Strategy: Buying Dips in Uptrend

Many altcoins are in a strong uptrend. But even in an Uptrend, prices never go straight up, day after day.

There are times when price consolidates, pulls back and then resumes an Uptrend. Such corrections are opportunities to join a trend.

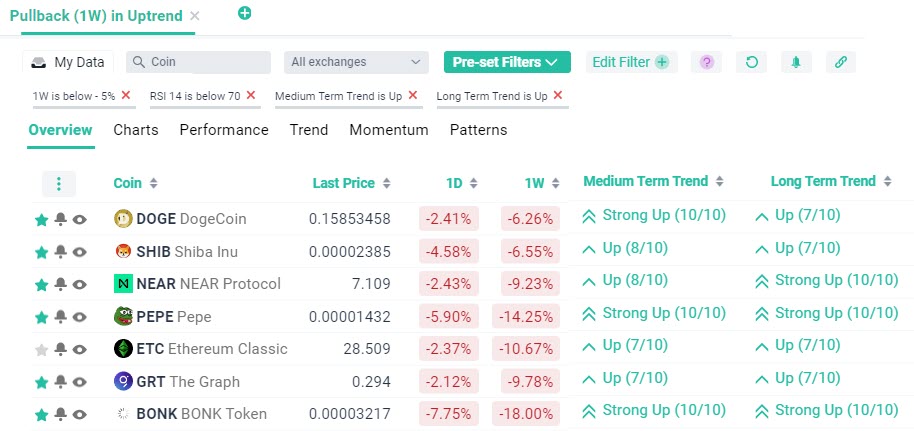

Use altFINS to quickly find such trading opportunities: DOGE, SHIB, NEAR, PEPE, ETC, GRT, BONK… (see all results)

Market Scan: Pullback In Uptrend

One of the best strategies during an Uptrend is to “Buy dips” or “Pullbacks in Uptrend”.

Because assets in an uptrend have a tendency to resume their uptrend after a temporary pullback.

Pullbacks can often provide opportunities to jump on an established trend. It’s difficult to catch a trend in early phases and conservative traders prefer to jump in midstream, once a trend is established.

We teach the Pullback in Uptrend strategy in Lesson 3 of our new Crypto Trading Course, which includes 10 lessons, 40 videos, notes and quizzes covering 7 trading strategies, leverage trading, short selling and risk management.

Members with Annual, Lifetime, and Education plans get access to our VIP Telegram group where we share the best trade ideas and tips.

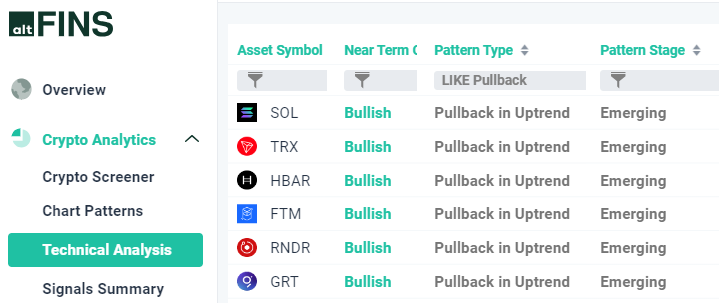

Graph (GRT) – Bullish, Pullback in Uptrend

Trade setup: : Price is in an Uptrend. It broke out of an Ascending Triangle, reached $0.36 and pulled back again to that key level of $0.30, now support. Stop Loss (SL) level at $0.27. RRR (Reward-Risk-Ratio) of 2:1.

How To Find And Trade Pullbacks In Uptrend? Watch this Tutorial Video

Media error: Format(s) not supported or source(s) not found

Download File: https://altfins.com/wp-content/uploads/2024/06/Video-Tutorial-1.mp4?_=1

Trading rules of this trading strategy are:

- Find coins in an uptrend that pulled back in the last 7 days (1W)

- Visually check charts to identify nearest support level

- Buy near support level

We teach how to find support and resistance levels in Lesson 3 of our new Crypto Trading Course.

altFINS helps you identify coins with Pullback in uptrends in few seconds…

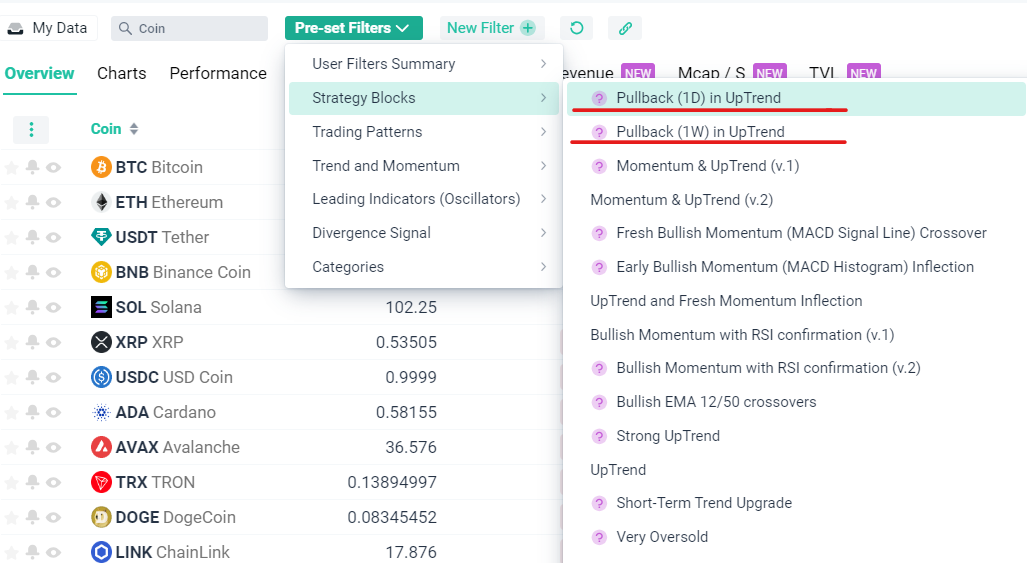

You can find such trading opportunities in three sections:

- 1. Screener > Pre-set Filter > select Pullback (1W) in Uptrend

0 Comments

Leave a comment