"Buy the Dip" Pullback in Uptrend Stregy: A Trader's Guide

For those actively trading altcoins, the “Buy the Dip” or “Pullback in Uptrend” strategy is a time-tested approach that offers the potential to join a trend at a more favorable price. While many altcoins may experience strong uptrends, the market never moves straight up. Periodic pullbacks provide opportunities to re-enter a position or catch the trend mid-stream. Here’s how you can maximize your profits using this strategy and tools like altFINS to make better-informed decisions.

Why Buy the Dip in an Uptrend?

Even during a powerful uptrend, cryptocurrencies will often pull back, consolidate, or experience brief corrections before resuming their upward movement. These dips provide traders with an opportunity to enter a trade without chasing a price that’s already overextended.

The advantage of buying a pullback is that you’re entering the trade after the trend is already established, which reduces the risk compared to trying to predict the start of a trend. This method appeals to more conservative traders who prefer jumping into an established trend rather than catching it too early. When timed correctly, these pullbacks allow for lower entry prices, optimizing profits when the trend resumes.

How to Identify Pullbacks Using altFINS

Finding coins in an uptrend that are experiencing pullbacks is easier with the right tools. altFINS offers market scans specifically designed to help traders identify such opportunities quickly. Here’s how you can find and trade pullbacks in an uptrend:

1. Use the Crypto Screener

With altFINS’ preset filter, you can quickly scan the market for coins that have pulled back in the last 7 days while still maintaining their overall uptrend. This ensures you’re focusing on assets that are simply pausing within a larger bullish move, not reversing the trend altogether.

2. Check Charts for Support Levels

After identifying potential trade candidates, the next step is to visually check their charts. The goal is to locate the nearest support level—a point where the asset has historically found buying interest. These levels can serve as optimal entry points during a pullback.

3. Enter Near Support

Once a coin’s price approaches a support level, it’s time to consider entering the trade. Buying near support offers the best risk-reward ratio, as you’re entering at a lower price with a clear exit plan if the support fails.

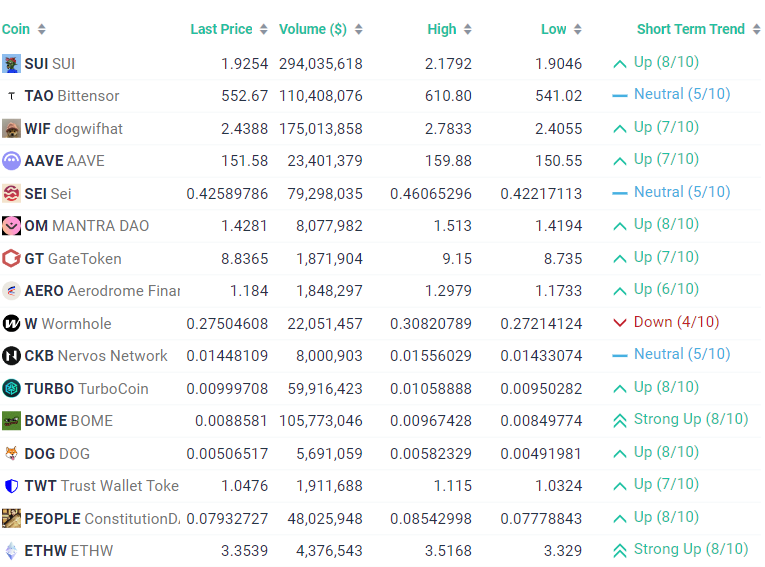

Examples of altcoins to Watch

Recently, coins like SUI, TAO, WIF, AAVE, and SEI have been identified by altFINS’ pullback-in-uptrend scans. Each of these altcoins has experienced a temporary correction, but they continue to show strong overall bullish patterns, offering excellent buying opportunities.

Enhance Your Trading with altFINS

For traders who want to take their strategy to the next level, becoming an altFINS member offers exclusive access to powerful tools and insights, including:

- Trade Setups for 65 top altcoins (including MEMEs and smaller coins)

- AI-Based Chart Patterns, delivering trade signals throughout the day

- 100+ Pre-Set Market Scans, tailored to different market conditions

- Exclusive Crypto Trading Course, covering 7 strategies, margin trading, short selling, and risk management techniques

- VIP Telegram Group, where expert insights and the best trade setups are shared

Mastering the “Buy the Dip” strategy during an uptrend can help traders maximize their profits while mitigating risk. With tools like

altFINS, you can quickly identify and act on these opportunities, ensuring that you stay ahead of the curve. Remember, it’s all about patience and timing—entering at the right moment can make all the difference.

0 Comments

Leave a comment