BTC update: Are Whales Hedging Downside Risk?

Are whales hedging BTC and ETH?

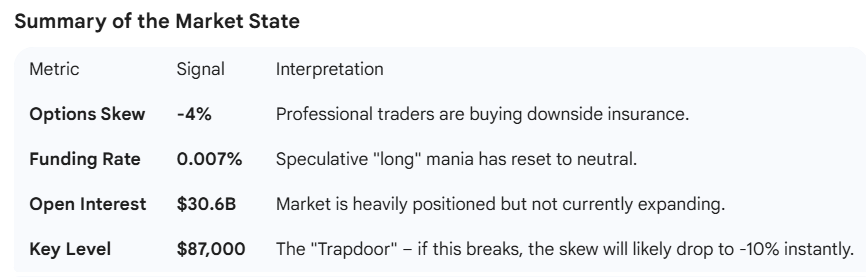

We analyzed current signals for BTC based on data from options markets, liquidations heatmap, funding rates and open interest:

The Bottom Line: Last week, traders took on a defensive stance (hedging), with fears of a pullback to $84,000.

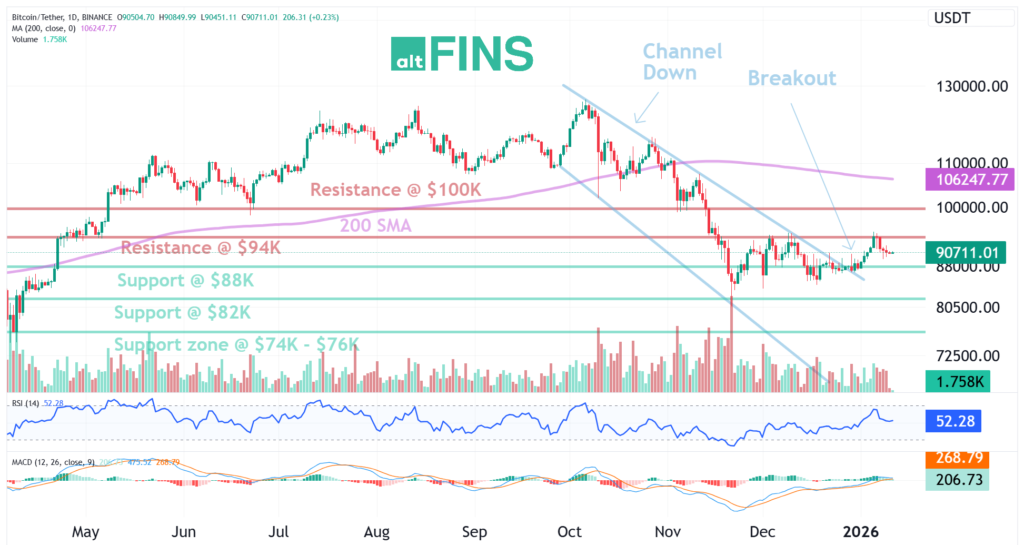

altFINS’ BTC trade setup below shows that after moving sideways for weeks, price broke out of a Channel Down pattern, which signaled a bullish trend reversal and price reached our near-term target of $94,000, where it got rejected so far.

If it breaks above that, it could continue to recover to $100,000 next. But there are likely to be some pullbacks along the way, providing new entry opportunities during this trend reversal path. We would be buyers on pullbacks to $88K key level again.

See 50 fresh trade setups by altFINS and AI-based trade signals here.

