Oversold in Uptrend: A Powerful Trading Strategy

The CEO of altFINS has recently shared some compelling trade ideas in our VIP Telegram channel, emphasizing the strategy “Oversold in Uptrend.” This approach targets assets that are in an uptrend, but temporarily oversold, offering lucrative opportunities for savvy swing traders.

Market Context

Markets are currently experiencing significant volatility. This turbulence, while nerve-wracking, can create profitable swing trading opportunities. The key is to identify “gems” that meet specific criteria, indicating they are poised for a potential rebound.

Key Criteria for Trade Selection

- Uptrend Confirmation: The asset should be in an uptrend on medium and long-term time frames.

- Oversold Conditions: Look for an RSI (Relative Strength Index) below 40, or even better, below 30.

- Support Proximity: The price should be near a support level and/or the 200-day Simple Moving Average (SMA 200).

Risk Management

Trading in volatile conditions carries the risk of “catching a falling knife,” where prices could fall further. Therefore, employing robust risk management strategies is crucial. This includes setting stop losses, sizing trades appropriately, and avoiding leverage. These techniques are detailed in Lesson 10 of our trading course.

Trade Setup: POLYX (Polymesh)

A current example of an attractive trade setup using the “Oversold in Uptrend” strategy is POLYX (Polymesh). Here’s a breakdown of the trade:

Source: altFINS

- Trend: POLYX is in an uptrend on both medium and long-term bases.

- Oversold Condition: The RSI is approximately 31, indicating an oversold status.

- Support Level: The price is near the $0.30 support, which also aligns with the 200-day SMA.

- Target and Stop Loss: Set a price target of $0.40 and a stop loss at $0.25.

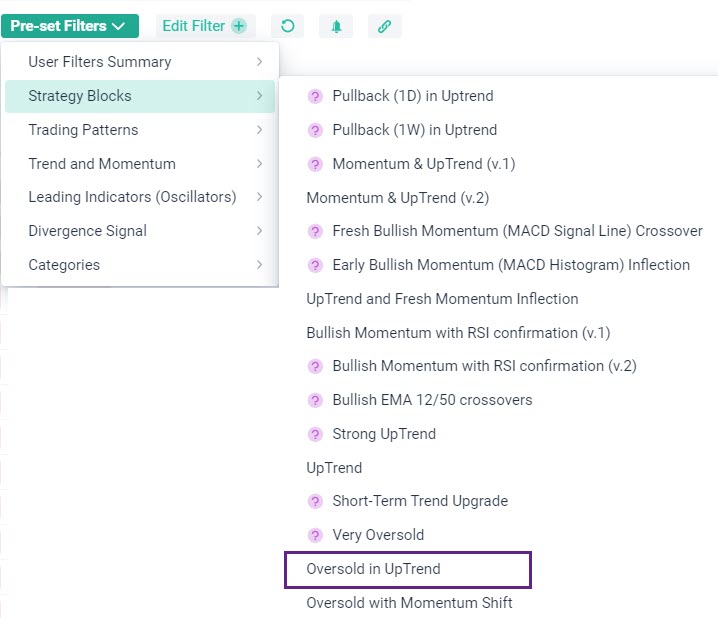

Pre-Set Market Scan: “Oversold in Uptrend”

This strategy is available on our Screener under Pre-Set Filters. It identifies coins in an uptrend that are oversold and near a support level, offering timely entry points. Typically, oversold conditions are defined by an RSI below 30, but for coins in an uptrend, even an RSI of 40 or less can indicate a potential bounce. See results here.

We teach this strategy in Lesson 5 of our comprehensive Crypto Trading Course, which includes:

- 10 detailed lessons

- 40 videos

- Quizzes and notes

- Coverage of 7 trading strategies, including short selling and leverage trading

- In-depth risk management techniques

The “Oversold in Uptrend” strategy offers a methodical approach to capitalize on market dips within an overall uptrend. By combining technical indicators like RSI and support levels, traders can identify promising entry points. Remember, successful trading hinges on disciplined risk management and continuous learning.

For more trade setups and to enhance your trading skills, join our community and enroll in our Crypto Trading Course today!

0 Comments

Leave a comment