How to Use AI for Crypto Trading: A Guide From the CEO of altFINS

As someone who has spent years building financial technology solutions and trading crypto myself, I’ve seen the space evolve rapidly. One of the biggest shifts? The rise of Artificial Intelligence (AI) in trading. How to use AI in crypto trading?

At altFINS, we’ve made it our mission to harness AI in a practical, trader-focused way. From identifying chart patterns to building AI Copilot, AI can give crypto traders a real edge—when used correctly.

In this article, I want to walk you through:

- How to use AI in crypto trading

- Why we built tools like AI Chart Patterns and AI Copilot

- The pros and cons of AI-powered trading

- Why it’s helpful in today’s 24/7 markets

- And how to integrate it into your workflow—even if you still use traditional tools

Whether you’re a beginner or a seasoned trader, AI can become a powerful partner in your trading process.

What Does “AI Trading” Mean in Crypto?

AI trading uses machine learning and automation to process large volumes of data, recognize patterns, generate trading signals, and—in some cases—execute trades autonomously.

Crypto markets are especially well-suited for AI because they are:

- Volatile

- Open 24/7

- Data-rich but noisy

- Driven by sentiment, technicals, and momentum

That’s why we developed AI tools at atFINS: to help traders cut through the noise and identify high-probability setups faster and with more confidence.

How You Can Use AI in Crypto Trading

1. Identify High-Probability Setups With AI Chart Patterns

Manually scanning hundreds of crypto assets for patterns like Triangles, Channels, or Double Bottoms is time-consuming and error-prone.

Our AI Chart Pattern Recognition scans hundreds coins daily and detects:

- Bullish and bearish patterns

- Success rates based on historical outcomes

- Timeframe-specific formations (from 15m to 1D)

This feature is designed to give traders an edge in technical setup discovery, without needing to stare at charts all day.

2. Build and Automate Trading Strategies Using AI Copilot

We created AI Copilot to help traders of all levels design custom strategies—without coding.

You can simply type:

“Find coins in an uptrend with MACD bullish crossover and RSI above 50”

AI Copilot understands your intent, builds a filter instantly, and presents trade ideas that match. You can save these scans, receive alerts, and even automate signal-based trading.

It’s like having a quant assistant by your side—available 24/7.

3. Combine AI With Human Expertise

Even as the CEO of a data and AI-powered platform, I still use traditional tools like:

- Charting

- Fundamental analysis on promising crypto projects

- Macro trend awareness and risk management

AI doesn’t replace experience or judgment—it amplifies them.

✅ Benefits of AI in Crypto Trading

- Increased Efficiency: AI helps you filter through hundreds of coins in seconds. What used to take hours now takes minutes.

- Removes Emotion: AI doesn’t panic. It doesn’t chase green candles or fear red ones. It operates on logic, not emotion—which is one of the biggest advantages over human behavior.

- Pattern Detection at Scale: AI can detect nuanced price structures and historical chart patterns you might miss manually, especially across multiple assets and timeframes.

- Accessible Strategy Automation: With AI Copilot, you no longer need to be a programmer to build a system. This levels the playing field between retail traders and professional quants.

⚠️ Downsides and Limitations of AI in Trading

AI is powerful, but not perfect. Here’s what to be aware of:

- Historical Bias: AI models often rely on past price data. That means they may struggle to adapt to black swan events or unprecedented macro shifts.

- Lack of Contextual Understanding: AI doesn’t understand market sentiment, geopolitical developments, or social cues unless explicitly programmed to incorporate them.

- False Positives Happen: Even the most advanced pattern recognition can produce setups that fail. No signal—AI or human—is guaranteed.

- Learning Curve for Beginners: AI tools are becoming more user-friendly (that’s our focus at AltFINS), but there is still an onboarding period to use them effectively.

How to Start Trading With AI (Even if You’re a Manual Trader)

Here’s a step-by-step guide I recommend to traders new to AI:

Whether you’re a beginner or an experienced trader, AI Copilot by AltFINS can help you discover better trade opportunities faster—without needing to code or scroll through dozens of charts.

