Understanding ICOs: What They Are and How to Evaluate Them

Initial Coin Offerings (ICOs) have become a foundational part of the crypto ecosystem. For investors looking to discover promising blockchain projects in their early stages, ICOs offer a potential gateway—but also come with significant risks. In this article, we’ll explore what ICOs are, how they work, and key criteria for evaluating whether a project is worth your investment.

What Is an ICO?

An Initial Coin Offering (ICO) is a fundraising mechanism where new blockchain-based projects sell their underlying cryptocurrency tokens in exchange for capital, typically in the form of Bitcoin or Ethereum. It is somewhat analogous to an Initial Public Offering (IPO) in the traditional stock market, but instead of shares, participants receive tokens that may have utility within the project’s ecosystem or serve as a speculative investment.

While ICOs offer an avenue for early participation in blockchain projects, they are largely unregulated, which makes it essential for investors to do their due diligence.

How Does an ICO Work?

Here’s a simplified breakdown of a typical ICO process:

- Project Development: Founders create a whitepaper outlining the project’s purpose, technology, roadmap, tokenomics, and fundraising goals.

- Marketing and Community Building: The team promotes the ICO through crypto communities, social media, and crypto-specific platforms to build interest and trust.

- Token Sale: Investors purchase tokens during a specific window using accepted cryptocurrencies. The sale may happen in stages (private sale, presale, public sale).

- Listing: After the ICO, the tokens may be listed on exchanges, allowing investors to trade them.

How to Discover New ICO Opportunities

Finding high-quality ICOs takes effort. Many investors track ICO listings on research-focused platforms and crypto news outlets. Additionally, exploring early-stage offerings such as presales can be a strategic move.

You can discover some of the best crypto presales by monitoring dedicated launchpads, forums, and aggregator platforms that list upcoming token launches.

Why Investors Participate in ICOs

ICOs are appealing for several reasons:

- Early Access: Opportunity to acquire tokens at a lower price before they hit public exchanges.

- Potential for High Returns: If the project succeeds, the token’s value may increase significantly.

- Support Innovation: Investors can back ideas they believe in and contribute to decentralized ecosystems.

However, these advantages come with inherent risks, including the possibility of project failure or fraud.

Key Criteria to Evaluate Before Investing

Investing in an ICO requires a thorough evaluation of the project and its team. Here are essential factors to consider:

1. The Whitepaper

The whitepaper is your first point of contact with the project. It should clearly explain:

- The problem being solved

- The proposed solution

- Use of blockchain technology

- Token utility and distribution

- Project roadmap and development timeline

- Funding goals and how funds will be used

If the whitepaper is vague or overly technical without clarity, that’s a red flag.

2. Team and Advisors

Research the background of the founding team and advisors. Ask:

- Do they have relevant experience in blockchain, business, or development?

- Have they successfully launched projects before?

- Are they transparent and active in public channels?

Lack of transparency or anonymous teams should be a warning sign.

3. Tokenomics

The token’s economics—its supply, distribution, and use—play a huge role in future value.

Look at:

- Total and circulating supply

- Token allocation (team, investors, reserve)

- Vesting schedules

- Utility within the ecosystem

Avoid projects with overly centralized token holdings or unclear utility.

4. Community and Communication

A strong community and open communication are indicators of a healthy project.

- Is the team active on platforms like Telegram, Discord, or X (formerly Twitter)?

- Do they regularly update the community?

- Is there engagement, transparency, and responsiveness?

5. Regulatory Considerations

Some jurisdictions have specific regulations around token sales. Make sure the project is compliant and check if participating could expose you to legal risk.

You can consult trusted resources like:

- U.S. Securities and Exchange Commission (SEC) – ICO Guidance

- Coin Center – ICO Analysis and Policy

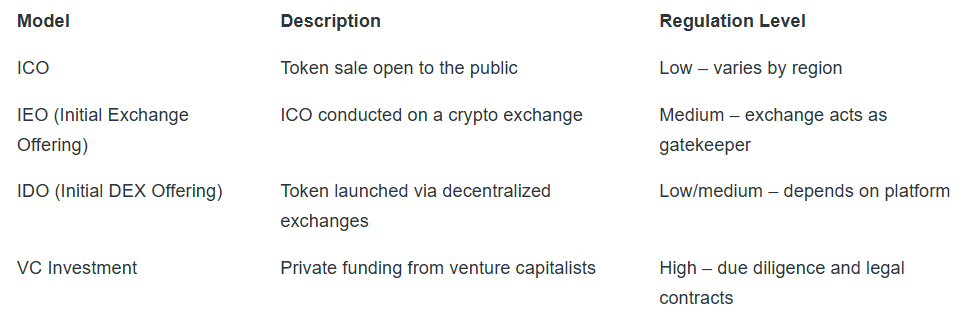

- ICO vs. Other Fundraising Models

Understanding the differences between ICOs and other crypto fundraising methods helps you make informed decisions:

Final Thoughts

Final Thoughts

ICOs offer exciting opportunities but demand caution. Always approach them with a healthy level of skepticism and never invest more than you’re willing to lose. Strong projects are backed by credible teams, have clear tokenomics, and are transparent with their development.

By using thorough research and due diligence, you can navigate the volatile ICO landscape and potentially uncover the next big success in crypto—while avoiding common pitfalls.

0 Comments

Leave a comment