Trading moving averages - part 2 (Ribbons)

Last week, we kicked off a series of blogs with trading strategies using moving averages that can be implemented on altFINS platform. In Part 1, we showed how to use EMA 12 and EMA 50 crossovers.

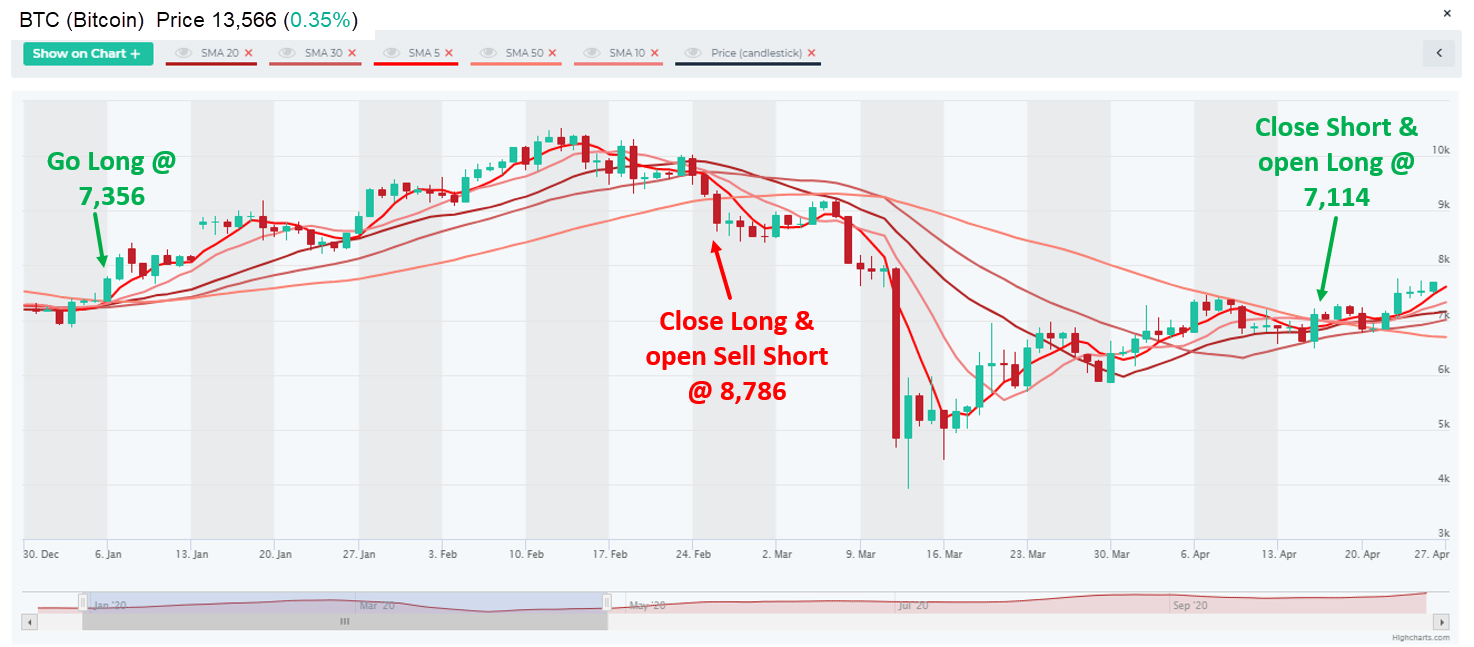

Today we’ll demonstrate how to trade Moving Average Ribbons. Ribbons are formed by using multiple SMAs (or EMAs). Our strategy uses a daily interval, SMA 5 (days), SMA 10, SMA 20, SMA 30, and SMA 50.

