Second Chances With Better Entry

Here’s what our CEO shared in the VIP channel yesterday:

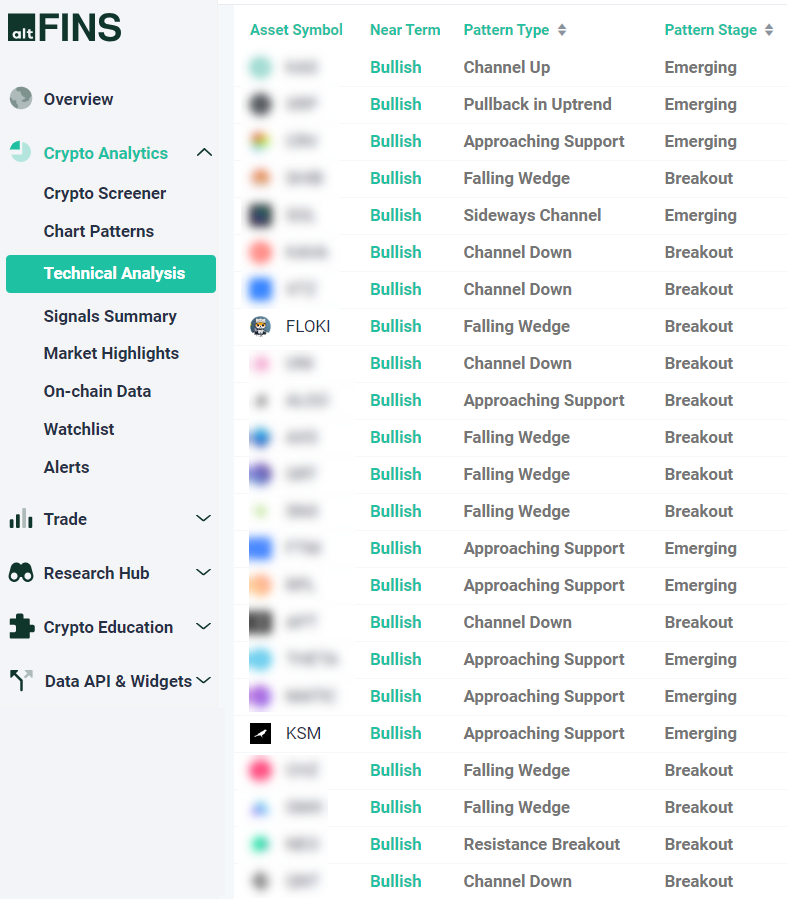

“After a flurry of breakouts from Falling Wedge and Channel Down patterns in the last two weeks, I’m noticing that many are retesting those breakout levels, which gives us second opportunities for swing trade entries.

What I like about these situations is that the Stop Loss levels are now closer to my trade entries because, well, the price has pulled back and I’m not chasing the breakouts.

I see this in the following trade setups: FLOKI, APE, XTZ, KAVA, SHIB, IMX, ALGO, AXS, GRT, SNX, FTM, THETA, MATIC, KSM CHZ, GMX, among others.”

You can find all of these in our Technical Analysis section, including price targets and stop loss levels.

TIP: best way to stay on top of hot trade ideas is to join our VIP members group.

Here are a couple of examples:

FLOKI Trade Setup

FLOKI Trade Setup: Price is in a Downtrend, however, it had a bullish breakout from Falling Wedge pattern, above $0.00013 resistance, which could signal at least a temporary bullish trend reversal with +30% upside potential to $0.00017. Price is now retesting that breakout level. Stop Loss at $0.000115.

KSM Trade Setup

KSM Trade Setup: Price is in a Downtrend, however, it had a bullish breakout from Falling Wedge pattern, which achieved its potential with price gaining +15% to $22.00 resistance.

Now price has pulled back near $16.70 support for another swing trade entry in Uptrend with +30% upside potential back to $22.00. Stop Loss at $15.80.

Technical Analysis (65 trade setups)

0 Comments

Leave a comment