Here’s a simple, step-by-step guide on how to use AI Copilot effectively, depending on your trading style and experience.

Step 1: Trade With the Trend

The golden rule of trading? Trade with the trend. Trying to fight the market is a common mistake, especially for beginners.

When using AI Copilot, start by focusing on finding coins that are already in an uptrend.

Example Copilot Prompts:

“Find coins in an uptrend with a pullback”

→ Great for entering at support during a temporary dip.

“Find coins with strong momentum in an uptrend”

→ Ideal for momentum traders riding breakouts.

The AI Copilot will interpret your request and generate a scan using relevant indicators like Moving Averages, MACD, RSI, and ADX to identify trending coins that fit your strategy.

Why it works: Trading in the direction of the prevailing trend increases your probability of success. AI helps you detect these conditions across hundreds of coins – instantly.

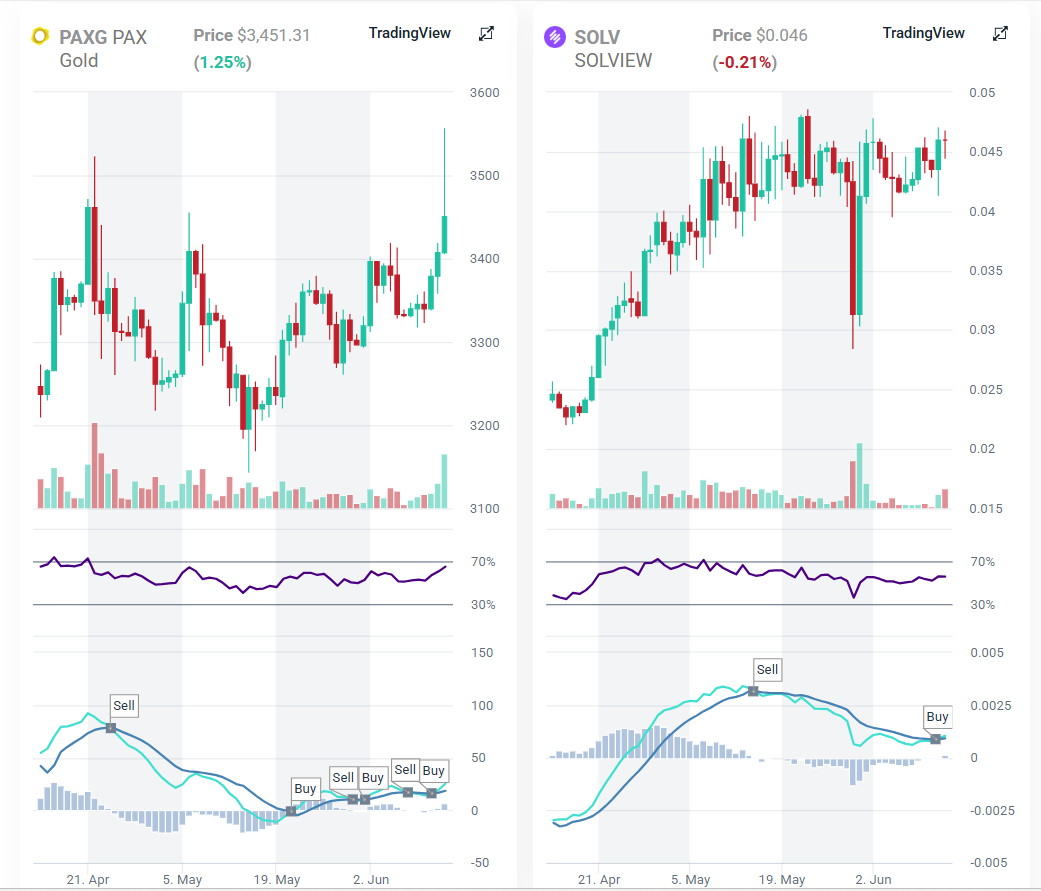

Step 2: Search for Trend Reversals (Advanced)

Once you’ve gained some experience, you may want to catch early trend reversals – where the price is shifting from a downtrend to an uptrend.