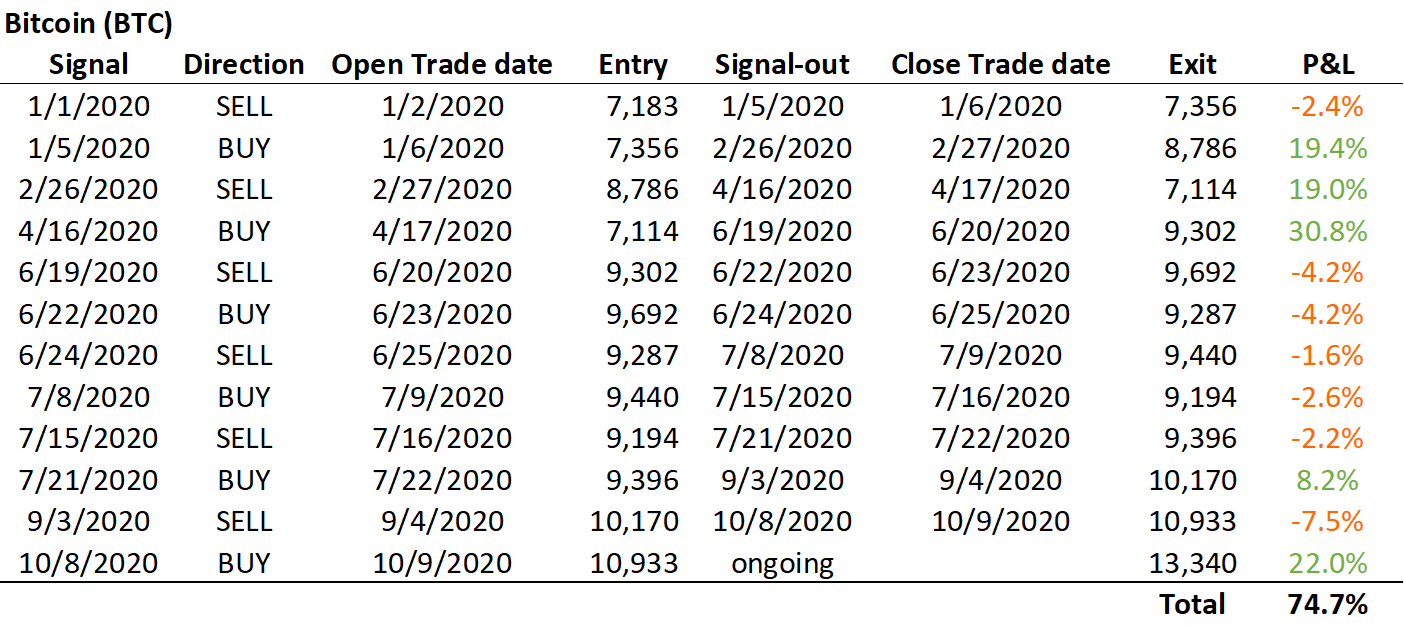

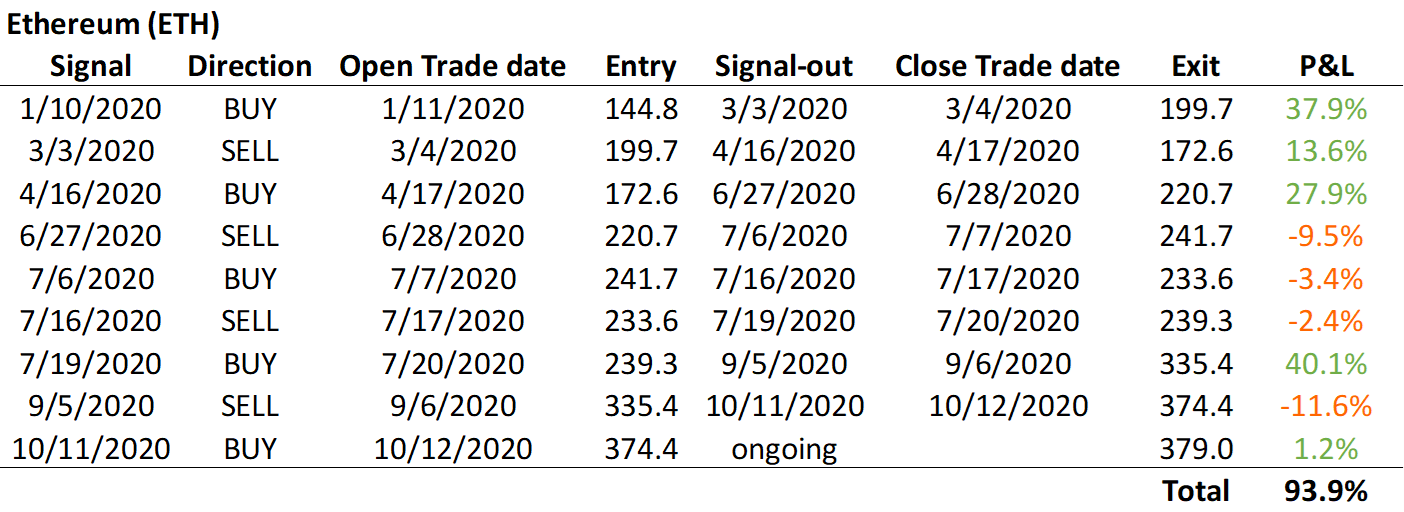

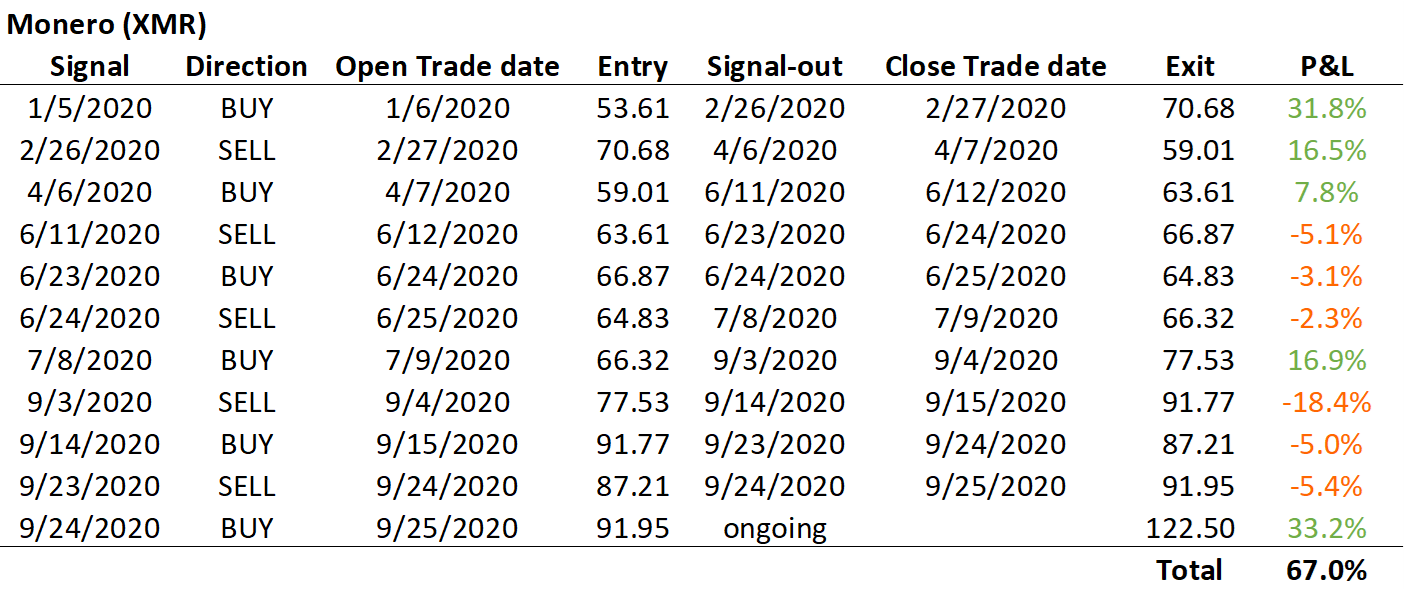

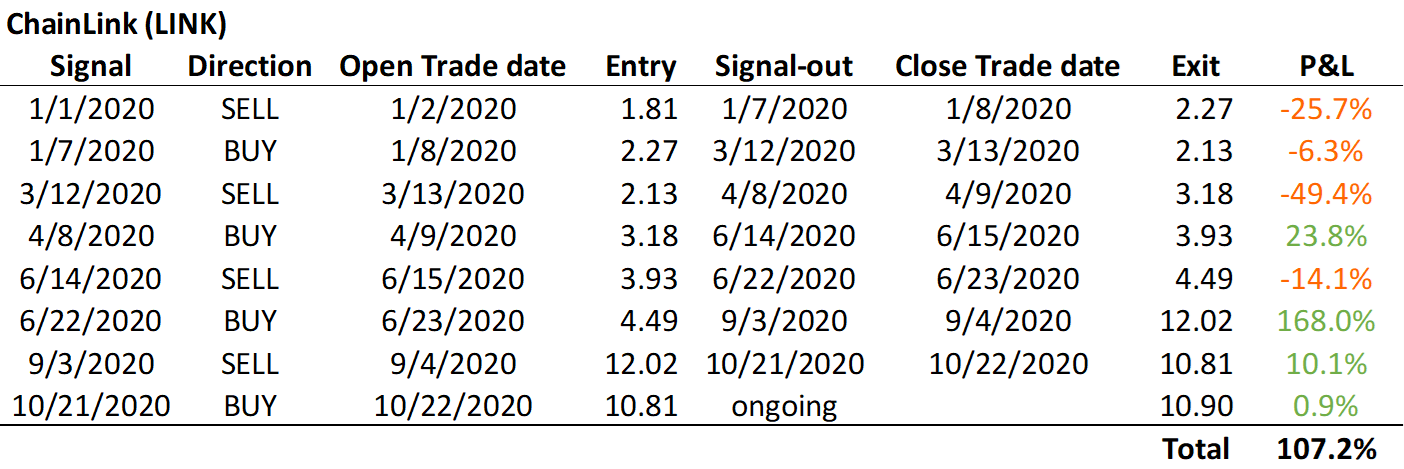

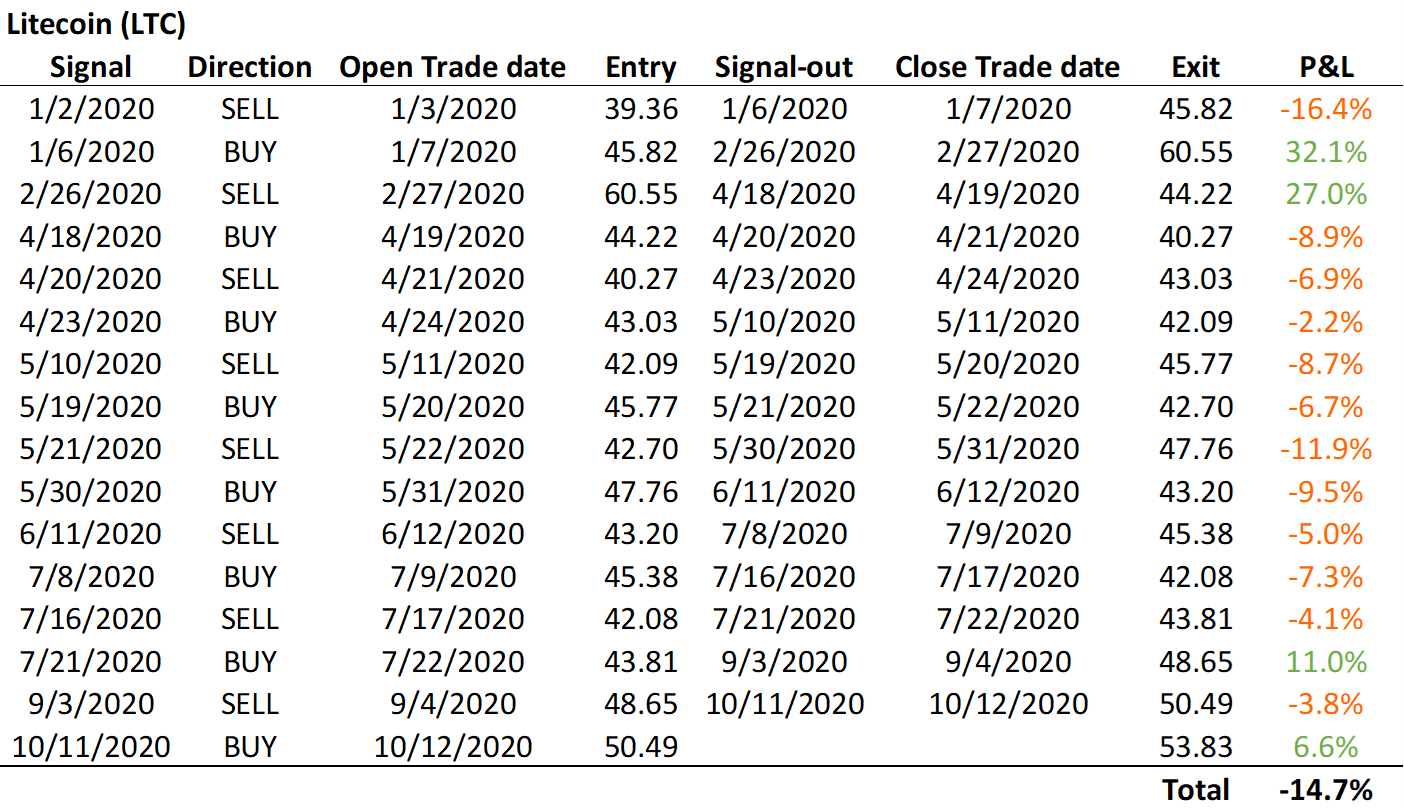

This strategy generated very healthy gains this year (YTD 2020) for four large caps: BTC (+75%), ETH (+94%), XMR (+67%), LINK (107%). The strategy certainly is not failproof as can be seen in Litecoin example, where we would have lost -15%.

Trading rules:

- Buy signal (go Long) – when price is above all SMAs

- Sell signal (and Sell Short) – when price is below all SMAs

Here’s an example of executing trading rules:

