Crypto Uptober Is Here! Four Reasons Why Crypto Will Rally In October

Richard Fetyko, CEO and founder of altFINS: “September was a decent month for crypto, despite the pullback at the end of the month. BTC was up 7.7%, ETH down 2.2% and top 100 assets on average gained 5.3%. Not bad for a month that has historically sucked (resulted in losses). But there are reasons to be bullish in October and frankly into 4Q-2025. This recent pullback is a gift! Uptober is here”

Don’t miss on the big gains ahead and join our VIP community with 50% off code: altfins-VIP Get access to all trade setups, signals, whale insights and coin picks.

Here are my 4 reasons why crypto should rally:

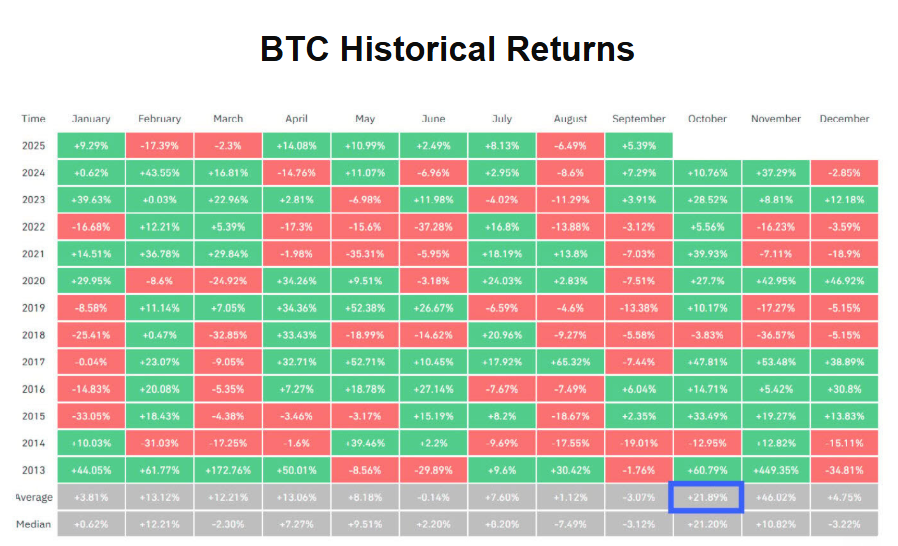

1. Uptober

(October) is known to be a great month for crypto. It’s recorded gains in 10 out of the last 12 years! (for BTC at least)

2. ETFs are coming!

Spot ETFs open up investing into crypto to the mainstream public. It worked well for BTC and ETH. BTC Spot ETFs now own $166B worth of BTC, or 7.3% of total supply.

Now several new ETFs are launching for altcoins like SOL, XRP, LTC, DOGE and ADA.

(Hint: these assets could experience significant buying pressure. That’s on top of the buying from DATs – see free report and buybacks – see free report)

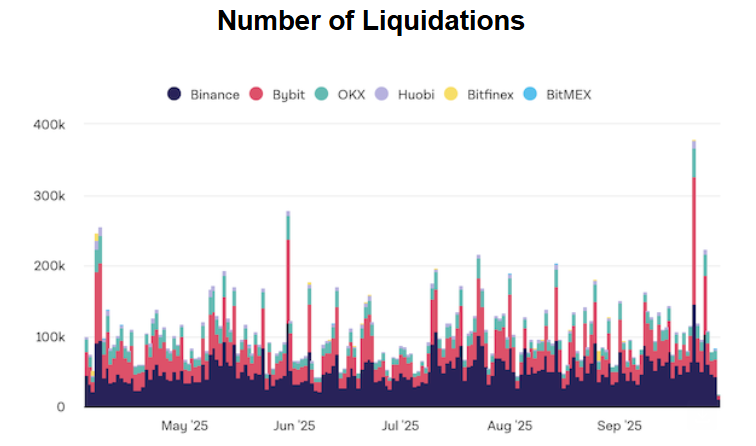

3. Massive liquidations

As prices pulled back in late September, lots of leveraged trades got liquidated. What happens is that a 10x long position is whiped out (closed, liquidated by exchange) when price goes down by 10% or less. A 50x position only needs 1-2% correction to get liquidated.

Long liquidations across major exchanges reached $1.5 billion on September 22nd, marking the highest single-day liquidation event since March 2024,

During such forced liquidations, traders’ assets are sold, which creates a feedback loop that amplified the market decline across multiple exchanges.

These liquidations pushed prices down to attractive levels again, creating tasty trade opportunities.

4. FED rate cuts…don’t fight the FED!

Lower interest rates are positive for asset valuations, especially risk assets like crypto and tech stocks.

Fed cut rates in Sep, after 9 month pause, and is likely to cut more in Nov, Dec and early 2026.

Weak jobs market is forcing the FED to start stimulating the U.S. economy.

To profit from this coming crypto rally, you should leverage altFINS’ exclusive trade setups, signals, whale insights, and Coin Picks, among other tools. And get access to our VIP telegram channel (Annual and Lifetime members) where we discuss the best trade ideas, share trading tips, and what strategies are working currently.

0 Comments

Leave a comment