Trading Descending Triangle Patterns

Our system has identified many altcoins trading in a Descending Triangle pattern. In this blog, we’ll show you how to trade it.

We teach trading Chart Pattern breakouts in our new Crypto Trading Course (10 lessons, 40 videos, 7 trade strategies, quizzes, notes, risk management, short selling, margin trading).

Here’s an example breakout from Descending Triangle that our system identified 6 days ago:

TURBO – Descending Triangle Breakout

See more AI Chart Patterns here.

The shape indicates that every time price bounces off of support trendline, the sellers push the price back down.

And the sellers are getting more desperate, so the bounces are smaller and smaller. Until the sellers overwhelm the buyers and price breaks below the Triangle support.

Here’s another emerging Descending Triangle trade setup for FET:

This asset is already in a Downtrend after it crossed below the 200-day moving average.

Now we wait for a breakout. It could go in either direction but most likely in the direction of the existing downtrend. Technical Analysis (60 trade setups)

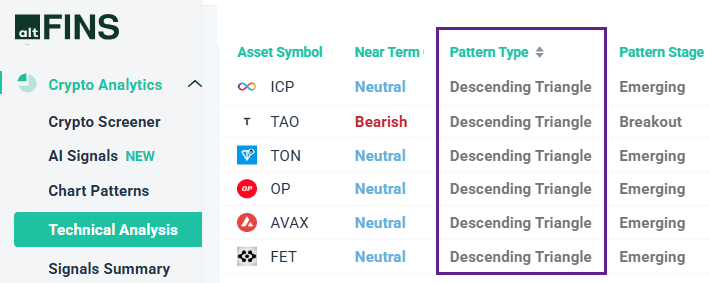

We have identified more assets trading in Descending Triangle patterns.

These could result in a breakout soon.

Find them in our Technical Analysis section where we keep trade setups for 60+ major altcoins.

Trade setups include Take Profit and Stop Loss levels for risk management.

Don’t miss these potentially big gainers on breakouts!

Descending triangle is a price trading pattern formed by drawing a horizontal line along the swing lows and connecting a series of lower highs with a descending trendline.

This results in a triangular shape with a flat horizontal support and a descending resistance.

Our historical data shows that Descending Triangles have 67% success rate. Check all stats here.

Do not miss these potentially profitable opportunities!

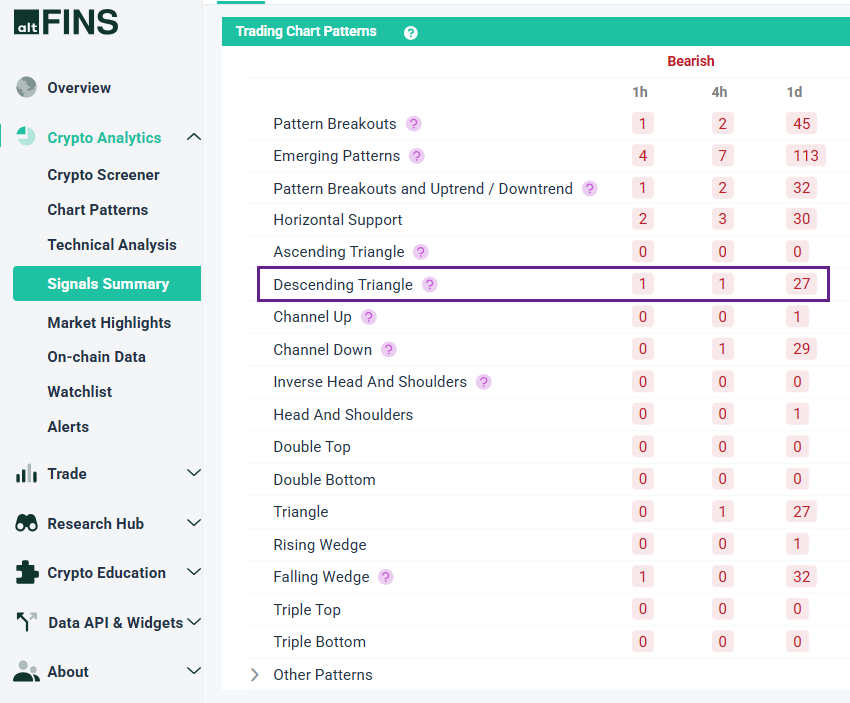

You can find them on altFINS platform in three sections:

1) Chart Patterns (search for Descending Triangle pattern type)

2) Technical Analysis (search for Descending Triangle pattern type)

3) Signals Summary – under Patterns section.

TIP: Never miss another trading signal. Create an alert for any chart pattern and receive notifications on your phone! Here’s how.

0 Comments

Leave a comment