BTC Flash Crash = Opportunity in altcoin Land Pullback in Uptrend Strategies

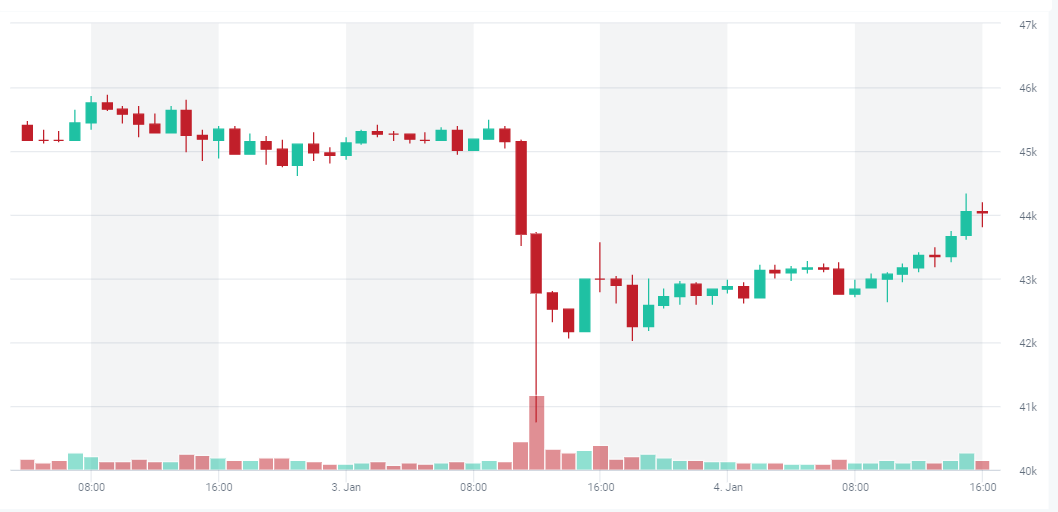

Yesterday, within three hours, Bitcoin (BTC) dipped by 10.4% to a low point of $40,760, then recovered to $44,000.

However, many altcoins are still down from their recent highs, offering a potentially profitable swing trade entry.

Especially in light of big upcoming catalysts (see more below).

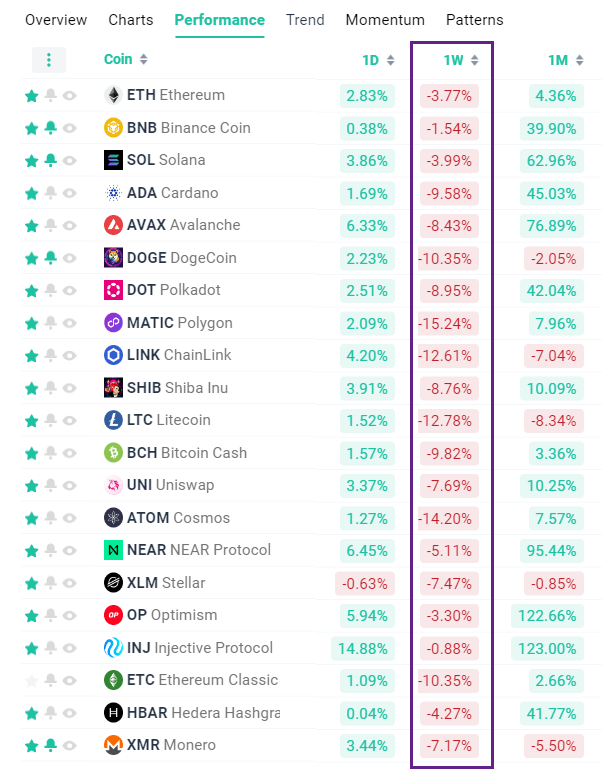

altcoins 1W (week) Performance

But where should we enter on such a pullback?

How do we find the right swing entry opportunities in Uptrend?

Here’s a quick tutorial that will elevate your trading skills instantly.

Read below or read this tutorial.

But first, let’s discuss what happened yesterday and what is likely to happen next week!!

Bitcoin (BTC) Flash Crash – 1H interval

While some analysts blamed the retracement on a Matrixport report claiming the SEC will reject all pending spot Bitcoin ETF applications, many researchers say excessive leverage in the digital asset markets led to the crash.

Financial analysts are still expecting that U.S. Securities and Exchange Commission (SEC) is likely to approve the first spot Bitcoin exchange-traded funds (ETFs) in the upcoming week.

This prediction is based on recent meetings between the SEC and major U.S. exchanges planning to list the ETFs’ shares.

In contrast to existing futures ETFs, spot Bitcoin ETFs would directly invest in and hold Bitcoin, potentially contributing to the scarcity of Bitcoin’s supply.

With the anticipation of a Bitcoin halving event and the potential approval of spot Bitcoin ETFs, observers believe this could initiate a new bullish trend for digital assets.

13 Spot Bitcoin (BTC) ETF Applications!!

But in every uptrend, there are periods of pullbacks and consolidation. It seem that we are due for such a pause, which can be great opportunities to re-enter an uptrend and profit from such downswings.

But where should we enter on such a pullback?

How do we find the right swing entry opportunities in Uptrend?

Here’s a quick tutorial that will elevate your trading skills instantly.

- FIRST STEP is to find assets in an Uptrend. That’s a cakewalk on altFINS.

- SECOND STEP is to find a good swing trade entry.

