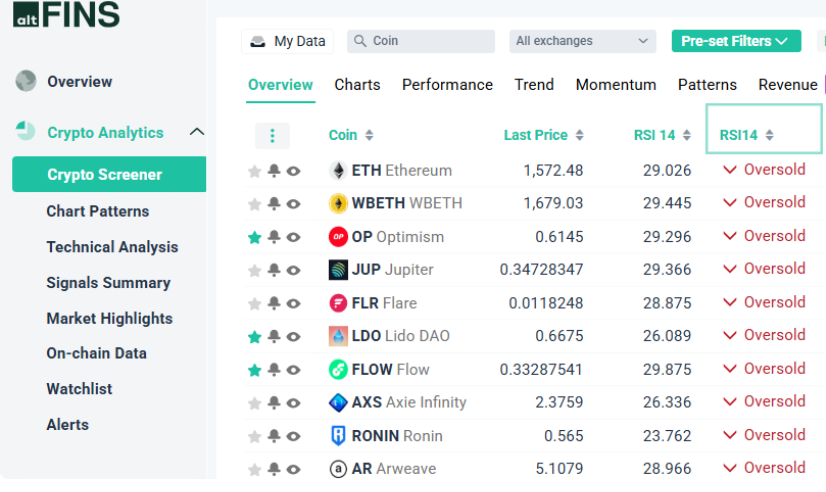

Oversold Crypto Market Showing Signs of a Bounce

📉 Are Markets Oversold?

One key indicator of an oversold crypto market is the Relative Strength Index (RSI). When RSI dips below 30, it signals that prices may have dropped too far, too fast — often followed by a bounce or reversal.

✅ You can easily find such oversold assets using the Pre-Set Filters on altFINS’ Screener.

RSI Oversold Screener Results here.

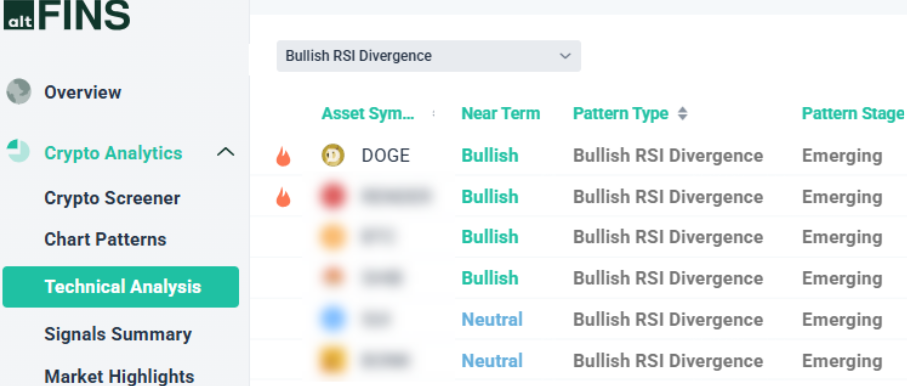

Bullish RSI Divergence: A Signal to Watch

Another powerful signal picked up by our system is Bullish RSI Divergence.

This pattern occurs when:

- Price makes a new low, but

- RSI makes a higher low

This suggests that downward momentum is weakening, often a precursor to a short-term price bounce.

Find these signals under Crypto Analytics → Technical Analysis → Trade Setups on altFINS:

Real Examples of Bullish RSI Divergence

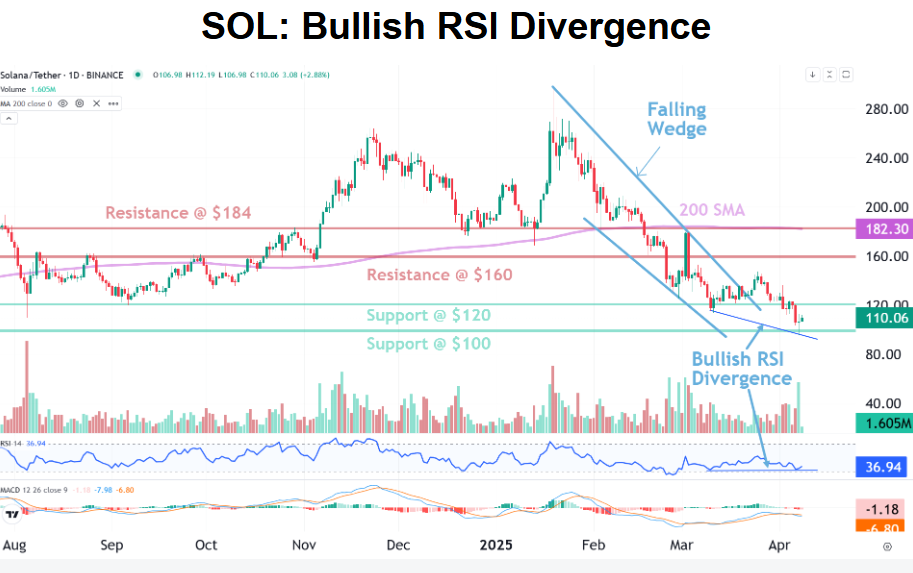

SOL (Solana)

