What Traders Should Evaluate Before Choosing a Platform for Derivatives on Digital Assets

Crypto derivatives trading has exploded, with futures volume hitting $1.7 trillion in some months. Platforms offering leveraged bets on BTC, ETH, and alts attract traders seeking amplified returns. In a market where 80% of retail traders lose money, picking the right platform is crucial.

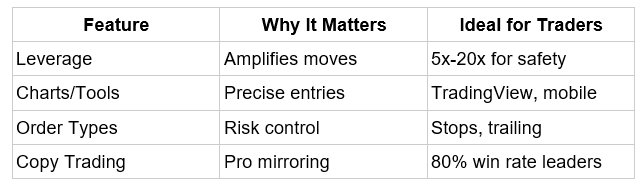

Safety, tools, and costs separate winners from losers. Copy trading adds an edge for beginners, automating pro strategies. This article breaks down key factors to evaluate before diving into crypto futures or CFDs on a platform.

Security and Regulation: Your First Priority

Security tops the list. Look for platforms with cold storage for 95%+ of funds, 2FA, and regular audits. Proof-of-reserves reports build trust – check if they publish them quarterly.

Regulation matters. Licensed platforms follow KYC/AML rules, reducing scam risks. In 2025, with SEC and CFTC oversight growing, regulated venues offer deposit insurance up to $250,000 in some jurisdictions.

Avoid unregulated spots promising 200x leverage – they often vanish with funds. Hacks cost $2 billion in 2024; choose platforms with $1 million+ insurance.

Trading Tools and Leverage Options

Good platforms offer robust tools. Advanced charts with TradingView integration, one-click orders, and mobile apps are essential. For futures, perpetual contracts with funding rates and expiry dates matter.

Leverage ranges from 5x to 200x. Higher amplifies gains but risks liquidations – a 1% BTC drop at 100x wipes capital. Beginners should stick to 5x-20x.

Order types like stops, limits, and trailing stops protect trades. Copy trading features let you mirror pros with 80%+ win rates and automate setups.

Fees, Liquidity, and Asset Variety

Fees eat profits. Maker/taker rates of 0.02-0.04% are competitive; high funding (0.1%+) kills holds. Withdrawal fees under $10 and no inactivity charges are ideal.

Liquidity ensures tight spreads. $1 billion+ daily volume per pair avoids slippage – BTC futures should have $500 million+.

Asset variety diversifies. 100+ pairs (BTC, ETH, alts) plus indices or commodities allow hedging. Isolated margin per position limits cross-risk.

User Experience and Support

Intuitive interfaces matter. Clean dashboards, fast execution (under 50ms), and demo accounts help test strategies. Mobile apps with alerts keep you connected.

Support should be 24/7 via live chat or ticket, with a response under 5 minutes. Educational resources – videos, webinars – aid learning.

Community features such as forums or copy-trading leaderboards build engagement. In 2025’s fast markets, seamless UX reduces errors.

Risk Management and Compliance Features

Strong platforms enforce risk tools. Negative balance protection prevents owing more than deposited. Margin calls at 50% equity warn early.

Compliance is key. KYC verification and tax reporting tools simplify regulations. In regions with crypto taxes, platforms offering CSV exports save time.

Avoid platforms with hidden fees or poor uptime (under 99.9%). Test withdrawal speeds – under 24 hours is standard.

Conclusion

Choosing a crypto futures trading platform in 2025 requires balancing security, tools, fees, and UX. Prioritize regulated venues with cold storage, low spreads (0.02%), and 5x-20x leverage to curb 80% loss rates. Liquidity over $500 million per pair ensures execution, while copy trading mirrors pros for beginners. Test demos, verify audits, and cap risk at 1-2%. In volatile markets, the right platform isn’t convenience—it’s your edge for survival and gains.

0 Comments

Leave a comment