Why the big volatility over the weekend?

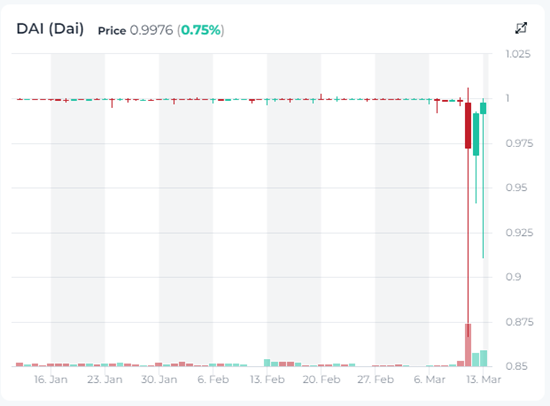

Why USDC and DAI de-pegged?

It was a turbulent week. Watch the video about current situation on crypto market.

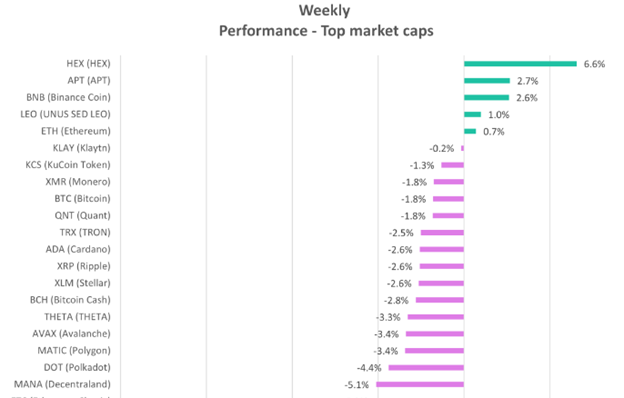

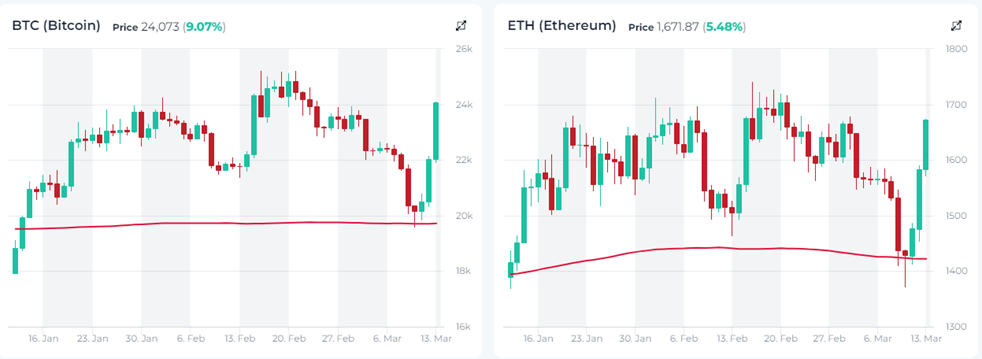

Look at performance for 1 week: flattish for BTC and ETH but that doesn’t tell the story. ETH and BTC dipped big and then rebounded.

Btw, you can read about the macro events that impact crypto markets in our weekly macro report under the Research Hub. And also watch video about current market situation.

Stablecoin de-pegged: USDC, DAI charts (no. 2 and no. 4 stablecoins)

That clearly shows that traders who had money in these stablecoins were trying to sell and convert them into other stablecoins like USDT or into other crypto like BTC, ETH, which actually traded up over the weekend.

USDC is operated by a company called Circle, which is based in the US. What it does is simple. It helps institutional investors onboard into crypto. So institutions like hedge funds that want to buy crypto currencies, first have to deposit fiat currency like USD and exchange into crypto. Well, Circle enables that. It takes USD from institutions and issues a USDC stablecoin with 1: 1 ratio.

That ratio of 1:1 got disrupted over the weekend because traders were worried about Circle’s reserves. Circle keeps the fiat money it collects from institutions in traditional banks. It uses many banks but one of them is Silicon Valley Bank. In fact about $3.3B of $40B, so about 8% of USDC reserves were deposited in Silicon Valley Bank.

So when Silicon Valley Bank got into hot waters, which I’ll cover shortly, traders got worried that if Circle loses $3.3B of the USDC reserves, it would get crushed by wirthdrawals and some institutional investors or retail investors would be left with nothing but useless USDC worth zero. Kinda like the Terra Luna stablecoin TUSD that was crushed in spring of last year.

Why did Silicon Valley Bank get into trouble?

SVB has been around for 40 years and has established itself as the bank for tech startups. In fact, nearly 50% of venture-backed tech companies were customers of SVB. We’re talking thousands of tech startups that raised capital form VCs and deposited that capital with SVB. One of them was Circle of course.

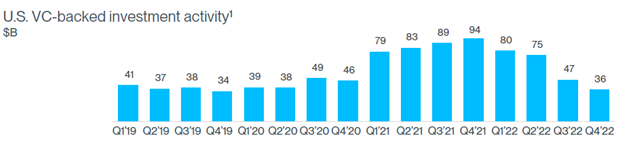

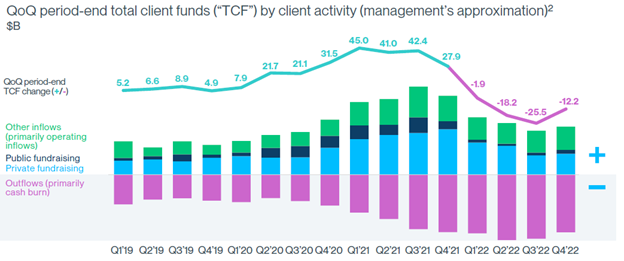

Things were going great for SVB when tech startups were raising boatloads of capital and had no problem raising more in 2020 and 2021. But that changed in 2022. VC funding has been declining.

That also means that these tech startups that usually operate at a massive loss, they need to dip into their deposits to pay for their operating expenses. So startups are raising less capital and are forced with gradually withdraw more money from SVB. That creates a steady stream of deposit withdrawals.

Now, if SVB kept all of their clients in cash, that would be no problem with these withdrawals. But banks never keep client’s deposits in cash. They invest most of that cash. Cash only represented 7% of SVB’s assets, most where invested into government bonds and loans (illiquid).

So when these start-ups keep withdrawing their money from the bank, SVB has to start selling their investments. But because interest rates have gone up, those investments are worth less than the invested capital, so the banks is realizing losses when they sell their investments portfolio. And that creates liquidity issues.

Then, on March 8, SVB announces that they’re selling all of their Available for sale securities – these are most liquid investments, and also raising $2.25B of capital via a sale of their own stock. That spooks their clients. It creates the impression that SVB is in trouble and in fact some VC tell their tech startups to withdraw their money from SVB. That creates even more fear and increases the deposit withdrawals….basically creating a bank run.

Within a couple of days, the FDIC steps in and backs the bank with deposit guarantees, which calms the situation, for now and stablecoins have regained their peg 1:1 to USD.

So what does that mean for crypto traders? Gotta hedge your bets. With the increased volatility, traders need to have both Long and Short positions in their portfolios. We’ll demonstrate that in our next video under the Education section. Stay tuned.