Pattern: Bullish RSI Divergence + Falling Wedge

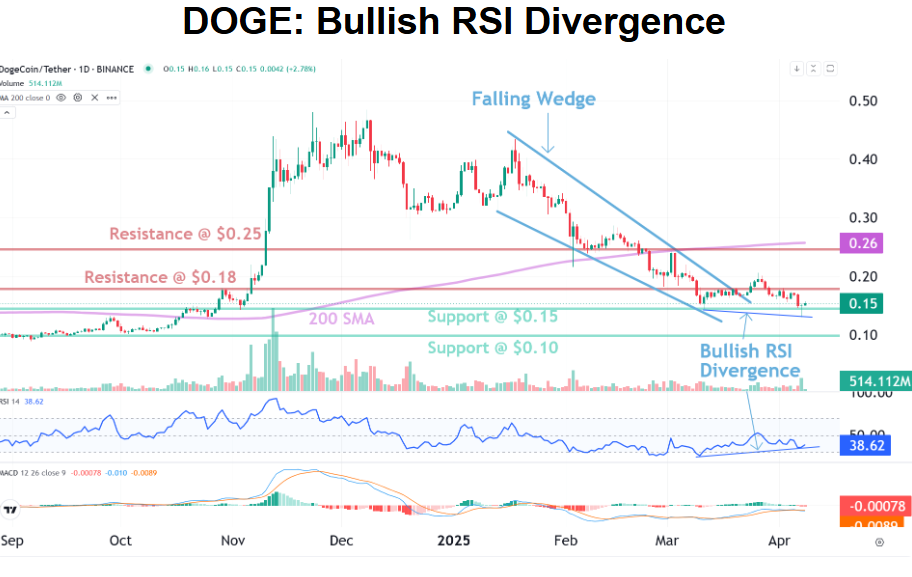

DOGE (Dogecoin)

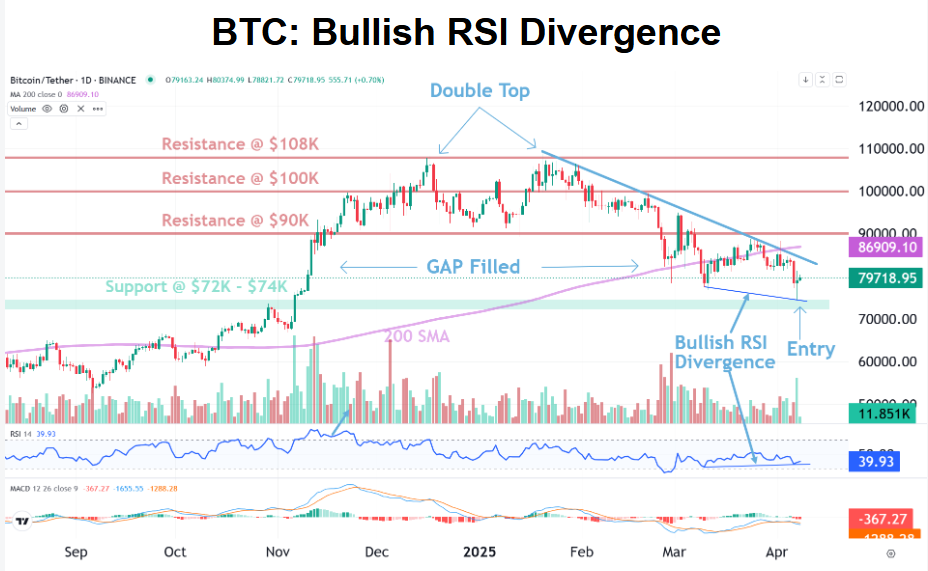

BTC (Bitcoin)

Pattern: Bullish RSI Divergence + Entry Zone

Summary

While most crypto assets remain in a downtrend, the emergence of oversold RSI conditions and Bullish RSI Divergence suggests a possible near-term bounce.

Use altFINS’ Crypto Screener and Trade Setups to identify these signals in real time and make data-driven trading decisions.

0 Comments

Leave a comment