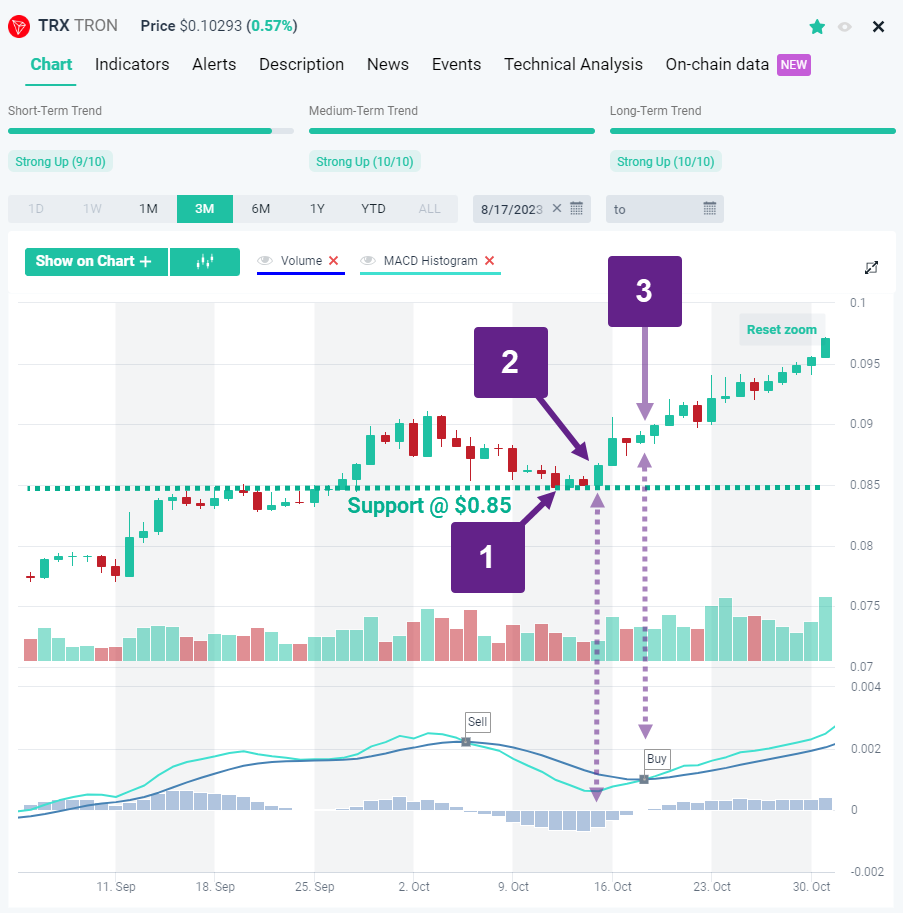

How to do that? Let’s illustrate 3 possible strategies with Tron (TRX):

Swing Trade Entry Strategies

As you can see, TRX was in a solid Strong Uptrend on a Short- Medium- and Long-term horizon. That takes care of STEP ONE. Trade with a trend, trend is your friend.

For timing of trade entry, we can use 3 possibilities (see 1-2-3 in chart above):

1. Enter when price approaches support area. You can find support areas in our Technical Analyses (aka trade setups) or identify support on your own (find a tutorial here).

2. Enter when MACD Histogram inflects. This is an early indication of a possible upswing. See live results.

3. Enter on MACD Signal Line crossover (“Buy” flags in chart). See live results.

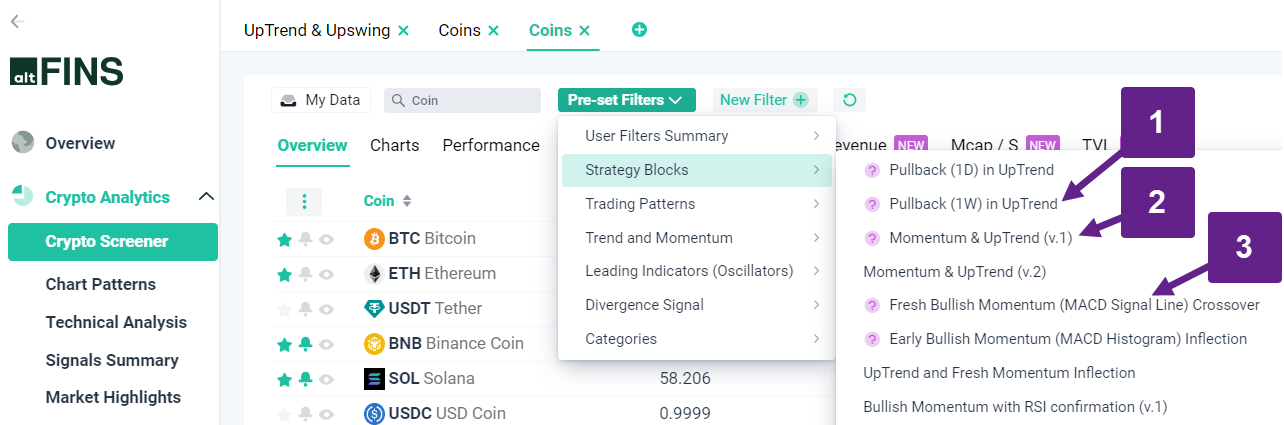

You can find strategies 2 and 3 in our Screener Pre-Set filters:

Each of these three trade entry strategies have their (dis)advantages.

First strategy gets the trader into the trade early, which means the highest upside potential. But it is also the most prone to failures (risk) – meaning the price may continue to fall below the support level.

Second and third strategies lead to a later trade entry and less upside potential but have higher success rates because we enter when price is already inflecting or even rising again. It’s already bounced off of support.

0 Comments

Leave a comment