How To Profit Or Hedge Risk In a Downtrend?

After a huge first half of 2023, when altcoins rallied 100%+, the market has given up most of those gains and is firmly in a downtrend.

Traders have to adjust their strategies based on market conditions (“market structure”).

In the trading video, Richard Fetyko – altFINS CEO, demonstrates how to profit from a downtrend or at least hedge long positions in the portfolio by short-selling assets (see market scan results). This is a valuable risk management strategy, especially in volatile markets and during a general downtrend.

Richard also demonstrates how to Short-Sell on Binance using a real trading example (LTC).

Typical traders are long-biased. That means that traders typically buy assets expecting a price increase and then they sell with a profit. They buy low and sell high.

However, to be a more complete trader that can survive a bear market, one needs to also learn how to Short-Sell. That means to first Sell High and then Buy back lower.

This is a useful technique that can either help a trader profit from a downtrend or hedge the portfolio of long positions.

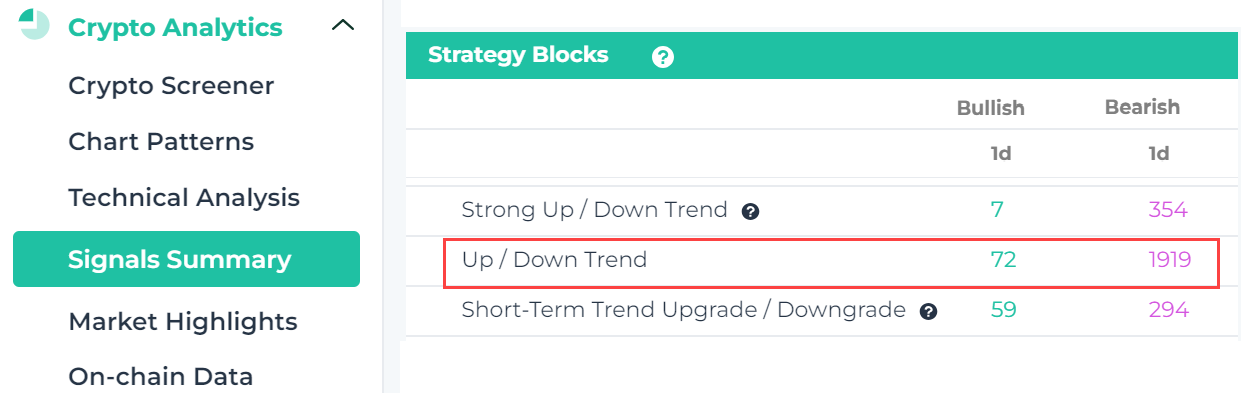

Currently, the market is in a downtrend, generally speaking, with some exceptions. Let’s check our Signals Summary page for evidence – only 72 assets (out of 2,600 tracked) are in an Uptrend currently versus over 1,900 in a Downtrend:

Source: altfins.com

Source: altfins.com

Despite the downtrend, Richard is somewhat bullish near-term but cautiously bullish (why? see recent 3 videos). The fact is that the market overall is in a downtrend and to trade against that downtrend is risky. Buying dips works in an uptrend but in a downtrend that is a risky strategy used by experienced swing traders. Trends have a tendency to continue. Betting on trend reversals is risky.

In a downtrend, a trader has to flip the rulebook upside down. Instead of buying the dips in Uptrend, one could sell bounces in downtrend.

In this trading video Richard shows how to find those assets that he can short-sell. That way, if he is wrong and the market resumes its downtrend instead of reversing it, then his losses will be reduced because he will profit from the short-sell positions.

If the market resumes a downtrend, his long positions will incur losses but his short-sell positions will have a gain, hopefully offsetting most or all of his losses. This is a risk management or mitigation strategy.

Now the question is which assets should Richard short-sell? Well, he wants to sell those assets that are in a downtrend but have recently bounced up to their nearest resistance level. Notice how this strategy is the opposite of Buying dips in Uptrend. When the market is in an uptrend, what Richard wants to do is buy dips, buy when price pulls back. Well, in a downtrend, he wants to do the opposite. Richard wants to short-sell when price bounces up because the assumption is that it will resume its downtrend.

Here’s a custom market scan that (downtrend + bounced): see results. You can save this filter for future re-use. Or you could modify it further.

Here are some examples of assets that fit the filter criteria:

LTC – near $80 resistance, bounced up 10-15% from bottom

BCH – near $100 resistance, bounced up from $93, up 10% from bottom

FIL – near $4 resistance, bounced up from $2.75, up 33% from bottom

FTM – near $0.30 resistance, bounced up from $0.25, up 10% from bottom

TWT – near $1 resistance, bounced up from $0.75, up 25% from bottom

COMP – near $30 resistance, bounced up from $$23, up 30% from bottom

Trading video contents:

0:00 What is Short-Selling and its benefits?

6:00 How to find assets for Short-Selling (build a custom market scan)

7:50 Market scan results (assets in downtrend but recent bounce up)

8:45 Assets near their resistance

9:00 LTC Technical Analysis

10:00 BHC Technical Analysis

11:20 Short-Selling LTC on Binance