Current Market Strategy: Oversold at Support

TL;DR: After broad-market declines, there are signs of near-term “local bottom” for crypto. We highlight two key recovery strategies:

-

Market Sentiment: With extreme fear (index at 25) and many altcoins oversold at major support levels, a brief relief bounce is expected.

-

Strategy 1 (High Risk): Buying Oversold at Support (RSI ≤ 30) while in a downtrend to catch the bounce.

-

Strategy 2 (Lower Risk): Buying Oversold in Uptrend (RSI < 40), such as DASH, which is currently pulling back to its 200-day SMA support.

Richard Fetyko, CEO and Founder of altFINS:

(these insights were first shared in VIP telegram group)

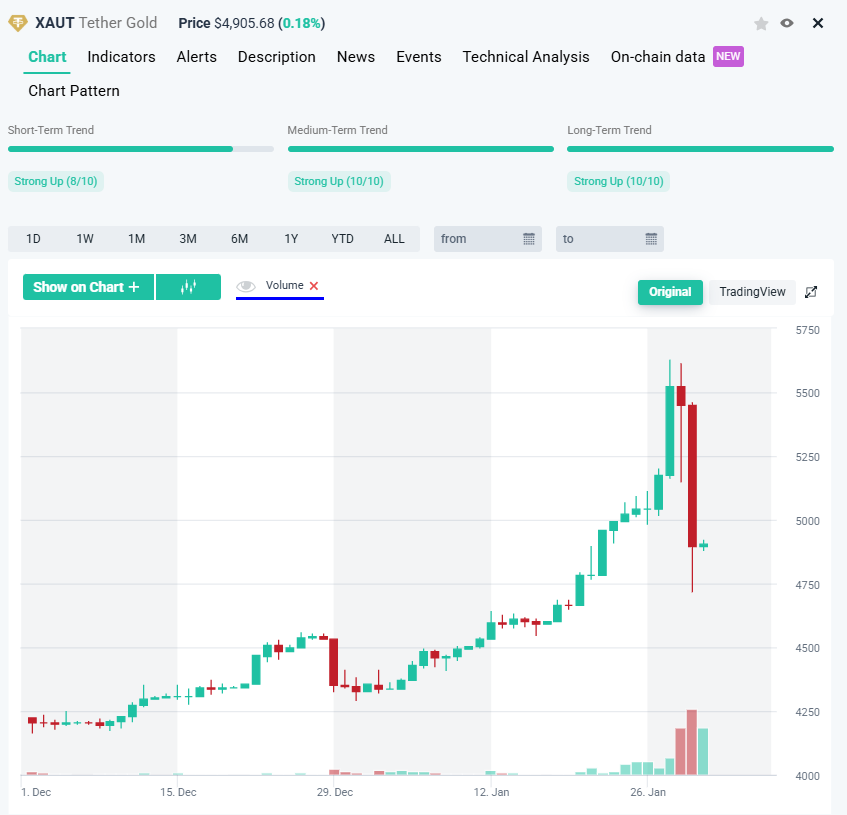

Markets declined sharply on Friday. And I mean ALL markets: equities, crypto, metals. Even Gold and Silver were down 13% and 33%!

See more details on Gold.

But there are signs of local bottom in the crypto markets at least:

-

Lots of altcoins are at or near their support levels, many are also oversold (RSI < 30)

-

Sentiment is crap, with Fear index at 25 (0-100 scale)

Feels like we could get at least a brief bounce up near-term.

Not saying the market is resuming an uptrend. Just that near-term, the downtrend could pause and briefly reverse.

Here are two strategies for the current market conditions:

1. Oversold at Support

2. Oversold in Uptrend

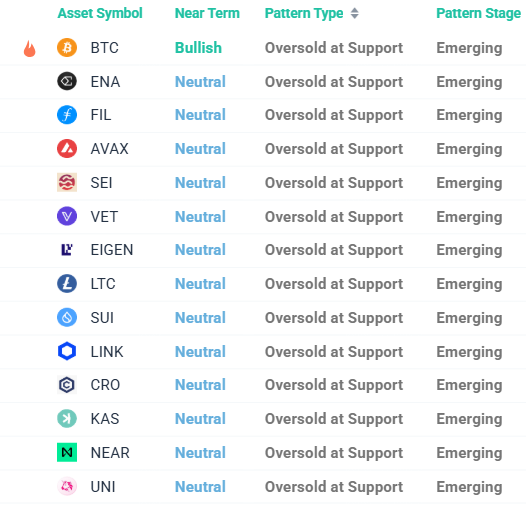

1. Oversold at Support

BTC and many alts are oversold (RSI =< 30) near Support levels.

They’re all in a Downtrend but we’re likely to get a bounce up near-term, in my opinion.

It’s a risky trade, against the trend. Normally we wanna buy assets in Uptrend (trade with trend).

Here are some of the Oversold at Support trade setups in our Technical Analysis section:

Source: altFINS Technical Analysis

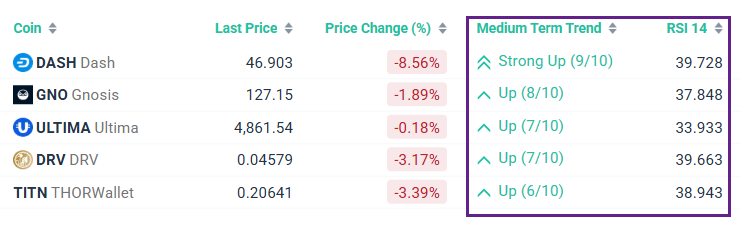

2. Oversold in Uptrend

Some assets are oversold (RSI < 40) while in Uptrend. This is a higher probability trade setup (Buy in Uptrend, trend with trend).

Here’s a link to market scan results.

DASH is a good candiate…pulling back to it’s 200 SMA (support).

altFINS was build to find such opportunities. To filter out the noise and surface valuable market insights.

One of the valuable tools is our Technical Analysis section, where we keep trade setups for 50 major altcoins and BTC.

These include entry levels, price targets, and stop loss levels for proper risk management.

This is also a great way for beginners to learn technical analysis, how to identify chart patterns, support and resistance levels, and momentum indicators.

Keep learning and discovering! And leverage the best market screener to save time and improve your success rates.

-Richard

Related Posts

-

Oversold in Uptrend: A Powerful Trading Strategy

The CEO of altFINS has recently shared some compelling trade ideas in our VIP Telegram…

-

Oversold coins in Uptrend

In today’s video, we review recent market action and demonstrate a custom screener to find oversold coins…

-

Oversold coins (RSI) near support levels

How to find oversold coins (RSI) near support levels In today’s video, we provide an…

0 Comments

Leave a comment