Bagging Big Winners on Breakouts

altcoins continue to show signs of bullish trend reversal. This is different from the short lived bounces we’ve seen in prior weeks.

After months of downward trajectory, BTC and altcoins started going sideways and are now showing signs of bullish trend reversals.

MEMEs have been among the biggest gainers in the last two days and the bullish rally is spreading to the broader market now. See performance for MEME coins here.

Recent Trade Setups Capture Profitable Moves

Our trade setups have captured some nice winners that we highlighted in our Technical Analysis section as well as VIP group:

Bitcoin (BTC) Reaches Key Target

BTC reached our $94K target. If it breaks above that, it could continue to recover to $100,000 next. But there are likely to be some pullbacks along the way, providing new entry opportunities during this trend reversal path.

Cosmos (ATOM) Hits Resistance for 25% Gain

ATOM reached our PT of $2.50 (resistance) for 25% gain. Would wait for a pullback to $2.00 for another swing entry.

Worldcoin (WLD) Breaks Higher After Triple Bottom

WLD – After forming a Triple Bottom, price reached our near-term target of $0.67 resistance (+20% profit). If it breaks above that, it could revisit $0.80 but we would prefer to wait for pullbacks near $0.55 key level for swing trade entry.

XRP Reached Our Near-Term Price Target

XRP – following a breakout from Channel Down, price reached our near-term price target of $2.30 resistance. If it breaks above that, it could revisit $2.57 next. However, it’s getting overbought now (RSI > 70), hence, we’d expect a pullback as traders take profits. We look for an opportunity for another swing entry on pullbacks.

DOGE: +15% Profit on Channel Breakout

BONK: +41% Profit on Channel Breakout

TON: +16% Profit on Channel Breakout

See more Trade Setups here.

See more Trade Setups here.

Chart Patterns Point to Bullish Breakouts

We’re noticing that many assets are trading in Falling Wedge and Channel Down patterns.

These patterns typically resolve in bullish breakouts and at least a temporary reversal, often good for 20-50% gains.

We’re now seeing breakouts from those patterns, generating solid profits for our VIP members.

Relief Rally or Trend Reversal?

This could be just a relief rally or a bear-market rally, but traders can make nice gains on these when timed correctly. When prices break out from Channel Down or Falling Wedge, they can move up quickly.

Traders should prepare for such bullish breakouts, set up alerts and use the altFINS mobile app to stay on top of trading opportunities.

Setting up chart pattern alerts is just a couple of clicks away: here’s how.

Our historical data shows that Channel Down breakouts have 73% success rate and Falling Wedge breakouts have 64% success rate. Check all stats here

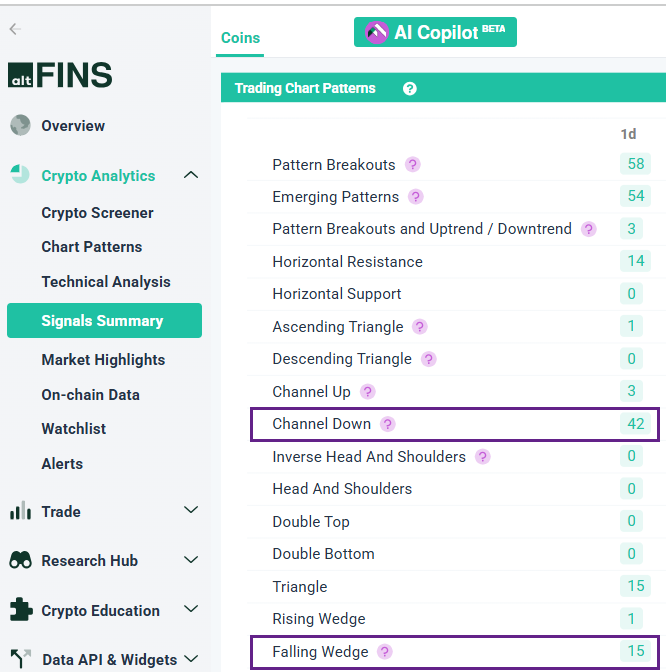

Where to Find These Patterns on altFINS

You can find them on altFINS platform in three sections:

1) Chart Patterns (search for Channel Down and Falling Wedge pattern types)

2) Technical Analysis (search for Channel Down and Falling Wedge pattern types)

3) Signals Summary – under Patterns section.

TIP: Never miss another trading signal. Create an alert for any chart pattern and receive notifications on your phone! Here’s how.

Signals Summary – Patterns Section

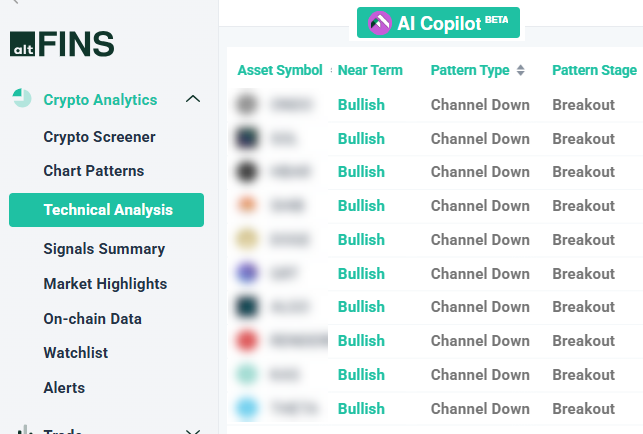

Technical Analysis (50+ trade setups) – Channel Down and Falling Wedge

Go to Technical Analysis Section

We have identified more assets trading in Channel Down and Falling Wedge patterns.

These could result in a breakout soon.

Find them in our Technical Analysis section where we keep trade setups for 50+ major altcoins.

Trade setups include Take Profit and Stop Loss levels for risk management.

Don’t miss these potentially big gainers on breakouts!

Why Channel Down and Falling Wedge Patterns Matter

These two chart pattern types are common trend reversal patterns. They often emerge in a downtrend, characterized by lower highs and lower lows.

But at some point, supply from sellers is absorbed by the buyers, the selling pressure is neutralized and steadily growing number of traders and investors find value at these lower levels.

Then, price finally breaks out and it is often followed by rapid price movements (i.e. profits).

0 Comments

Leave a comment