What are NFTs?

What are NFTs?

Coingecko defines NFTs as “a form of digital ownership that represents something unique: photos, images, game artifact, music, videos, etc.

NFTs leverage innovative smart contract technology to store and record unique information on the blockchain, which means that whenever an NFT is created, only one of it verifiably exists. With NFTs, one can digitally certify that an asset is authentic. NFTs can be traded on specialized marketplaces.”

NFTs Will Go Mainstream In 2022

🎉We’re thrilled to announce that our CEO, Richard Fetyko, has been selected by SeekingAlpha as a contributing author on crypto investment topics. His first article “NFTs will go mainstream in 2022” was released yesterday: https://seekingalpha.com/article/4484976-nfts-will-go-mainstream-2022

Do you like the article? Follow altFINS channel on Medium and his account on SeekingAlpha to get updates on crypto market, research reports and articles about crypto trading.

Summary

- NFTs had a breakout 2021 and trends have accelerated again in 2022.

- Use cases for NFTs are growing, which is likely to drive mainstream adoption.

- Several publicly traded companies are positioning to catch the NFT gravy train.

- Cryptonative investors have several ways to play the trend.

NFTs will permeate our lives

After a huge breakout year in 2021, it’s clear that non-fungible tokens (NFTs) will become part of our everyday lives when consuming content and interacting with apps including digital photos, images, games, music, videos, and perhaps in other areas like real-estate.

2021 was a year of shifting interest between cryptocurrencies and NFT’s as shows charts from capital.com.

NFT use cases are growing. For example, The Block reported that: “popular music festival Coachella has recently partnered with crypto exchange FTX US to launch an NFT collection. The NFTs, called Coachella Collectibles, will give consumers the opportunity to unlock festival passes, art prints, photo books, digital collectibles, unique real-life experiences at the festival and physical merchandise.”

Similarly, the NFL announced it will give fans attending Super Bowl LVI “virtual commemorative tickets in the form of NFTs.”

So we better learn about NFTs and find ways to invest into this subclass of digital assets.

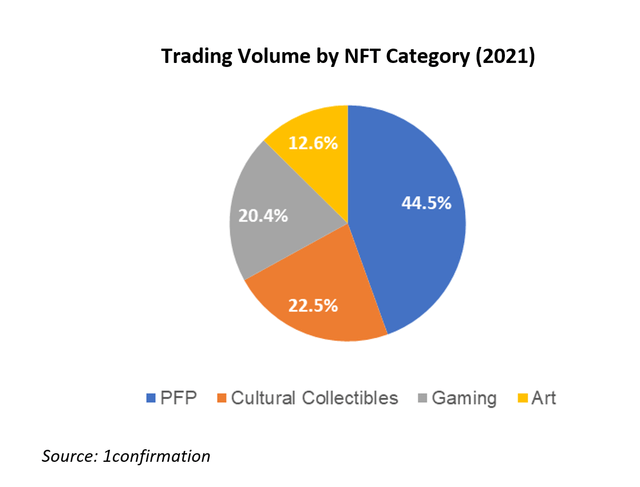

Source: NFT marketplace on OpenSea.ioGrowing Use CasesSo far, four key NFT categories represent the majority of the activity: visual art, profile-pic-projects (PFP: CryptoPunks, Bored Ape Yacht Club, CrypToadz), cultural collectibles (sports, music, photo, video), and gaming.

NFTs give digital artists a new way to monetize their work and talent. The easy authentication of original work through blockchain technology enabled digital artists to sell over $2.BT worth of artwork on Ethereum in 2021, according to Cryptoart.io.

In gaming, companies like Activision Blizzard (NASDAQ:ATVI), Epic Games and Electronic Arts (NASDAQ:EA) generate billions of dollars from players buying or earning in-game items, but the players are not able to sell them. With NFTs, players can turn their in-game accomplishments into money because they can trade NFTs. Axie Infinity (AXS-USD) is an example of a leading play-to-earn gaming platform where players can also earn and trade NFTs.

Expect to see NFTs getting integrated into gaming. Ubisoft (OTCPK:UBSFY) has already integrated them into Ghost Recon Breakpoint and others will likely follow. This could stir up some additional growth for the gaming companies.

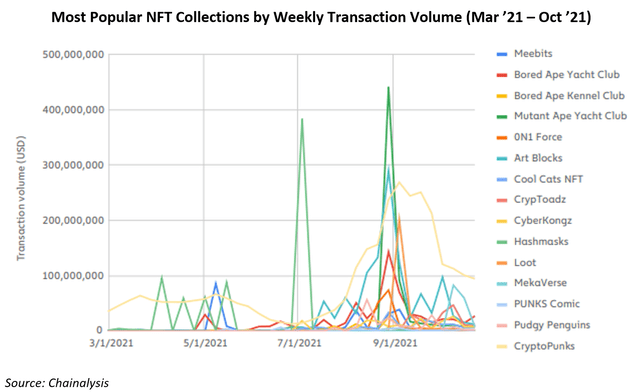

There were more than 6,000 NFT collections traded on OpenSea at the end of 2021, up 20x Y/Y, but the majority of the volumes concentrate among the few most popular collections (see graph below). About 250 collections represented 80% of secondary NFT sales.