Ideally, trade entry is close to a point when the moving averages converged closely together after the price flattened out into sideways range. That usually forms a base for a break-out, either up or down.

To create your own coin screen for SMA Ribbons strategy on altFINS platform, use these filter criteria:

- Last Price is above 100% of SMA 5 for Buy Signal (or below 100% for Sell signal)

- Last Price is above 100% of SMA 10 for Buy Signal (or below 100% for Sell signal)

- Last Price is above 100% of SMA 20 for Buy Signal (or below 100% for Sell signal)

- Last Price is above 100% of SMA 30 for Buy Signal (or below 100% for Sell signal)

- Last Price is above 100% of SMA 50 for Buy Signal (or below 100% for Sell signal)

- Volume ($) is above 100,000 (some min liquidity)

You can also follow this video tutorial (4 mins):

Let’s look at some past examples:

(note that our performance calculations use closing price one day after crossover day, to be conservative)

Risk management – Stop Loss and trade size. In all of these setups, traders should use Stop Loss orders to manage their downside risk, in case the trade goes against us, as it often will. Trading is about probabilities and even though these setups have a high win rate, one must be prepared to minimize losses on the trades that go bust. If Stop Loss order types are not supported by they exchange, at least set up a price alert (see video). Also, trade size should be such that you never risk losing more than 2% of your total equity. Keeping the trade size small allows the trader to setup a wider Stop Loss, which gives the trade more room and time to complete with success. Setting Stop Loss levels too tight can often result in getting knocked out of a trade prematurely.

Disclaimer: This content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice. There are risks associated with investing in cryptocurrencies. Loss of principal is possible.