Options Skew Sharply Declines

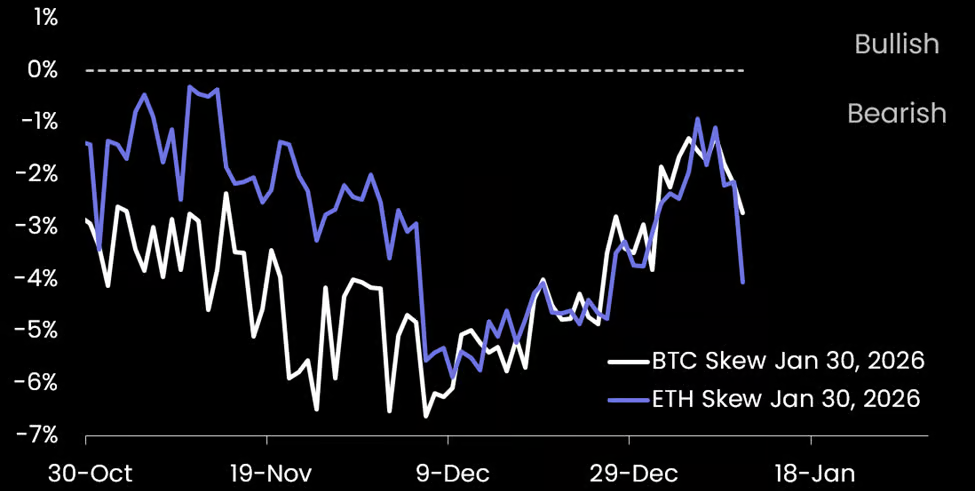

Over the past few weeks, the BTC and ETH options markets have changed.

The Puts v. Calls options ‘skew’ implies how traders, institutional mostly, are positioning. If they’re buying Calls, they are bullish. If they’re buying Puts, they are bearish.

During December and early January, the options positioning was improving from very Bearish to Neutral.

But just in the last week that sharply corrected.

This movement suggests that the “smart money” is actively hedging against a volatility spike rather than betting on an immediate breakout.

Basically ‘whales’ are increasingly buying insurance (buying puts) to protect from a potential ‘vacuum’ drop in BTC price.

BTC ‘Hunt for Liquidity’?

Based on data on Jan 10, 2026, the BTC liquidation heatmap shows a market coiled between two massive liquidity clusters.

1. The “Magnet” Below: There is a massive $10.6B long liquidation wall sitting at $84,000. Because the market is currently hovering around $90,000 traders see that massive pile of liquidity as a “magnet.” They are buying puts (lowering the skew) to hedge against a potential hunt for that liquidity.

2. Rejection at $95,000: BTC recently failed to clear the $95,000 level, which would have liquidated about $2B in shorts. Since that “short squeeze” failed, the path of least resistance has shifted toward the downside clusters.

3. Institutional Defensive Posture: The skew is reflecting a shift from “aggressive buying” to “capital preservation.”

The “Pain Point”

The $87,000 level is the immediate trigger. If BTC trades below this, it could ignite the first $5B cluster of liquidations. This creates a “forced selling” loop that could drive BTC to $84,000 level quickly.

Funding rates indicate a ‘Cool Down’

As of January 10, 2026, the funding rate data confirms that the market is currently in a state of “Deleveraging & Reset.”

When we combine our observation of the options skew dropping to -4% with the current funding data, a very clear picture emerges: the speculative “heat” has left the room, and traders are now paying for safety rather than upside.

Current perpetual funding rates across major exchanges (Binance, Bybit, OKX) have compressed significantly over the last 48 hours:

-

Current Rate: ~0.007% to 0.01% (every 8 hours).

-

Annualized: Roughly 7% – 11% APR.

-

The Context: Just a few days ago, funding was as high as 0.05% (50%+ APR).

What this means: Longs are no longer aggressively paying shorts to keep their positions open. The “leverage tax” has vanished because many speculative longs have already closed their positions (either voluntarily or via small liquidations as BTC dipped toward $90,000).

Open Interest (OI) Analysis

Open Interest has stabilized around $30.6 Billion. While this is high, the fact that it isn’t rising alongside a price drop is actually a “healthy” sign—it means we aren’t seeing a massive wave of new “panic shorts” yet. Instead, we are seeing a “slow bleed” of exhausted longs.

Related Posts

-

Crypto Market Update

In today's video, we look for ways to spot a bottom, at least a local bottom,…

-

Trade Setups for BTC and SOL

In today's Trading Video, our CEO, Richard Fetyko, demostrates how to do a technical analysis…

- Using price alerts for risk management

In our latest video blog post (see below), we check on our DCR / USDT…

0 Comments

Leave a comment