Opportunities in the Crypto Crash

Crypto Markets Crash: Opportunities Abound

The crypto markets have recently experienced a significant crash, but this downturn presents numerous opportunities for savvy traders. Timing your entry and finding the bottom can lead to substantial profits, potentially making your entire year’s worth of gains during these periods. Positive catalysts are also on the horizon, making this an ideal time to strategize.

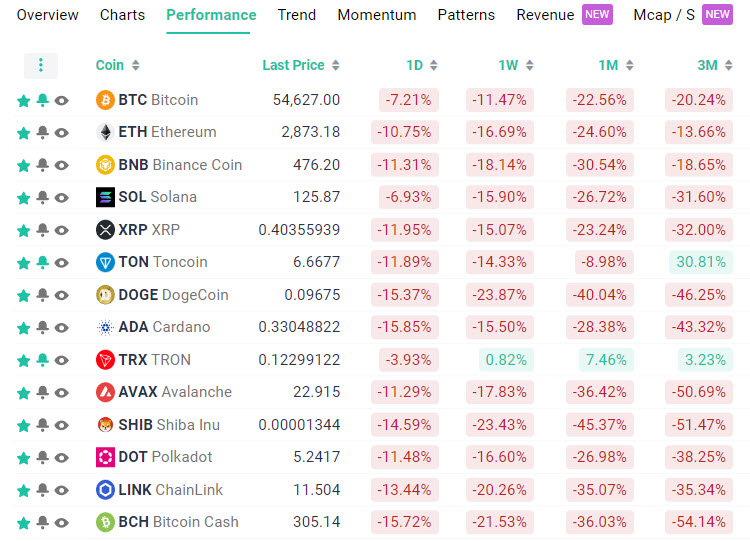

Majors Performance: Is the Bottom In?

We use three key factors to gauge whether the bottom is in:

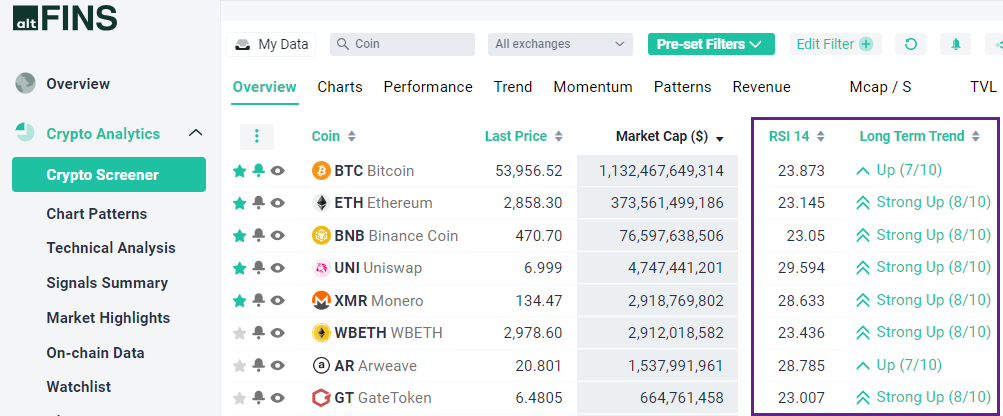

- Uptrend on Long-term Basis: Identifying assets that maintain a long-term uptrend.

- Relative Strength Index (RSI): Looking for assets where the RSI is oversold (below 30).

- Support Level: Checking if the price is near a significant support level.

When these factors align, it often leads to highly profitable swing trade entries for a bounce up. Currently, some assets exhibit these conditions, with RSI values under 25, which is highly unusual. This includes major assets like BTC, ETH, and BNB.

Majors Performe

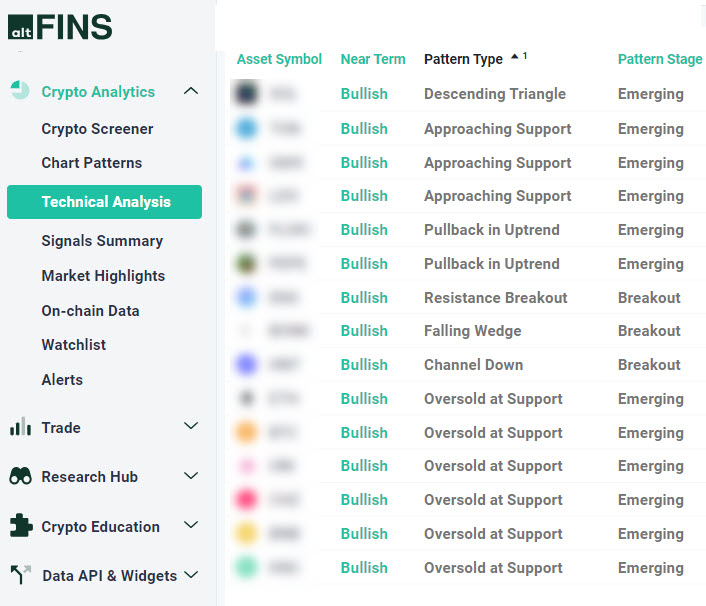

Oversold Assets in Uptrend

Using a Crypto Screener, you can find assets that are oversold and in an uptrend. This aligns with our trading strategies, “Oversold in Uptrend” and “Oversold at Support,” which we teach in our new Crypto Trading Course. This course covers seven trading strategies and risk management techniques to help you profit in any market.

You can also find these trade setups in our Technical Analysis section, which includes price targets and stop-loss levels.

Reasons for the Market Crash

Mt. Gox, one of the first crypto exchanges, launched in 2010, handling 70% of BTC trading volume by early 2014 before it got hacked and shut down. Investors will finally get some of their BTC back, causing FUD related to upcoming Mt. Gox distributions, worth about $9B. If 50% of the investors decide to sell, that’s $4.5B, only 4% of BTC’s market cap. This distribution will be absorbed quickly, but the fear ahead of this event is driving the current selling.

We believe prices could snap back in July, offering a gift for long-term investors but a short-term pain for traders.

Positive Catalysts Ahead

Many positive catalysts are expected to drive crypto asset prices in the second half of 2024:

- BTC Post-Halving Rally: Historical trends suggest significant price increases following BTC halvings.

- BTC Spot ETF Inflows: Potential approval and inflows could drive prices up.

- Ethereum Spot ETF Launch: Expected by the end of summer, likely boosting ETH prices.

- Solana Spot ETF Launch: Possible launch, adding to the positive momentum.

- Interest Rate Cuts by FED (U.S.): Lower interest rates typically lead to higher asset prices.

- Presidential Elections (U.S.): Elections can create market uncertainty, often followed by a stabilization and rally.

Stay tuned and leverage these opportunities to maximize your profits in the crypto markets. Happy trading!

0 Comments

Leave a comment