This requires more precise timing and confirmation, but the AI Copilot makes it easier to scan for signals like MACD crossovers, RSI divergences, or chart pattern breakouts.

Example Copilot Prompts:

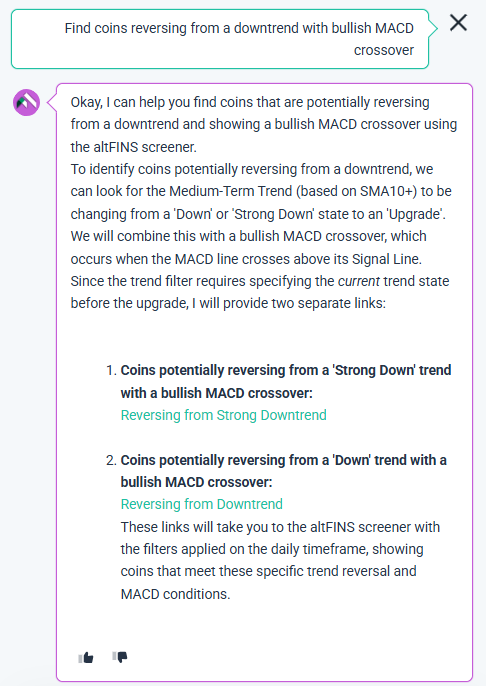

“Find coins reversing from a downtrend with bullish MACD crossover”

“Find coins forming a double bottom pattern”

“Find oversold coins with RSI rising”

These types of filters are ideal for swing traders and those who prefer to get in before the crowd.

💡 Pro tip: Combine reversal signals with chart pattern recognition from the AI Chart Patterns tool for extra confirmation.

Step 3: Customize and Save Your Strategy

Once the AI Copilot gives you a list of coins that match your criteria, you can:

- Adjust the filters (timeframe, volume, trend strength, etc.)

- Save the scan to use it regularly

- Set alerts so you’re notified when new coins meet your conditions

You can even automate signal-based actions (like alerting or trade preparation) based on your saved strategies.

🔁 Bonus: Combine Trend + Reversal

Many traders use a hybrid strategy – trading with the trend most of the time, and selectively entering reversals when the risk/reward is favorable.

Example Copilot Prompt:

“Find coins in an uptrend with RSI pullback and MACD turning bullish”

This type of scan combines trend continuation with momentum recovery, offering a balanced approach.

Final Thoughts: AI Copilot isn’t just a scanning tool—it’s your strategy assistant. It helps you:

- Discover setups you might miss manually

- Save time by scanning 1,000+ coins instantly

- Avoid emotional decision-making by sticking to your criteria

- Evolve from reactive to systematic trading

- Start simple. Focus on trends. Layer in reversals as you grow confident.

The future of trading isn’t fully automated—it’s AI-assisted. And with Copilot, that future is here.

What Traders Are Saying About AI in Trading

We hear from altFINS users every day—here’s some of the feedback that stands out:

“AI Copilot saved me hours every week. I describe what I want, and it gives me clean, trade-ready results.”

— Martin, swing trader

“Chart Pattern AI picked up a bullish wedge on FET before the breakout. I didn’t catch it manually. That was a big win.”

— Victor, technical analyst

“I use AI to find setups, but still confirm with my own tools. It’s like a second pair of eyes.”

— Leo, full-time trader

Final Thoughts From the CEO

“AI won’t replace traders—but it empowers them.

At AltFINS, our goal is to make institutional-grade tools accessible to everyone, from the weekend swing trader to the full-time professional. We’ve built AI tools not as black boxes, but as transparent assistants that help you trade smarter, faster, and more consistently.

AI is already shaping the future of crypto trading, and it’s available today. If you haven’t explored what AI can do for your trading yet, now is the time. Get started today:

Explore AI Chart Patterns

🤖 Try building your own strategy with AI Copilot

Feel free to connect with me on LinkedIn or reach out through our platform. I’d love to hear how you’re using AI in your trading.”

Richard Fetyko

Founder & CEO, altFINS

0 Comments

Leave a comment