Fear and Uncertainty Create Opportunities in Crypto Markets

Markets pulled back amid a wave of fear, uncertainty, and doubt (FUD), driven by renewed tensions in the Middle East. While geopolitical unrest is tragic and complex, market reactions to such events often present short-term opportunities for disciplined traders and investors.

Market Pullbacks Are Often Buying Opportunities

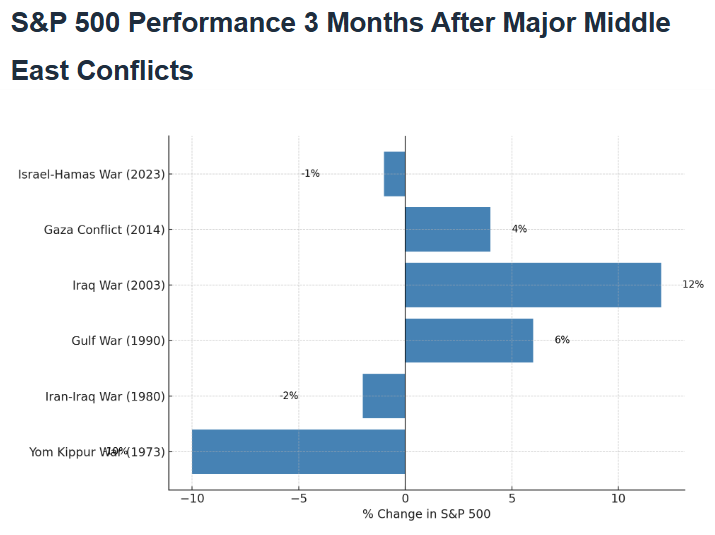

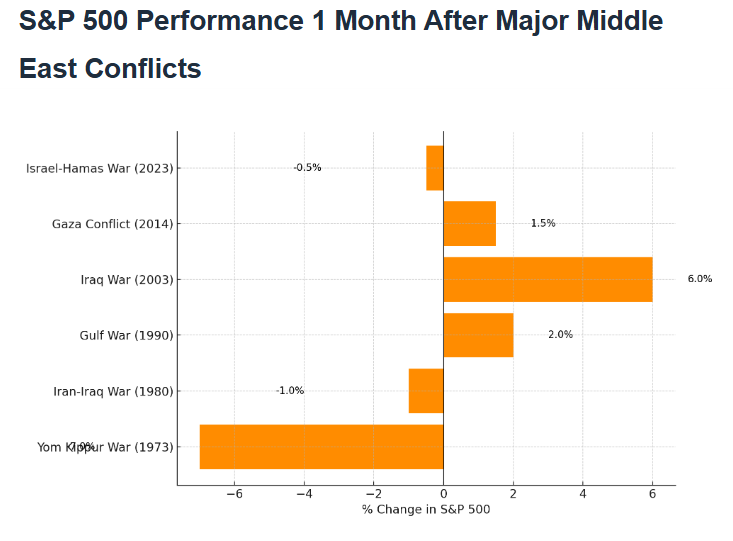

Historically, major Middle East conflicts have sparked brief dips in global markets, followed by recoveries. Just look at the S&P 500’s performance 1 month and 3 months after major Middle East conflicts — the data consistently shows rebounds.

Why? Because market dips during an uptrend tend to be temporary. Traders who understand this often use them to buy the dip.

What Should Traders Focus On Right Now?

Look for assets in a strong uptrend that have pulled back 5–10%, ideally to well-established support levels. These setups can offer attractive risk-reward opportunities.

A simple principle of trend trading: trends tend to continue. Pullbacks are often just pauses before the next leg higher — driven by renewed buyer demand and positive sentiment returning.

This is classic crowd psychology in action, and it’s one of the key forces behind asset price movements.

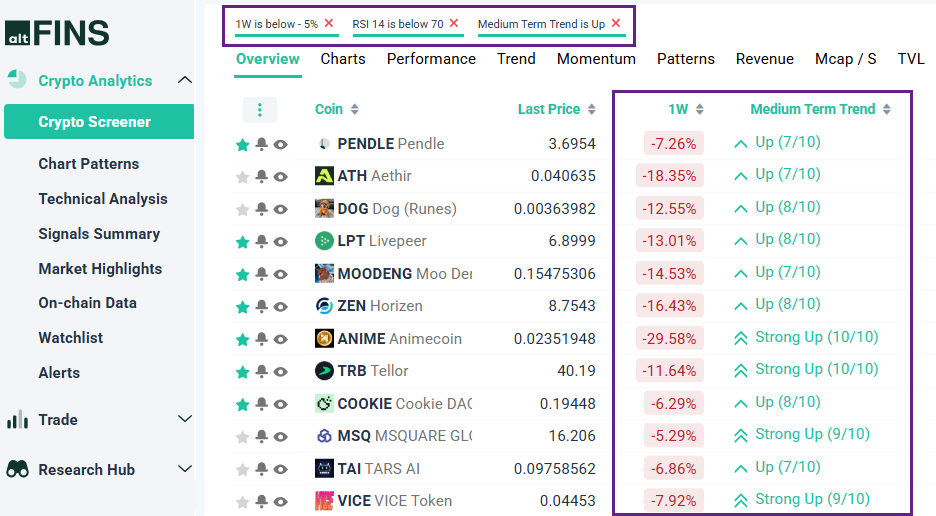

Scan for Pullback Opportunities Instantly

With altFINS’ Market Scanner, you can quickly identify such setups:

👉 Market Scan: Pullback in Uptrend

Or ask our new AI Copilot to do the heavy lifting for you.

Trade Setup Example: Monero (XMR)

Let’s take a closer look at Monero (XMR):

- Trend: Uptrend

- Recent Price Action: Pulled back to the $290–$325 support zone

- Opportunity: This level has acted as strong support historically, making it a potential swing entry zone.

- Target: $400 resistance = +20% upside potential

📈 XMR +20% Upside Potential on Pullback in Uptrend

🎯 One of the best strategies during an uptrend?

Buy the Dip.

Because pullbacks in an uptrend are often springboards for the next move up.

0 Comments

Leave a comment