CryptoPunks was established in 2017, even before the NFT craze, and has been consistently a leading collection, until recently when it was surpassed by Bored Ape Yacht Club.

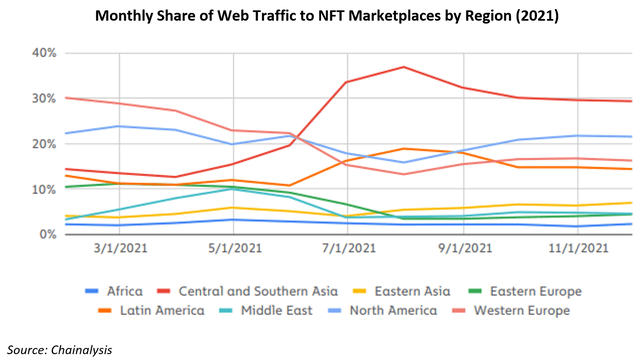

NFTs are a global phenomenon

Much like Bitcoin (BTC-USD) and other cryptocurrencies, NFTs are traded by investors around the globe.

2021 was a banner year for NFTs

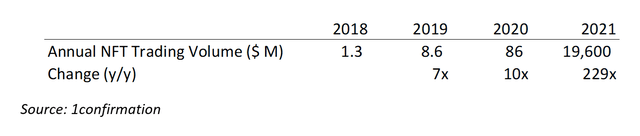

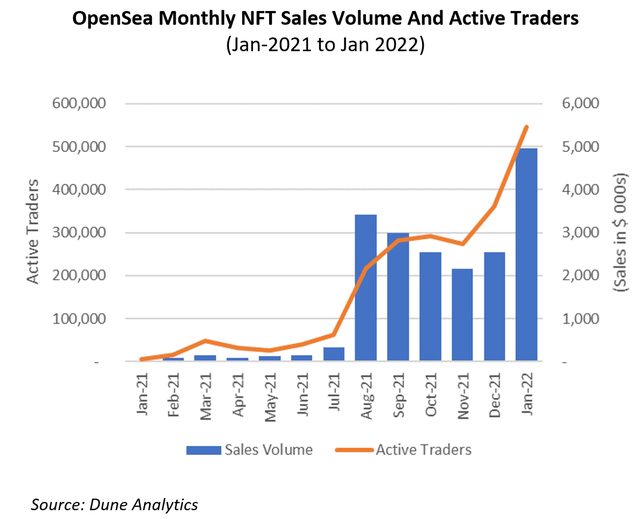

NFT activity exploded in 2021 with signs of mainstream adoption. If 2020 was the year of DeFi, 2021 was the year of NFT.Total NFT trading volumes reached $19.6B in 2021, up from merely $86M in 2020. About 2 million NFT traders were active in 2021.

After summer 2021, it appeared that the hype was over and the market was getting oversaturated with NFT collections and activity sharply declined from a peak of $325M in daily volume in September to only $50M daily by November 2021.

However, NFTs caught a second wind at the end of 2021 and early 2022, with sales volumes ramping back up again.

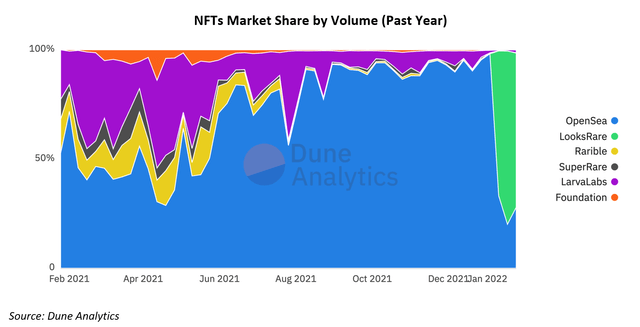

We use OpenSea’s volumes as indicative of the NFT marketplace since it had 90%+ market share among NFT marketplaces.

Competitive Landscape

OpenSea has had the lion’s share, until LooksRare (LOOKS-USD) launched on Jan 10th with a “vampire attack”.

