Opportunties in Crypto Correction

Markets are puking. Just when pain is unbearable, is when swing traders can make some nice profits. There are opportunities in crypto abound, if you can time your entry and find the bottom.

In fact, these are times when traders can make their entire year’s worth of profits!

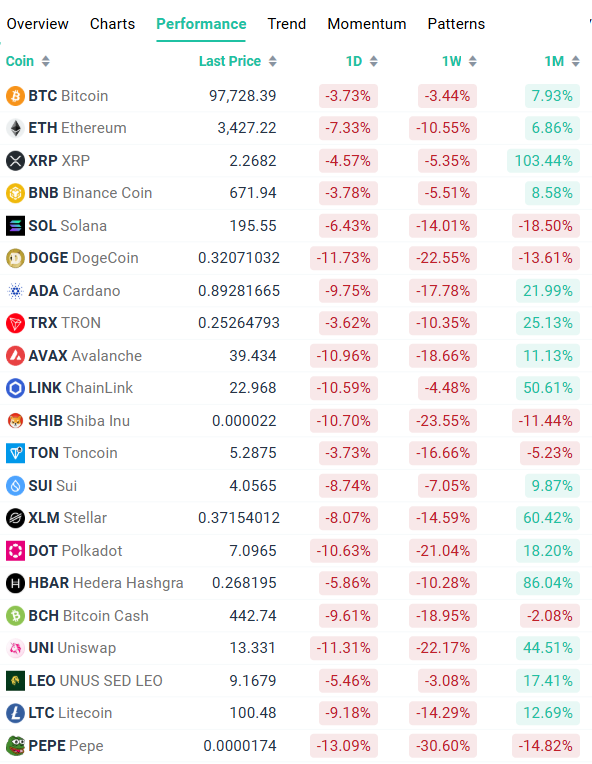

Majors Performance

See crypto performance in real time here.

Is the Bottom In?

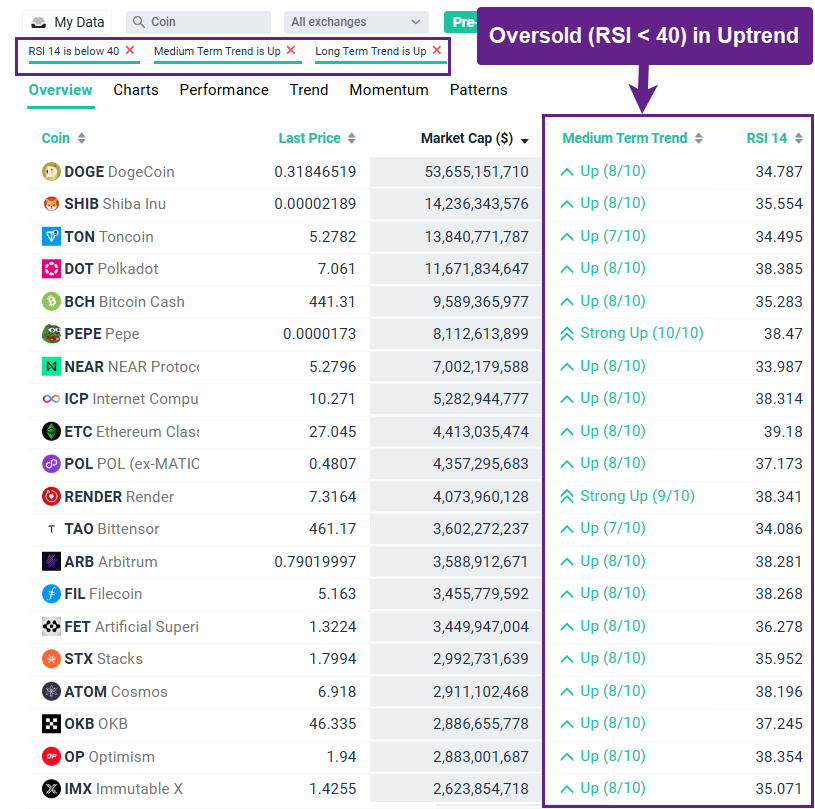

We use three factors to gauge where the bottom is:

1. Uptrend on Long-term basis

2. Relative Strength Index (RSI)

3. Support level

We look for assets in an Uptrend, where RSI is oversold (below 40) and price is near a support level.

For some assets, these factors have lined up!!

This has typically lead to highly profitable swing trade entries for a bounce up.

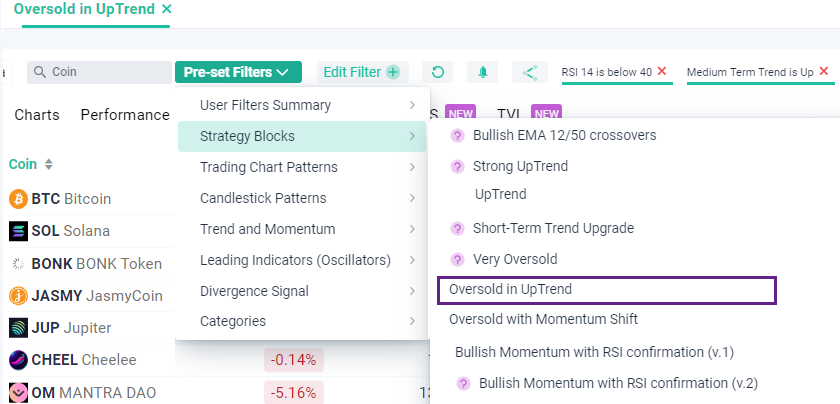

You can find such assets in the Crypto Screener.

Here’s a link to live market scan results.

Pre-Set Market Filter: Oversold in Uptrend

Oversold Assets in Uptrend

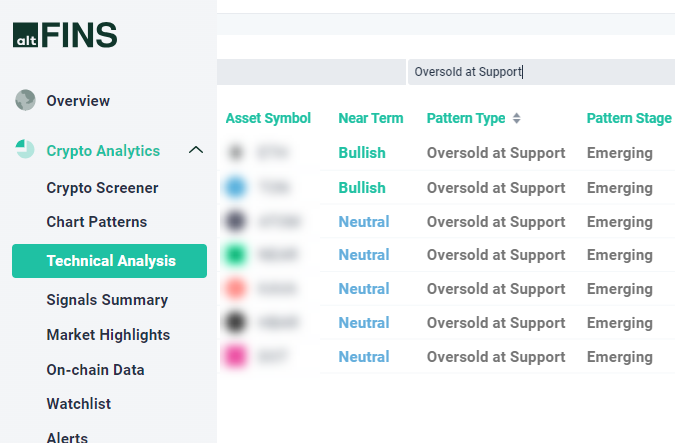

We teach the “Oversold in Uptrend” and Oversold at Support” trading strategies in our new Crypto Trading Course, which covers 7 trading strategies and risk management to help you profit in any market.

You can also find such trade setups in our Technical Analysis section.

These include price targets and stop loss levels.

Here’s one such trading idea that checks all three conditions: Uptrend + Support + Oversold: KAVA

KAVA: Trade Setup

KAVA Trade setup: price is in an Uptrend, it’s pulled back to $0.42 support which is also a 200-day moving average (also acts as support) and RSI ~ 30 (oversold). Price Target (PT) of $0.55 and Stop Loss (SL) at $0.36. That’s a 2.5 RRR (Reward to Risk Ratio).

0 Comments

Leave a comment