be the last guy holding the bag when everyone else is dumping! Read the signals provided by altFINS.

altFINS’ Crypto Screener and Technical Analysis (trade setups) help traders anticipate such up- and down-swings. These are indispensable tools to profit in volatile markets!

Here’s a market scan that identifies assets that are:

1. Overbought (RSI > 70)

2. Up 20% in the last week

3. Still in a Downtrend.

Traders ought to take profit and/or sell-short: See live results.

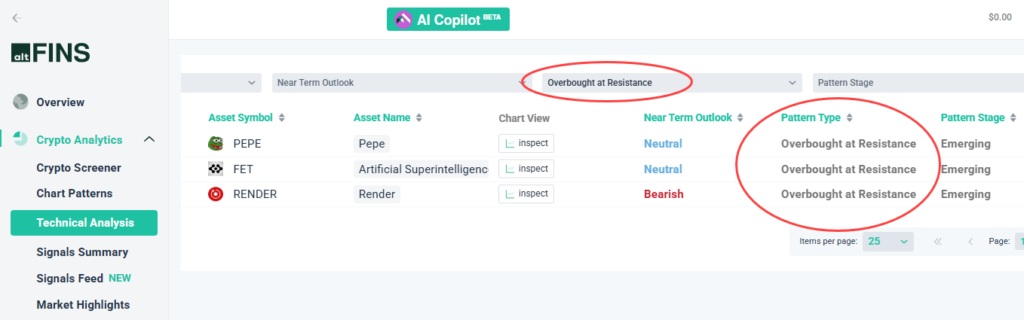

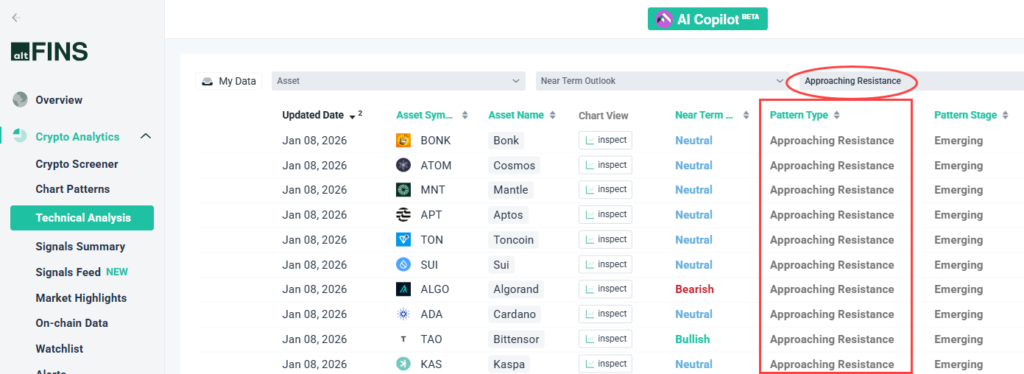

altFINS Technical Analysis section also shows coins that are “Approaching Resistance” or are “Overbought at Resistance”.

This is another great tool for traders to profit from potential pullbacks.

Trade Setups: Overbought at Resistance

0 Comments

Leave a comment