Among the largest NFT marketplaces are:

- OpenSea — raised $300M in Series C round at $13.3B valuation in January 2022

- LooksRare — direct competitor to OpenSea

- SuperRare (RARE-USD) — focused on high end visual art

- Foundation — many cultural asset categories

- Rarible (RARI-USD) — collectibles and artwork

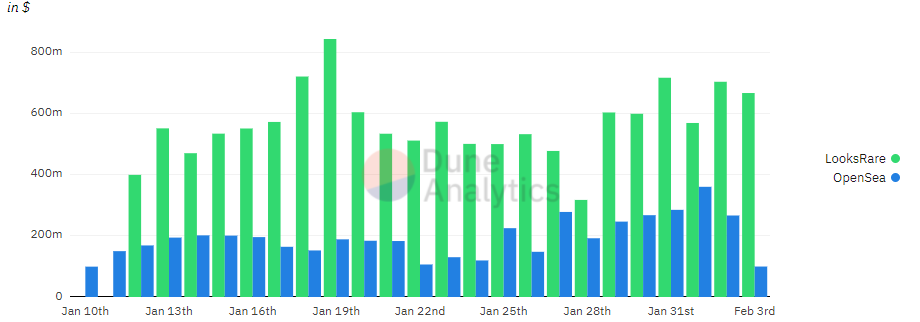

LooksRare’s “vampire attack” refers to a go-to-market strategy that attempts to lure traders and sellers away from OpenSea. Essentially, LooksRare is giving fat incentives to NFT traders and sellers who list and trade NFTs on its marketplace. These traders can earn LOOKS and Weth (WETH-USD) coins, which currently generate a whopping 400–600% APR. Clearly, that’s not sustainable and is expected to decline.

LooksRare charges 2% fee on all trades (0.5% less than OpenSea) but 100% of those fees go to those staking LOOKS tokens, which also makes it more attractive than OpenSea (no sharing of fees).

The “vampire attack” seems to be working so far as LooksRare marketplace is buzzing with trading volumes, although there is some wash trading going on as well.

LooksRare’s long-term success will depend on how successful it will be to take market share from OpenSea once the current trader incentives diminish.

LooksRare vs. OpenSea Daily Volume

What’s ahead for NFTs in 2022?

NFT sales volumes are off to a strong start in 2022, with January volumes setting all-time records.

Such volumes will attract more players. Cryptocurrency exchanges are a natural fit: Binance (BNB-USD), ByBit and Coinbase (COIN) have already launched or announced plans to launch NFT marketplaces.

With 80M users as of 4Q-2021, Coinbase could become a huge player. In fact, their marketplace waiting list reached 1.5M in just two days, which is more than OpenSea’s active users.

The exchanges will also offer fiat on-ramps, which will make it easier for people outside the crypto ecosystem to buy NFTs. For example, Coinbase will let users buy NFTs with fiat via Mastercard (NYSE:MA), which should also help with onboarding newer users.

Also, as mentioned already, gaming companies are likely to integrate NFTs into their games, exposing tens of millions of players to NFTs. GameStop (GME) has plans to launch an NFT marketplace for in-game NFTs by end of this year.

More consumer brands and celebrities will launch NFT projects, bringing more mainstream attention to the category.

Use of NFTs will evolve beyond the visual arts into music, virtual real-estate, in-game artifacts, which will dramatically expand the category.

How can investors participate in NFTs growth?

Investors who are still outside of the crypto trading ecosystem can participate through proxies like Coinbase, GameStop or wait for an IPO of OpenSea, which hinted at an IPO recently.

Other possible ways to play NFTs is through Meta (NASDAQ:FB) and Twitter (NYSE:TWTR), which have announced plans to let their users select an NFT for profile pics.

This is likely just the tip of the iceberg for these Web 2.0 social media giants when it comes to leveraging NFTs. This is also a natural extension of Meta’s metaverse initiative, an avatar-filled world that the company is investing $10B annually into.

Crypto native investors can either 1) trade NFT collections on one of the leading marketplaces, 2) invest into the tokens of such marketplaces: LooksRare, SuperRare, Rarible, or 3) invest in some of the NFT infrastructure providers like Immutable X (IMX-USD), Worldwide Asset eXchange (WAX-USD), and Loopring (LRC-USD).

Investment risks

It’s exciting to be at the early stages of a whole new asset subclass. Being early has potential for massive gains but it also exposes investors to high risks. Investors ought to consider spreading their bets across a basket of NFT related investment ideas to capture the overall trend, yet minimize unsystematic, company specific risks.

- Legal and copyright issues. There is a debate around whether artists should receive licensing or copyright fees from secondary market sales. It’s also easy to create new NFT collections that look very similar to originals.

- Competition is likely to heat up. As demonstrated by LooksRare vs. OpenSea, the barriers to entry for new NFT marketplaces are relatively low. We expect many launches this year, which could pressure their fee take rates.

- Decentralized NFT marketplaces run on smart contracts (programmatic code-based), which may or may not have been audited but even if they were, could run the risk of getting hacked.

- There have been “allegations of insider trading”, even in the leading marketplace (OpenSea) by their own executive.